Good luck withdrawing your life savings

Also in today’s edition: Sony’s aha moment; Disinvestment fail; Gloves off between BYJU’S, shareholders; Finance bros are (in)fighting

Good morning! The times are a-changin’, and English county cricket clubs aren't chuffed about it. The England and Wales Cricket Board (ECB) is reportedly looking to privatise a new 100-ball tournament called The Hundred. The tournament is bleeding money, and with the English game in a flux, IPL franchises are making their play. Also, a certain Lalit Modi, the erstwhile IPL “commissioner”, has a plan or two. But the old guard of county cricket, having none of it, is throwing its weight around. How so? Check out the latest edition of The Playbook to find out.

Kamalika Ghosh, Dinesh Narayanan, Venkat Ananth, and Adarsh Singh also contributed to today’s edition.

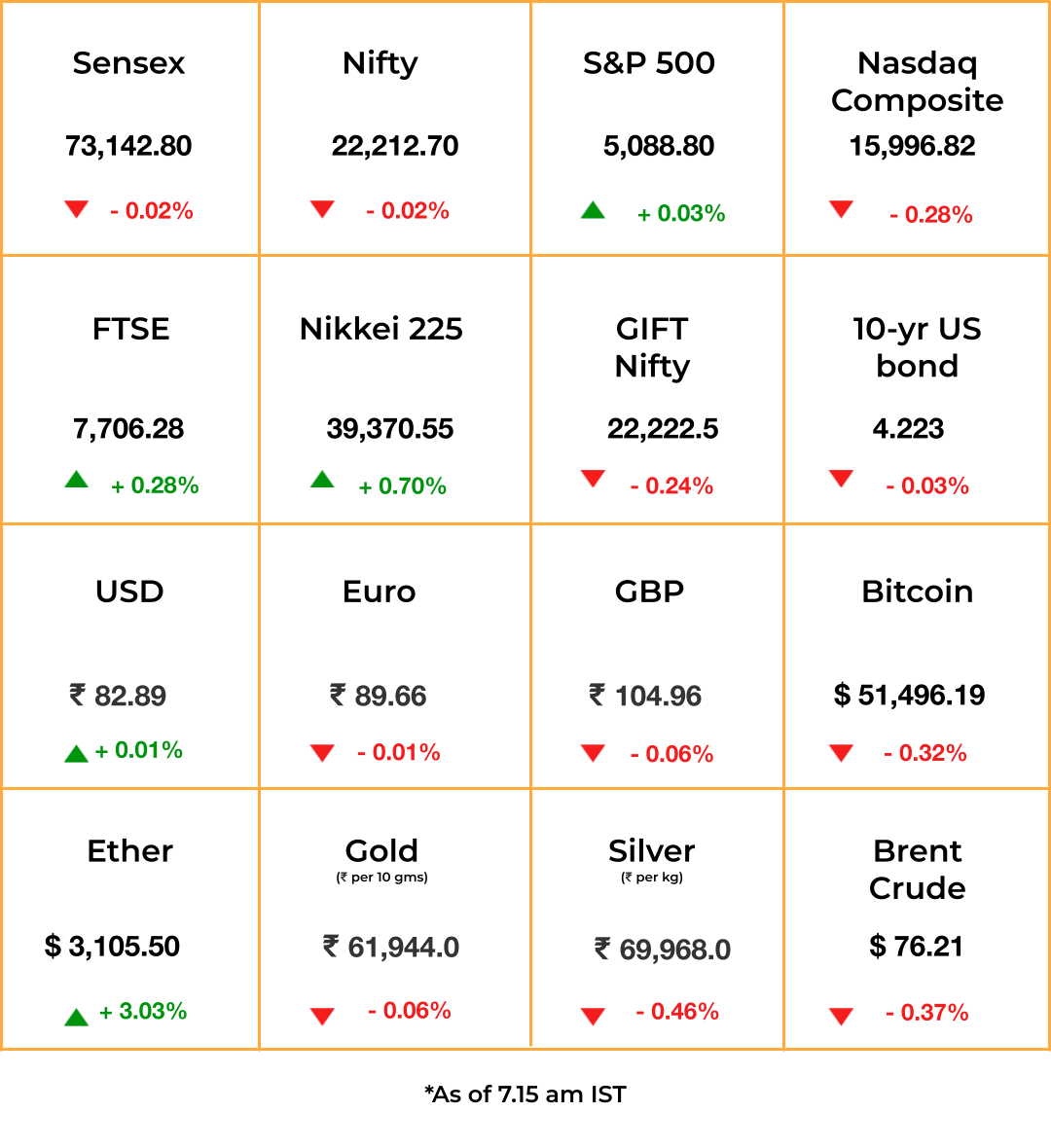

The Market Signal

Stocks & Economy: Asian markets opened mixed, with Japan and Shanghai buoyant but the rest subdued. The GIFT Nifty indicates a positive opening for Indian equities.

