MBA? Meh.

Also in today’s edition: WeWork didn’t work; Canon’s chip challenge; Binny Bansal’s big bet; A thaw in China’s icy relations

Good morning! If your boss’s tone-deaf communication has often left you wondering whether they might just be robots in disguise, then you’re probably right. Futurism reports that Polish drinks company Dictador has appointed a robot, Mika, as its "experimental CEO”. We… don’t really know what or how to react to this, but there’s one silver lining for sure: no more cringy LinkedIn posts of bosses weeping or being shirtless at meetings. 🙃

🎧 AI CEOs are here. Also in today’s edition: IT jobs hit a wall. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

Dinesh Narayanan and Adarsh Singh also contributed to today’s edition.

We would like to know more about you. Participate in our annual survey by filling up this form. We’ll use your answers to tweak our products and make them more enjoyable for you. As always: you will remain anonymous.

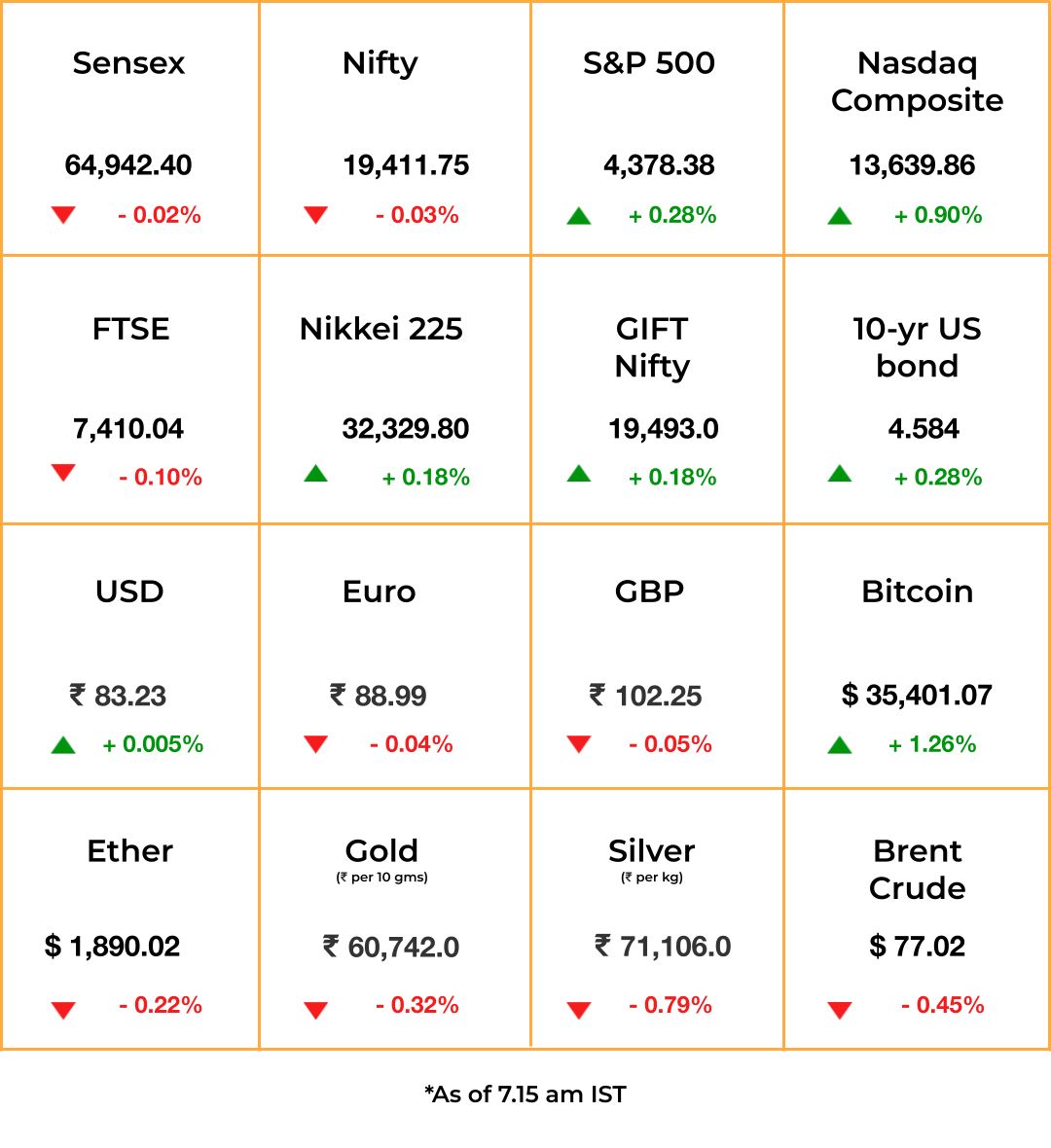

The Market Signal

Stocks & Economy: Asian stocks were more or less flat in opening trade, with Japanese equities showing a positive bias while the rest staying marginally in the red. US stocks had held on to gains but remained largely static.

Morning trade in the GIFT Nifty indicates a flat opening with sentiment remaining lacklustre. Investors are awaiting fresh economic data to make their decisions.

Chinese stocks could be in demand with the US and China working overtime to improve relations. Templeton Global Equity Investments’ chief investment officer, Manraj Sekhon, believes the thaw presents an opportunity to invest in beaten-down Chinese stocks.

Another report, however, said China is unable to hold back long-term foreign investors who continue to pull out investments from that country as part of their de-risking strategy. Oil traders continue to be pessimistic about Chinese demand and US’ economic prospects.

EDUCATION

We Don’t Need No MBA

US Ivy League colleges have a problem: their MBA programmes aren’t so sought after anymore. A survey by Bloomberg Businessweek revealed that applications to 17 of the top 26 MBA programmes in the US have declined since at least 2017.

However, it’s only American students who seem to be losing interest in an American MBA: 85% of full-time MBA programmes saw fewer domestic applications in 2022 compared with 2021, while 80% of them received more international applications. Experts put this down to a strong US economy and job market even through the pandemic, while online MBAs might also have had a role to play.

In India, though, which was hit by the global slowdown and resultant tech layoffs much harder, MBA degrees continue to be coveted. A record 330,000 people registered for the Common Admission Test or CAT this year.

