Guns, goons, and insurance

Covid-19 aids rise of insurance frauds and investigators bear the brunt

Good Morning! A big hello to readers who signed up this week. This is The Signal’s weekend edition. Our story today is about investigators buying guns and hiring bodyguards as criminal gangs use Covid-19 to defraud insurers. Also in today’s edition: the best reads from the week. Happy weekend reading.

Balwant Singh has acquired a gun licence and will invest ₹25,000 in a 7mm locally-made handgun after Navratri.

“The one good thing that came out of the pandemic is that my face stays covered,” says Singh, a 64-year-old insurance claims investigator for three decades in the Mumbai-Pune circle.

It is intriguing why an ageing man who has been a part of the industry since 1980 feels the need for a gun now. According to him, 2020 and 2021 have been the toughest two years of his career. In October last year, he was accosted by three bike-borne men when he was on his way to check out an accident claim. He was beaten up badly and barely managed to escape. Later, it was discovered that the accident ‘victim’ had died of Covid-19 but his family was coaxed into buying a policy to make a fake insurance claim.

During another investigation early this year, Singh received several phone calls from two people threatening to abduct his wife and young daughter if he didn’t give up being an investigator. Some weeks later, he spotted suspicious-looking men outside his home. That is when he decided to ‘arm’ up.

Medical and life insurance frauds rose steeply as Covid-19 spread fast and deaths began to mount. Quarantines and masking made identification difficult, and with a little help from hospital staff, faking illness became easy. Health insurance claims that stood at ₹34,000 crore in FY20 rose sharply with the second wave of infections. General insurers processed close to 1.2 million Covid-19 claims in the first quarter of this financial year compared to 0.98 million received in the whole of FY21.

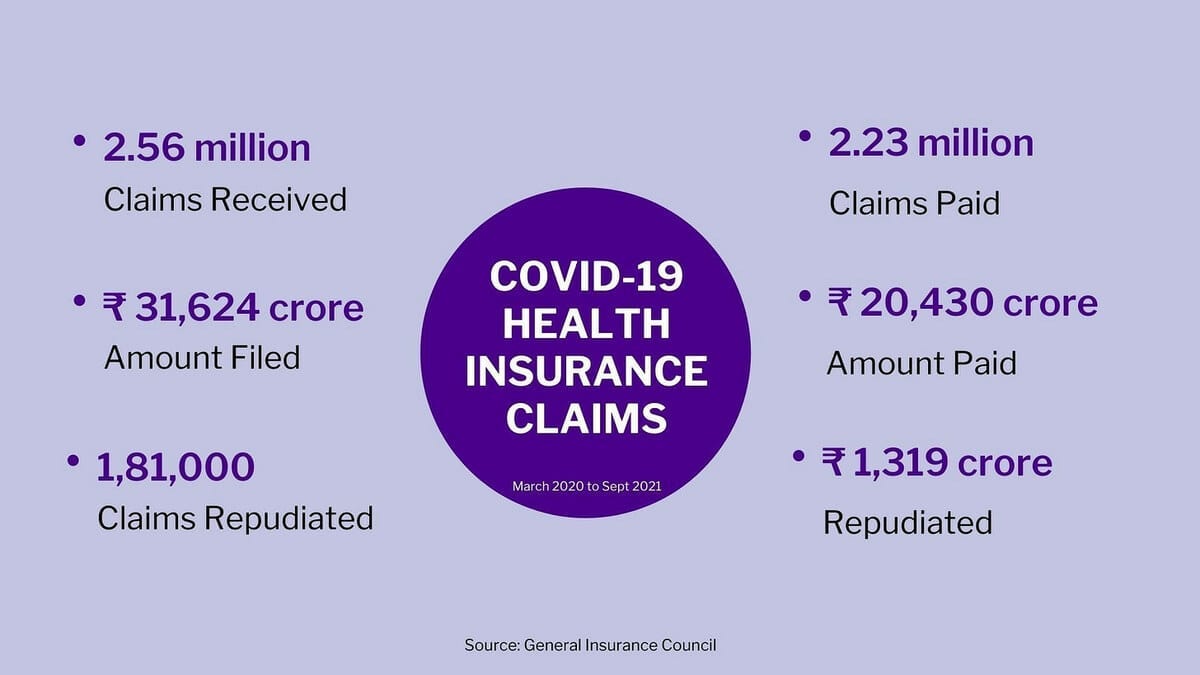

As of September 27, more than 2.5 million Covid-19 health claims worth ₹31,624 crore were filed with the 33 general insurers and health insurers. Of this, 1,81,000 claims worth ₹1,319 crore were repudiated. Maharashtra leads the chart. Multiple industry sources told The Intersection that most of them were fraudulent. That has increased pressure on investigators.

