Chasing Choksi

Also in today’s edition: JPMorgan’s bad eggs; Whiplash weather wreaks havoc on crops; Amul’s cola ambitions; Mukesh Ambani, the hotelier

Good morning! Just in case the makers of Succession needed any inspiration to make a fifth season, media tycoon Rupert Murdoch has found love. For the fifth time. The 92-year-old is engaged to be married to Ann Lesley Smith, 66, six months after the couple met and eight months after he divorced former model Jerry Hall. The News Corp. founder sealed the engagement with an Asscher-cut diamond solitaire ring last week, according to his tabloid, New York Post. News of the engagement comes at a time when Murdoch and his Fox News network are battling a $1.6 billion defamation lawsuit. What do we know? Maybe the fifth time’s the charm.

A programming note: We are taking a break on March 22 on account of Gudi Padwa and Ugadi. There will be no editions of The Signal and The Signal Daily podcast on March 23.

Today’s edition also features writing by Soumya Gupta, Srijonee Bhattacharjee, Jaideep Vaidya, and Julie Koshy Sam.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

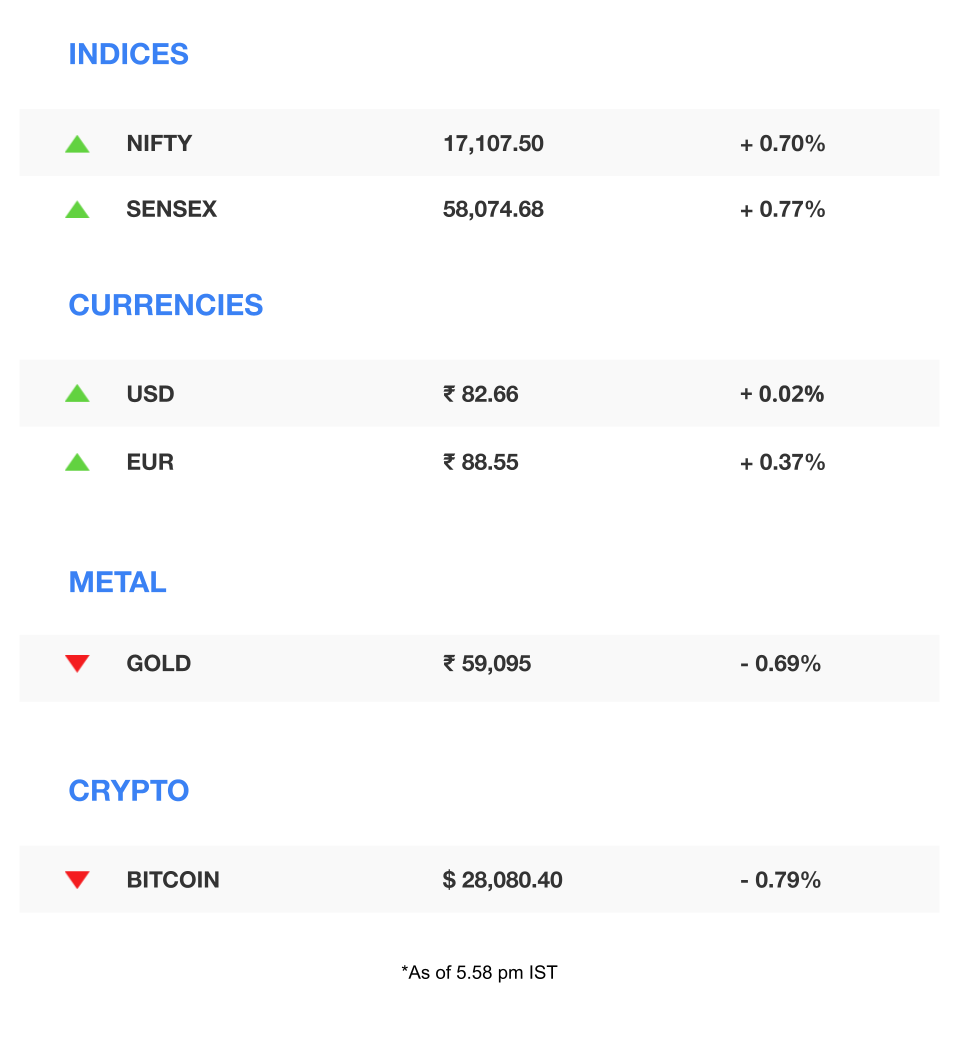

The Market Signal*

Stocks & economy: Global stocks rallied after US treasury secretary Janet Yellen said the federal government was ready to protect any bank showing signs of distress but concerns over "systemic credit risk event" remained and a global poll by Bank of America underlined that.

