Surat's diamonds lost in war

Also in today’s edition: Paddy prices go up; Prime’s losing its novelty; China claws back Hong Kong; US abortion ruling could impede careers

Good morning! After a much-hyped opening, LA-based NFT-themed burger joint Bored & Hungry has paused ApeCoin and ETH payments. Just good old cash will do. This crypto crash sure forced the owner to wake up and smell the coffee.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

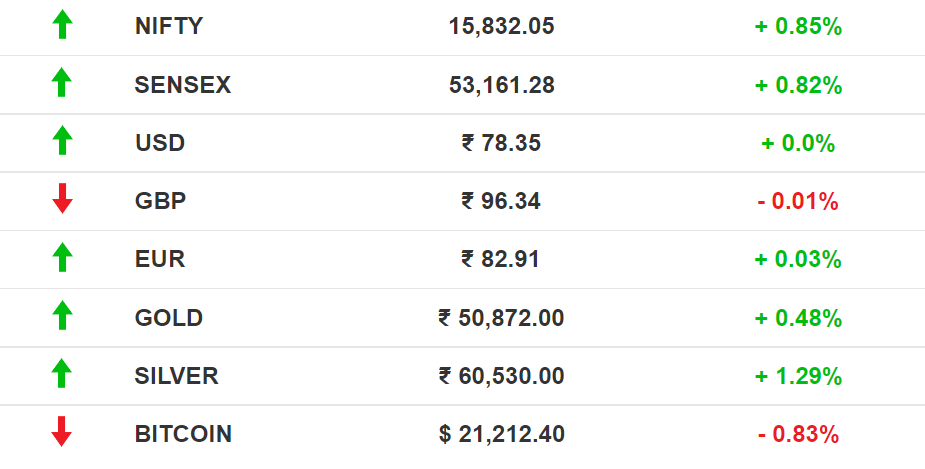

The Market Signal*

Stocks: Benchmark indices maintained their winning streak for the third straight day. Reports of India's economy picking up in May also led to an upward tick. Zomato's shares tumbled below 6% after news of its Blinkit acquisition.

Early Asia: The SGX Nifty (-0.15%) and Hang Seng Index (-0.98%) were in the red at 7.30 am India time. Nikkei 225 (0.49%) held the fort.

RUSSIA-UKRAINE

Diamond City Loses Sheen

India’s Diamond City, Surat, is the latest casualty of the Russia-Ukraine war. The region, known to shape 85% of the world’s roughs, isn’t receiving enough of the precious stone.

Specifics: India purchases more than a third of diamonds from Russian mining giants such as Alrosa. But supplies have been halted ever since the US and its allies imposed sanctions and cut Russia off from the SWIFT international payments network. The result: no diamonds, no work. A local trade union estimates 30,000 to 50,000 job losses now.

Grim reality: Surat’s diamond industry went through a production dip fuelled by the pandemic. About 25% of labourers left the city and 13 died by suicide due to financial troubles during this time.

🎧 The side effects of the Russia-Ukraine war are felt in Gujarat's diamond district, Surat.

COMMODITIES

Rice May Be The Next Wheat

After soaring wheat prices, rice could be next in line. Bangladesh slashing import duty and tariffs from 62.5% to 25% led to a 10% jump in Indian rice prices as traders here scurry to finalise export deals.

Tell me more: Bangladesh usually buys rice from West Bengal, Uttar Pradesh and Bihar. Prices in these states have increased by 20%, prompting other states to enforce a 10% hike. Bangladesh is depending on India for paddy imports after heavy rains and floods damaged crops in the country.

Price advantage: India has a market share of 40% in the global rice trade. Foreign traders, perhaps sending that India may impose export curbs on rice, are purchasing aggressively–more so because some Indian variants are cheaper than rice from Thailand and Vietnam.

E-COMMERCE

A Day Past Its Prime

Amazon's Prime Day isn't getting shoppers to the yard. At least in the US.

Add to cart: Customers aren’t adding large orders to their shopping carts, a consumer pattern of a slowing economy. So Amazon is extending its annual event by two days to lure impulsive shoppers. It is also planning a second follow-up, Prime Fall, between October to December, just in time for the holidays.

It doesn’t help that Amazon has been sneakily platforming its homegrown products—Alexa and Fire TV Sticks. Barring electronics, discounts on most products during Prime Day linger around the 30% bracket; this does not surpass discounts on non-Prime days.

The Signal

Once a strategy to boost slower summer sales and peddle its Prime membership, Amazon’s Prime Day was the OG marquee sales event. Taylor Swift once headlined the Amazon Prime Day Concert. Psst: cues taken from Alibaba's Singles Day event.

Prime Day's current muted reception wasn't a one-off. For the most part, Amazon hasn't been going all guns blazing. Something CEO Andy Jassy admitted, as part of its strategy to drive growth in other businesses. E-commerce sales are slower even across the other side of the world: China.

Prime Day’s success forced competitors such as Walmart to take notice. So much so that it set the stage for Amazon-Flipkart sales battles in India. Walmart-owned online fashion retailer Myntra claims it had a successful run with its EORS event. Amazon will host its Prime Day event in India by July. There's hope.

🎧 Amazon's Prime Day is losing steam. Find out why.

CHINA

Chinese Bear Hug Of Hong Kong Tightens

The vestiges of a colonial entrepot that morphed into a financial centre with Western roots are falling away from Hong Kong as the mainland tightens its grip on the island’s political institutions and its economy.

