RBI should be addressing people, not markets: JR Varma

The RBI rate-setting panel member says the central bank’s cryptic policy language is not in sync with its mandate

Good morning! World over, central bankers start getting fidgety when prices begin to rise. Most of them have a mandate to keep inflation at a certain level or within a band by using monetary policy instruments at their disposal. The most effective weapon they have is the interest rate or cost of borrowing money. By changing the cost of money for banks, central banks can control the interest rates prevalent in the economy, which helps in dialling up or down demand, which, in turn, helps regulate prices. But that tool has proven to be rather less effective in the current context.

There are multiple reasons for it. Prices are behaving differently because of several factors that disrupted the normal course of economic activity and flow of business and trade. It began with the pandemic, which shut down normal life. The Russia-Ukraine war followed, upending the global energy trade. China’s extended zero-Covid policies, economic downturn, and strategic rivalry with the US are reordering global supply chains and trade relationships. Add to that the accumulated costs of past fiscal mistakes such as distributing money almost free during the pandemic.

Policymakers in the West are calling for new frameworks to deal with a situation they are finding hard to come to grips with. What they do will have implications for emerging markets like India.

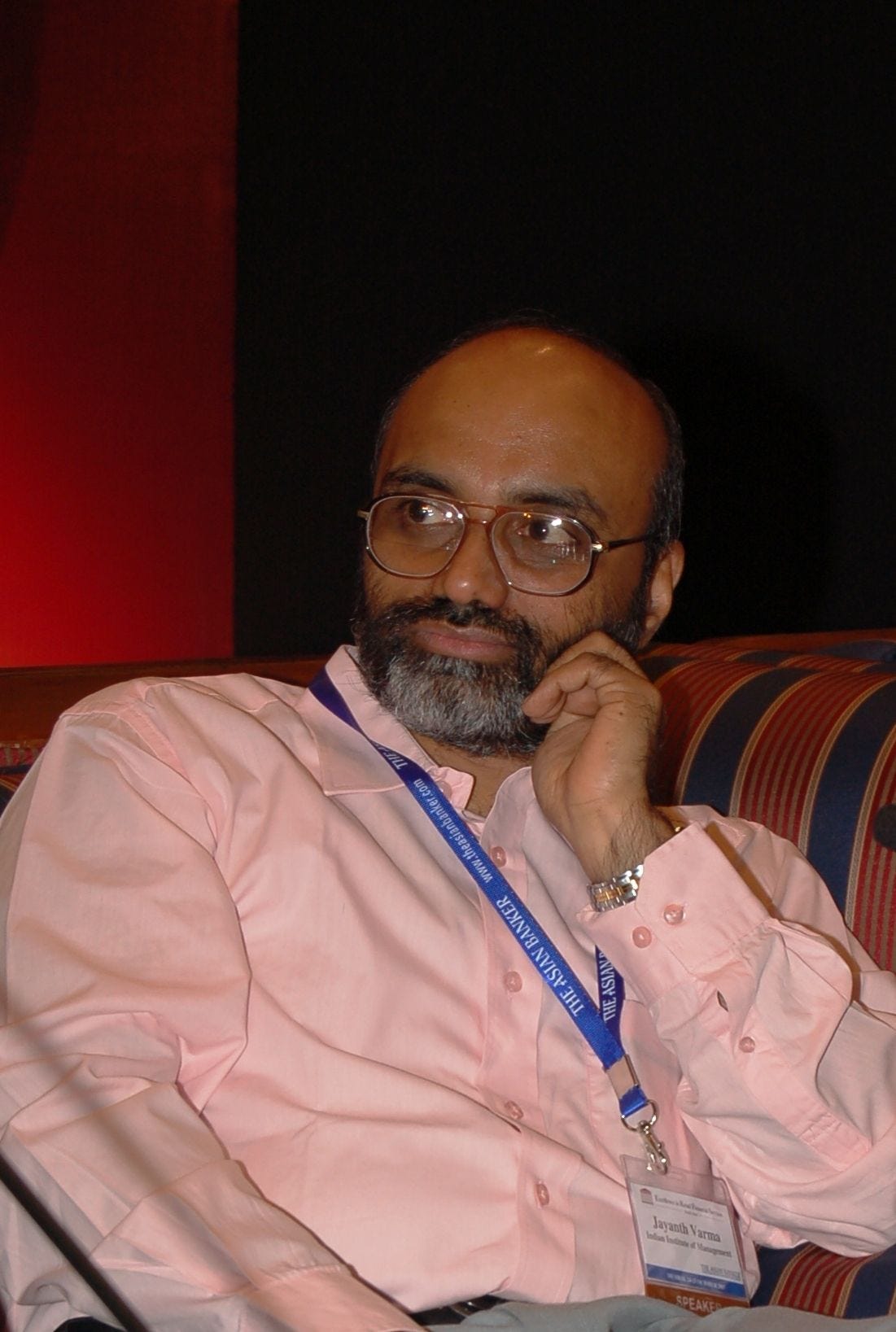

The Intersection spoke to Jayanth R Varma, professor of finance at Indian Institute of Management, Ahmedabad, and member of the Reserve Bank of India’s rate-setting monetary policy committee (MPC), to understand what is going on in policymakers’ minds. Here are excerpts from the interview. These have been lightly edited for clarity.

Also check out our curation of the best long-reads of the week.

The Signal is now on Telegram! We've launched a group — The Signal Forum — where we share what we’re reading and listening through the day. Join us to be a part of the conversation!

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter Instagram and Threads.

Photo courtesy: Jayanth R Varma

Central bankers agree that long-term structural changes will have implications for inflation. They expect frequent supply shocks, higher prices, and higher volatility in financial markets. European Central Bank president Christine Lagarde suggests creating a new playbook. What in your view could be a new playbook?