Creating fear

“I would get probably one call a month (before the pandemic) to investigate but now it is one call a week,” says Malathy, a 39-year-old claims investigator who operates in the Bengaluru-Hoskote-Budigere belt.

Malathy, who requested that her last name be kept confidential because it is uncommon and could be easily used to identify her location, says she was forced to buy a car in July because her job was getting increasingly dangerous. She would often get followed when she was riding her Scooty.

“For how long could I live in fear? Buying a car meant that I had to take a loan but at least it is safer,” she said. Crimes aren’t uncommon in insurance but the last 12-14 months have been the worst.

“Both genders face equal pressures but women in this line face higher threats. And not everyone chooses to continue,” she added. Her fellow investigator Alice was kept captive in a warehouse for three days in Hyderabad in November during an investigation of a ₹14 lakh health claim filed just two months after the policy was purchased. She was released only after she promised to quit.

Alice, who has moved back to her hometown in Mizoram, told The Intersection over phone that she is no longer a claims investigator. She did not wish to comment on past incidents either.

Body for sale

The claims head at a bank-led general insurer said that fraud is most widespread in health and accident insurance claims.

Another official, the chief financial officer at a state-owned insurer, said that the common modus operandi is to purchase insurance in the name of a dead person and file a claim as ‘accidental death’.

In 2019, a gang carrying out fraudulent insurance activity was busted. The gang targeted terminally ill patients and then used their dead bodies to claim the insurance. The industry suffered a loss of ₹100 crore from this gang alone. Covid-19 deaths made it easier for fraudsters to obtain bodies.

In some places, investigators found hospitals and mortuary staff ‘smuggling’ out dead bodies for a price. At the peak of the second wave, any death evoked fear. Even kith and kin often left the dead for hospitals and civic bodies to deal with. They also needed to be cremated or buried quickly because of infection risk. Macabre as it may sound, there was a steady supply of dead bodies that could be dressed up for fake insurance claims.

“With Covid deaths, it really isn’t difficult to get a dead body with ‘assistance’ from hospital ward boys. These bodies are then thrown on the highway to get accident injuries,” Malathy explained.

While each district and municipal council keeps a track record of Covid-19 cases and deaths in their locality, cross-verification often becomes tough. For claims investigators, it is a constant battle between getting names verified and tackling criminals.

Atul Das, an investigator originally based in Maharashtra has changed his location thrice since June 2020. He first moved to Madhya Pradesh but realised that the crime network had expanded there too. Das then shifted to Chhattisgarh and Odisha. Investigators like Das are akin to police informers. They maintain a low profile and are friends with the local police and sometimes even petty criminals who could be a useful source of information.

During a claim investigation, Das visited a house where two people gave him drug-laced tea. He had a narrow escape because the dose wasn’t too strong. It was later discovered that the Covid-19 health claim was fake.

“I hired a personal bodyguard in February,” said Das.

The insurance sleuth

According to Regulation 8 of the IRDA (Policyholder's Interest) Regulations, 2002, the insurer is required to settle a claim within 30 days of receiving all documents.

Every insurance company has its own claims team. This team is involved in scrutinising and settling claims depending on the policy terms and conditions. Often cases emerge where the insurer is not sure if the claim is genuine. That’s when a claims investigator comes into the picture; to verify the claim and sniff out the fraudulent ones.

An insurance claim investigation can take up to six months. During this time, external investigators are brought on to the case. The claim is either accepted or repudiated based on their report.

Criminal gangs that file false claims accost investigators through this period, threatening or even physically harming them to make sure the insurance money comes through. Bribes are not uncommon for ‘softer’ investigators.

The claims head at a health insurer told The Intersection that while police complaints are filed frequently, gangs move districts or states frequently. The police have little incentive to investigate these cases when they have more serious crimes to deal with, he said.

Threats and intimidation are common. Shankar Naskar, a 47-year-old Bengal-based claims investigator was beaten up when he visited a claimant’s family in April. The customer wasn’t even unwell and had been moved to an undisclosed location to get the insurance pay-out.

