Birla vs. Ambani 2.0

Also in today’s edition: BYJU’s wants to replace tuition teachers now; Unpacking the Economic Survey; Unilever’s change of guard; Innovation is dead

Good morning! Tech isn’t the only sector suffering the post-pandemic boom and bust cycle. Bloomberg reports that beekeepers in New Zealand, home of the much-treasured manuka honey, are either leaving the business or struggling to make ends meet as demand cools. It doesn’t help that recurring purchases aren’t frequent for honey, which has a famously long shelf life. At its peak, premium manuka honey—once dubbed “liquid gold”— sold for $104 per kg, while affordable variants averaged $41; the latter has now corrected to $8. As a result, the number of beehives in New Zealand are down by 20% from 2019.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

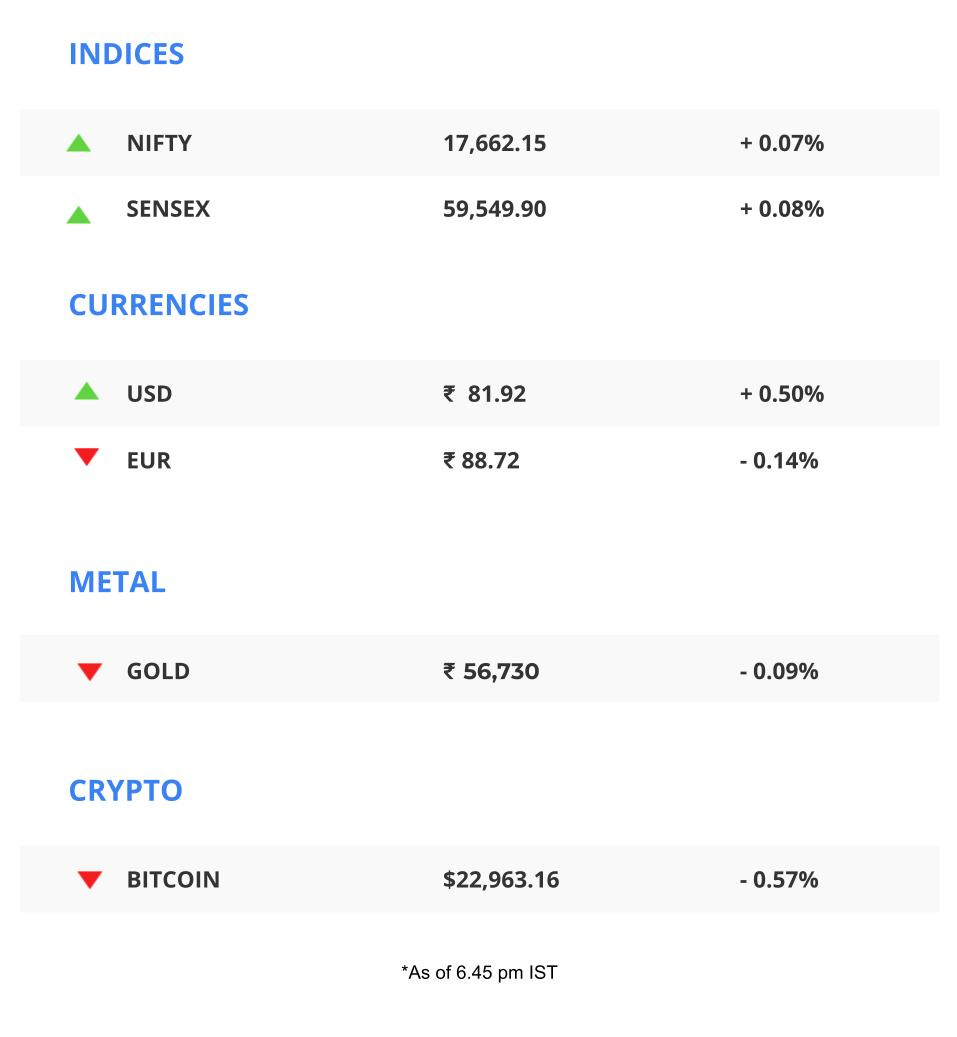

The Market Signal*

Stocks & Economy: Rich Indian investors rallied behind the country’s richest man in his hour of crisis. Billionaire Gautam Adani’s group flagship Adani Enterprises overcame the Hindenburg jolt to manage enough and more subscriptions on the last day of its follow-on share sale. The $2.5 billion issue was subscribed 112%, The Economic Times reports, as non-institutional investors heavily bought into it. The Nifty Bank index, which was also routed on fears of banks’ exposure to the Adani Group, rallied on Tuesday.

