Good morning! Every billionaire has a dream. Elon Musk’s is probably to troll the world, his shareholders and his employees. But Bill Ackman has an interesting dream. He wants to build a penthouse shaped like a flying saucer overlooking Central Park in New York. Ackman, for those who don’t know, made most of his money, about $2.2 billion, by betting on the financial devastation the coronavirus would cause. He believes this flying saucer penthouse would add to the beauty of the park. His neighbours don’t really agree with him.

Btw, our podcast has been going strong for two months now. Tune in on your daily jog, drive to the office, or even as you WFH-ers have breakfast in bed. We promise it’ll be music to your ears.

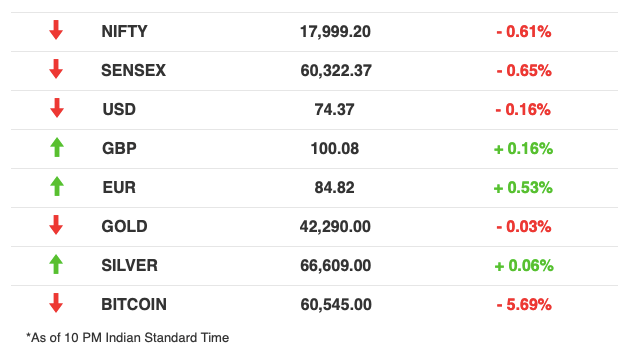

The Market Signal

Stocks: Benchmark indices closed in the red today on profit booking as well as lack of any major factor to impact sentiment. Auto and some tech stocks were the only bright sparks. An RBI report said equity valuations were stretched by most yardsticks. Inflation fears and the uneven nature of global recovery continue to weigh on Indian stocks.

India’s Game Theory

It has been 20 years since Microsoft first unveiled the XBox and changed gaming forever. But India’s gaming industry is just about warming up with more gamers, more studios, and unsurprisingly, more money with FOMO-infected investors.

Why? The numbers speak for themselves. There are about 400 studios in the country, nearly 3x more than there were five years ago. The market has expanded to 425 million gamers, a vast majority of them casual, mobile gamers. Perfect time to go native.

Demand: Indian gamers, an Economic Times report said, were on the lookout for local heroes. And studios are delivering them. One at a time. From mythology-based games such as Kurukshetra: Ascension to battle royale shooter games such as Indus.

Comes with a price: However, with this boom, comes the classic security risk. Gamers are hit by cyberattacks on their accounts and several lakh users have been de-platformed for cheating in Battleground Mobile India.

Biden, Xi Zoom It Out

US President Joe Biden and Chinese President Xi Jinping held an over 3-hour virtual summit to ease ballooning tensions between the two superpowers.

Big-power chat: The two leaders are said to have discussed wide-ranging issues, including Taiwan, the South China Sea, trade and climate change. China is said to have categorically told the US that those who play with Taiwan fire will get burned. President Biden raised human rights issues in Xinjiang province and China’s unfair trade practices.

Two poles: The summit happened at a time when Biden’s popularity is at its lowest while Xi is at the peak of his power. He has extended his term and ensconced himself in the pantheon occupied only by the People’s Republic’s founding father Mao Zedong and Deng Xiaoping, the architect of China’s economic might.

Take two: Apple vs Meta ft. Hardware

Privacy, it appears, might have been a shadowboxing act in this ongoing tussle between Apple and Meta Platforms (we’re still getting used to it). The real war, according to Bloomberg’s Mark Gurman, is coming, and coming soon. It is over hardware for Mark Zuckerberg’s latest obsession, the Metaverse.

But why? Facebook, Gurman says, has conceded the smartphone battle and Mark Zuckerberg is betting the house on Metaverse. But for that, he needs hardware, a territory Apple has made its own. Meta does own an ace in the high-end mixed reality headset, Cambria. For now, it appears to be a chess move against Apple’s “lighter-than-iPhone” headset (iPhones are not exactly featherlite) due to launch next year at an expected price of $2000. Both might have an eye on cash-rich companies.

MetaWatch: Meta also intends to launch and go deeper in two categories of hardware Apple already owns: smartwatch and home devices (it already has the Portal). Which is also where it meets some familiar friends in Amazon and Google.

Parting shot: Tim Cook isn’t into buzzwords, while Zuck wants his own Meta stores.

