Ambani gets keys to the Magic Kingdom

Also in today’s edition: Apple puts its Titan to rest; Levi’s goes bottoms up; CBAM isn’t all that; Scavenger hunts paused for the taxman

Good morning! In scenes reminiscent of The Big Short, VCs are funding the rise of startups that specialise in ‘winding down’ other startups. As per TechCrunch, startups like Sunset and SimpleClosure have raised $1.45-4 million for this purpose. Their job entails everything from returning capital to investors to negotiating debt obligations with creditors or auctioning off assets. Since 90% of startups fail, revenue is pretty strong for these companies. Talk about schadenfreude!

🎧 Made-in-India social media wasteland. Also in today’s episode: Apple has pumped the brakes on its electric vehicle aspirations. Tune in to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you listen to podcasts.

Roshni Nair, Anjali Palod, and Adarsh Singh also contributed to today’s edition.

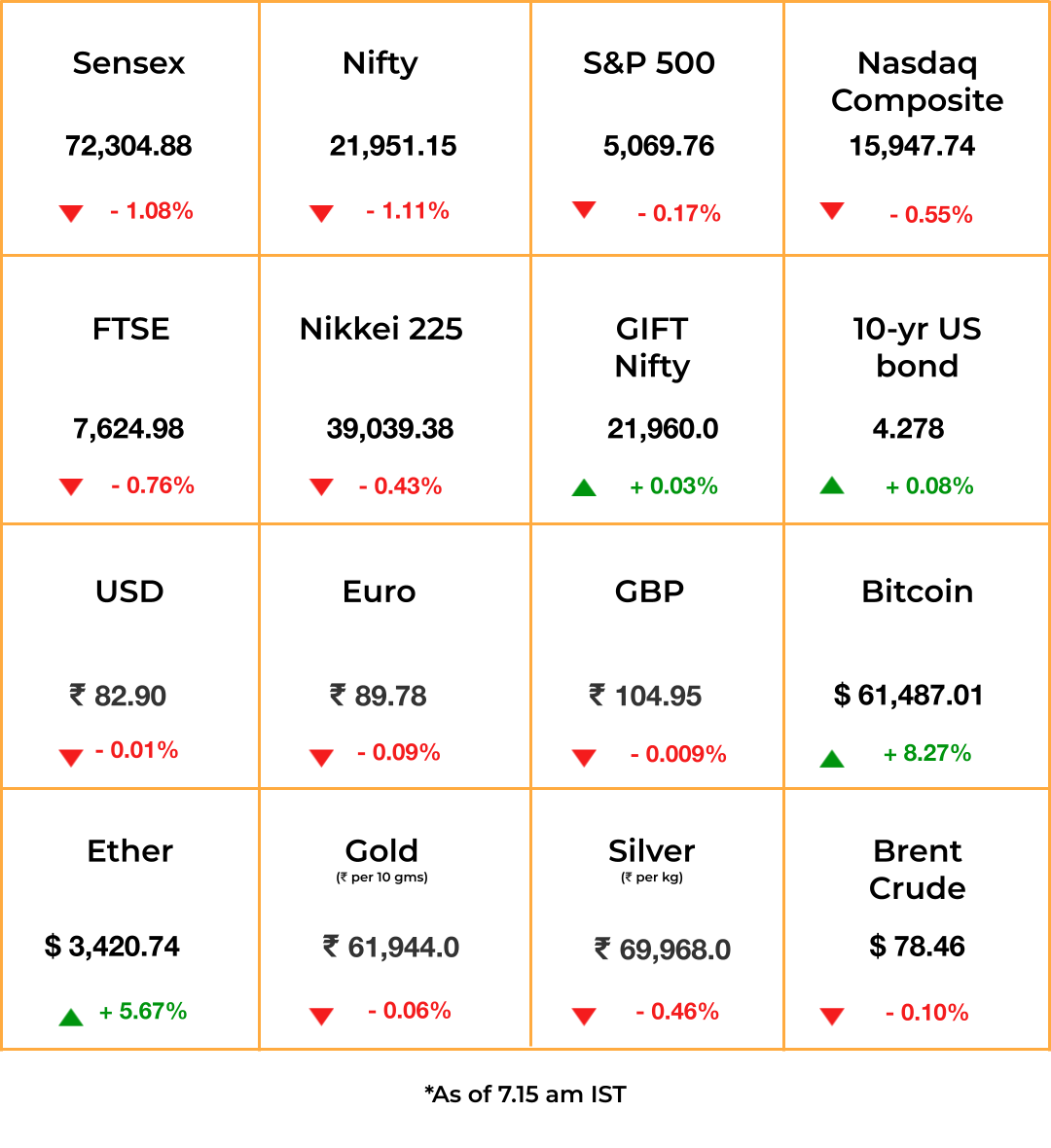

The Market Signal*

Stocks & Economy: Indian equities were driven down on Wednesday after the Association of Mutual Funds of India (Amfi) cautioned its members to restrict investment flows into small- and mid-cap funds.