The Economic Survey 2022-23 noting that Indian exports would continue to struggle, even as the country faced the risk of global commodity inflation, hit the rupee. All eyes are on Wednesday’s Union Budget and the US Federal Reserve’s rate-setting meeting.

Early Asia: The SGX Nifty was down 0.33% at 7:30 am India time. The Nikkei 225 (0.46%) and Hang Seng (0.22%) were up.

SUCCESSION

5G Versus 3G

A new rivalry will unfold between the fifth generation of the Aditya Birla Group and the third generation of Reliance Industries Limited. Months after Reliance honcho Mukesh Ambani made official the succession plan of his children Akash, Isha, and Anant, Birla boss Kumar Mangalam Birla has done the same with his progeny, Ananya and Aryaman. The duo are now on the boards of Aditya Birla Fashion and Retail Limited (ABFRL) and Aditya Birla Management Corporation.

ABFRL and Reliance Retail are fierce competitors in India’s luxury and fast fashion markets. It’ll be interesting to see how this competition will pan out between Reliance Retail head Isha Ambani and singer-songwriter-entrepreneur Ananya Birla.

Aryaman Birla, who’s played first-class cricket for Madhya Pradesh, joins Mahindra Group’s Anand Mahindra and Max Group scion Veer Singh in initially staying away from the family business to pursue other interests.

EDTECH

BYJU’S Goes Old School

The world’s most valuable edtech company’s latest service is…wait for it… one-on-one home tuitions. No, we’re not kidding.

Started as a pilot programme in Bengaluru in August 2022, BYJU’S Home Tuitions has hosted around 650 demo classes and onboarded 100 teachers, according to The Economic Times. The service is an extension of its foray into physical tuition centres last year, as it looks to achieve what co-founder Byju Raveendran termed the “elusive edtech triad”—physical classrooms, digital platforms, and hybrid centres.

After a tumultuous 2022, BYJU’S seems to be throwing many things at the wall to see what sticks as it strives to achieve profitability. But experts have warned that home tutoring is a highly fragmented space in India and difficult to monetise. Undercutting is a major challenge, and previous business models in the larger tutoring space have struggled to scale.

ECONOMY

Just Holding It Together

India’s chief economic advisor V Anantha Nageswaran is praying for a global slowdown, which he believes will serve India’s interests better than an economic acceleration.

Price worry: Nageswaran’s fears stem from the fact that faster global economic growth could fuel commodity prices, especially that of oil, putting India under pressure. Higher inflation would also mean central banks will continue to hike interest rates, which will tighten global capital flows.

The Economic Survey 2022-23 is betting on private investments and demand in FY24 to keep the baseline real GDP growth rate somewhere between 6.5% and 7%.

This, Nageswaran believes, is possible without an export kicker. Post-pandemic recovery is now complete, and the government’s capital expenditure and newly repaired balance sheets of banks and firms have helped lay the foundation for a one-way (up) growth trajectory for the next decade, Nageswaran said at a press conference.

The Signal

Although the Economic Survey paints an optimistic scenario, it also conveys a sense of precariousness. It says the government has done its part, and the next stage of growth depends on the country’s industrialists, entrepreneurs, consumers, and global developments.

What we missed in the survey, however, is the one big idea that made it debate-worthy. Nageswaran’s predecessor KV Subramanian baked in “Blue Sky” thinking and behavioural economics into the Economic Survey of 2019 and garnished it with quotes from the Upanishads and Martin Luther King. Before him, Arvind Subramanian presented new thinking and cutting-edge research in each of the four surveys he helmed.

🎧 What were the hits and misses in the Economic Survey 2022-23? Also in today’s episode: BYJU’s bets on home tuitions. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

A MESSAGE FROM OUR PARTNER

Job posting: Future of India Foundation

Interested in a career in public policy? The Future of India Foundation is hiring and would like to hear from you. We are a New Delhi-based foundation that provides thought leadership on India’s transformation at the intersection of her demographic dividend, political economy, and rapid technological change.

What's in it for you?: A stimulating work environment and an opportunity to build a network in the policy space. We are also a flexible workplace, requiring at least one in-person day a week.

Your role: Researching public policy, curating workshops and talks for students and young professionals, creating content on topical policy issues, analysing regulatory, political, and market developments in key sectors to formulate evidence-backed positions on relevant policy issues.

