Gujarat preps a GIFT horse

Also in today’s edition: TV’s turnaround; Old money, new horizons; India’s single malt moment; Japan shoots for the moon

Good morning! We’ve all heard of tales of American consumerism but this takes the prize. Stanley, the maker of sturdy, colourful and expensive water bottles, has become the talk of the town thanks to a TikTok trend called WaterTok. As per Vox, the trend revolved around adding flavoured powder to water to encourage drinking it more. Somehow, Stanley became a mainstay of this trend and they converted those eyeballs into loyal customers. How loyal? Enough to take the company from $73 million in revenue in 2019 to $750 million in 2023. Now that's something.

Adarsh Singh and Dinesh Narayanan also contributed to today’s edition.

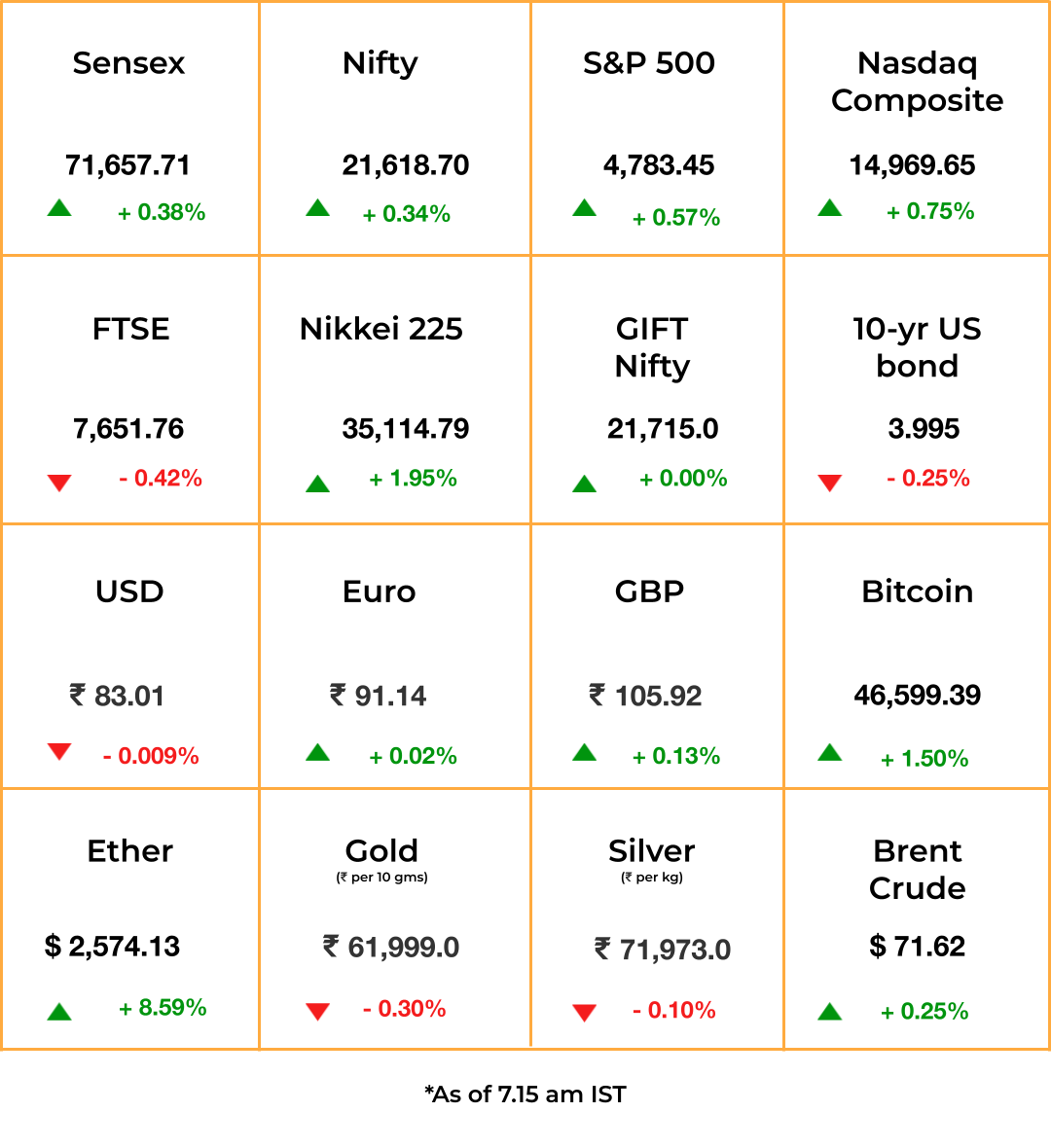

The Market Signal

Stocks & Economy: Cryptocurrencies got a rocket-fuel boost on Wednesday when the US Securities and Exchange Commission allowed exchange-traded funds tracking Bitcoin for the first time. The regulator cleared 11 applications, including that of the world’s biggest asset manager BlackRock. The move comes a day after its X (formerly Twitter) handle, which it claimed was hacked, posted the same info. The move is seen as a gamechanger for Bitcoin and some expect upwards of $50 billion to flow into it this year itself.

US and Asian stocks shed New Year blues to rally as investors awaited US inflation data. Apple risks losing its status as the world’s most valuable company to Microsoft after 4% of its value was eroded in 2024, while the latter gained 2%.

Indian equities may track global counterparts. The GIFT Nifty was indicating a flat to positive opening.

ENTERTAINMENT

Broadcasters’ Revenge

Will this be the year linear TV biggies play a trump card against their streaming and social media arch rivals? Sinclair hopes so. By the end of March, the company—which owns 40% of the US broadcast market—and other broadcasters in the country will partner with music channel Roxi to use its FastStream technology. It could be a gamechanger.

FastStream, which requires the ATSC 3.0 TV tuner to run, allows viewers to pause videos, skip content, and choose from different playlists without an app or the internet. FastStream behaves like a transitory app, meaning it’ll only be on/in use when you’re on Roxi; if you change the channel, it goes away. The company has likened the tech to TikTok, where everything is pre-programmed, and reckons that FastStream will eventually be used for live shopping and on-demand TV.

In other news, the next generation of WiFi is here.

🎧 A new interactive TV channel could help save broadcast TV. Also in today’s edition: Stanley Ka Tumbler. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

INVESTMENT

