FAME and (mis)fortune

Also in today’s edition: One election, higher GDP?; Time and tide against TikTok; The Assam feather in Tata's hat; Small mercies for parched Luru

Good morning! In a classic example of biting the hand that feeds you, AI startup Cognition has created the world’s first AI software engineer. The model, named Devin, can write code, scan errors, and then correct them just like a human programmer, as per The Indian Express. Cognition is backed by high-profile names like Peter Thiel, former Twitter exec Elad Gil, and DoorDash co-founder Tony Xu, among others. Feels like the final nail in the coffin for the ‘advice’, jUsT lEaRn tO cOde…

🎧 Dating apps aren’t cool anymore. Also in today's edition: TikTok in trouble. Tune in to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

Jessica Jani, Roshni Nair, and Adarsh Singh also contributed to today’s edition.

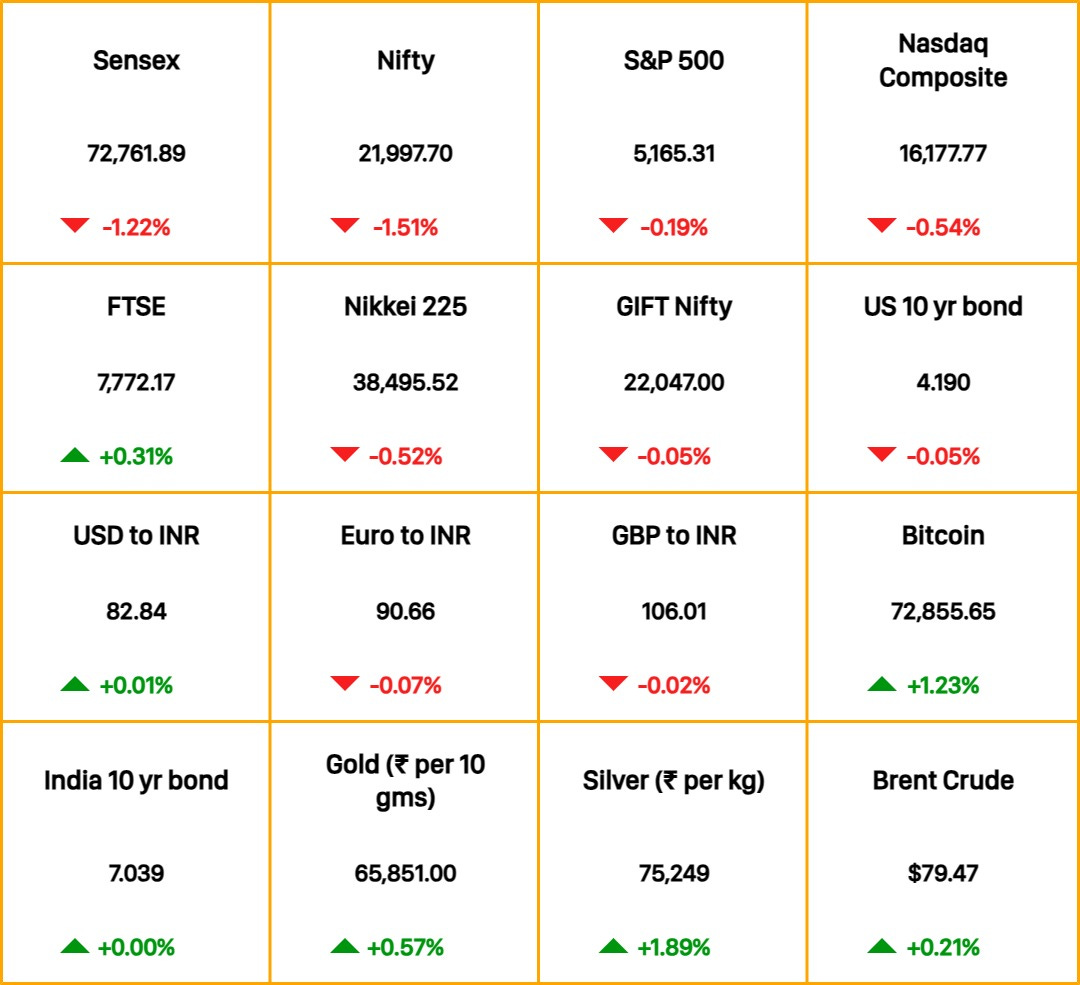

The Market Signal

Stocks & Economy: Pressure from the Reserve Bank of India and market regulator Sebi appears to have finally got to Indian equities, particularly small and midcap shares. Sebi chairperson Madhabi Puri Buch is already seeing froth in the market, although billionaire banker Uday Kotak believes it is minimal. Additionally, the Enforcement Directorate freezing bank accounts linked to a Dubai-based hawala operator, who was allegedly channelling money into small and midcap stocks, spread fear, leading to a crash in indices. Reports also connected the operator, Harishankar Tibrewala, to a Dubai-based betting platform, Mahadev Online Book, which was alleged to be involved in money laundering.