“I thought of filing a complaint but was too shaken. I now stay in rented accommodation across Kolkata and nearby districts so that my permanent address is not revealed. Now I also carry a knife and pepper spray at all times,” said Naskar. He too is planning to hire a bodyguard next month.

Spotting fraud

T A Ramalingam, Chief Technical Officer, Bajaj Allianz General Insurance, says that fraud has kept pace with the industry’s exponential growth.

“Insurance fraud encompasses a wide range of illicit practices and illegal acts involving intentional deception or misrepresentation,” Ramalingam told The Intersection. “Fraudulent claims have a severe impact on organizations and customers. It also increases the loss ratios of insurers,” he added.

Companies run checks on customers to see if they’ve had any history of malpractices. They also look for clues in claim intimation calls. At Bajaj Allianz, they use voice analytics and artificial intelligence to analyse the caller’s emotional state, often a giveaway in cases of fraud.

Ramalingam added that insurance companies in India annually lose about 9% revenue to fraudulent claims.

As per the Insurance Regulatory and Development Authority of India’s Annual Report 2019-20, gross general insurance premiums were ₹1.89 lakh crore that year. That means, at a success rate of 9%, fake claims took away a whopping ₹17,000 crore in 2019-20 and ₹15,200 crore in the previous year.

Plugging the loophole

India does not have a specific legal provision for insurance fraud. It is currently governed by Section 464 of the Indian Penal Code (IPC) that deals with forgery, Section 420 which handles cheating, and Section 205 concerning impersonation.

Rajiv Srinivasan, a former general insurance executive and currently a legal consultant to insurers, told The Intersection that India needs an Insurance Fraud Control Act similar to the one in the UK.

“Once there is a specific criminal act only for insurance, the police will also act swiftly. Criminals would also not be able to get away with forgery so easily,” Srinivasan said.

Until then guns, knives, pepper sprays, and bodyguards are the only guardians of insurance sleuths.

Sponsored By CTQCompounds

Ever thought of rediscovering your reading habit? Or feared that your skills might become obsolete in a fast-changing world?Head over to CTQCompounds.com for the Daily Reader program. New batches start every month. They also have FutureStack that keeps you up to date with ideas, skills & mental models that will help you stay prepped for the future. FutureStack batches start every Saturday. Also check out their Social Capital Compound to master social media. So head on over to CTQCompounds.com and uplevel yourself. You owe this to yourself.

As a bonus, our readers get ₹2,500 off on the subscriptions (using the links above).

ICYMI

‘Inspired’ Artistry: Would using someone else’s experiences in one’s book be considered appropriate. Is it plagiarism? A New York Times article explores the layers of conflict between two female writers about one borrowing (or inspired by) literary work from the other’s real-life organ donation story.

Tucci’s Flavours: American actor Stanley Tucci treats food not just as a means to sustenance but as a map to his Italian roots. In his autobiography Taste, Tucci narrates his life story from his Italian-American upbringing and acting career to the battle with oral cancer, all through food-related anecdotes.

Knotty Adventures: The 1927 classic The Hardy Boys book series featuring Joe and Frank Hardy turned 94 this year. A Hulu series inspired by the mystery-solving boys has been renewed for a second season. This is a good time to revisit a 1998 Washington Post article that throws light on why the author of the books hated the plots, the characters and every moment he spent creating them.

Are Records Dead? Those born in the ’80s and ’90s spent a lot of time at record stores browsing through catalogues. Those shops are now non-existent. A review based on Kelefa Sanneh’s book Major Labels questions whether platforms like Spotify are doing musicians a disservice by erasing the soul of the composition and pushing it as background music.

Boomer Facebook: The social media giant is facing a mid-life crisis of sorts. It has grown old with its early adopters. Gen Alpha (those born after 2010) considers Facebook as an ‘oldies’ site. The platform is now facing whistleblower allegations around fake news, political bias, and Instagram-linked body image issues. Despite its best efforts, FB is ‘graying’ because youngsters no longer find it cool.

Dog Origins: Is it older than The Bible? Did the ancient Romans and Greeks breed and domesticate them? How do 600-year-old paintings feature dogs similar to today’s Maltese? These are some questions about the Maltese dog breed that this New York Times essay looks into. DNA research done on them has so far remained inconclusive.