Musk pockets Twitter

Also in today’s edition: RIL, L&T help out govt; Who will win the cement war? India’s labour force has shrunk; Even bras aren’t immune to inflation

E-commerce has come full circle. The online marketplace is now looking for real estate space, reports The Wall Street Journal. Why? Sales have plateaued online and digital advertising costs have swelled. Another added incentive: people are hitting the streets again. Stores now want to lure a new set of customers to hand them their money.

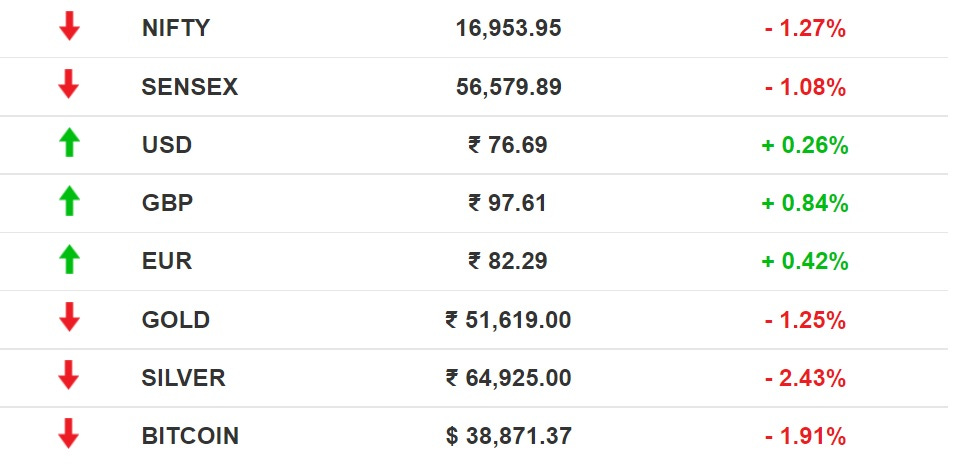

The Market Signal*

Stocks: Benchmark indices ended in the negative territory on Monday as prospects of an aggressive rate hike by the US Fed and a persistent Covid-19 wave in China triggered a global sell-off. Investors have lost over ₹6 lakh crore in the last two sessions.

Early Asia: The SGX Nifty was trading -0.06% lower at 7.40 am India time. The Nikkei 225 was up 0.32% and Hong Kong’s Hang Seng index rose.

SOCIAL MEDIA

Twitter’s Board Reads The Room

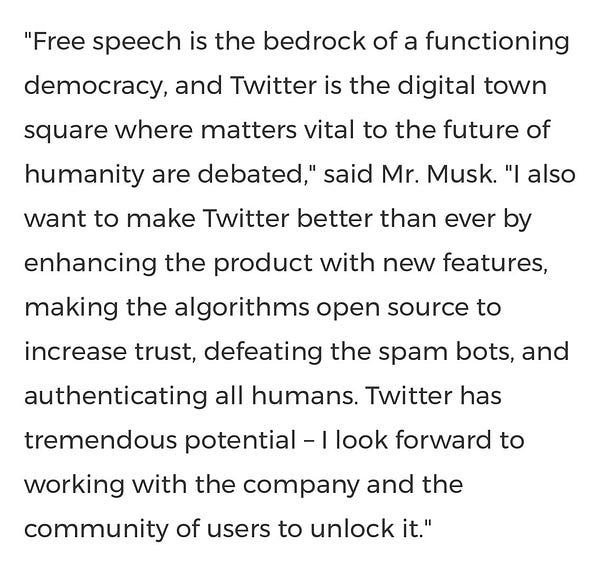

It has happened. Elon Musk will acquire Twitter in a cash transaction that values the company at approximately $44 billion. Twitter shareholders will receive $54.20 in cash for each share they own, also Musk’s “best and final offer” from last week. Twitter shares surged 5.7% to $51.70 at Monday.

