Apple’s Jack Welch handshake

Also in today’s edition: CCI has a beef with PEs; Reliance could spark an FMCG price war; Meesho hits a hurdle; China is a global worry

Good morning! That Elon Musk has fans is no surprise. But that there is a growing cult of Musk fans in South Korea who've bet their life savings, even homes, on Tesla's shares is astonishing. They see the stock as the escape hatch from the financial dystopia so cuttingly dramatised in the Oscar-winning Parasite and Netflix blockbuster Squid Game. Tesla stock devotees call themselves “Teslams” on Twitter, says Bloomberg, and consider Musk their redeemer from poverty.

🎧 South Koreans are banking on Elon Musk’s Tesla shares for a better life. An ex-security-chief-turned-whistleblower has accused Twitter of inadequate privacy and security protocols. The Signal Daily is available on Spotify, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

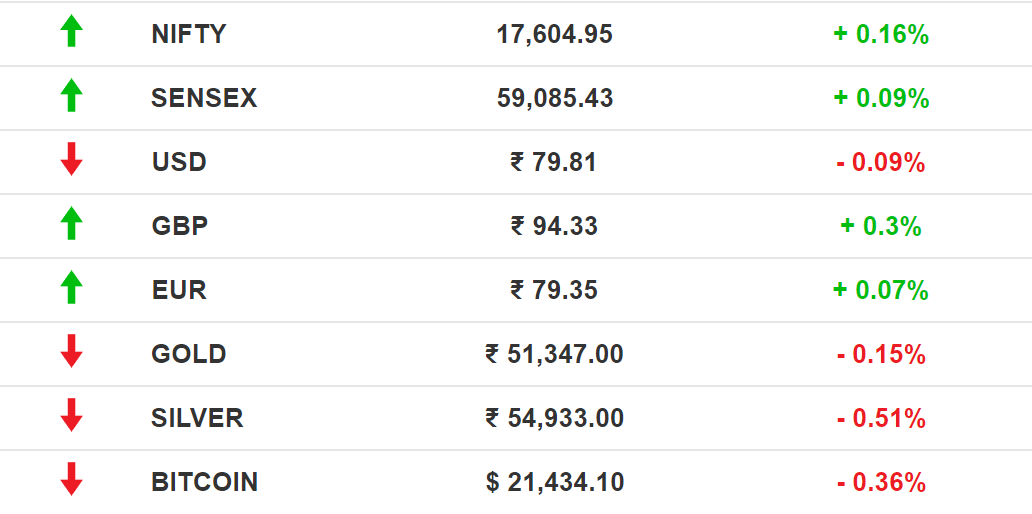

The Market Signal*

Stocks: Indian equities were up despite Asian markets underperforming on Tuesday. Five of seven Adani Group stocks were in the red for the second straight day after a Fitch group firm said the Group was 'deeply overleveraged'. Brent oil hit $100 after OPEC said it was mulling over cutting output.

Early Asia: The SGX Nifty (0.41%) and Nikkei 225 (0.57%) started the day on a high note at 7.30 am India time. Trading was halted on the Hang Seng Index due to a typhoon.

ANTITRUST

No Riding Two Horses At The Same Time

Private equity (PE) funds will be in a quandary. Indian antitrust regulator, the Competition Commission of India (CCI) is not very happy about investors occupying board seats in competing firms.

CCI believes board membership gives investors influence and same investors on rival boards will hamper competition, an important requirement of a healthy business environment. It’s now studying board membership patterns.

Vague disclosure: That is not good news for PE funds, which generally like to have a ringside view of the functioning of companies they invest in. A board seat is essential for that. Large PE funds such as Blackstone, KKR and Carlyle are known to be active on boards. Many funds might even be reluctant to invest in companies without board membership. That could be a bummer for investments.

RETAIL

Reliance Goes To Kiranas With Private Labels

There's a new sheriff in town, and it's eyeing premium space in grocery aisles. Reliance Retail is going mainstream with its private label brands, potentially a margin-blunting competitor to FMCG players.

Context: FMCG companies such as Nestle, HUL, P&G and ITC have well-oiled manufacturing distribution set-ups. Until now retail chains stocked home brands on their own shelves. Reliance wants to hawk its private label food, personal, and home care products to the general trade, wading into the catchment area of traditional FMCG players. It is incentivising super stockists with double margins, and aims to go live by September.

Bummer: Reliance will be up against brand loyalty. Bigbasket and Grofers’ ambitions to take their wares beyond the app were snuffed out by pilots. But in inflationary times, prices matter, and a price war could be on the cards.

MANUFACTURING

Can Apple Be GE for India?

The iPhone 14 would ship from India. With a two-month lag after China to begin with but eventually leading to simultaneous shipping from both countries.