The Signal

The iPhone was undoubtedly the quantum leap in mobile phone technology and design. No other device has seriously threatened the prima donna status of Steve Jobs’ creation. Similarly, no company has dominated enterprise software like Microsoft has. Meta, which hopes for early adoption by companies (think Horizon Workrooms), will be up against Microsoft’s $2000 HoloLens and a metaverse office suite complete with PowerPoint and Excel. Cisco is already started using HoloLens for its Webex Hologram conferencing. Meta could score over both on price to lure gadget-loving companies. But until the Xiaomis and Samsungs show up with their own toys, the metaverse is likely to remain a world far removed.

No China? Head To India

India is emerging as an alternative investment destination as investors adjust to regulatory action in China.

How it flows: Best performing equity markets have added to the allure as a slew of tech stocks successfully listed in the past few months, offering early investors hugely profitable exits. For every dollar invested in Chinese tech companies, $1.5 has flowed to India in the quarter ended September Financial Times reported.

Down, up: Money raised in tech startup listings in China is expected to drop for the first time in seven years while it has jumped 550% in India. Yet, in absolute terms, so far in 2021, China tech firms raised $14 billion while Indian companies collected about $5 billion.

The jitters: High valuations are, however, already worrying investors. The rush of investors has already turned 35 startups into unicorns this year alone. But almost all of them are burning investors’ cash. Used vehicles portal Cars24 returned minus 53% on invested capital while e-commerce company Udaan’s return on capital invested was negative 80% for the year ended March 2020.

H&M Wants To Take on Apple Watch

Imagine a t-shirt that could monitor your heart rate or remind you to drink water. That’s what H&M’s chief technology officer Alan Boehme is visualizing.

Evolved clothing: Boehme wants fashion to go neck-to-neck with the wearables industry that’s making quite the splash in today’s health-conscious markets. H&M isn’t the first one to go down this road. A few years ago, Levi’s and Google got together to make Bluetooth-connected jackets that could help users navigate phone functions with a few gestures.

Tough bet: During the pandemic, H&M teamed up with fashion-tech company Boltware to design jackets that could mimic hugs but it didn’t get enough traction to make it to the racks. For starters, there would be trouble connecting clothing to the internet in certain countries. Then there’s the question of whether they can actually compete with wearables such as Apple’s smartwatches that are immensely popular.

What Else Made The Signal?

Taking off: Rakesh Jhunjhunwala’s airline venture, Akasa, has ordered 72 Boeing 737 Max aircraft which are worth $9 billion at list prices.

Fastest unicorn: Mensa brands raised $135 million in fresh funding and joined the unicorn club within six months of launch.

IPO-bound: LIC plans to file the first draft papers for the IPO by the first week of December, more than 100 investor names have been shared with 10 banks working on this deal.

Cheap drug: Pfizer will let generic Paxlovid, its experimental antiviral for Covid-19, to be sold in 95 low- and middle-income countries.

No change: Fitch Ratings has retained India’s rating at the lowest investment grade and outlook negative. Moody’s had recently raised India’s outlook to stable from negative.

Back to normal: The government has allowed airline to offer meals and newspapers on flights.

FWIW

Too late? Celebrity tokens are not always about celebrities, it seems. Many celebrities jumped onto the NFT bandwagon and cashed in on the initial frenzy but those who purchased their digital artwork were not so lucky. The prices plummeted. That affected other celebs who were late to the party such as Shawn Mendes, Paris Hilton and wrestler John Cena who described his NFT drop “a catastrophic failure”.

The perfect shot: Sportsmen often use weird, unconventional techniques to achieve greatness. Consider the case of basketball star Stephen Curry. Before this season, Curry wasn’t too happy with his shot. He felt the basket was too big. His solution? Shrink the basket. And well, it was all thanks to a cancer researcher.

Case closed: This is one of those rare successful heists where the thief disappeared without a trace. But the mystery has been solved. In 1969, a 20-year-old bank teller, inspired by the Steve McQueen-starrer The Thomas Crown Affair released the previous year, walked out of the Society National Bank in Cleveland with $215,000. He was never found. Federal Marshals last month confirmed that Thomas Randele who lived out an ordinary life in Boston was in fact Theodore J Conrad, the bank thief.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.