Closing it: What began on January 31 with Musk’s gradual amassing of Twitter shares, ended on Sunday when the Twitter board, unable to find a “white knight”, decided to consider the world’s richest man’s offer. By Monday afternoon, the deal was done. And now it is Elon’s Twitter!

Mixed reactions: Not everyone is too pleased with Monday’s outcome. This includes Twitter employees, who have some questions over Musk’s proposed “free speech” plan for the platform. Meanwhile, one such concern, about former US president and fellow free speech enthusiast Donald Trump might have just been resolved, even as fellow conservative politicians (unsurprisingly) celebrated Musk’s takeover, while Democratic senator Elizabeth Warren sought “serious regulation for Big Tech.”

A MESSAGE FROM OUR PARTNER

Say Hello To Crypto SIPs

What if you could invest in the world’s fastest-growing asset class without worrying about monthly fees, manual trading, and volatility? And what if you could do it regularly?

That ‘if’ is now a certainty with Mudrex Coin Sets. Mudrex's crypto baskets across portfolios such as Crypto Blue Chip, DeFi 10, and Web 3.0, to name a few ensure that your investments aren’t lumped in one place. Think SIPs, but for crypto.

Mudrex is democratising crypto trading. With just $10, you can schedule your Coin Set investment frequency. Want to invest daily or every few months? No problem. You can even start, pause, or withdraw your investment any time. No wonder over 250,000 people invest on Mudrex.

Mudrex is offering $15 of crypto to everyone who signs up through The Signal. Claim your $15 and start investing today!

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.

FINANCE

RIL, L&T Bond With Govt

The RBI’s inflation management tactics and policy commentary have combined to create a dual interest rate environment. While cash-rich companies and the government benefit, borrowers and depositors bear the brunt.

The big guys: Last week, Reliance Industries and L&T bought government bonds worth ₹11,000 crore because they were getting at least 1.2 percentage points more than what SBI pays depositors for a five-10 year deposit. The final return on bonds depends upon the price a buyer pays for them. When more people compete to buy bonds, their prices increase, lowering their return on the price paid or yield. The opposite happens when demand ebbs.

Loans cost more: RIL’s and L&T’s purchases shored up demand for central government bonds and helped suppress the interest rates for the government. While the corporates and the government benefited, another move by the RBI has pushed up interest rates for borrowers.

M&A

Jindal, Birla, And Adani In Cement Mix

As Swiss multinational Holcim considers selling its India businesses—which includes a 63.19% stake in Ambuja Cement and 5% in ACC—three contenders have emerged in the running: the Adani Group, Sajjan Jindal’s JSW Group, and Aditya Birla Group’s UltraTech. With more than a fifth of India’s cement market share, UltraTech is likely to face scrutiny by the Competition Commission of India if it buys the second biggest player in the sector.

Consolidation history: It began with Gujarat Ambuja buying the Tatas’ 7% stake in ACC in 1999. Global leader Lafarge entered India the same year buying units owned by Tata Steel and Raymond. Later, Holcim picked up Gujarat Ambuja and ACC. Meanwhile, AV Birla consolidated its cement business, set up new plants and acquired rivals Jaypee Cement and Binani Cement. In 2015, Lafarge and Holcim merged globally and Lafarge gave up its Indian interests to duck antitrust scrutiny.

The Signal

Ambuja-ACC’s acquisition will catapult the acquirer to second place in India’s cement kingdom that is expanding, not least thanks to India’s construction boom and the central government’s ambitious projects such as Gati Shakti.

Interestingly, Holcim and potential acquirers appear to have differing approaches to sustainability: while the former looks to salvage its reputation by divesting cement assets, Indian companies such as JSW and Adani want to expand their footprint in the climate-apathetic industry. Adani has a mighty presence in renewable energy but is a cement novice. JSW has become adept at raising sustainability-flavoured finance. It is courting private equity giant Carlyle to back its $7 billion-$10.6 billion fundraise for the Holcim bid. Turning Holcim’s cement plants green could be an eminently financeable sustainability target.

