Instagram 🤝 OnlyFans

Also in today’s edition: Wet blanket on ByteDance’s party; Just one from a family, please; Vaccine monopoly no more? Google bets big on crypto

Good Morning! Last year, we told you about Amazon’s take on departmental stores, with one eye on Walmart. Well, it’s here, and called Amazon Style. The first store will open in Los Angeles, and in true Amazon fashion, will be tech-heavy. And if you are into Amazon’s private labels, there's a good chance you’d find ‘em there, along with an algorithm. All this, after uprooting brick and mortar stores.

In the latest episode of The Signal Daily, we discuss how the rollout of 5G technology near airports has grounded airplanes in the United States or led to disruptions. We also dive deeper into the LIC IPO, the massive IPO everybody is looking forward to in India.

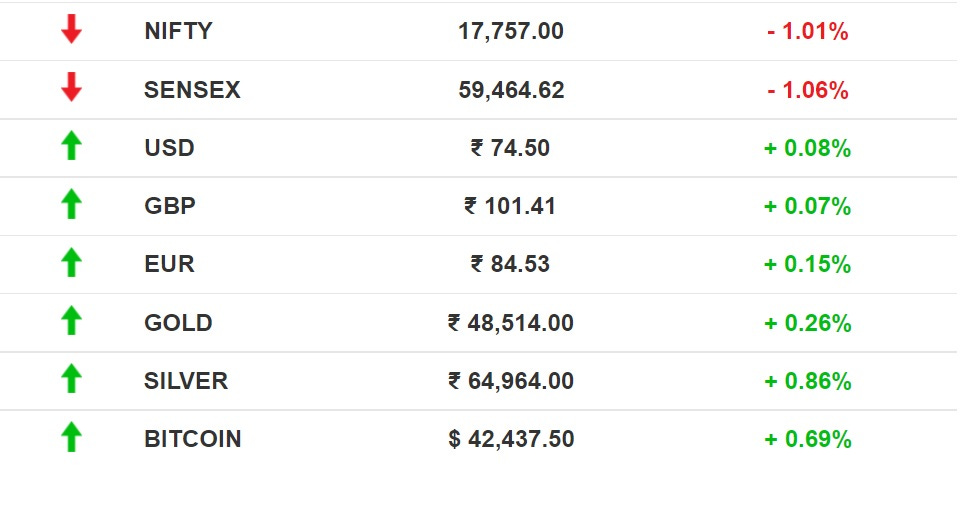

The Market Signal*

Stocks: Spooked by rising oil prices and inflation, investors continued to sell equities pulling indices down even more. This could also be the market turning cautious ahead of the union budget on February 1. The budget would be the next big determinant of sentiment.

Cryptocurrencies: The crypto market was also buffeted by rate hike fears and the resultant turmoil in the bond markets. Bitcoin prices have held above the $41000 level for a week but the Grayscale Bitcoin Trust, a fund that invests in cryptocurrency, has been trading at a deep discount, indicating that institutional investors are bearish on cryptos.

(Byte)Dancing To Regulatory Tunes

TikTok parent company ByteDance is dissolving its investing arm as China reins in its tech giants. The move follows even as the Cyberspace Administration of China (CAC) denied drafting guidelines that mandate investment approvals for platforms with over 100 million users or $1.58 billion in revenue.

Antitrust issues: China has taken an explicit anti-monopoly stance since 2021. For one, the State Administration for Market Regulation (SAMR)—the country’s market regulator—slapped record fines on Alibaba and Meituan for antitrust violations. The SAMR and CAC’s hawkishness also resulted in scuttled IPOs (read: Didi Chuxing), and behemoths like Tencent rethinking investment strategies. It has now renewed its vows “to curb the influence of tech companies on governments.”

Global gatekeeping: There’s no respite for ByteDance across the Pacific either. The US antitrust bill has now been expanded to include TikTok and WeChat. Meanwhile, TikTok also logged slower revenue growth year-on-year.

No Family Tag Teams At The Top

Companies that have promoter family members in top management are wringing their hands in anticipation of a rule that comes into force April 1. India Inc is naturally beseeching the regulator to abandon or delay the rule.

One-two: The new Sebi rule splits the positions of chairman and managing director and also insists that relatives cannot hold the posts at the same time. Bajaj Auto, for instance, has Rajiv Bajaj as managing director, uncles Madhur Bajaj and Niraj Bajaj as vice chairman and chairman respectively, and father Rahul Bajaj as chairman emeritus. From April 1, three of these positions will have to be unrelated persons.

Several state-owned companies such as ONGC are also headed by one person who is both chairman and managing director. The rule will affect 485 large companies and not even half are compliant currently.