Indian consumers are spending more on discretionary goods and services than ever, newly released household consumption expenditure survey (pdf) data showed. Urban consumers now spend 61% of their income on non-food items while rural households spend 54% on the stuff other than food.

The top 5% of the country’s rural and urban population spent an average of ₹10,501 and ₹20,824 per head per month and the bottom 5% spent an average ₹1,373 and ₹2,001 per capita every month, respectively. The spending share for cereals fell the most, from 10.69% in FY12 to 4.89% in FY23, while the highest jump was in conveyance, from 4.2% to 7.55%. Shares of education, clothing, footwear and taxes too fell markedly in the decade.

SOCIAL SECURITY

Where Is My Money?

Bugs in the Employees’ Provident Fund Organisation’s (EPFO) systems are making life difficult for workers trying to withdraw their life savings.

What’s wrong?: The EPFO rejected nearly a third of all provident fund final settlement claims in FY23, up from 13% in FY18, ostensibly due to trivial issues such as discrepancy in the spelling of names and KYC, including Aadhaar details. It also denied nearly 24% of PF transfer claims, the EPFO annual report of 2022-23 showed (pdf). There were over 21.1 lakh establishments and 28.5 crore members in its domain.

An EPFO official told The Signal on condition of anonymity that one reason why KYC discrepancies creep in is that employers are casual when submitting staff data. Although there are provisions to pull them up, the organisation has not really exercised them.

MEDIA

Party In The M&A

While Zee cleans up the mess of its terminated merger, Sony is busy. Per Mint, it has teamed up with Kalanithi Maran’s Tamil media empire Sun TV to potentially buy a stake in Telugu-language OTT platform aha. The deal could value the firm at ₹1,500-2,000 crore (~$180-240 million).

Sony wanted Zee’s regional language channels to diversify from its urban, Hindi language audience. It could do that with Sun and aha, which started Tamil offerings in 2022. Co-founder Allu Aravind told the media that year the platform was for everyone in small town South India.

Fun fact: aha’s hit show Nenu Super Woman is modelled on Sony’s Shark Tank India.

Sealed: Meanwhile, Reliance has sealed the deal to acquire Disney’s India assets including Star, and potentially, its minority stake in Tata Play, according to Bloomberg.

The only one left out of this M&A party now is Zee.

DISINVESTMENT

Can’t Kill Two Birds With One Stone

The fiscal year 2023-24 will close soon with the disinvestment target missed once again. It managed to achieve only ₹12,540 crore (~$1.5 billion) in FY24, which is just a little over a fifth of its budgetary target.

Why disinvestment: One, to reduce government involvement in operating businesses, except for those deemed strategically crucial. And two, to help shore up the fiscal deficit. Both objectives remain largely unfulfilled.

Only the sale of former national carrier Air India to the Tata Group in FY22 and the privatisation of Neelachal Ispat Nigam Limited a few months later were successful disinvestments. The privatisation of the state-run helicopter services provider Pawan Hans and Bharat Petroleum had to be called off for various reasons.

High bar: The government sets highly optimistic targets often overlooking prevailing market conditions, which limit their feasibility. Often, valuations and the quality of investors get in the way of the disinvestment process. Even selling off moderately-sized companies gets complicated as they have a diverse portfolio spanning various industries.

The Signal

The challenge extends beyond the lack of interested buyers. By linking disinvestment to reducing the annual fiscal deficit, execution has become more challenging. Setting high disinvestment targets in the budget serves as a tactic to present favourable fiscal deficit projections. As DIPAM secretary Tuhin Kanta Pandey said, disinvestment can’t fix the fiscal deficit.

Often, the government merely shifts ownership from its books to public sector undertaking portfolios, beating the very purpose of privatisation. Head to The Core for more.

CORPORATE GOVERNANCE

BYJU’S Races Against Time… Again

Byju Raveendran is on coals for the umpteenth time.

After a chaotic weekend, when a group of shareholders voted for his ouster, the BYJU’S chief stood defiant. “I continue to be CEO,” he declared in a missive to employees a day after the company declared Friday’s emergency extraordinary general meeting (EGM) “invalid.”