WORK

Workers Don’t Want Jobs Anymore

Indian companies are likely to face a tough time finding workers as nearly half of the country's working age population does not want a job. It will not only make life difficult for industry but also put paid to India’s hopes of reaping the much-touted demographic dividend.

Not looking: Private research firm Centre for Monitoring Indian Economy found that overall labour participation rate, a measure showing the number of workers in jobs plus those seeking work, fell six percentage points to 40% in the past five years.

Workers have stopped looking for employment as they are unable to find jobs they want. It is not a phenomenon limited to India. In fact, India is less affected. The pandemic changed the world and triggered what is known as the Great Resignation. The US was the worst affected.

Meanwhile, the EPFO reported that formal job creation continues to be uneven.

🎧 No clickbait, this. India's labour force is no longer looking for jobs. We tell you why.

ECONOMY

Inflation’s Booby Trap

Here's one more reason to ditch boob jails: buying a bra has become expensive AF. The average price for an underwire bra is up by 17%.

Ballooned: Blame it on inflation amped by supply chain snags and the cost of raw material on the boil. The oppressive underwires themselves have become a sore point: it's 20% pricier than January 2020. Bra hooks are up by 25%; as is dyeing the fabric. This premium charge isn't getting cheaper any time soon. Surging oil prices could hike these rates further.

Going bust: The timing is unfortunate, what with underwires (reluctantly) finding their place in the wardrobe again as people embrace the pre-pandemic life. In related news, the sports bra is being used to calculate inflation in the UK much like the Men’s Underwear Index whose rise indicates recovery and dip hints at an economic downturn.

🎧 The inflation has come for lingerie. Inflation and rising energy prices have contributed to the surge. Tune in to The Signal Daily!

FYI

Lackluster: Microsoft acquiree Activision Blizzard reported a drop in first-quarter revenue at $1.48 billion compared to $2.7 billion a year ago. Its biggest franchise Call of Duty saw weak demand.

Not over yet: The fourth Covid-19 wave may have just hit Delhi while Shanghai has resorted to extreme measures as death rates go up.

💰💰💰: Gautam Adani has surpassed veteran investor Warren Buffett to become the world's fifth richest man. Buffett's wealth plunged after his Berkshire Hathaway shares dropped by 2% because of a drop in the US stock market on Friday.

Add to cart: Edtech firm Veranda Learning Solutions acquired Hyderabad-based T.I.M.E for ₹287 crore. With this, Veranda will now enter the MBA, NEET and JEE preparations, and the pre-school space.

Hit pause: Sri Lanka's opposition party Samagi Jana Balawegaya has gathered support—signatures of 113 lawmakers—for a no-confidence motion against the Rajapaksa government.

Arms race: Global military expenditure crossed $2 trillion in 2021, an all-time high for the seventh consecutive year. India was among the top five spenders.

Work from UAE: US-based Kraken, one of the world's biggest cryptocurrency exchanges, has received a nod to shift base to Abu Dhabi.

FWIW

Get aboard the nostalgia train: Three new toy trains will chug along the Shimla-Kalka route in Himachal Pradesh, a change after 118 years. The old wagons will give way to Vistadome coaches. Expect a panoramic view and 180 degrees rotatable chair seats. These trains will run on the 96.6-km narrow-gauge tracks built by the British in 1903.

Eye-spy: Windows to the soul, indeed. The eyes can reveal if someone has aphantasia: a condition where people can't visualise imagery. According to the study, pupils of those without aphantasia, dilated or constricted according to the bright or dark shapes. Those with the condition showed no such reaction.

Home away from home: The pandemic has changed how we live. No, really. It's function over size now. Builders today are adding smaller rooms to accommodate WFHers and exercise fanatics. Say hello to more power outlets and USB ports. As the home increasingly becomes a place of work, the bedroom remains sacred.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.