US equities suffered losses on Wednesday and passed on the sentiment to most of Asia this morning. Indian equities are expected to open weak, going by morning trends in the GIFT Nifty. Regulatory actions will likely direct market movements in India in the next few days.

POLITICS

We’re One Big, Happy Election

A report on the impact that ‘One Nation One Election’ can have in India has concluded that simultaneous elections bump up the GDP by 1.5%, The Indian Express reports. It also found that inflation rates fell in such years. The study’s authors considered any year where 40% or more of the states went to the polls together as a ‘simultaneous election’ year.

It’s dubious: Outside consultants told the study’s authors their conclusions were ‘bold’. The data may not have accounted for confounding variables affecting GDP growth rates, government expenditure, and inflation rates in the past.

Last month, industry representative bodies including FICCI and CII supported an older government claim that holding state and central elections together could save the country between ₹7,500-₹12,000 crore ($905 million-$1.4 billion). Another high-level committee may propose the country follow the German model of ‘constructive no-confidence’ elections.

PODCAST

Tune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and economy.

In today’s show, G Chokkalingam of Equinomics Research talks about Wednesday’s stock market crash and the small cap malaise. Plus: Peter McGuire of XM.COM on the gold and bitcoin boom.

SOCIAL MEDIA

TikTok’s Race Against Time

As expected, the US House of Representatives overwhelmingly approved the ‘ultimatum bill’ against the world’s most popular shortform video app. TikTok will be banned in its largest market unless ByteDance divests it in 180 days.

Despite assurances about storing data locally and intense lobbying, TikTok was up against lawmakers who believe the app’s Chinese parent poses a national security threat—enough to influence the 2024 elections that’ll be contested between President Biden and former President Trump.

The development will intensify tensions between Washington and Beijing. China will either block a sale or make ByteDance—which also operates Douyin, the ‘Chinese TikTok’—suffer consequences if it transfers ownership.

The bill faces an uphill climb in the US Senate, where reservations remain about the ultimatum. But ByteDance hasn’t helped its case: by investing in a Beijing-backed semiconductor firm during the thick of the US-China chip wars, it’s also alienated its already-spooked US shareholders.

ELECTRIC VEHICLES

No Incentive, No Dice?

EV car sales in India hit a five-month low in February despite steep discounts offered by Tata Motors and MG Motor last month. A further slowdown is expected: according to The Economic Times, Tata is cutting production until May even as it expands its manufacturing footprint.

Electric two-wheeler majors like Ola Electric and Ather Energy also aggressively slashed prices, but it worked out for them. Sales grew 24% year-on-year in February. The huge discounts aren’t just to boost demand, they’re to outrun the looming FAME-II scheme deadline. FAME-II provides subsidies to EVs sold before March 31, 2024. It covers all electric two-wheelers and commercial vehicles in other categories like cars and three-wheelers.

Prices are also expected to rise after the scheme ends, hence the anticipated slowdown in e-car sales. Electric scooters and three-wheelers are insulated for now. The Centre on Wednesday announced a new incentive scheme for them, which will be valid for four months starting April 1.

In other news from the EV-sphere, The Morning Context reported that Hari Shankar Tibrewala, associated with the Mahadev online betting scam, shares deep links with BluSmart-backed Gensol Engineering.

The Signal

Right now, it appears that EV sales are still heavily dependent on subsidies. The true scale of EV adoption will only be clear once these are drawn back. According to a report by Mint, 6-8 EV manufacturers are planning to go public in the next two years. The reliance on incentives and production cuts could impact their IPO valuations.

SEMICONDUCTORS

How The Chips Fell In Tatas’ Favour in Assam

Prime Minister Narendra Modi on Wednesday virtually launched the construction of three semiconductor projects, two in Gujarat and one in Assam.

