Making Sense of Solana

One of the world’s most valuable blockchain platforms is courting India. Here’s why that matters

Good morning! A big hello to readers who signed up this week. Welcome to The Intersection, The Signal's weekend edition. This weekend we talk about blockchain platform Solana's ambitious plans for India and why it comes with a few caveats. Also in today’s edition: we have picked the best weekend reads for you.

On February 8, 2022, a Twitter handle dropped a crossover that puts whimsy to shame.

That handle is @SuperteamDAO, and the crossover features Sima Taparia, better known as ‘Sima Aunty’, endorsing Solana. Getting the marriage broker from the hit Netflix series Indian Matchmaking to utter ‘GM’, ‘Sima Inu’, ‘Web3’, ‘WAGMI’, and ‘Rust’ was a coup for one of the world’s most valued blockchains.

| |||

You are cordially invited... 🙏 Please RSVP here - | |||

| |||

| |||

Feb 8, 2022 | |||

| |||

2.06K Likes 406 Retweets 252 Replies |

In case you’re wondering, here’s what all that means:

SuperteamDAO is a collective that facilitates projects on the Solana blockchain across India and Southeast Asia. Its founding members are Tanmay Bhat, Devaiah Bopanna, and Akshay BD. Bhat is the co-founder of All India Bakchod (AIB). Bopanna, also an AIB alumnus, cofounded media company All Things Small. BD was part of Uber India’s founding team. He’s now an advisor to the Solana Foundation, the non-profit arm of the Solana network.

SuperteamDAO is spearheading Indian efforts in Riptide, Solana’s annual hackathon that calls on developers to build dapps (decentralised apps) for its blockchain. The scope is limitless: gaming, payments, marketplaces, collectables, social media, and even more DAOs.

With over 1,100 registrations, India is second only to the US in Riptide participation. Moreover, short video platform Chingari—which uses its native token $GARI to reward creators and is now listed on cryptocurrency exchange CoinDCX—built its token on Solana.

| |||

| Replying to@sumitgh85 | |||

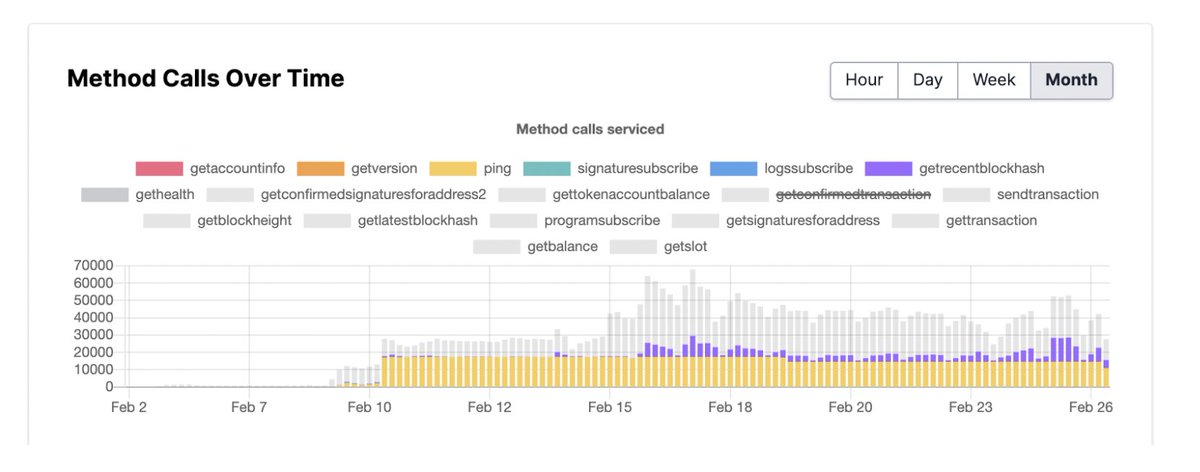

@garitoken@solana 5/ Solana! Solana! Solana! 👏👏. Choosing you as the blockchain to be built upon was the best decision. Making more than 50k daily interactions with Solana Nodes with 99.99% success rate and under 1 second transaction finality is now the new norm 🥳. @solana | |||

| |||

Feb 26, 2022 | |||

| |||

31 Likes 2 Retweets 1 Replies |

This is all to say that Solana is courting India like no other international blockchain platform. The objective is to tap into the country’s reservoir of developers a la Silicon Valley. After all, India is estimated to overtake the US as the world’s largest developer population centre within two years. As a heavily VC-backed blockchain—15 VCs invested in 2021 alone, taking total funding up to $335.8 million—Solana’s value lies in amassing developer ecosystems atop its chain. Its market cap jumped a whopping 17,500-fold since its inception and earned it the moniker, ‘Ethereum killer’.

If the upstart indeed wants to replace Ethereum as the world’s most popular blockchain for decentralised projects, it has to do everything it can to get eyeballs and shore up developer might. Hence Sima Aunty, in a country where more people know about Indian Matchmaking than crypto. Hence SuperteamDAO aggregating and driving $1,000-$10,000 ‘Instagrants’ and running Solana India Foundation grants too.