CORPORATE

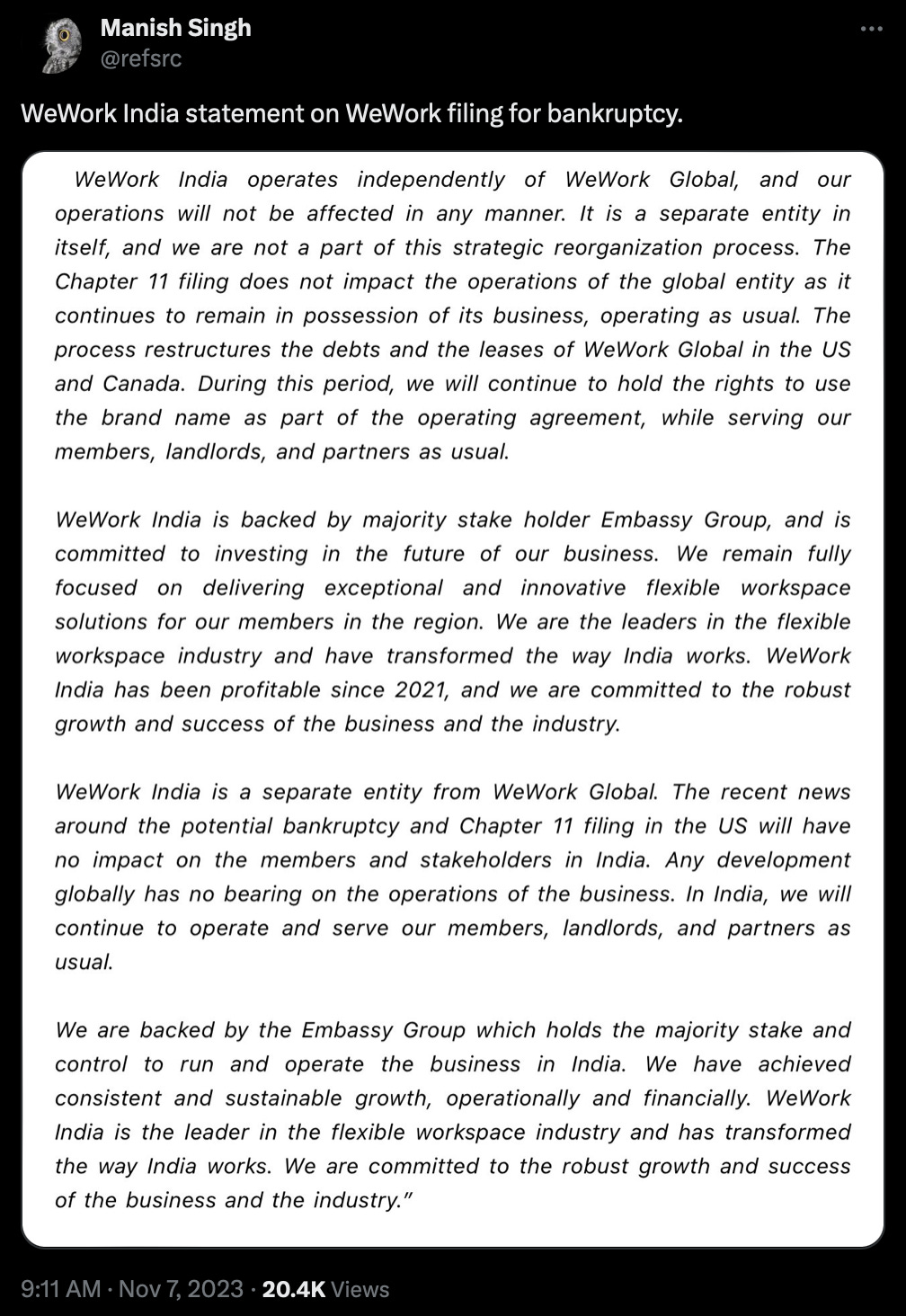

Banking On Bankruptcy

"Our valuation and size today are much more based on our energy and spirituality than it is on a multiple of revenue." That was WeWork co-founder Adam Neumann to Forbes magazine after investor SoftBank valued the company at $20 billion.

That Neumann was wrong and intrepid SoftBank chief Masayoshi Son was even more wrong about Neumann was definitively proven right when WeWork filed for bankruptcy on Monday. It will help the company restructure debt and renegotiate lease contracts. WeWork outside the US and Canada and its franchises will be unaffected. WeWork India is majority-owned by the Embassy Group and is a profitable venture.

Once the US’ most valuable startup, WeWork was laid low by expensive rent agreements and high operating costs combined with the work-from-home trend continuing long after the pandemic subsided.