One is a full-fledged semiconductor fabrication unit in Dholera, Gujarat, by the Tata Group. The other two are outsourced assembly and test facilities (OSATs) being set up by CG Power and Industrial Solutions Ltd in Gujarat’s Sanand, and the Tata Group in Morigaon, Assam.

The Core reported on how Assam chief minister Himanta Biswa Sarma wooed the conglomerate to get the project for Assam. The state government has rolled out the red carpet for the Tatas, including buying a bankrupt Hindustan Paper Corporation factory with a sprawling office-cum-residential campus to house the chip unit. Yet, it is not without its challenges. Read the full story here.

DROUGHT

Water-stressed Bengaluru Tops Reuse Scale

One bad monsoon—in 2023—has brought Karnataka to its knees. The state and its capital Bengaluru are facing their worst water shortage in 40 years.

Karnataka, however, emerged as the second best state in used-water treatment and reuse in a study by independent think tank Council on Energy, Environment and Water (CEEW). Haryana topped the list of states that have an active used-water management strategy. Surat and Bengaluru topped a CEEW used-water management index that ranks municipalities and corporations.

The think tank estimates that by 2050, over 96,000 million litres per day of reusable water will be available in India. More than 80% of the 503 urban local bodies across 10 states that CEEW assessed were average or below average in recycling water.

Water shortages typically mean that governments prioritise the resource for residences and farms, while industries are last in the line.

FYI

Collecting them like infinity stones: Reliance has agreed to buy Paramount’s 13% stake in Viacom18 for ₹4,286 crore ($517 million); upon completion, its stake in the entity will increase to ~70.5%.

All in a day’s work: A Prime Minister Narendra Modi-led panel will meet today to pick two election commissioners. Another committee, headed by former President Ram Nath Kovind, will likely submit its report today on holding simultaneous elections to state assemblies and Parliament.

Pink slips: Paytm is laying off staffers as part of an annual performance appraisal cycle, with some divisions being asked to reduce team sizes by 20%, Moneycontrol reports. According to Bloomberg, oil major Shell is cutting 20% of jobs in its deals division, while Swiss bank UBS is slashing 70 jobs in its Asia wealth unit.

Lil bit of this, lil bit of that: The Karnataka High Court extended interim protection to BYJU’S cofounder Byju Raveendran against a potential ouster by investors. Meanwhile, the Institute of Chartered Accountants of India has "found gross negligence” by BYJU’S auditors.

Clone wars: Spotify will roll out full-length music videos for premium users in 10 markets from Wednesday, pitting it against YouTube.

Impossible is nothing Nothing is impossible: Adidas reported its first annual loss in over 30 years on Wednesday, warning of weakening sales and high inventories in North America.

Weight and watch: US pharma giant Eli Lilly is partnering with Amazon to deliver its weight loss drug Zepbound, which competes with Danish drugmaker Novo Nordisk’s Wegovy.

THE DAILY DIGIT

₹14 lakh crore

Or ~$169 billion. What investors lost on Wednesday after Indian stocks hit 52-week lows. (Business Today)

FWIW

Back at it: Vinyls, the black disc-like thing you usually see in the home of a rich dude in the movies, are staging a comeback in the UK. The country’s Office for National Statistics (ONS) has included it among the items used to calculate inflation. The Office cited its “resurgence of popularity” as the reason to incorporate it, after it stopped doing so in 1992. As with all things music these days, Taylor Swift has to be thanked for vinyl’s popularity. Her album, 1989 (Taylor’s version), was the biggest-selling vinyl record last year in the UK. Look what you made the ONS do, Swifties!

Sequel: Have money, will do weird stunts. That’s pretty much the formula of billionaires these days. The latest addition to that list is Australian Clive Palmer who is leading plans to build Titanic II. No, we’re not talking about the flick, but the actual thing. The replica has had multiple setbacks, thanks to Palmer’s other pressing needs like unsuccessfully running for office and saving his business during the pandemic. This time though, Palmer thinks the timing is just right and believes the ship can provide “peace between all countries of the world.” Sure, whatever the rich dude says.

Needle in a haystack: That age-old idiom perfectly encapsulates the job of looking for image manipulation in scientific papers. But that’s changing fast and software from two startups, Proofig AI and Imagetwin, are leading the way. Imagetwin can compare photos in one paper against a database of 51 million images collected over 20 years. They’re also ‘taught’ that no two tissue samples taken from different animals and/or two different cell cultures should ever look the same under a microscope. Together with human data detectors, these tools have tripled rejection rates in leading journals. A clean-up seems to be in the offing.