“But honestly? I’m not bullish on Solana. I’ve been in crypto for almost a decade and take big claims like theirs with a pinch of salt,” says a top executive with a cryptocurrency exchange, who spoke to The Intersection on condition of anonymity.

Dapps can only be as good as the chain they are built for. And so, we examine Solana’s claim of being “the world’s most performant and efficient blockchain”.

Spoiler Alert

Solana is neither performant nor efficient. Not yet, anyway.

For context, let’s consider Ethereum creator Vitalik Buterin’s ‘Blockchain Trilemma’. The theory proposes that while blockchains should adhere to the holy grails of decentralisation, security, and scalability, developers are forced to trade off one to accommodate the others. It’s impossible to check all three boxes when building for the blockchain.

When it comes to decentralisation, Solana doesn't fare well compared to its peers. Nearly half the platform’s tokens are held by insiders (investors, founders, and company). There’s scant little for public sale.

The data by crypto market intelligence platform Messari is nearly a year old. It’s likely that insider allocation increased after Solana’s June 2021 funding round.

Such allocation means that major decisions pertaining to the blockchain are concentrated in the hands of a few. Worse, billionaire investor Chamath Palihapitiya, who has stakes in two Solana projects, quipped that he was offered Solana tokens at a discount.

What happens to the $SOL token once insiders decide to sell? Your guess is as good as ours.

Next comes security. A flaw in its interface was responsible for a $320 million hack through a cross-chain protocol named Wormhole. It’s also overrun by bots and suffered six outages in January 2022 alone. Why market yourself as “the fastest blockchain in the world” if your quest to scale overrides network stability?

“If your network is down for 10+ hours, it’s not a blockchain. I explored Solana six months ago but dropped it because of the outages,” says Adarsh Sunil. Sunil is a researcher and convenor with the Kerala Blockchain Academy.

Sunil adds that blockchain platforms Cardano, Near, and Polkadot have mathematically-proven protocols. Cardano’s Ouroboros is the first peer-reviewed protocol, and Ethereum’s standards go through a voting and approvals process. While community consensus is the beating heart of Web3, Sunil feels Solana’s decision-making is more attuned to building fast and building big.

Green Room

The last point we examine—and this is a biggie—is Solana’s claim of climate friendliness. This is critical because crypto has a much-storied climate problem. Bitcoin and Ethereum are the worst offenders here due to their proof-of-work (PoW) algorithms.

PoW is one of two consensus mechanisms that secure transactions on a node, or a computer that runs blockchain software. The other is proof-of-stake (PoS). PoW needs significant computing power to validate transactions. PoS was developed as an alternative to the energy-guzzling PoW; in this system, validators ‘stake’ a portion of their coins to secure transactions. If they approve malicious blocks, they lose said stake.

Solana has a hybrid mechanism but is categorised as a PoS network. The Solana Foundation wants us to believe that one transaction on the platform consumes less energy than Googling or charging your phone.

This was put to test by the Crypto Carbon Ratings Institute (CCRI), which researches crypto's environmental impact. Its findings (pdf) indeed confirm that Solana consumes the least energy per transaction.

There’s a catch, however.

Because Solana has the highest hardware requirements of all PoS platforms, it has the highest electricity consumption per node. It also has the biggest carbon footprint. For perspective, the Tezos blockchain emits as much carbon dioxide as nine business class trips from Munich to San Francisco. These footprints will increase with scale.

Solana touts the transaction metric because that’s what all crypto platforms do. But in its report, CCRI notes: “Companies that want to report emissions associated with cryptocurrency should not use a transaction-based allocation approach.”

“It’s ultimately a matter of perspective which metrics matter more. Investors may care mostly about the carbon footprint of holding an asset without doing transactions. This is a completely different calculation as well, as you determine the footprint based on the amount held and the holding period,” Alex de Vries tells The Intersection. de Vries is the founder of Digiconomist, which studies the environmental impact of cryptocurrencies. In February 2022, he wrote about the carbon footprint of Polygon, the VC-backed Indian blockchain that also claims to be ‘green’.

What does SuperteamDAO make of all this?

Talent > Chain

For SuperteamDAO founding member Akshay BD, it’s less about Solana and more about putting India at the forefront of Web3.

Over an hour-long call from Singapore, he cites Solana’s low fees as the clincher. All crypto platforms charge ‘gas’, or a fee to execute each transaction. Ethereum is notorious for its volatile gas fees, which range from $10 on a good day to as high as $150. Compare that with Solana’s average transaction fee of $0.00025.

Affordable gas is a USP in India. More so if you’re looking at the country as a funnel for ecosystem development atop your chain.

Solana’s accessibility in this context is the perfect springboard for SuperteamDAO’s ambition– which is to be a “a YCombinator-like ecosystem” for Web3 founders and developers across India and southeast Asia.