I don’t think we need a new framework. We have been having shocks like this for a very long time. Every five or ten years, there is some shock or the other. In 2008 we had the global financial crisis, then we had the pandemic, then the Ukraine war… I think the issue is not about changing the framework. I think the broad framework still works. I think inflation targeting frameworks work. The growth-inflation trade off has not gone away, and real interest rate is the key policy tool to bring inflation back to target. I don’t think these have changed. Yes, there is more volatility but we have to live with that.

When you hear statements like this, the sense you get is that the situation has gone out of hand.

I think that sense is there more in the advanced economies than in the emerging economies, and I think what happens is that people learn the wrong lesson from the GFC (Global Financial Crisis of 2008-09). They learnt that monetary policy can solve all the world’s problems.They thought that you can make these problems go away by flooding the world with money and that it won’t cause inflation

In 2007-2008, the world needed large liquidity injections. It is true that it wasn’t inflationary at that time because demand was depressed, but when you apply that lesson to the pandemic then everything goes wrong. Because unlike the global financial crisis, the pandemic was more of a supply shock than a demand shock. Not only did monetary policy become very loose, but fiscal policy also became very loose in advanced economies. On both these accounts emerging markets were different. When you put the two together you have this strange situation where people have a lot of money to spend but a lot of the factories are not running.

Emerging markets did not get into as big a trouble on this because both fiscal and monetary policies were not as loose as they were in the West. Therefore, the impact on inflation, even peak inflation, was less. If you look at India, we hit 7.5%, which is nearly two times our target. But you look at the West, they have a target of 2% and at one point they surpassed four times the target. As for fiscal policy, they just sent cheques that people could spend. What did India do? We said we will give food free. That will actually dampen inflation.

(The sense that things are out of hand is) Partly guilt and partly panic, the feeling that we went overboard during the pandemic and, therefore, now we must go overboard on the other side. That sense is not as strong in the emerging markets as it is in the developing markets.

US inflation had gone outside living memory. Unless you were 60+, you hadn’t seen that kind of inflation in your life. In India, we had seen high inflation as little as 10 years ago, so things have not gone beyond our memory.