Old Block Backs Breakaway Chip

Ambitious fund managers, picky investors, and powerful sovereigns chasing influence are altering the global big capital landscape.

New hustle: Portfolio manager Diego Magia is breaking away from multi-strategy hedge fund Millennium to set up Taula Capital with a $4 billion starter. Magia is poaching 30 colleagues from his employer, which is also backing him with $3 billion.

Former Millennium executive Bobby Jain is offering steep performance fee discounts for those who commit a minimum of $250 million to his Jain Capital scheduled to launch in July.

No ESG please: Investors are losing appetite for environment, social and governance-focussed funds, with launches dwindling to six in the second half of 2023 from 55 in the first. Some are even scratching their ESG labels.

Desert boom: Saudi Arabia beat rival UAE to get more venture capital investment in 2023, as it ploughed sovereign money into seeding a VC industry.

FINANCE

GIFT Exchange

After spending years as a ghost town, Gujarat’s ambitious GIFT City is finally getting attention. This week, it allowed billionaire Azim Premji to set up a family investment fund, among the first high-profile tenants of the financial hub. Infosys co-founder Narayana Murthy has also applied to set up a family fund and several other billionaires are visiting the city next week, Reuters reported.

Spotlight: This year, GIFT City is also hosting the state’s flagship Vibrant Gujarat Investment Summit with hundreds of thousands of CEOs and business owners expected to attend. Already, demand for office space is outpacing supply in the financial hub: rents have more than doubled and GIFT City authorities are allowing companies to rent co-working spaces to complete registration.

The Signal

The Indian government has been nudging businesses to move to GIFT City all of last year. First, it moved the benchmark futures index SGX Nifty to the hub in July. It may allow unlisted Indian firms to list directly at GIFT. It is also considering lifting overseas investment limits on mutual funds if they put money in Indian firms trading at GIFT City exchanges. It has even allowed alcohol in the city, despite prohibition in Gujarat.

India is hoping these moves will finally push GIFT City to emerge as an international financial centre rivalling Dubai and Singapore.

But free-flowing wine and a couple of billionaires won’t cut it: it needs policies that will attract big capital, investor whales, and global intermediaries.

CONSUMER

Thirsty For Local

On Tuesday, we told you about the rise and rise of Indian chocolates. Today, we’ll look at Indian single malts, which had a headline year in 2023, zipping past globally renowned brands (mostly Scottish) in sales and on the award circuit.