“Anybody in crypto can raise money, but talent is scarce. We want things to be at a stage where the next Sundar Pichai does not have to go to the US,” BD says. He takes his cues from India’s SaaS (software as a service) boom, which culminated in Freshworks and Zoho morphing into competitors to established giants such as Salesforce. Both companies have a reputation for cold-shouldering VC flashiness and being community and developer-driven. Their success also turned Chennai into India’s SaaS capital.

We asked BD what he makes of Solana’s ‘Blockchain Trilemma’; about its quest for scale overtaking issues like unequal token allocations and patchy security.

“I think it's a healthy conversation to have, because of the capital formation process and the ethics around it, and it will force a conversation around retail participation in these markets ,” he admits. “[As for security], every hack stress tests the system and makes it antifragile. There’s a 24x7 security bounty on every protocol that has money locked in.”

The Intersection reached out to Solana cofounder Raj Gokal over email. At the time of publishing, Gokal didn't respond.

SuperteamDAO bills itself as an experimental project, which is almost exclusively developer and founder-facing. It has no tokens or funding, and is currently aggregating grants and fellowships. The Sima Aunty ad did well to deliver an otherwise-boring message about a high-speed, low-fee environment organising a hackathon, which is a big deal in the world of Web3.

Whether that environment is stable is another matter altogether. There’s a reason users stick to Ethereum despite its high gas fees. Some would accuse us of FUD (fear, uncertainty, and doubt in cryptospeak). We call it being objective.

A MESSAGE FROM OUR PARTNER

Are You Still Going To A Bank In 2022?

If you’re still filling a bucket-load of forms and waiting for days to open a bank account, we have news for you. You’re not in 2022.

You can now open an account online with Fi in three minutes. For starters, you can have a zero balance account (you won’t keep it at zero though). There are no hidden fees and no minimum balance.

What’s Fi? It’s a neobanking app that’s entirely digital and comes with absolutely none of the hassles of opening an account or fending off offers for a lifetime free credit card and such. It’s a well-designed banking experience made for you.

Fi ensures you save, and even win rewards. With really cool and smart ways to save, such as FIT Rules (like when your favourite cricketer hits a boundary, you save 50 bucks), or Fi Jars that help you save for that swanky new slab of glass and metal or the much needed holiday. The saying ‘a penny saved is a penny earned’? That’s what Fi is about.

Get Smart with Fi. And if this is still not enough, use the code SIGNALONFI to earn up to ₹250 on adding money to your Fi account. We told you it wouldn’t be zero!

ICYMI

The Greatest: Nobody saw it coming. Not even Shane Warne as he paid a tribute to another Australian cricketing legend, Rod Marsh in his last tweet. On March 4, 2022, cricket lost one of its biggest ambassadors—Warne. So as news of his death flashed on the screens, cricket lovers had a collective flashback of their childhood memories of the King. In this piece, Gideon Haigh, the Australian journalist and author, rightfully notes why there will be no one like Warne.

Beyond Brinkmanship: As the Russian invasion of Ukraine worsens, analysts are divided on the United States’ involvement in this crisis. Political scientist John Mearsheimer argues that the US pushing the NATO agenda eastward increased the likelihood of the war. But, another school of thought believes that, Russian President Vladimir Putin would have gone ahead with the attacks irrespective of the foreign policies of the US. Even as the Russian media is towing the government line, Nobel-winning newspaper Novaya Gazeta is holding fort independently by refusing to incorporate the government’s view in their coverage.

Redefining Personhood: What makes a living being a person? If corporations can be considered ‘persons’ in court cases, would the same apply to animals as well? That’s the bone of contention between an animal rights group and the Bronx Zoo. Interestingly, the habeas corpus petition has been filed on behalf of an Asian elephant named ‘Happy’. This deep-dive by The New Yorker looks at the series of litigations seeking ‘personhood’ for animals and whether these creatures really have the cognitive capacity to make independent decisions.

Tumbling Down? Fifteen years ago, blogging was our social media. Viewing and commenting on Tumblr posts constituted the core of internet activity. But as Facebook and WhatsApp got popular, Tumblr lost out. The problem was aggravated by the constant ownership changes of the platform, often with no vision for the future. This story narrates the acquirer-led troubles of Tumblr and how it is a product in need of direction.

Anarchist Riders: Amsterdam, the global cycling capital, may seem to have effortlessly eased into cycle use. The reality, however, is that the shift to bikesharing was fraught with difficulties because its original proponent Provo was considered a left-wing group aiming to overthrow authority. The idea was instantly rejected, only to slowly pick up interest all over Europe. This piece chronicles the anarchist origins of the shared-cycle revolution.

Knotty Drama: Two e-commerce entrepreneurs decided to set up a knitting venture and make money. Once the knitting.com domain name purchase was made public, the online knitting community was enraged. There were murmurs about knitting patterns and talks of racism. Knitters felt that businessmen with zero idea about knitting were out to disrupt the ecosystem, while the entrepreneurs say otherwise. This story looks at what went wrong with the idea.

— By M Saraswathy

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Intersection.