Weather-induced food inflation caught the Reserve Bank of India (RBI) off guard, which shows our lack of visibility on the impact of climate change and shifting weather patterns. Has climate change become an integral variable in monetary policymaking in India yet? Also, given the uncertainties, is it even possible to estimate short-term demand and supply

The points about climate change are very valid over longer horizons. When you look several years later, that look, we had to worry about this back then. But then I think uncertainties on monsoons were flagged well before.

Historically, monsoons have always been a part of our policymaking. We had the busy season and slack season credit policies. What I mean is, apart from monsoons, have other climate change factors become integral variables in policy making?

Over decades, India has learnt to live with monsoon vagaries by keeping buffer stocks. And even if we have to buy stocks from outside, we have $600 billion of foreign exchange reserves. Those are very big shock absorbers.

What has pushed inflation up in July-August is vegetables, and we don't stock vegetables. I am sure people are thinking of investing in stronger cold chains so as to at least store vegetables over one harvest and so on. I am sure lessons will be learnt and we will deal with it a lot better in even five years. As a country we are very adaptive.

What is nice about vegetables is that harvests come more frequently. Losing one tomato crop is not nearly as scary as losing one wheat crop, where you will have to wait another six months for the next crop. You wait for two months and the next tomato harvest is there. It is important to have some kind of floor price for tomatoes because if they fall to ₹10 a kg, people would not want to produce the crop.

What happens with vegetable prices is that they are so volatile that what goes up very fast also comes down, and it is possible for monetary policy to look through this for a few months. You can’t look through six months but you can look through one or two months. In that sense, what is happening to fruits and vegetables is not scary so long as you keep in mind that there is volatility. I remember in the June (MPC) meeting, members were all happy that inflation had come down. I said that you should not congratulate yourself so early.

You have consistently disagreed with the RBI’s monetary policy stance. Could you tell us why?

When I began disagreeing, I was worried that on some pretext or the other the MPC might push rates further even to 6.75% or 7%. Had people taken that stance very seriously, and we knew that the July (inflation) numbers were going to be 7+, then that would have been a pretext for another 25 bps [basis points] hike. At that point of time, I was scared that 6.5% is already quite high. It is sufficiently restrictive that a hike in tomato prices will not spill over into other things.

When are volatile food prices a problem? If that high food price immediately leads to a demand for higher wages and that feeds into costs of other goods, and so on. But when monetary policy is restrictive, that does not happen for two reasons. One, because inflation expectations are well anchored and even if not households, businesses see through this. Businesses are convinced that the RBI is on the job and inflation will come down. This reflects in business expectations. They are forecasting very comfortably that inflation will come down and are not very worried about it. If businesses don’t think that inflation will stay (high), they do not grant wage increases. The second round of the spiral will not begin. In my view, 6.5% is sufficiently high to ensure that. I used to be scared that the MPC does not see 6.5% itself as quite high and they might push it up to 6.75% or 7%. But in the past three meetings, I have seen that they pay lip service to “withdrawal of accommodation”. They are standing pat at 6.5%, which means that I am no longer scared that they will push the rate up even more. My point is that if you don’t intend to raise rates then why should you have a stance that says you are going to do it? You should just keep quiet, or not have a stance, or just have a neutral stance.

As I said in June, the inflation problem is a long battle. It will take a fair amount of time. I am not saying that the problem is over. I am saying that we are winning the war; 6.5% will be enough to win that war if we are patient. And we can afford to be patient because there is sufficient credibility about the monetary policy.

It isn’t as if we need to get to 4% tomorrow. We can be a little more relaxed on that and pay a little more attention to the growth fragilities.

That brings me to central bank communication. There was a period when legendary central bankers such as the Bank of Japan’s Eisuke Sakakibara, who was known as “Mr Yen”, the US Federal Reserve’s Alan Greenspan, and back home, YV Reddy, used words as potent instruments to signal to markets. Do you think that central bank language as an instrument has lost its sharpness in the past couple of years?

