Cool heads will prevail

Also in today’s edition: Silver lining for Indian carmakers; Capex give, capex take

Good morning! Grindr is the wild, wild west of dating apps. Nah, scratch that, calling it a dating app is a stretch. It is primarily where gay and bisexual men go to seek hookups with the like-minded locals. But, as per a report in The Wall Street Journal, Grindr is now growing up. It dreams of becoming a proper dating app, so the company will develop eight new products to facilitate lasting connections. The most intriguing one is the introduction of an AI wingman to help users find Mr Right. Fear not, though. Hookups via Grindr ain’t going anywhere.

🎧 No jobs for married women in India’s iPhone factory. Also in today’s episode: fake resume are everywhere. Tune in to Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

Jessica Jani, Anup Semwal, and Roshni Nair also contributed to today’s edition.

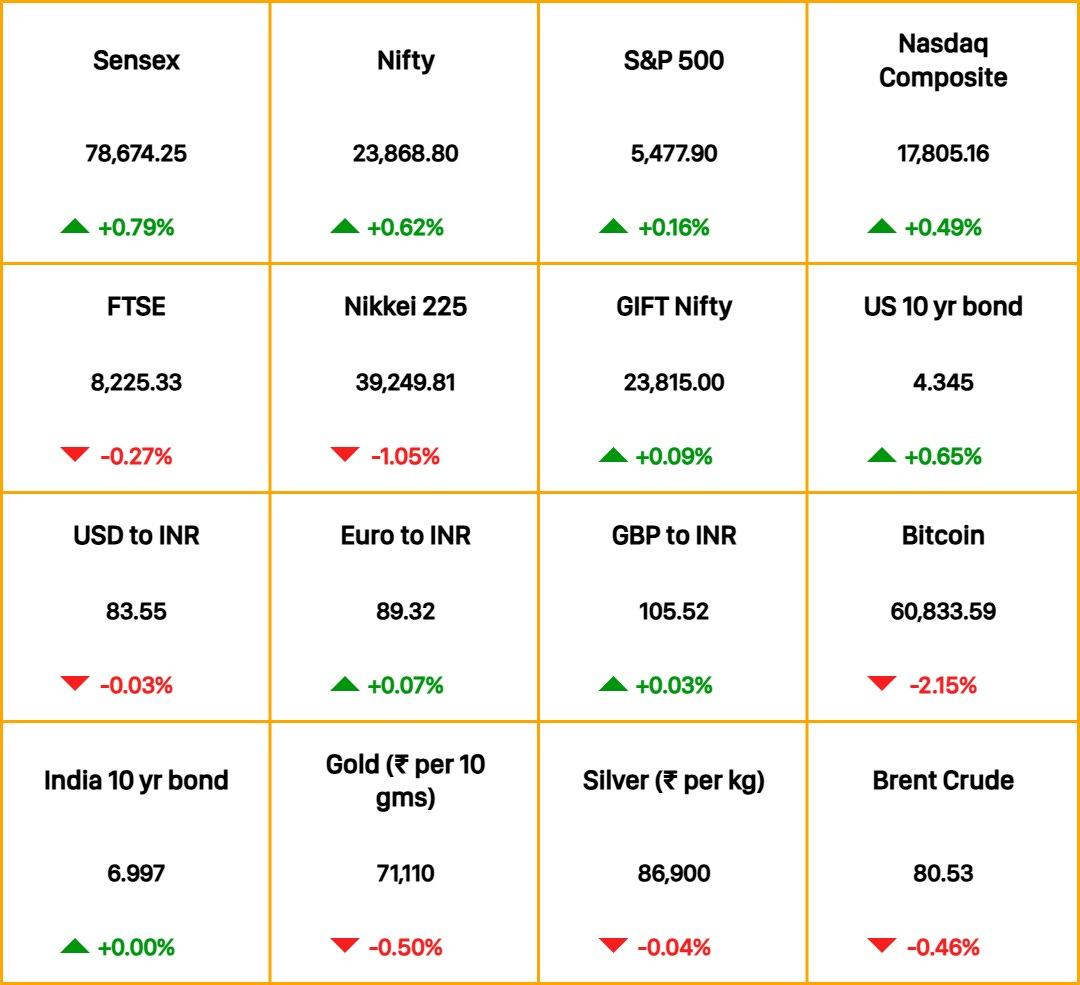

The Market Signal*

Stocks & Economy: Usually when regulators caution about too much exuberance and it becomes public that a large mutual fund is under investigation for possible malpractice, investors turn wary, which affects sentiment. Not Indian equities. Despite Sebi warning of froth in small-cap shares and the Reserve Bank of India watching futures and options, indices continue to set new records.

Sandeep Tandon, founder and chief investment officer of Quant Mutual Fund, which grew assets by 400% and notched up returns of 560% in five years, brushed aside the charges of frontrunning to “jealousy”. Tandon told investors that the fund, which has shifted from mid-caps to large-cap shares, was not facing any abnormal redemption pressure.