Shares of First Republic Bank, which were sliding earlier, jumped as JP Morgan discussed further funding and on talks of more aid from the government.

Indian equity indices may rise on the global cues after a flat opening.

The US and UK central bank decisions due today and Thursday—both may raise rates by 25 bps—will provide direction this week. The CME FedWatch tool also showed a 25% possibility of the US Fed not raising rates at all.

Back home, investors must exercise caution as markets will be volatile ahead of the Fed's decision. The recovery in bank stocks may continue.

BANK FRAUD

The Art Of The Slip

One of India's most wanted fugitives is slowly slinking out of the global dragnet thrown by Indian agencies to capture him. The Interpol has withdrawn the Red Corner Notice (RCN) issued against diamantaire Mehul Choksi, wanted for allegedly defrauding Punjab National Bank.

The Central Bureau of Investigation has said the RCN withdrawal would not hamper its efforts to extradite him from Antigua, where he is holed up. But Choksi will be free to travel anywhere in the world. Choksi had claimed that Indian spies had abducted him in 2021 and taken him to Dominica, where a case of illegal entry was slapped on him. Dominica dropped the case in May 2022.

Incidentally, the Enforcement Directorate reportedly already seized assets worth 85% of the ₹23,000 crore ($2.7 billion) the trio of Choksi, his diamantaire nephew Nirav Modi, and liquor tycoon Vijay Mallya owe Indian financial institutions.

FMCG

Utterly Butterly Ambitious

India’s largest dairy brand has dreams of becoming India’s largest FMCG brand. Amul’s new managing director Jayen Mehta told The Economic Times that the company wants to “straddle every foods category consumers use in the kitchen”.

While the dairy cooperative already makes products like cookies, bread, snacks, and milk-based protein beverages, it wants to expand into non-dairy beverages (including sports drinks), pulses, edible oil, organic foods, and frozen foods. That would pit it against the likes of Parle, Nestle, Britannia, and Pepsi.

Why?: Milk prices in India rose by ₹8 ($0.1) per litre in 2022 because of various factors, including the underfeeding of calves during Covid lockdowns, when demand slumped. Inflation in the dairy industry has been higher than in the general consumer products category since October. And it’s unlikely to stabilise until Diwali, which could be why Amul is looking to diversify.

CLIMATE CHANGE

Hail Marys, Hailstones, And Harvests

In 2015, 196 countries adopted The Paris Agreement and the overarching goal to limit global warming to 1.5°C. Cut to today, that goal is in jeopardy. The latest report by the Intergovernmental Panel on Climate Change warns that we may cross this threshold within 10 years.

It’ll take a near-miracle to not exceed the 1.5°C barrier. This includes slashing fossil fuel infra (even as the world stocks up on polluting energy sources due to an ongoing war), and industrialised nations halving emissions by 2030. The EU wants to enforce a 25-30% carbon tax on certain imports, but countries such as India—which has decried the inequity between developed and developing nations in assuming climate responsibilities—are having none of it.

Warming above 1.5°C will unleash food insecurity, apocalyptic weather, human displacement, species extinction, and diseases. The first has already come home to roost. Whiplash weather across India, induced by extreme heat and the possibility of El Nino conditions, is destroying crops everywhere.

The Signal

Virtually every crop—from spices in Gujarat and wheat in Punjab, to green gram in Telangana and mustard in Uttar Pradesh—has been battered by unseasonal rains and hailstorms; ditto mango and watermelon. The India Meteorological Department has issued advisories for farmers.

The prices of staples will shoot up, all while India grapples with already-slowing consumption. A recent finance ministry report also underlines that inflationary pressure hereon will be weather-driven. Ergo, any economic advantage India had amid a global banking crisis may not fructify anytime soon.

🎧 Sri Lanka receives a $2.9 billion economic lifeline. Also in today's edition: climate change is coming for food security. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

BANKING

Chink In The Knight’s Armour

JP Morgan is Wall Street’s favourite knight in shining armour from the time of its legendary founder, John Pierpont Morgan, who famously got together the biggest US financiers and industrialists to save the country’s financial system from collapsing in 1907.

