No more moonshots

Also in today’s edition: Vedanta in a spot; Global food woes; Pichai and Nadella slug it out; Reading between the lines of India's unemployment data

Good morning! Monday was a big day for Indian Americans. For the first time, a member of the community has been elected president of the Harvard Law Review (HLR), the prestigious publication attached to the Harvard Law School. That member is second-year law student Apsara Iyer. Iyer, who’ll serve as HLR’s 137th president, has bachelor’s degrees in Spanish, Economics, and Math. The Indian Express reports that she joined HLR after acing a competitive process, and that she also worked in the Manhattan District Attorney’s Antiquities Trafficking Unit, which tracks stolen artefacts and artworks. We can safely say the jury isn’t out on Iyer’s list of achievements.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

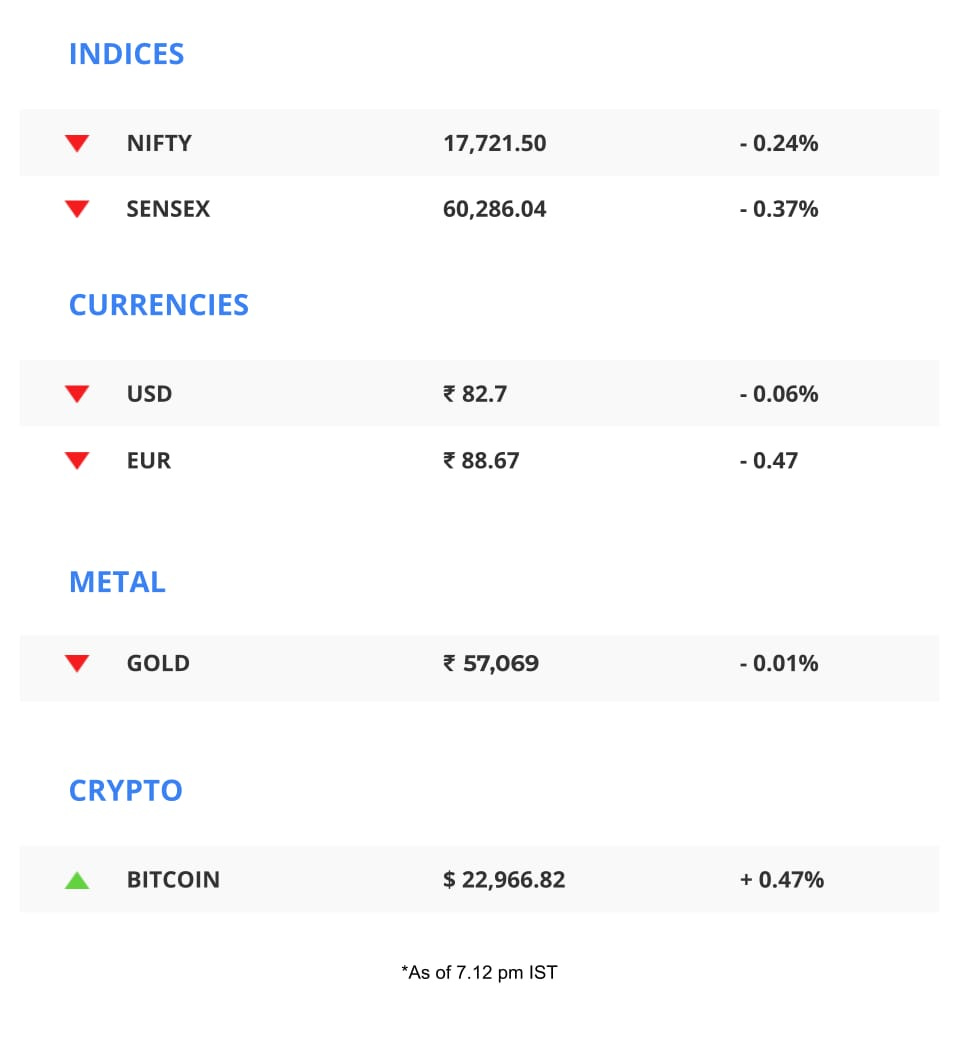

The Market Signal*

Stocks & Economy: Several Adani Group stocks recovered some ground after news emerged that the conglomerate is prepaying share-backed loans. While The Economic Times reports that distressed-assets specialists are feasting on hammered Adani bonds, Bloomberg says Adani Ports will repay a debt of $605 million and announced cuts in capital expenditure. That would help shore up the country’s largest private infrastructure operator’s balance sheet but would be a blow to a finance minister counting on private investment to bolster GDP growth.

