Amazon’s brand new bet: unbranded fashion

Also in today’s edition: Zee’s unending soap opera; Nuclear energy may go private; Microsoft minus Nvidia; Public displays of aggression

Good morning! If you think streaming has become a pain, then boy do we have more bad news for you. Bloomberg reports that the days of uninterrupted international streaming might be over. Since 1998, WTO members have placed a moratorium on taxes on digital trade, ensuring that online subscriptions can be accessed anywhere in the world without any additional tax. That moratorium is on the ballot next week, with developing countries like India, Indonesia, and South Africa looking to vote against it. Sigh… everything good comes to an end. 😞

Roshni Nair and Adarsh Singh also contributed to today’s edition.

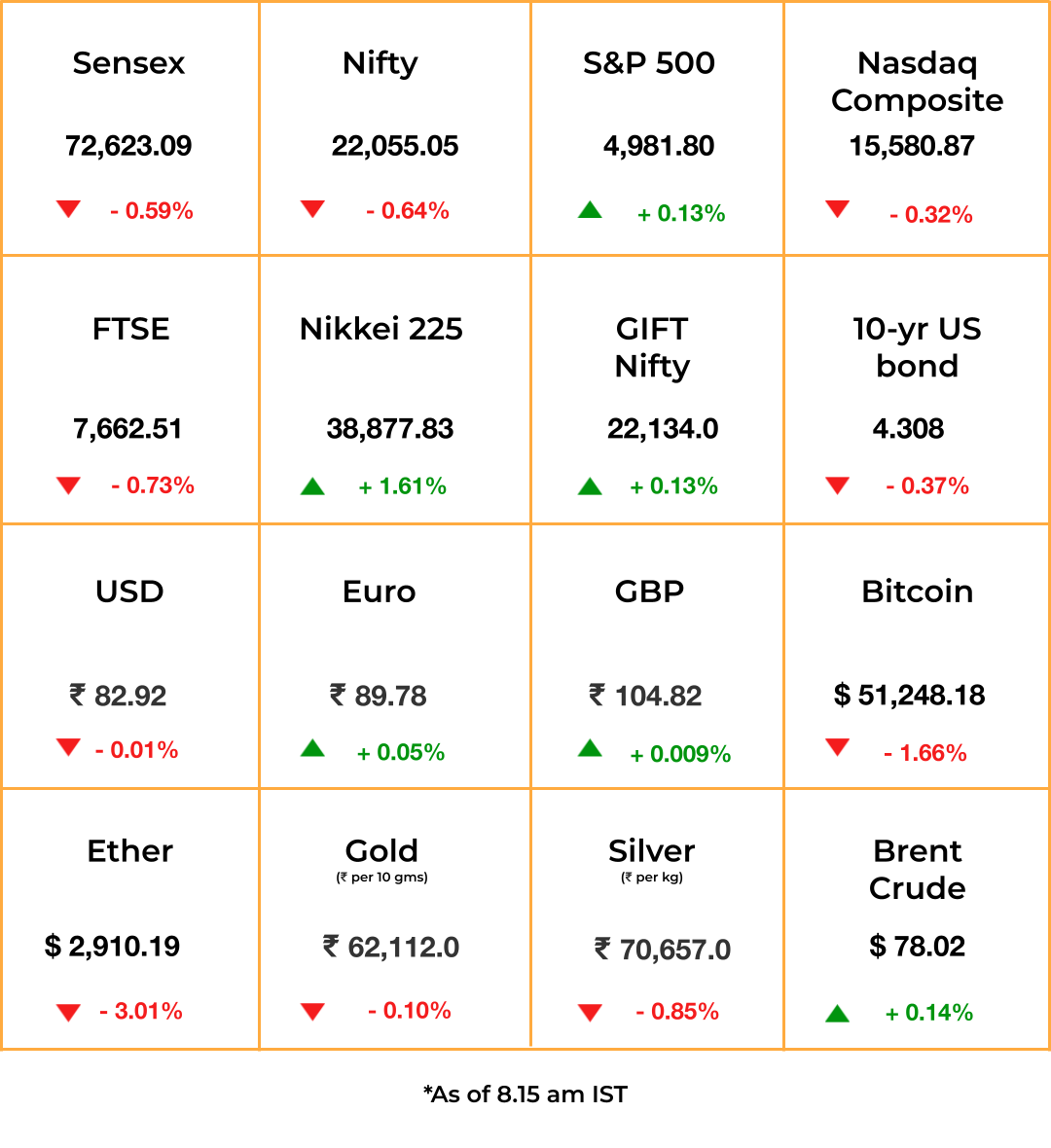

The Market Signal

Stocks & Economy: Nvidia’s fourth quarter performance blew investors’ minds, with a 265% jump in revenue to $22 billion. Even better, it projected the next quarter’s revenue to top $24 billion.