BFD: It's a piece of the reordering of global supply chains. Apple is diversifying manufacturing bases for its gadgets to other countries such as India and Vietnam. The pandemic and geopolitical tensions have exposed the vulnerabilities in global supply chains, especially the over-dependence on China’s factories.

And when Apple makes a move, others take notice and often follow.

The Signal

In the 1980s, the then GE chairman Jack Welch started an outsourcing revolution when he handed over a $10 million pilot contract to India. A few years later, GE’s global development centre programme gave $100 million contracts to TCS, Wipro, Infosys and Patni. GE then was the most valuable company and the world’s top innovator, a space occupied by Apple today.

Apple’s India foray is similar to GE’s strategic handshake that set up the software services boom. Apple has already been assembling its phones in India and strictly speaking Foxconn, which makes iPhones, is Taiwanese, the parts it uses are Chinese, but the managers and workers are local. They get to learn global manufacturing processes and practices which can spread to other industries. There are other spin-offs too. For instance, Foxconn plans to make semiconductor chips with Vedanta. Who knows, other components also may soon have a Made in India tag.

STARTUPS

Meesho Enters The Upside Down

The devaluation bogey that plagued Instacart, Klarna, BlockFi, and Stripe earlier this year has arrived in India. The Morning Context (TMC) alleges that Meesho—backed by SoftBank, whose last quarterly results forced Masayoshi Son into uncharted territory—may resort to a down round.

Meesho was valued at $4.9 billion after two funding rounds in 2021. It sought another round this year at $10 billion… in vain. It’s now reportedly considering a 25% valuation cut (i.e. approximately $3.7 billion).

Why? Meesho pivoted from social commerce to e-commerce. This new business model, which led to significant cash burn and ad spends, hasn’t convinced investors who believe it’ll trail behind the juggernauts (Amazon and Flipkart).

Pow-wow: Meesho employees are denying that the townhall cited in the story took place. CEO Vidit Aatrey called the report false. TMC maintains that Meesho never denied anything on record.

CHINA

China’s Heatwave Could Singe Global Economy

China is battling one of its worst crises as a severe heatwave in west-central provinces and a troubled property market threaten to drag it down into a recession. That wouldn’t augur well for the global economy.

Heat is on: The worst drought in 500 years that has affected Europe and the US has also dried up parts of China’s lifeline, the Yangtze River. A third of the country’s population lives alongside the river which also irrigates its major grain-producing regions. Here is a thread on the impact.

The heat has pulled the plug on hydropower generation, cutting off electricity to residential and commercial areas. Many factories are shut.

Bigger mess: This comes even as the property sector takes a $130 billion loss. Large asset managers such as BlackRock and UBS are cutting down on investment after reporting a double-digit loss.

FYI

Back to business: The RBI lifted restrictions on American Express to add new customers in India, after 15 months.

Fundraise: Servify, a platform that manages devices for many electronic gadgets makers such as Apple and Samsung, has raised $65 million in a funding round and plans to file for an IPO in two years.

Crash: BendDAO, a lender against NFT pledges, is in a crisis after the value of collateral plunged by more than half due to a rise in Ether’s price.

Dragged: Tinder parent Match Group has filed an antitrust case against Apple with the CCI in India accusing the tech giant for its monopolistic conduct.

Bank sale: The Indian government and LIC, which own nearly 94% stake in IDBI bank, are planning to sell at least 51% of the bank’s stake for ₹22,017 crore.

Rolling in: The world's largest EV make, BYD, is looking to enter the Indian market. The Chinese tech giant will also assemble its vehicles in Sriperumbudur, near Chennai.

Upshot: Two EU data protection regulators are investigating allegations about Twitter's security and privacy made by its former head of security, Peiter Zatko. He will also testify against the social media platform's security flaws on September 13 in the US.

FWIW

Beer no more? Soaring energy prices are soon going to have real-life ramifications. Independent pub brewers are waiting on a miracle. About 70% of pubs face shutters because of rising energy costs. Rising inflation isn't helping matters either.

No love for java: In related news, inflation is affecting Australian coffee-drinking enthusiasts. So much so, a $0.69 coffee is getting increasingly popular. Usually, the supermarket collects an average of $5 for a latte. Dominos Pizza, too, is witnessing a similar trend where pizzas on the higher side are being skipped for the more humble meals.

Lights, camera, action: MoviePass is getting a second chance. A subscription-based movie ticketing service that had to shut down in 2019 for offering too many discounted tickets, is making a come-back. It will launch in a beta form and offer a pricing of $10, $20, or $30 a month. It also has a 25% partnership with the US theatres.

Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here.

We recently got funded. For a full list of our investors, click here.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.