Rating agency Moody’s has also warned banks that they would be putting themselves at risk if they lend more to Adani Group companies, Business Standard reports.

The Carlyle Group and KKR reported a steep drop in incomes, while SoftBank said it lost nearly $6 billion in the quarter ended December 2022.

Early Asia: The SGX Nifty climbed 0.37% at 7.30 am India time. The Hang Seng Index (-0.14%) and Nikkei 225 (-0.62%) were swimming in the red.

CONGLOMERATE

Another Tycoon Buried In Debt

Metals and mining tycoon Anil Agarwal could be caught in a pinch as his carefully laid out plans to use one company to pay another company’s debt may come unstuck. That’s because the government is prickly about valuations, presumably chastened by the Hindenburg-Adani episode.

The plan: Hindustan Zinc Ltd (HZL), which Agarwal had bought from the government, was to buy the group’s international zinc business, THL Zinc, through a series of transactions in South Africa and Mauritius. The cash generated would be paid as dividends to HZL’s parent Vedanta and eventually to the London-listed Vedanta Resources.

If the government, which still holds ~30% stake in HZL, prohibits the transaction, Vedanta Resources will struggle to meet its debt repayment schedule. Vedanta has a debt of $4.7 billion that will have to be repaid or refinanced over the next four years.

WATCH NOW

Will The Union Budget 2023 Help India Grow Fast?

At a panel discussion hosted by Niveshak, the Finance and Investment Club of IIM Shillong, chief economic advisor to the government of India, V. Anantha Nageswaran; Crisil chief economist, Dharmakirti Joshi; and former economic advisor to the government of India, Anand Singh Bhal, discussed how the Budget would impact the economy. The discussion was moderated by Dinesh Narayanan, co-founder and editor of The Signal.

INFLATION

From Cheap To Dear

Erratic weather and economic shocks are throwing global food output and prices in a tailspin, and also forcing changes in buying behaviour.

Exhibit one: Prices of olive oil, a luxury in India but a staple in the Mediterranean region, have increased by a minimum of 50%. Blame hampered supply, caused by an uncharacteristically-scorching European summer last year.

Exhibit two: India’s coffee capital, Kodagu (Coorg), is contending with a 95% decline in yield because of weather-induced disruptions in the coffee-picking season.

Exhibit three: Indian milk prices have shot up. Reason: a year-on-year drop in milk procurement. Wholesale wheat prices are up 31% year-on-year. Despite the record crop sowed for 2022-2023, there’s uncertainty about the quantum of harvest. Everyone’s fearing a repeat of 2022, when a brutal Indian summer battered output.

Exhibit four: Americans are buying staples at dollar stores instead of grocery stores and supermarkets due to skyrocketing food prices.

STARTUPS

Error 404: Funding Not Found

Monstera/Pexels.com

Austerity is the norm as funding dries up for Indian startups across the board. The sector collected only $1.38 billion in funding in January 2023, compared with $4.56 billion in January 2022. That’s almost a 70% slump.

Only three companies—PhonePe, VLCC Wellness, and KreditBee—mopped up over $100 million last month, compared with 11 in January 2022. Ninety-two deals had cheque sizes under $50 million in January 2023, compared to 269 in January 2022.

No Indian startups made it to the coveted unicorn club last month. Diagnostics firm Molbio was the last to attain the status in September 2022.

Bitter pill: There are more reasons to be worried, as the Finance Bill 2023 has proposed including foreign investors under angel tax.

The Signal

Purse strings will get tighter than ever. As SoftBank continued to bleed through the market downturn, it infused less than $350 million in startups in the last quarter. And for the first time in two years, Tiger Global passed up on investing in Indian startups last month.

Tech giants too have had to give up on ‘moonshot’ ventures to focus on revenue and profitability. A handful of Indian startups are already trimming the flab.

The new manual (bean counter edition) focuses on core businesses to conserve cash. One of the casualties will be innovation (Wasn’t that the whole point of new-age thinking?) as many are keeping ambitious ideas in the freezer.

ARTIFICIAL INTELLIGENCE

Pichai Vs. Nadella, Like Never Before

The AI news cycle is tiresome, but every now and then comes a moment that makes you go, “These people are getting petty, where’s my popcorn?” This is that moment between Google and Microsoft.