Asian markets were awash in red in early trade even as currencies across Asia slipped against the US dollar. The GIFT Nifty indicates a slow start for Indian equities.

CONSUMER GOODS

You’re Gonna Have To Pay More To Beat The Heat

This was the year the unfortunate among us living in heatwave-afflicted areas realised that the very appliance supposed to offer reprieve from white-hot heat is actually ineffective because of it. According to a survey by community social media platform LocalCircles, 43% of respondents said their ACs were ineffective in reducing ambient temperatures to the desired 23-24°C. Of these, 84% were users of split ACs.

There were also reports of fires in the NCR because of AC blasts, supposedly caused by overheated compressors. The current crop of ACs aren’t built to withstand temperatures exceeding 42-44°C; just 2-3% of models are able to operate in temperatures over 50°C.

Result: brands such as Godrej, Voltas, and Daikin will increase the proportion of models that can run in extreme heat. That calls for higher-grade compressors, which translates to higher input costs and ultimately, more expensive ACs. Either way, we’re doomed.

AUTO

Growing Traffic For Indian Cars

It’s boom time for India’s car market. Nine manufacturers, which account for about 97% of the market, are adding capacity of three million cars per annum starting November this year. The additional capacity will take the Indian car market from the current 5.77 million to 8.77 million cars by FY31, Business Standard reported. The wheels have been in motion mostly due to robust post-Covid recovery and record sales in the last fiscal year.

India’s top car makers have big plans. Hyundai Motor is going public with what could be India’s biggest ever IPO. Maruti Suzuki is increasing capacity and will roll out its first EV this year. And MG Motor’s joined hands with steel giant JSW.

Tata Motors demerged its commercial vehicles and passenger vehicles segments into two separate entities earlier this year. N Chandrasekaran told shareholders that the demerger would allow the company to ensure synergies between its PV, EV, and premium JLR businesses.

CORPORATE

Show Me The Money

Will the much-anticipated private capex cycle start gaining momentum post-Budget? There are mixed signals.

The Adani Group will invest Rs 1.3 lakh crore in FY25 (~$15.5 billion) as part of its 7-10 year business expansion plan. The money will go into its portfolio companies in sectors ranging from infrastructure to media. The group has previously said that it would invest up to $100 billion during this period.

Some others are turning cautious, however. The Tata Group did not infuse any new capital into its e-commerce and electronic retail businesses such as Tata Neu, Tata Cliq and Croma in FY24. It is reportedly focussed on improving efficiencies before committing more capital.

Other conglomerates such as Reliance, JSW, and AV Birla groups also have large projects in the pipeline but none of them has announced any fresh ones.

The Signal

Finance minister Nirmala Sitharaman has repeatedly raised government capital expenditure in her budgets, providing primary fuel for economic growth in the past two years. The minister’s hope that private capex will pick up the baton has been belied. She will likely make another attempt to prod industry into committing more capital, of which they have enough and more, in her July Budget. A June 10 research report published by broking firm Motilal Oswal said the profits to GDP ratio of listed companies climbed to a 15-year high of 5.2% in FY24.

FYI

Probed: India asked the Tamil Nadu government to investigate Foxconn facilities in the state after a Reuters investigation found they denied jobs to married women.

Foreign shores: Aditya Birla Group will invest $50 million to set up an advanced materials facility in Texas, marking the US entry of the conglomerate’s chemicals business.

New money: E-commerce firm Flipkart launched a mobile payments app Super.money in beta mode, competing directly with its former group company PhonePe.

Shopping: Struggling telecom operator Vodafone-Idea bought spectrum in 11 circles worth Rs 3,510 crore in a government auction held this week.

Cleared (?): India’s Ministry of Corporate Affairs found edtech firm Byju’s did not siphon funds or cook its books, Bloomberg reported; the MCA has denied this.

Powering through: Megha Engineering (MEIL) won a Rs 12,800 crore contract to build two plants for the Nuclear Power Corporation of India in the latter’s biggest ever tender. The CBI is investigating MEIL for alleged bribery for its purchase of electoral bonds worth Rs 966 crore.

THE DAILY DIGIT

47 million

The number of fake resumes circulating in the Indian job market, representing 10% of the total Indian workforce (The Economic Times)

FWIW

C'est la vie: 2024 is do-or-die for the Olympics. Tokyo and Beijing's ghost-town games were duds, with Covid-emptied arenas tanking TV ratings. Can Paris flip the script? They're trying. Organisers are betting on the City of Light's natural pzazz to pull off a spectacle without breaking the bank. The star of the show? The river Seine which will double up as a swimming pool for triathletes and swimmers. A lot is at stake. Nevertheless, Parisians don’t give a fig. They're already grumbling about the chaos and closures, and the looming tourist tsunami is what they’re afraid of. If the Netflix show Emily in Paris taught us anything, it's that nothing ruffles Parisian feathers quite like a flock of tourists, especially loud-talking, chirpy Americans.