Amfi’s caution followed a nudge from market regulator Sebi, which was concerned about froth buildup due to heavy inflows into funds. Some asset managers had already stopped accepting lumpsum payments in their funds. The NSE’s Nifty Smallcap Index and the Nifty Midcap Index fell sharply, while the overall market also tanked.

Global markets seem to have caught the flu as a resurgent February comes to a close. US stocks declined ahead of the release of retail inflation data, while equities across Asia were subdued in morning trade. The GIFT Nifty indicates a flat opening for Indian shares.

Money pouring into Bitcoin has pushed the cryptocurrency beyond the $61,000 mark for the first time since late 2021.

TECH

Attack On Titan

The decade-long effort that cost Apple billions of dollars is no more. The company has wound down Project Titan, its autonomous electric vehicle (EV) project. Apple reportedly broke the news to its 2,000-odd member team in a 15-minute meeting. While most staffers will be absorbed into other divisions, particularly machine learning, those without new roles will be laid off.

Project Titan’s demise isn’t surprising. Despite road-testing, acquisitions such as the autonomous vehicle startup Drive.ai, and reports of partnerships with Japanese and Korean carmakers, Apple kept changing the division’s leadership and postponing launch dates. The current landscape is also unconducive. The global EV market is experiencing a slowdown, and autonomous driving is beset with technical and regulatory hurdles. We’d covered the latter in our podcast, TechTonic Shift.

Apple will now focus on generative AI, a domain where it’s lagging behind Big Tech rivals. Maybe even new wearables, who knows?

STRATEGY

Levi’s Is Living Unbuttoned

One of the world’s oldest denim brands is changing how it does business in its home country—and taking a page from its India operations in the process.

Michelle Gass, CEO of Levi Strauss & Company, wants the brand to become synonymous with denim lifestyle/outfitting, not just jeans. But what can it do for its bags, tops, and caps to fly off shelves? Enter the direct-to-consumer (D2C) strategy.

Unlike in India, where it sells a “shirt for every pair of bottoms”, Levi’s sells one shirt for every four jeans in the US. That’s because Levi’s prioritised expanding stores in India. Gass is now doing the same in the US after Levi’s reported an 11% increase in sales through its own channels, compared to a 2% decline in sales through other retailers.

The D2C focus comes with operational changes too, such as enlisting new vendors and displaying apparel the way Levi’s wants.

MEDIA

A Star Is (Re)born

It took Mukesh Ambani more than a decade to build a media empire piece by piece. It started with Reliance taking over Network18 in 2014, acquiring Raghav Bahl’s successful business news unit, along with generation-defining Viacom18 properties such as MTV.

Now, Disney-Star is joining this empire (pdf), as is Uday Shankar, the man who built Star. Ambani’s wife Nita Ambani will chair this behemoth even as Shankar comes back to drive a much bigger avatar of the business he once built.

Shakeup: Meanwhile, a top Disney executive has left the firm; Warner Bros. Discovery has ditched plans to acquire Paramount, and news and videos app Dailyhunt is in talks to acquire Indian social media firm Koo.

Battlelines: It’s also the season of high-stakes battles. Universal Music Group (UMG), the world’s biggest music label, began removing all songs it has ever published from TikTok, following a music licensing dispute.

Meanwhile, OpenAI accused The New York Times (NYT) of hacking ChatGPT to deliberately generate ‘misleading’ evidence for its copyright infringement lawsuit.

The Signal

Change is in the air for the media business worldwide. Struggling to eke out a profit, some of the world’s biggest media and entertainment companies are desperately seeking mergers to protect their margins.Others are fighting for their business models. UMG and TikTok’s standoff could determine what social media companies may have to pay labels for their music. The NYT-OpenAI lawsuit will probably lay the groundwork for content deals between generative AI companies and media firms.