I have several problems with that (language). One is a fundamental, ideological, and philosophical problem. An inflation-targeting central bank is accountable to the people. It is a target that affects every citizen of the country and they are looking at the central bank to then deliver on price stability. When you have that kind of situation, I don’t believe that the central bank’s audience is limited to a bunch of bankers and banking economists. It cannot talk in esoteric language and say that all the professional economic forecasters understand what we are saying.

When you have a price stability mandate you have to talk in a language that a common person can understand. You cannot talk in coded language. I remember about the ECB they used to say that if they say “highly vigilant” it is one thing, and if they just say “vigilant’, it means something else and so on. Which is why I suggested that you should replace the stance with a dot plot [data represented as dots on a graph] that anybody can understand. A majority of the committee thinks that the rate will go to 7%. Everybody understands what that means. That may or may not happen but you understand what the MPC is saying.

What you are essentially suggesting is that an inflation-targeting central bank should not be bowing to the markets, and that is what is happening today.

You shouldn’t be worried about what is happening to the exchange rate, or the 10-year yield or the Nifty. That is not your mandate. The MPC has only two mandates: price stability and growth.

Back in 2007-08, central banks across the globe had coordinated policy actions compared to the divergent policies we see today. What in your view will be the ramifications of that?

Back in 2007-08, you saw the G20 work with a kind of consensus that is definitely not there today. That happens in a kind of crisis that affects everybody in the same way. Today, the problems that confront the US are very different from those that confront Japan or Europe. An appropriate policy for the US is very different from an appropriate policy for Egypt.

Emerging markets and advanced markets are in very different books. You tend to get synchronised responses when the problems facing the world are similar. If the shocks that are coming in are very different, you will get very different responses.

If you go back, I think 2007-2008 was an aberration in terms of the consensus. The Plaza Accord was also another instance where everybody agreed that the US dollar was overvalued. That is when policymakers sit down and say let's solve this problem and that too lasts for a short period. Then we go back to the same bickering, because nations ultimately pursue their self-interest.

One banker has said that the regulatory framework today is very orthodox and it is stifling innovation. Two years ago the fintech sector was thriving. You have been a SEBI board member too, where you have seen companies through a different lens. What do you think is the golden mean where regulation is tight enough to guarantee systemic safety and at the same time, it doesn’t choke innovation?

It is true that fintech companies are very unhappy with the regulatory regime, but we must also recognise that we have had a fair amount of innovation in India.

One must also recognise that the same combination of monetary and fiscal stimulus led to a lot of excesses in the financial markets, one being the big start-up bubble. That obviously has deflated. When you look at the Indian fintech sector, 60% of the problems that they are facing is in meeting funding (requirements) and only 40% is the regulatory obstacles. The start-up bubble pushed companies to do too much too quickly. There is a mentality that you will go ahead and break the rules and it is all okay. That is okay in some sectors of the economy, but not in finance.

ICYMI

End of an era?: Superhero movies adapted from comic books had the last two decades in a chokehold. The years between 2016 and 2019 were the golden age for this genre, with an average of six films releasing each year. Superhero franchises raked in billions of dollars in box office collections. But genre fatigue has set in. The audiences have seemingly had enough, and the Marvel and DC universes are falling on hard times, as recent numbers show. DC's Black Adam, Shazam: Fury of the Gods, and The Flash were flops. Critics, too, seem exhausted with the relentless CGI fests. Six films collected $1 billion in worldwide ticket sales since 2020, but only one superhero film was a legitimate success (Spider-Man: No Way Home). In this statistical analysis, Daniel Parris highlights why superheroes aren't invincible, after all.

What’s next for Parle-G?: Growing up in Mumbai’s Andheri East suburb, one of my (Jaideep) fond childhood memories was sticking my nose out the window of the local train as much as I could as it crossed the Vile Parle station. Because between the Vile Parle and Andheri stations, right along the railway track, was the factory of Parle Products, best known for its biscuit brand, Parle-G. That whiff of Parle biscuits being manufactured as the train crossed the factory was akin to a snack. Parle, which launched in 1929, is the world’s largest biscuit manufacturer by volume today, having built its business by selling snacks to low- and middle-income families. Parle-G’s ubiquitous ₹5 pack became the second Indian FMCG brand to cross the $1 billion mark in retail sales in 2020-21, after sweets and savouries maker Haldiram’s. However, considering biscuits and snacks are discretionary spends, particularly for low-income households, Parle is expected to face significant challenges at a time of low economic growth. How can the nearly century-old company ensure it lasts for another 100 years? Check out this feature in The Economic Times.