Say cheers: India is the world’s fifth-largest alcohol market, with consumption of scotch doubling by volume between 2020 and 2022, signalling increasing demand. Pair that with the 150% import duty on Scotch, and the opportunity for Indian brands is too good to ignore. Possibly why Indian brands accounted for 53% of all single malt cases sold in 2023, per industry data.

Coming of age: Over the last decade, Indian distilleries have been winning numerous awards globally (Indri-maker Piccadilly Industries is the latest), and that frenzy has helped boost domestic sales. However, it is exports (global markets) that could define if Indian single malts match their hallowed Japanese counterparts and break out.

SPACE

Japan Aims For The Stars

What a year 2023 was—not just for India’s Chandrayaan-3 mission, but for space missions as a whole. SpaceX, which disrupted this race with its reusable rockets, launched nearly 100 of them last year. China’s LandSpace Technology has an ambitious plan to compete with SpaceX by 2025, and Beijing also wants to put Chinese astronauts on the moon by 2030. The US’ Artemis Mission was aiming for a crewed lunar flight in 2025; it’s now postponed to 2026.

This is all to ask: where’s Japan placed in all this?

Why does Japan matter?: It was the fourth country after the (then) Soviet Union, US, and France to put a satellite in orbit. It was a rich history of space programmes, though that legacy’s watered down over the years.

Japan’s now attempting the first-ever “pinpoint” lunar landing and has a joint mission with India to explore lunar water resources in 2025.

FYI

More moolah: The Board of Control for Cricket in India (BCCI) has roped in Reliance-owned Campa and home appliances company Atomberg as its official partners for all home cricket series from 2024 to 2026.

Fresh cream: Bengaluru-based organic dairy startup Akshayakalpa has raised a $12 million (₹100 crore) Series C round. The round was led by A91 Partners. Investment firm Gruhas has tied up with talent management firm Collective Artists Network to launch a ₹150 crore consumer-focused fund.

Pink slips: Amazon will trim 35% of Twitch’s workforce (~500 employees) as well as hundreds of staff from Prime Video and Amazon MGM divisions. Asset management giant BlackRock will also lay off 600 employees (3% of its global workforce).

Coming soon: After a more than four-year hiatus, a new Star Wars movie—The Mandalorian & Grogu—will go into production this year, breaking away from Disney’s streaming-only strategy for the franchise.

Calculated risk: Betting on international oil prices cooling, India has decided to not refill depleted strategic oil reserves that would have cost $600 million. It will help keep the fiscal deficit in check.

Delete them: The Indian government has ordered Apple and Google to take down offshore crypto apps from the App Store and Play Store, respectively, Bloomberg reports.

Bulwark: Indonesia is planning to spend $10 billion to build a massive wall to keep the sea from swallowing its capital Jakarta.

THE DAILY DIGIT

654,581

The number of seats on the Mumbai-Delhi airline route in December, ranked eighth among the world’s top 10 busiest domestic routes by aviation analytics company OAG. (Business Standard)

FWIW

Future is here: An all-powerful personal assistant, like Jarvis from Iron Man, has been the stuff of dreams for all tech enthusiasts. Now, it seems like we’ve taken the first step towards it. Meet R1, an AI device that is based on a “Large Action Model”. The model has been trained by humans interacting with apps like Spotify and Uber, teaching it how they work. Once it has ‘learnt’, R1 can perform all the tasks in the app. The best thing about it is that you can teach it to learn almost any app from Photoshop to video editing, making it a truly personal assistant.

Trial by TV: In scenes reminiscent of a masala Hindi film, officials from the Chinese football administration admitted to taking bribes in a documentary. The documentary in question was aired on state television and seems to have been the result of a long investigation into the underperformance of the men’s football team. It aired admissions of guilt from the likes of the former chairman of the Chinese Football Association and former coach of the men’s team. China watchers believe that the documentary was an important message by President Xi Jinping, who was miffed at the failure of his plan to transform China into a footballing prowess. If only naming and shaming worked on our sports administrators… 😥

Uno reverse: The Thailand government has decided to ban cannabis for recreational use in the country. This comes a mere 18 months after the country became the first in Asia to decriminalise the plant. The new government in Thailand, led by Prime Minister Srettha Thavisin, came to power on the promise of strict action against drug abuse. The ban is part of that promise. The ban is a body blow to the fledgling weed industry that had cropped up in the country since the decriminalisation. With businesses shuttered and farmers hurt, the government is in the weeds with the economic pitfalls of the ban.