Bangladesh exports are India's headache

Also in today’s edition: Chaos in the capital; Poachers' paradise

Good morning! Remember how Amazon waged a price war against shoe-seller Zappos and Quidsi’s Diapers.com before finally cornering them into acquisitions? Now it’s Amazon’s turn in the corner. The Wall Street Journal (WSJ) reports that Amazon has ditched thoughts of Target and Walmart to fight a new kind of price war, this time with Temu and Shein instead. Is Shein worried? Nope. WSJ reports it is busy getting ready to sell SCaaS—‘supply chain as a service’. Brands and designers are willing to pay good money to use Shein’s fast fashion secret sauce. As Michael Scott said, “Well, well, well, how the turn tables”.

🎧 The PIB fact-checking fracas. Also in today's episode: Indian alcohol brands can’t hide behind mineral water ads. Tune in to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

Soumya Gupta also contributed to today’s edition.

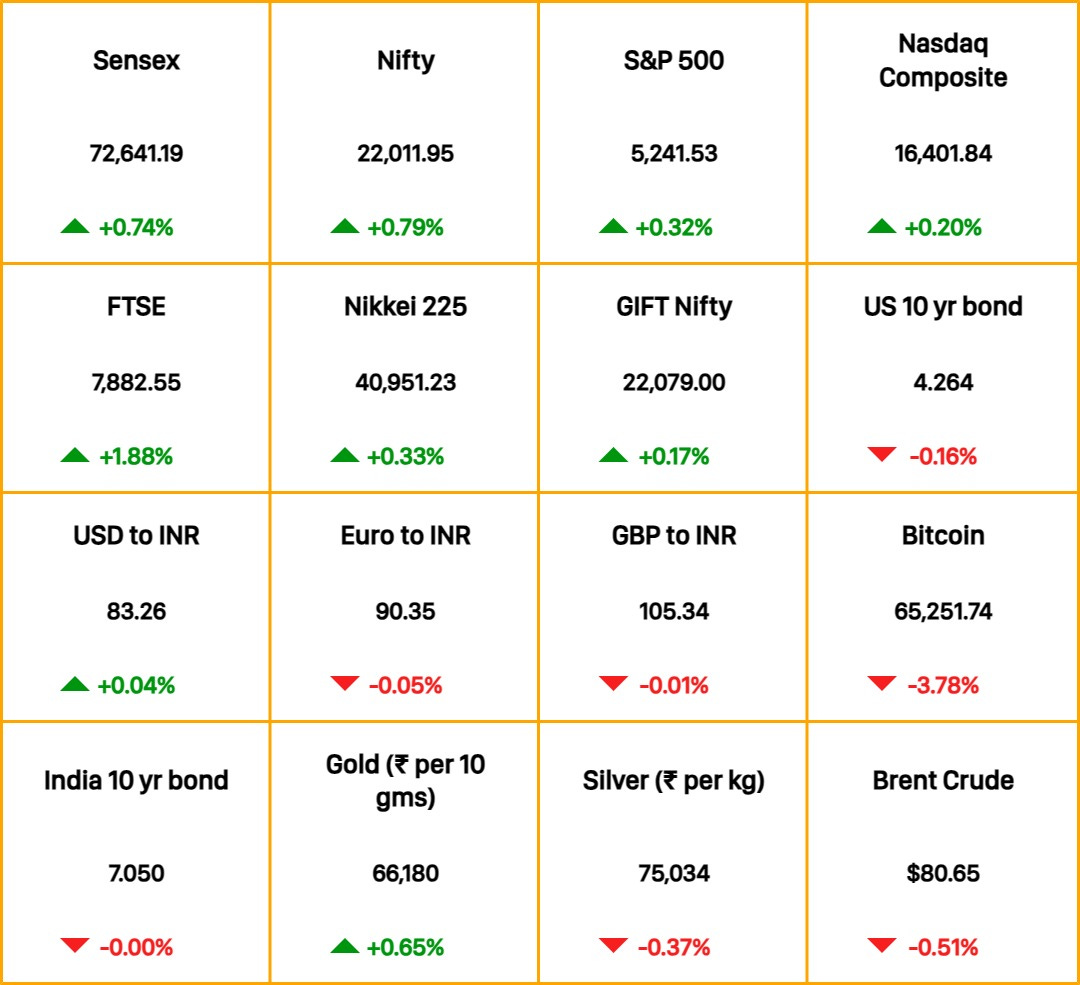

The Market Signal*

Stocks & Economy: The world’s most valuable company, Apple, lost $113 billion or over 4% of its market value in one day after the US Department of Justice and 16 attorneys general announced a probe into its market domination. The iPhone maker is also facing investigations in Europe even as sales are slowing.

That did not stop US indices from their upward march. Social media company Reddit’s stock, which debuted on Thursday, soared 48%.

Indian mutual funds investing in foreign exchange traded funds will have to slow down as market regulator Sebi has told them via the Association of Mutual Funds in India to stop fresh investments from April 1. The instruction follows them nearing the $1 billion prudential limit for the industry.