Instagram Hops On The Subs Bus

Mark Zuckerberg made good on his promise to help creators make more money by introducing subscriptions on Instagram. Meta will also allow users to mint and sell NFTs.

The specifics: Instagram subscriptions, currently on test in the US, will allow creators to have subscriber-exclusive Lives and Stories and set monthly fees ranging from $0.99 to $99, at no cost until 2023.

Catching up or leading the way: YouTube launched channel subscriptions four years ago, Twitter launched ‘Super Follows’ last year and Facebook launched subscriptions for pages in 2020. TikTok, however, is still testing subscriptions.

The Signal

Meta is going out of its way to attract teenagers and younger Gen Z users who prefer Snapchat and TikTok. This is one more lure for creators to take to Instagram and its short-video feature, Instagram Reels, which has been a success largely because of India.

Creators have been earning from brand sponsorships, partnerships and platform payouts through creator funds set up to attract talent. Follower hordes are a measure of success outside the proverbial paywall but subscription is the true litmus test of fandom. OnlyFans and Patreon seem to have cracked this model.

Meta has also been trying to diversify its revenue sources as Apple blocked tracking on iOS, which severely impacted Facebook’s ad business. But Meta may still have a brush with Apple (maybe even Google) as app payments for these subscriptions become the bone of contention because of cuts taken by gatekeepers.

TRACKING THE THIRD WAVE

India Wants A Vaccine Waiver. Now

India wants to waive intellectual property rights for Covid-19 vaccines from the WTO. India and South Africa have been running in hoops since October 2020. But the European Union, and Australia, among others, are being a killjoy.

Currently, the TRIPS agreement hinders countries from scaling up treatments or vaccines. If India’s request is approved, poor countries could get equal access to vaccines and treatments to fight the pandemic.

Numbers talk: The graph continued to rise on Thursday. Even as cases dip in Mumbai and Delhi, rural India may be the next victim.

Meanwhile, an expert panel has recommended granting regular market approval for Covishield and Covaxin. If approved, the shots could be available across smaller clinics, and ramp up the vaccination drive. Both are the need of the hour.

Google Getting Token-Ready

Finance pros from PayPal and a company veteran are in the van of Google’s foray into future businesses, particularly finance and crypto.

Backend: Google hired Arnold Goldberg from PayPal to join former colleague Bill Ready, who is now the head of commerce. It has also created a blockchain and distributed computing unit under Shivakumar Venkataraman in its long-range tech projects division, Google Labs. Venkatraman had earlier worked on ad infrastructure and payments.

Finance: The company hopes to be the “connective tissue for consumer finance industry” and is working on a comprehensive digital wallet, including digital tickets, airline passes and vaccine passports.

What it means: Google’s ambition seems to be to become a complete payments solution; irrespective of method and currency. The end product could enable a user to buy and move anything—fiat money, transfer assets, cryptocurrency—seamlessly in the real and virtual worlds and between them. It could also be building a blockchain infrastructure to bolster search.

FYI

Standing stall: Meta is under pressure to release a much-delayed report about Facebook's impact on human rights violations in India. It was also grilled by an Australian government committee about misinformation and cyberbullying.

Deal with it: World Bank chief David Malpass criticised Microsoft’s acquisition of Activision Blizzard, questioning the capital allocation at a time when the world is struggling with poverty and a pandemic.

Scurrying: Disney is reshuffling management and investing in international content for its Disney+ service after 2021 made a mickey of its streaming subscriptions.

Wind up: Six months after raising $9 million in investments, Protonn has shut its operations and dispatched the money back to its financial backers.

Raking in: Payments infrastructure startup M2P has raised $56 million in its latest funding round, taking its valuation to $600 million.

Top gear: Luxury carmakers Lamborghini and Porsche registered 86% and 62% growth in India sales, respectively.

Sea-ing red: China is shifting parameters over its claim on various territories in the South China Sea.

FWIW

Snip symphony: The Van Gogh Museum in Amsterdam doubled as a beauty salon. Another local got a haircut with the Concertgebouw orchestra playing a symphony in the background. Dutch museums and concert halls decided to protest against mandated closures. In related news, a Czech folk singer succumbed to Covid-19 after deliberately contracting it.

Not in this economy: Think a $535 million Roman villa with artwork by fabled Baroque artist Caravaggio would find buyers among the rich and famous? Think again. The six-floor Villa Aurora had zero takers in a recent auction. It will now go on sale at a 20% rebate, much to the chagrin of owner Rita Carpenter.

Swan song: Ninety-two-year-old Giddes Chalamanda is a TikTok sensation. Although he doesn't even own a smartphone, his song Linny Hoo has garnered over 80-million views on Tiktok and spawned several mash-ups. He is hoping to secure royalties for his music.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.