Handover: The UK returned Hong Kong to China on July 1, 1997, with the condition that it will remain as one country and two systems for 50 years, with the administration and economy distinct from the mainland.

Companies from the mainland are increasingly taking over market share in sectors ranging from financial services to communications and supermarkets. Political unrest and draconian pandemic restrictions of the past few years chased away thousands of professionals from the financial centre. The Chinese embrace will likely envelop the former colony much sooner than the 50-year grace period.

WORKPLACE

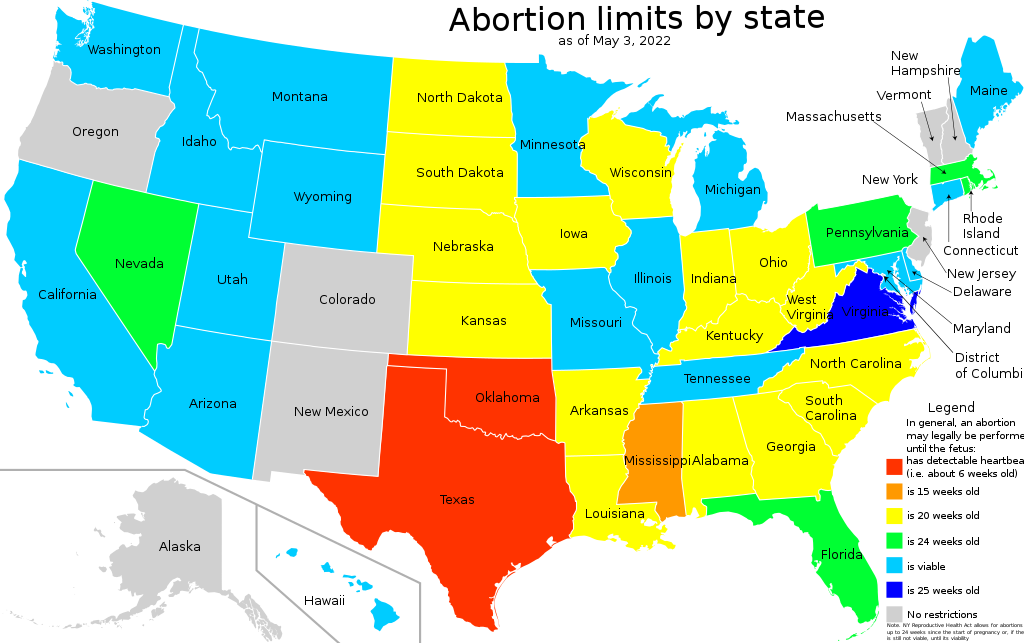

US State Abortion Laws May Raise Glass Ceiling

The overturning of Roe V. Wade—which scrapped Americans’ 50-year-old constitutional right to abortion—is making tech companies walk the tightrope between rejigging HR policies and complying with subpoenas that’ll demand abortion data.

Explain: While tech companies announced relocation and abortion-related travel coverage for staff, they’re silent on safeguarding the digital trails of employees and all users—including abortion service providers who’ll be charged with facilitating a “crime”. Meta stores information on abortion seekers. Ditto, Google. Amazon has complied with 75% of orders demanding user data.

Macro view: The US doesn’t mandate paid parental leave. Its gender pay gap is exacerbated by the fact that working moms earn less than women without children. At a time of bear market-fuelled cost-cutting, women may find it harder to get recruited by companies that’ll view abortion-related benefits as additional burdens.

FYI

Take off: Jet Airways, which will take to the skies again after shuttering in 2019, has reportedly placed a $5.5 billion order with Airbus.

Bad streak: Social commerce platform Trell, currently under investigation for due diligence lapses, has not paid influencers for 6-7 months. About 100 employees have also either left the company or been laid off.

Funding alert: Legacy dairy brand Milky Mist is seeking institutional investors for a D2C play. B2B marketplace Solv raised $40 million in a Series A round led by Japan’s SBI Holdings.

Clamour: Thailand’s largest conglomerate Charoen Pokphand is competing with Reliance, Swiggy, PremjiInvest, and (possibly) Tata to acquire the India operations of German retailer Metro AG.

Pick up: Sam Bankman-Fried’s FTX crypto exchange is reportedly debating internally whether it should acquire Robinhood Markets Inc. FTX has denied it is in active talks with Robinhood.

Red mark: Russia defaulted on its foreign debt for the first time since 1918 due to Western sanctions in the wake of the Russia-Ukraine war.

Nesting doll: The Indian government is now censoring tweets criticising censorship.

FWIW

A-baht time: Thailand's Baht is seeing brighter days thanks to the surge in tourism. About 1.5 million tourists are expected to visit the country this year. It's also jumped on the wellness tourism bandwagon (codename for cannabis legalisation) to aid its economy.

Chalo, Japan: Japan's international schools have it all: skiing and golf classes. Their TG? Elite Asian families, particularly from China. The relentless Covid-zero policy and enforced remote learning is driving Chinese parents to shortlist Japanese schools. It helps that Japan boasts the developed world's lowest Covid death toll.

Face the music: 3M Co's foam earplugs could cost the company billions in legal settlements. About 100,000 military veterans have reported hearing damage after using the earplugs. The company believes that soldiers weren't trained to use them properly.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.