CLIMATE CHANGE

Indian Companies Get An ADB Prop

The Asian Development Bank (ADB) has dismissed a European proposal to tackle carbon emissions as practically ineffective. The study backs what India has been saying all along.

Beginning 2026, exporters to Europe will have to pay charges for the carbon dioxide emissions embedded in the production of steel, cement, power and other products under the European Union’s Carbon Border Adjustment Mechanism (CBAM). The ADB study says it will only cut global carbon emissions by 0.2%, way lower than what an emissions trading scheme can.

India is pushing for a total waiver of the tax or at least a four-year delay before it is imposed on Indian exports. A Goldman Sachs report had estimated the impact to be the most on steel producers, who may have to pay an additional $102-190 per tonne for their products to enter the bloc.

POLICY

Government To Fix Liquidation Beeline

Taxmen will not be allowed to pick at the remains of a company before those who have lent to it get their fair share.

Banks first: The Indian government will amend the Insolvency and Bankruptcy Code (IBC) to ensure banks, to whom the borrower had pledged assets, will first get whatever is realised from liquidating it. The order of settling dues is workmen and secured creditors first, followed by other staff and unsecured creditors and finally, the government. But some courts had ruled that statutory dues have to be settled first. The government is now planning to correct the ambiguity.

Insolvency and Bankruptcy Board of India data (pdf) shows that creditors have, on average, realised just 32% of the admitted claims and 168% of the liquidation value in cases resolved under IBC.

Meanwhile: Debt-laden Chinese property giant Country Garden has been threatened with liquidation to recover a $205 million loan.

FYI

End of an era: Thrasio, the poster child of roll-up commerce that inspired Indian brands such as Mensa and GlobalBees, has filed for bankruptcy in the US and entered into a restructuring agreement with lenders.

Cranking up: Buoyed by Foxconn’s iPhone exports, India’s share in electronics exports to major markets such as the US and the UK is rising as a proportion to China’s. It rose to 7.65% from 2.51% for the US and 4.79% to 10% for the UK.

Offload: Private equity firm KKR is looking to sell its ~54% stake in Mumbai-based JB Chemicals & Pharmaceuticals “amid interest from potential buyers”, according to Bloomberg.

Oasis: The India outpost of bankrupt WeWork, operated by the Embassy Group, narrowed its year-on-year losses by 77% in FY23 and reported a ~68% increase in operational revenue for the same period.

Stakes are up again: Russia’s threshold to use nuclear weapons may be far lower than earlier believed, Financial Times reported, citing confidential military papers. The leak comes just when France mooted sending troops to support Ukraine, a move Russia would see as Nato declaring war.

Bounce back: India bought 11.3% more personal computers, including laptops and tablets, worth $276 million from China in December 2023 compared to the previous month when government curbs had shrunk their imports by 14%.

Doddering: The Himachal Pradesh government has plunged into crisis, with Congress chief minister Sukhvinder Singh Sukhu battling dissension after party candidate Abhishek Manu Singhvi’s surprise Rajya Sabha election loss.

THE DAILY DIGIT

$5.8 million

The amount one would need to be counted among the wealthiest people in the world. That is 15% more than what was required a year ago to be in the one-percenter club. (Bloomberg)

FWIW

New beginnings: Bill May is one happy man. The 45-year-old, a former performer at the Cirque du Soleil, is finally getting to live his dream of representing the US in the Olympics. Thanks to a rule change in synchronised/artistic swimming, men are finally allowed to take part in the competition ever since the sport was first added to the Olympics in 1984. The rule change allows for athletes to compete as a team or a duet, with a total of six medals up for grabs. While it isn’t going to be easy, May is hopeful and so are we! 💛

Fail Mary: A new study has found that smoking, vaping or ingesting marijuana poses a significantly higher risk of heart attack and stroke irrespective of a history of heart disease and smoking. The study, published in the Journal of the American Heart Association, surveyed 430,000 adults from 2016-2020 across age groups and found that men under 55 and women under 65 faced a 36% higher risk of heart disease as a result of using marijuana. 😬

Cost-cutting: One doesn’t usually associate science with rebellion against the establishment. But in France, that’s not the case. Scientists in the country are furious with the government’s decision to slash the budget for research by €383 million ($414.7 million). This is the result of the French government’s revision of its GDP growth forecast from 1.4% to 1%. The country’s national research union deemed this decision ‘incomprehensible’ and saw it as an indication of the government going back on its own research plan for this decade. What a shame!