But despite its heavyweight status, it is surprisingly gullible. Last week, the London Metal Exchange (LME) cancelled nine contracts for nickel worth ~$1.3 million owned by JP Morgan Chase & Co. But when LME inspected the warehouses that held the contracts’ wares, what should have been bags of nickel turned out to be sacks of stones. The bank had booked a $160 million loss from nickel trades last year.

In 2021, JP Morgan was also allegedly taken for a ride by entrepreneur Charlie Javice, who sold her company Frank for $175 million showing off its database of five million college students. Most of that database was fake.

HOSPITALITY

Meet Me At The Hotel

After petrochemicals, telecom, and retail, billionaire Mukesh Ambani’s next frontier could be the hospitality business.

Reliance Industries will build hotels and resorts near the Statue of Unity in Kevadia, Gujarat, per The Economic Times. Earlier this month, India’s largest conglomerate set up a new entity called Reliance SOU with an initial investment of ₹25 crore ($3 million) to get into commercial real estate. Reliance would be up against the Tata Group, which had announced two new hotels near the world’s tallest statue last year.

Old hat: These aren’t new pastures for Reliance. In 2010, it acquired a ~14% stake in the luxury Oberoi Group of hotels for over ₹1,000 crore ($120 million); it later hiked that stake to 18.5%. Last January, it acquired the luxury Midtown Manhattan hotel Mandarin Oriental for $270 million in cash and debt. It’s unclear if Reliance’s Kevadia hotels will also be all-luxury.

FYI

Shore up: With its IPO plan out of the picture, Fabindia is looking to raise ~₹1,200 crore ($145.1 million) at a ₹11,000 crore-12,000 crore valuation. Its private equity investors—PremjiInvest and Lighthouse Funds—will reportedly part with shares in the latest round.

Greenlight: Credit rating firm Moody's has upgraded Elon Musk's Tesla to investment-grade status from junk.

Blacklisted?: India may draw up a "negative list" of countries where data pertaining to its citizens cannot be transferred. This could make its way into the upcoming draft of the Digital Personal Data Protection Bill (DPDPB), 2022.

Please don’t go: Talks are on to convince outgoing Tata Consultancy Services CEO Rajesh Gopinathan to take on a strategic advisory role at the IT major or the Tata Group.

Yield: Apple wants a tweak in India's labour laws to maximise its local production. According to Bloomberg, Tamil Nadu, which houses India’s largest iPhone plant, may carve new reforms to make working hours in factories more flexible.

Shake-up: Walmart-backed Flipkart has reshuffled its top management across a few categories. Additionally, it has also cut back on its quick-commerce service, Flipkart Quick, to mainly sell fresh groceries.

Gather: E-vehicle manufacturer Ola Electric is looking to raise about $250 million-$300 million in its latest round to expand its operations. It has reportedly tapped sovereign wealth funds such as Qatar Investment Authority and Abu Dhabi Investment Authority.

THE DAILY DIGIT

$88 billion

The amount spent by China on procuring Russian oil and gas since the Ukraine invasion in 2022. (Bloomberg)

FWIW

Whose rights are these anyway?: Busy, the courts may get. AI chat tool Character.AI has its own fan base. Heavily inspired by pop-culture fandom, users can create AI-generated characters on the platform. Like Yoda, Hermione Granger, and Walter White. This could spur a war yet again(?!), as such AI chatbots infringe on intellectual property. Character.AI, for instance, places the onus on users to do due diligence. How convenient.

Food for thought: The pandemic has made people kinder. According to the World Happiness Report, benevolence—measured by acts of donation, volunteering, and helping strangers—rose by ~25% in 2022, ever since the pandemic began. We wonder how humanity would fare if a toilet paper shortage was the litmus test *cough cough*. In related news, Finland is the world's happiest country for the sixth year in a row. India stands at 126th. Afghanistan occupies the bottom spot at 137.

Mouse apocalypse: Here's a job fit for NYC's rat czar. Marion Island in the Indian Ocean has turned into a mouse house. Unsurprisingly, it wants to get rid of rats that are threatening its endangered seabirds and the wandering albatross. As part of the Mouse-Free Marion Project, a fleet of helicopters will spread rodent poison across the sub-Antarctic island by 2025. This plan better work: previously, an army of cats tasked with the job ended up turning feral 😼.

Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here.

Do you want the world to know your story? Tell it in The Signal.

Write to us here for feedback on The Signal.