Asian markets were mixed in morning trade. Most were in the red but Japanese stocks continued to rally. The GIFT Nifty indicates a positive start for Indian equities.

TRADE

Red Sea Missiles ‘Hit’ Delhi Export Hub

The ripples of the Red Sea crisis are being felt at Delhi airport.

Air freight rates from Delhi have more than tripled and exporters are not happy about it. Their anger, however, is directed towards Bangladeshi garment exporters who have been using Delhi airport as their transshipment hub since February 2023. It was going well until the West Asian crisis, which disrupted ocean traffic and raised demand for air cargo, The Core reports.

The decision to let Bangladesh exports pass through Delhi was a reciprocal gesture—India has been using the neighbour's Mongla and Chattogram ports since 2022. It was aimed at boosting the national economy while lowering shipment costs for manufacturers and increasing daily international cargo exports via the GMR-run Delhi Airport. It was expected to be a milestone for Delhi airport and India-Bangladesh ties.

PODCAST

Tune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and economy.

Today, he speaks to Jay Kale, Auto Analyst & Sr VP, Elara Securities, on the auto investments frenzy, from JSW-MG to Tata Motors.

POLITICS

Peak Delhi Plays Out Again

The Enforcement Directorate (ED) arrested Delhi chief minister Arvind Kejriwal on Thursday evening following allegations that he and members of his government received kickbacks to bend excise policy to favour some alcohol businesses. It’s the first time that a sitting chief minister has been arrested in India.

Kejriwal dodged several summons saying the case was baseless and engineered to politically damage him. He is the second chief minister to be held in an alleged corruption case in as many months after Jharkhand’s Hemant Soren, although Soren had resigned a day before his arrest.

The detention came on the day the Election Commission of India published data with details that helped match donors and recipient parties through electoral bonds. While it could be argued that businesses and influential individuals have donated to all parties, they clearly favoured those in power, whether at the centre or in the states.

ARTIFICIAL INTELLIGENCE

Uneasy Alliances

While tech superpowers US and China duke it out for AI dominance, those on the sidelines are getting into tactical positions.

Capitalising on the EU’s stringent AI Act, Canada and the UAE are pitching themselves either as “light-touch regulation” or business-friendly territories to startups in the bloc and the UK. On offer are research and development credits, lenient taxes, fast-tracked immigration, and subsidies. The companies they’re courting to move headquarters include the UK’s StabilityAI and Synthestia, and Germany-based Aleph Alpha.

But West Asia’s billion-dollar AI investments and a regulation-lite approach may be peaches and sunshine only for so long. Concerns abound over digital authoritarianism and an AI-fuelled arms race in a volatile region. And there’s growing anti-immigrant sentiment in Canada.

The Signal

On the companies front, Big Tech’s proclivity to buy out competitors or blitzkrieg them into oblivion is already under scrutiny. While Apple and Google negotiate bringing the latter’s Gemini AI to iPhones, Microsoft is investing in, then “partnering” with startups (OpenAI, Mistral, Inflection AI) that innovate in ways risk-averse giants don’t. This has helped it corner the enterprise market, but not all its investments are failsafe.

Take Cohere, which The Information notes isn’t making much money as an outlier in a market where poaching is the norm. Or UK-based Builder.ai, mired in money laundering and loan fraud investigations by India’s Enforcement Directorate and CBI. One of the many standouts, as Financial Times reports, include suspicious money trails between Builder.ai co-founder Saurabh Dhoot and his uncle, Videocon tycoon Venugopal Dhoot.

FYI

This ain’t working mate: Vedanta-controlled Hindustan Zinc Limited may scrap demerger plans due to the government’s rejection of the proposal, The Economic Times reports.

Going digging: Jindal Steel & Power has taken over Venezuela’s largest iron ore mine; it will invest $800,000 in the complex.

Shutter down: Edtech firm Byju’s will close 200 tuition centres next month, two thirds of its total network, The CapTable reported.

A little late: Patanjali Ayurved’s managing director Acharya Balkrishna gave an ‘unconditional’ apology to the Supreme Court for a contempt charge; the SC wants founder Baba Ramdev to be in court on April 2.

Swept away: A bankers’ survey found that low-cost deposits are slowing down in a majority of Indian banks as investors look for higher returns; loan demand is still high.

THE DAILY DIGIT

Rs 545 crore

The amount of money firms and individuals linked to Reliance Industries donated to the BJP. (Scroll)

FWIW

De-addiction from de-addiction: The wonderful thing about Ozempic (and its peers) is that it has helped millions of people lose weight by suppressing their appetite. What’s more, scientists think it could help cure alcohol addiction too. But what if you end up with an Ozempic addiction instead? Americans are spending as much as $300 a month on medication and coaching to wean themselves off of Ozempic and Wegovy while making sure they don’t gain weight again, Bloomberg reports. It’s steep, but still not as steep as the over $1,000 a month Ozempic can cost in the US. There are no wins in addiction, are there?