The AI chipmaker has been at the forefront of the rally in the US stock markets, which invariably set the global trend, beginning in the latter half of 2023 until now. Its performance has become the benchmark to gauge industry adoption of artificial intelligence, which its founder and CEO Jensen Huang says, is at a “tipping point”. Nvidia’s earnings buoyed early Asian trade too, with the Nikkei 225 nearing its all-time high.

The minutes (pdf) of the last US Fed Reserve monetary policy committee meeting showed members were wary of cutting rates early. Investors are awaiting S&P’s PMI data, which gives an indication of activity in companies.

The GIFT Nifty indicates a positive start for Indian equities.

E-COMMERCE

Amazon Chases ‘Bharat’

Your local boutique with cheap outfits is now up against serious competition. Amazon is reportedly launching Amazon Bazaar, a no-commissions marketplace devoted to online sellers of unbranded clothes, shoes, and accessories that cost less than ₹600 (~$7.2). Bazaar won’t charge sellers a commission; instead it will earn from selling them logistics services.

Fist-fight: This pits Amazon directly against SoftBank-backed Meesho, which has made its name in selling affordable, mid-quality goods to ordinary consumers in India. Besides, it must compete with Shopsy (owned by Flipkart) and Reliance’s new Ajio Street, all tapping so-called ‘bottom of the pyramid’ customers of affordable, unbranded goods.

Uphill battle: This isn’t a new strategy. In the 2010s, Snapdeal differentiated itself from Flipkart by focusing on low-margin goods with few national brands, but could not attain scale or turn a profit, per its draft prospectus (pdf). Besides, it abandoned plans for an IPO in 2022.

🎧 Amazon’s budget-friendly ‘Bazaar’. Also in today’s episode: Thailand wants to prohibit cannabis for recreational use, just two years after decriminalising it. Tune in to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you listen to podcasts.

MEDIA

Zee Scripts A Potboiler

The twists are hard to stomach. First, The Economic Times reported on Tuesday that Zee had been meeting Sony executives for the last two weeks to salvage the Sony-Zee merger. The Zee stock zoomed over 6% in Tuesday’s trading. After market hours, Zee denied the story.

Then Bloomberg reported that market regulator Sebi has found evidence that Zee’s promoters siphoned off ₹2,000 crore (~$241 million) in an ongoing investigation into CEO Punit Goenka. This is 10 times the amount Sebi had previously found.

Zee denied the allegations (pdf). But, per Moneycontrol, Sebi is questioning Zee’s former directors.

Two-front fight: Without the merger, Zee is scrambling to manage costs and find a path to growth. In an earnings call, Goenka promised investors a 18-20% Ebitda margin and 8-10% growth in revenue. With Sebi on its back, the Goenkas must manage their struggling media empire, disenchanted investors, and a serious investigation.

ENERGY

Private Sector Ignition

From being an international pariah to throwing open the doors to the private sector to set up nuclear plants, India has come a long way.

What’s new: Reuters reports that to achieve its climate change mitigation goals, India is seeking $26 billion investment from private parties to set up nuclear power stations. It is said to have approached five big conglomerates, including the Tata, Reliance, and Adani groups to build them. India’s oldest, Tarapur Atomic Power Station (TAPS), built by the US giant GE.

Sitrep: India currently has 22 reactors with an installed capacity of 7,480 MW. In 2004, one year before the Manmohan Singh government signed the nuclear deal with the US, India had targeted raising its nuclear capacity to 20,000 MW by 2020. However, India’s tough compensation regime in the event of accidents has kept global private companies away.

The Signal

Nuclear power, arguably one of the greenest while in operation, is also relatively cheap to produce over the long run. Power produced at the Tarapur Atomic Power Station (TAPS), built by the US giant GE and commissioned in 1969, costs less than ₹1 ($0.012) per kWh while the latest, Kudankulam units 1 and 2, cost about ₹4 per kWh.

In 2018, the Central Electricity Authority projected the capital cost per MW to range from ₹12.2 crore-₹20 crore in FY23 to ₹14.2 crore-₹23.4 crore in FY27, depending on whether the reactor used pressurised heavy water or light water.

ARTIFICIAL INTELLIGENCE

Conscious Uncoupling

Nvidia’s indispensability in AI chips turned it into one of the world’s most valuable companies, but two questions loom. One, for how long can Microsoft-OpenAI, Meta, Amazon, Google, and other AI frontrunners spend billions on Nvidia’s ecosystem before the bills begin to bite? Two, will Nvidia’s power erode once said companies wean off of their dependence on its hardware?

