Licious drops the meat wagon

Also in today’s edition: Ports in a (car) storm; Another RBI crackdown

Good morning! Fearless girl will not go on trial. Kristen Visbal, the creator of the “Fearless Girl” statue on Wall Street, and asset manager State Street Global Advisors, which commissioned it, have settled a copyright and trademark violation dispute. State Street ordered the sculpture of the girl standing with her chin up, hands on hips and a proud expression, in 2017 to be installed opposite the famous “Charging Bull” statue to symbolise women’s empowerment and market its index fund for gender-diverse companies. It sued Visbal in 2019 for creating replicas of the statue but has now settled out of court, Reuters reports. The terms remain undisclosed.

🎧 The Godrej family business splits in two. Also in today’s episode: the rising popularity of ramen noodles in India. Tune in on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

Roshni Nair and Dinesh Narayanan also contributed to today’s edition.

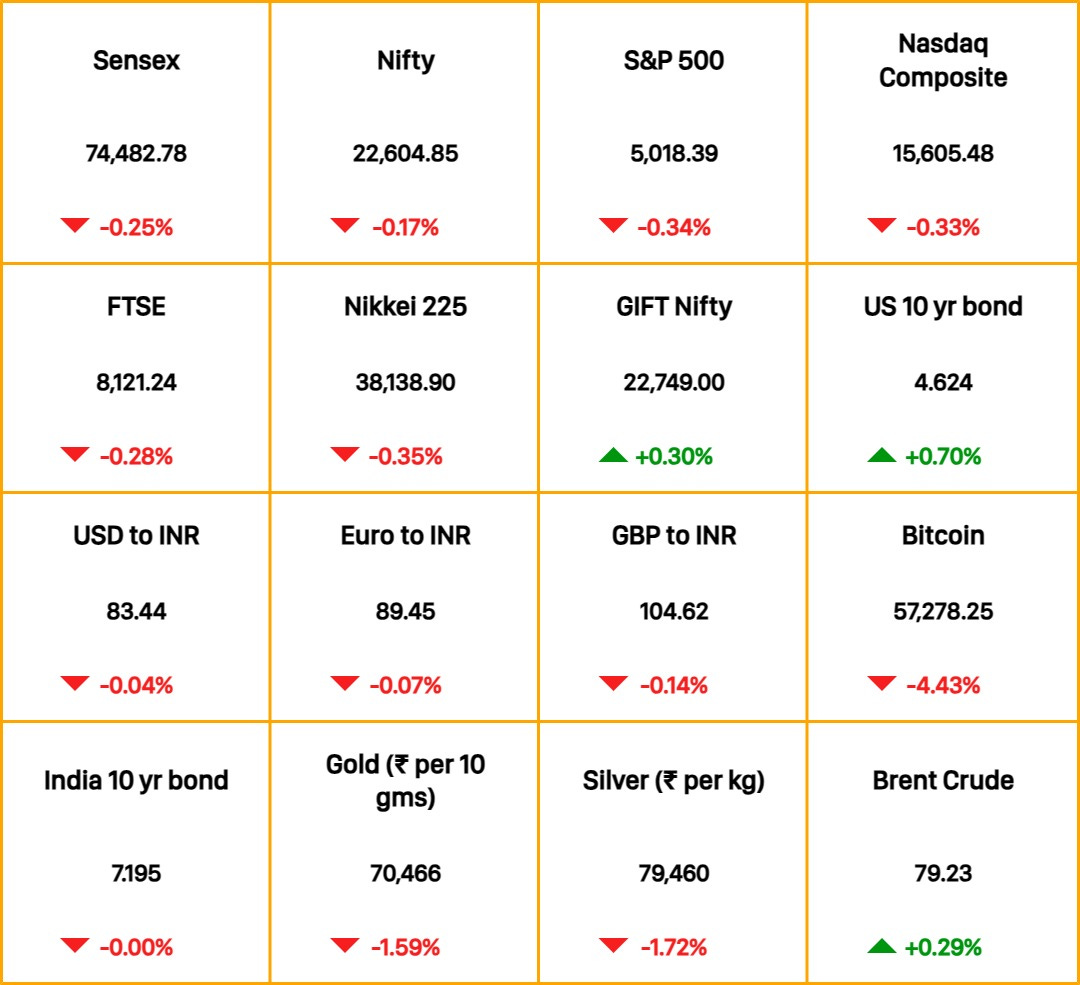

The Market Signal*

Stocks & Economy: The only thing US Federal Reserve chair Jerome Powell chose to affirm was that he doesn’t see the likelihood of a rate hike this year. But rates will stay at current levels for longer.

High US interest rates are strengthening the dollar globally. The Japanese yen is one of the worst affected and the Bank of Japan is said to be secretly intervening in the market to check its fall.