Explain: Right after Alphabet/Google CEO Sundar Pichai formally introduced his ChatGPT rival, Bard, Microsoft officially launched a ChatGPT-powered Bing search, among other things—a day before Google holds its own AI event.

Microsoft, which pumped $10 billion in ChatGPT operator OpenAI, is integrating the chatbot across products, including its Edge browser.

Bard’s search services will be separate from Google Search, for now. Pichai also wants to integrate other in-house AI tools such as MusicLM, PaLM, and Imagen in Google products.

Here a bot, there a bot, everywhere a bot-bot: Q&A platform Quora has something called ‘Poe’. And China’s Baidu is naming its ChatGPT-like bot ‘Wenxin Yiyan’, or ‘Ernie Bot’.

🎧 It’s Sundar Pichai vs. Satya Nadella in the AI rat race. Also in today’s episode: millets get their place in the sun. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

JOBS

A False Sense of Comfort

First, the good news: India’s unemployment rate fell sharply from 8.3% in December 2022 to 7.1% in January 2023. However, that doesn’t necessarily mean there are fewer unemployed people in the country right now.

As Mahesh Vyas, managing director and CEO of the think tank Centre for Monitoring Indian Economy, noted in a Business Standard column, the drop in unemployment rate reflects a falling labour participation rate—from 40.5% in December to 39.8% in January. That means many workers are not looking for work. Those who stop looking out are not counted as unemployed. But that is often because there are no jobs available in the market.

Even if you take India’s 7.1% unemployment rate at face value, it’s quite high for one of the fastest-growing economies in the world.

FYI

Fresh dough: Roll-up e-commerce company Mensa Brands has raised ₹300 crore ($36 million) in debt from TradeCred. Edtech unicorn BYJU’S is closing in on $250 million-$300 million as part of a fresh funding round.

Red signal: India’s Supreme Court has refused to grant relief to bike taxi company Rapido, after the latter approached it against Maharashtra’s ban on “non-transport vehicles for aggregation and ride-pooling.”

Green signal: The Federal Trade Commission will not appeal its loss in a US district court over Meta’s acquisition of virtual reality company Within Unlimited.

Scaling up: Walmart-backed PhonePe will allow Indian users to make UPI payments when they travel to countries such as the United Arab Emirates, Mauritius, and Singapore among others.

Free for all: Meta is opening up its metaverse app, Horizon Worlds, to users aged between 13 and 17, The Wall Street Journal reported. The change could come as early as March. In related news, Meta has served an ultimatum to its managers and directors: either transition as an individual contributor in coding, designing, and research or exit the company.

More pink slips: Video-conferencing platform Zoom will slash 1,300 jobs or approximately 15% of its global workforce as the pandemic-fueled demand for the service wanes.

THE DAILY DIGIT

0

The number of cryptocurrency ads in the 2023 edition of the Super Bowl. Last year, crypto companies such as Crypto.com, Coinbase, and FTX shelled out $6.5 million each on 30-second TV ad slots. (Sports Business Journal)

FWIW

Food for thought: Pet food makers are thinking beyond meat-based options for four-legged friends. A host of startups peddle food products based on plants, insects, and lab-grown protein. Their founders claim there are takers. British startup Yora Pet Foods has been working on an insect-based option since 2015 and ships to at least 20 countries. Even the big guys—Nestle and Mars—are weighing their options. But, pet food is usually made with meat that isn't favoured by humans. Our take: Let them eat meat.

Digi-wedding: BJP national president JP Nadda's son's wedding reception may be remembered for more reasons than one. The invitation card came with a felicitation kit replete with a QR code with the location of the venue, parking slip, and another QR code for guests to access their photos. All it took is registering with their face IDs and contact details to receive photos straight to their email addresses. Yikes. We realise Nadda is a fan of QR codes. Good thing there's no privacy bill in place yet.

Fault in the lines: We usually keep away from sombre news in this section, but we have to make an exception today. Keep reading if you are curious why Turkey is so prone to earthquakes. The country is sitting on three tectonic plates: the Anatolian, Arabian, and African plates, which constantly rub against each other. In this case, the movement between the Arabian and Anatolian plates caused a rupture longer than 100 km. The crisis could get worse. Unfortunately, the rupture could cause more aftershocks in the next few days and even months.