The answer to the first is in plain view. The tech majors are making their own AI chips and now, The Information reports that Microsoft is developing its own networking card as an alternative to Nvidia’s ConnectX-7. Network cards accelerate traffic between servers, which in turn is crucial for producing larger AI models. Pradeep Sindhu, the co-founder of networking gear company Juniper Networks whose server chip startup Fungible was acquired by Microsoft last year, will head the project.

As for Nvidia: it’s returning the favour by getting into Big Cloud’s turf.

CONSUMER ELECTRONICS

Screen Test

Japan would have had the last laugh if it too wasn’t threatened by the same Chinese upstarts as South Korea. We’re talking display manufacturing, an industry once dominated by Japanese brands before the chaebols took over. Now, Chinese enterprises such as BOE Technology are nipping at Korean giants’ heels when it comes to LCD and high-end OLED screens. The threat is so significant, it’s pushed rivals Samsung and LG into a partnership.

The Samsung-LG deal was first reported about in 2023, when the former decided to source OLED panels from LG. Their LCD businesses were hit by the Chinese, and they wanted to cement South Korea’s prowess in making displays primarily used in premium TVs and flagship phones.

But BOE (which also supplies to Apple), Visionox, and Star Optoelectronics are building huge OLED manufacturing factories thanks to Beijing’s subsidies. Time—and karma—may not be on LG and Samsung’s side.

FYI

Fight or flight?: India’s Enforcement Directorate has requested the Bureau of Immigration to issue a fresh lookout notice against BYJU’S founder-CEO Byju Raveendran, The Economic Times reports.

Conditional crackdowns?: A joint investigation by The News Minute and Newslaundry reveals that 30 companies investigated by central agencies in FY 2018-19 and 2022-23 “donated” ~₹335 crore ($40.4 million) to the ruling Bharatiya Janata Party. Some companies, including Haldiram’s, Hindalco, and Aurobindo Realty, made donations after raids, while others received clearances or licences.

Beg, Borrow, Steel: Sajjan Jindal’s JSW Steel is seeking $750 million from banks for capital expenditure, in line with the company’s goal to double output by the end of this decade, The Economic Times reports.

Upvote!: In an unusual move, Reddit is planning to reserve some IPO shares for 75,000 of its most prolific users when it goes public in March, according to The Wall Street Journal.

Keeping up with the Joneses: Following Meta’s open-source large language model Llama, Google has released a suite of “open models”, named Gemma, for free.

Shown the door: Boeing 737 MAX’s misfortune has touched the head of the factory that makes the aircraft. The company has thrown out Ed Clark, VP and general manager, who ran the Seattle unit.

Not secure: The US plans to replace foreign-made, especially Chinese, cranes at its ports in the next five years as they pose a strategic risk.

THE DAILY DIGIT

9.5%

The average hike in salaries expected by companies in 2024, according to a survey of 1,414 companies by consulting firm Aon. (Livemint)

FWIW

Brightest of all: Australian astronomers have found the brightest known object in the universe: a quasar. It’s powered by the fastest-growing black hole ever discovered and is so bright that it is 500 trillion times brighter than our sun. Its light travelled for more than 12 billion years to reach Earth. The astronomers relied on telescopes in Siding Spring Observatory in Coonabarabran to find the quasar and then confirmed their findings with the help of the European Southern Observatory. The quasar is so big that it devours a sun a day and has a mass 17 billion times more than that of our sun. Sounds cool and terrifying at the same time.

Role reversal: Not all patriarchal societies are similar and South Korea is a good example of that. The deeply patriarchal country is witnessing a curious tradition, with women outnumbering men in following sports. So much so that they make up 55% of fans at all professional sporting events. The factors behind this are somewhat familiar though; the country’s deep love (read obsession) for good-looking athletes, easier access to their favourite players and safe, family-friendly infrastructure in stadiums are some of the reasons behind it. Whatever the case be, it’s always nice to see sports bringing together a country.

Kim Sim: Keeping up with the Kardashians also means keeping up with their business ventures and in particular, those of Kim Kardashian. The star’s earliest venture, “Kim Kardashian: Hollywood”, was a simulation game intertwined with her life. Fans could get a taste of her life through their own digital avatars. The game was very successful; it earned $74.3 million in revenue in the first six months of its release, with lifetime downloads reaching 59 million. Sadly though, the game is shutting down this year, closing yet another avenue for the fans of Kim to follow her life.