Rocky: The US-Japan relationship has also hit a few potholes despite Prime Minister Fumio Kishida’s successful Washington visit a few weeks ago. President Joe Biden, who had earlier frowned at Nippon Steel buying US Steel, has now called Japan xenophobic and clubbed it with Russia and China.

Up: India’s GST collections in April touched a record high of Rs 2.10 lakh crore (~$25 billion).

Asian markets opened mixed. The GIFT Nifty indicates a positive opening for Indian equities.

AUTO

There’s No Fixing This Pile-Up

In February, we told you about the great Chinese EV dump. An oversupply of EVs from the country is clogging ports the world over, especially in Europe.

That congestion problem will now get worse.

Financial Times reports that terminal operators have placed orders for nearly 200 ships, and logistics giants MSC and Wallenius Wilhelmsen are investing in car carriers and dedicated terminals. But such planned capacity expansions won’t manifest before 2027.

This is happening while car shipments are increasing: in 2023, global car shipping capacity increased by 17% year-on-year. So until 2027 or so, terminals will continue doubling as glorified car parks.

Another reason for the pile-up is some automakers changing distribution models. For example, Volvo has tied up with Wallenius Wilhelmsen to distribute its Polestar EVs. Since terminal operators are shipping cars directly to end customers, vehicle build-up is a given.

BANKING

Breathing In Thin Air

The Reserve Bank of India is putting the fledgling Indian fintech industry through the wringer as it tries to curb risky lending and careless transactions.

It has asked peer-to-peer (P2P) lending platforms not to give any default loss guarantees (DLGs) to investors. The RBI allows unregulated entities to offer up to 5% DLGs to lenders but it has now directed that P2P platforms linked to NBFCs cannot do so. That’s likely to hit the business of platforms such as Lendbox, LiquiLoans, Faircent and LendenClub, The Economic Times reports.

Separately, the RBI has asked banks to be careful about asset valuation when lending against gold in transactions originated by fintech companies. The central bank had shut down NBFC IIFL Finance’s gold loan business after it allegedly found irregularities in valuation.

CONSUMER

It’s De-Licious

In 2015, Bengaluru-based Licious began selling fresh meat and seafood online, promising to disrupt a trade dominated by small neighbourhood shops employing people of communities traditionally in the meat trade. Nine years later, Licious’ “next big focus” is… opening small neighbourhood shops to sell meat.

Licious will open five new stores in Bengaluru by next month and have 500 such stores in the next five years. ̛It is under pressure to turn profitable, although it has hit a $100 million annual revenue run rate.

Past fumbles: This isn’t Licious’ first physical tango. Last year, it opened five ‘experience stores’ in the National Capital Region: large stores in malls and shopping complexes with a small restaurant attached. It also launched plant-based meat brand UnCrave two years ago.

The Signal

Nearly all Indian direct-to-consumer startups promised to disrupt traditional consumer businesses by replacing the middleman and selling online for cheaper. One by one, most are embracing the traditional models they challenged. The problem: these models can’t scale at the furious pace VCs expect.

Renting a shop and maintaining a cold chain to supply fresh meat across the country is expensive and operations-heavy. Besides, packaged meat, like any other consumer staple, tends to be a lower-margin business because it competes with unbranded, unpackaged alternatives. Licious will find it hard to scale up and make profits by investing in an offline business. But then, that is why it had launched an online service in the first place.

FYI

Drop: Adani Power reported a net profit of Rs 2,737.24 crore for the quarter ended March, down ~48% year-on-year from Rs 5,242.48 crore.

Big plans: Jindal Stainless Steel has earmarked Rs 5,400 crore for acquisitions and expansion in production capacity over the next three years.

The heat is on: The India Meteorological Department has issued a warning for severe heatwaves for the next three days, with temperatures expected to rise up to 47°C in parts of east India.

What is he thinking?: Reuters reports that Tesla is retreating from its ambitious gigacasting manufacturing plans. The news comes a day after CEO Elon Musk abruptly laid off the company’s EV charging team.

Jumbo rivalry: The Wall Street Journal reports that Brazilian aircraft maker Embraer is planning to challenge the Boeing-Airbus duopoly with a narrow-body plane that will rival the 737 MAX and A320.

THE DAILY DIGIT

71%

Share of the services sector in the 185,300 new companies registered in FY24. (Livemint)

FWIW

Kansai has it in the bag: While Singapore’s Changi and Qatar’s Hamad International duke it out for bragging rights to the world’s best airport, a much smaller airport is blowing the bugle for a different achievement. Kansai International Airport in Japan has been adjudged the world’s best airport for baggage delivery by aviation ranking website Skytrax. Apparently, Kansai International’s ground staff have never lost any passenger bags since September 1994. It’s a big deal considering this is only Japan’s seventh-busiest airport. Staffers aren’t making much of the accolade though, saying they’re just doing their job. Ok, humblebrags.