Endless confinement: The US has one of the highest incarceration rates in the world, having imprisoned 531 out of every 100,000 people in 2022. And Francis Clifford Smith is probably its longest-serving prisoner. Smith, who turns 99 this month, has spent nearly 85 years in the US justice system. Starting from his time in juvenile detention, he’s missed some of the most epochal moments in contemporary history: the liberation of Auschwitz, Elvis Presley’s debut on The Ed Sullivan Show, the first moon landing, the invention of the internet, 9/11. His last recorded visitor was in 2013. Smith, who’s prone to paranoia and suffers from mild dementia, has no friends in the secure nursing home he now lives in. Would he ever want to step out into a world that’s alien to him? The Boston Globe profiles a man who claims he never committed the murder he was charged with—a man without an identity, and a man who’s a stand-in for the US’ rapidly-ageing prison population.

Big, not beautiful: Eighty-one metres. One hundred and seven metres. Stuff longer than the size of a football field. The “stuff” we’re alluding to is wind turbine blades. The race to ramp up renewable energy has propelled (pun not intended) developers to supersize wind turbines to a point where components now weigh 800-1,000 tonnes. FYI: the largest blue whale ever recorded weighed about 190 tonnes.

This is happening because developers want turbines to generate enough electricity to power homes with a single rotation of their blades. And it seems to be working. The International Renewable Energy Agency found that wind energy costs decreased by 60% in the decade leading up to 2021.

But there’s a problem. The breakneck evolution has taken place without standardisation. The result: existing models are ageing faster than observers are able to gauge performance, and the infrastructure to transport and install these mega-marvels can’t keep up. There’s also the China threat. To know more, head over to the Financial Times.

The Talented Mr. Deschanel: For a long time, banking and finance was a boring world occupied by staid men. Today, it is full of glamorous young folks neck deep in pitch desks, fancy dinners, and sometimes copious amounts of alcohol (or cocaine). It’s easy to see, then, why Kyle Deschanel spent years pretending to be a scion of the Rothschild family, passing off as the managing director of an obscure firm called Oxshott Capital. This long profile in Vanity Fair tells the story of Aryeh Dodelson, a respected rabbi from an insular Jewish community in Lakewood, New Jersey. In 2018, he transformed into Paul-Kyle de Rothschild Deschanel, renting a townhouse, shopping fake pitch decks, and hobnobbing with heirs and supermodels over $500 brunches. Much like the legendary Anna Delvey (or Matt Damon’s iconic Mr. Ripley), Deschanel wooed people and made off with their money by pretending to raise for highly-valued startups. Among them was BYJU’S, which actually retained Oxshott Capital’s services. But it never received the money, adding to the edtech firm’s growing pile of financial woes.

Ghost town: Forest City was supposed to be Chinese real estate company Country Garden's largest overseas project, across four reclaimed islands in Johor, Malaysia. Billed as heaven on earth, the project's website showcases buildings surrounded by lush greenery. The $100 billion project was launched in 2013 to accommodate 700,000 residents, with office towers, malls, and schools in tow. But only 9,000 people currently live in Forest City. What remains is a ghost town dotted with deserted streets and empty shops. Through the years, the corporation also had to deal with regulatory issues, political resistance, and a global pandemic. There are also concerns about environmental damage due to a huge land reclamation effort. Add to it, the Chinese government has undertaken steps to thwart its citizens from buying overseas properties. Aside: on Thursday, Forest City’s Chinese developer warned that the company may default on its debt. This story in Bloomberg highlights the downfall of a dream project.