To the courts: The shareholders have taken the legal route, going to the Karnataka High Court to demonstrate the EGM’s validity. Additionally, four investors with about 25% ownership in BYJU’S have approached the Bengaluru bench of the National Company Law Tribunal to stop the $200 million rights issue, citing “oppression and mismanagement.”

Elsewhere: Aakash Institute “white knight” Ranjan Pai is now firmly in the driver’s seat. Pai has taken a 40% stake in BYJU’s coaching classes company, besides infusing further working capital to the tune of ₹250 crore ($30.1 million), The Economic Times reported.

🎧 Why Byju’s is racing against time. Also in today’s episode: one of the world’s most popular multiplayer games is a funnel for teen gambling. Tune in to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you listen to podcasts.

FINANCE

Moneybags In Fistfights

Power struggles playing out at Goldman Sachs and Sequoia Capital are exposing just how personality-driven the slick world of finance can really be.

Old trees die: At Sequoia, partner Matthew Miller—with the alleged backing of current chief Roelof Botha—failed to unseat former chief Michael Moritz from the board of Swedish fintech Klarna, a key portfolio company, Financial Times reports. Although the dispute is about the best way for Klarna to move to the UK for an IPO, insiders say it is a front in the battle between Sequoia’s old and new guard. The latter sees the former hanging around as a sign of no confidence in the new leadership.

Old man snacks: Meanwhile, Goldman Sachs CEO David Solomon has angered several partners by taking a 24% pay hike despite delivering terrible earnings. Several partners across Europe are threatening to leave. But Solomon, confident of the board’s backing, is reportedly unbothered.

FYI

Not possible: Paytm could not have violated the foreign exchange management law because the payments bank never had an outward remittances licence, the fintech firm has reportedly told the Enforcement Directorate.

Indirect hit: Fresh US sanctions on Russian entities will likely cripple its state carrier Sovcomflot and 14 of its oil tankers, which transport the bulk of the crude oil India buys from that country.

Friends in need: Mineral-rich-but-bankrupt African country Zambia has struck a deal with creditors India and China to restructure its debt, which will help it get a $1.3 billion IMF bailout package.

Not well-oiled: The NSE and BSE have slapped fines for the third straight quarter on six state-owned oil and gas giants including ONGC, GAIL (India), and IndianOil for failing to have the requisite number of independent and women directors on their boards.

Unstoppable Don: Former President Donald Trump won the South Carolina Republican Party primary, handing rival Nikki Haley a 20-point defeat in her home state.

Slow down, fast fashion: US lawmakers, especially Republicans, want an import ban on goods shipped from Chinese e-commerce platform Temu for alleged violations of the Uyghur Forced Labor Prevention Act, The Information reports.

G Bye: Google Pay is shutting down in the US from June 4 this year, paving the way for Google Wallet to be the company’s standalone pay app in the country.

THE DAILY DIGIT

8

The number of months it took Nvidia to reach the hallowed $2 trillion valuation in market capitalisation. For perspective, it took the company 24 years to reach the $1 trillion mark. (The Wall Street Journal)

FWIW

Thiel Inc: Billionaire Peter Thiel has an offer for students they can’t refuse. He’s offering $100,000 to students to drop out of school to start non-profits and companies. This isn’t new though; more than 271 ‘Theil Fellows’ have been selected in more than a decade of the programme’s (if one can call it that) existence. Alumni include the founders of Ethereum and The Ocean Cleanup. Theil started the fellowship to undermine the importance of colleges, and the ‘woke’ tide across elite universities has only strengthened his resolve. If only something like this existed during his student years, he would've never gone to Stanford, right?

Science vs. politics: A recent ruling by the Alabama Supreme Court has thrown a wrench in the plans of fertility centres operating in the state. As per the ruling, an embryo is a child “regardless of its location.” Given such wording, many fear that the court’s decision would severely impact the unproven but promising technology of artificial wombs and synthetic embryos made from stem cells. It raises questions about abortion laws’ impact on these technologies and what the legal rights will be of these ‘babies’. As usual, the US is in for one hell of a ride.

Inclusive science: Science is incredibly hard as it is. Now imagine if there were no words to explain how or what certain phenomena are. That’s the reality for deaf Indian students, because the Indian Sign Language (ISL) had little to no words for STEM words. Simply taking words from English and American sign language counterparts doesn’t cut it, as the sign must remain short, factual and easy to understand for Indians. Which is why a team at the Council of Scientific and Industrial Research’s Institute of Microbial Technology

has been working to enrich ISL vocabulary. This piece wonderfully captures its progress. Wholesome!