CORPORATE

Delivering Unilever, Dressed & Stuffed

FMCG giant Unilever has appointed food industry specialist Hein Schumacher as its next CEO. Schumacher will succeed Alan Jope, who was a marked man after activist investor Nelson Peltz joined the company’s board.

New York-based Trian Fund built up a 1.5% stake in Unilever last year in a successful bid for a board seat for its chairman, Peltz, who had just finished a clean-up drive at Procter and Gamble, helping lift its stock by 90%. Unilever under Jope had gone through a botched $50 billion purchase of GSK’s consumer health business, and its food portfolio was getting stale.

Schumacher is expected to chop and change the portfolio to boost growth and shareholder value. Curiously, some have criticised Jope for focussing too much on sustainability but praised Schumacher for being “ESG savvy, but in a pragmatic and commercial way”.

TECH

We Don’t Need No Incubation

Forward-looking projects seem to have no place in the companies that once funnelled $$$ into innovative or experimental R&D endeavours billed as ‘moonshot initiatives’.

Meta is closing down its experimental social app Move, which was part of the company’s New Product Experimentation (NPE) division. Move joins a slew of shuttered NPE projects, including couples-focused app Tuned, video speed-dating service Sparked, and livestreaming platform Super.

This development comes on the heels of Alphabet laying off employees across experimental non-Google divisions (“Other Bets”) and in-house incubator Area 120. Only three Area 120 projects, which will eventually be folded into core Google products, remain.

In November 2022, Insider reported that Amazon was considering shutting down its innovation lab, Grand Challenge, entirely. Google, Meta, and Amazon are prioritising economic viability over long-term projects in the wake of the tech downturn.

FYI

Take three: Andhra Pradesh chief minister YS Jagan Mohan Reddy announced Visakhapatnam as the state’s new capital. It is the largest and most populous city in Andhra Pradesh.

Escalating: US companies can no longer sell technology to Chinese telecom major Huawei, courtesy of the Biden administration further tightening export controls targeting the company.

Chipping in: Days after Intel shared dismal quarterly results, rival AMD reported a 16% increase in revenue in Q4 2022 to $5.6 billion, much of it coming on the back of its data centre business.

Oh Snap!: Snapchat parent Snap Inc, whose India unit recently posted a profit for the financial year ended 2022, reported its worst year-on-year revenue numbers, with Q4 2022 net loss amounting to $288.5 million.

Hit out of the park: Oil major Exxon Mobil smashed earnings records with an annual profit of $55 billion for 2022.

Pink slips: Prosus-owned OLX will lay off 1,500 employees or 15% of its workforce globally (and in India) as part of its restructuring efforts.

Cookie time: Reliance Consumer Products Limited will bring Sri Lanka’s popular Maliban biscuits to India as part of a strategic partnership. RCPL’s foray into the biscuits space will pit it against Britannia, Parle, and ITC.

THE DAILY DIGIT

21

The number of judges for every one million people in India. Indian courts, which had over 50 million pending cases in 2022, need at least 50 judges per million. (The Indian Express, NDTV)

FWIW

A woof and a beep: You’ve heard of dogs eating kids’ homework, but have you heard of dogs gnawing on… Apple AirTags? Well, it’s a thing. Apple’s tracker is handy in locating lost or misplaced items, but some pet owners are using them on dog collars. Much to their chagrin, floofs have been known to nibble on these devices either out of boredom or curiosity. The trick is to make dogs vomit or poop the AirTags out. If you’ve appended an AirTag on your pet’s collar, we request you to keep a very, very close watch.

Safe, not sorry: Countries such as India should take a page out of Thailand’s sex-positive book. In the run-up to Valentine’s Day, the southeast Asian country is planning to distribute 95 million free condoms to those who hold universal healthcare cards. These ‘gold card holders’ will be eligible to receive 10 condoms per week for a year from primary care units and pharmacies. Government spokesperson Rachada Dhnadirek says the move will help promote safe sex and public health as a whole. We agree.

Penny wise pound foolish: Elon Musk’s Twitter has gone the whole nine yards to recoup pennies in the form of selling furniture and even USB dongles and keyboards. It doesn’t, however, seem to be concerned about recovering the laptops of former employees. This matters because these corporate laptops are MacBooks, whose refurbished versions can go up to $1,000. Why is Musk prioritising the return of company-issued phones, chargers, badges, et al over gold standard laptops? As with most things the man does, we’ll never understand.

Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here.

Do you want the world to know your story? Tell it in The Signal.

Interested in the business of sports and gaming? Subscribe to The Playbook here.

Write to us here for feedback on The Signal.