SEMICONDUCTORS

Lights, Camera, Action

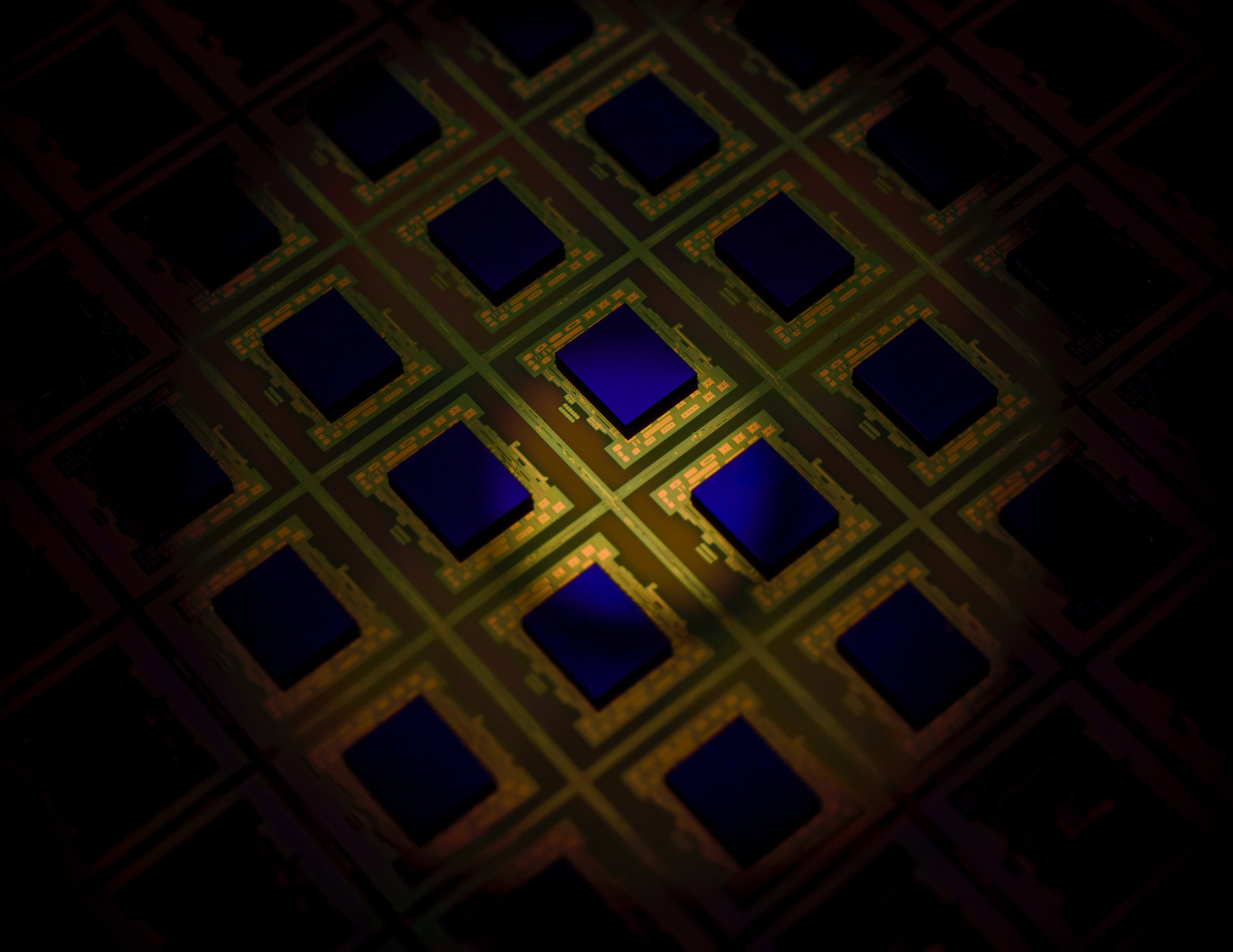

Nearly a century after it developed the Kwanon 35mm prototype—which paved the way for Ricoh, Nikon, Fujifilm, Pentax, Sony, and Olympus in the consumer market and eventually cemented Japan’s dominance in camera-everything—Canon is keen to make history again. This time, in lithography.

Wut?: Lithography is critical to advanced chipmaking. Because it’s the only company in the world making extreme ultraviolet (EUV) lithography equipment, Dutch vendor ASML is indispensable to every chipmaker. Each machine costs about $200 million.

Canon wants to challenge this monopoly by pricing its machines “one digit less than ASML’s EUVs”. It’s doing so by using a different process: nanoimprint lithography (NIL).

Why should I care?: Canon claims its tech may eventually produce 2nm semiconductors. The smaller the number, the more advanced a chip.

US chip sanctions, adopted by allies, block Chinese access to chips smaller than 14nm. While ASML has banned EUV exports to Chinese customers, Tokyo’s curbs don’t single out NIL.

The Signal

Canon is the world’s second-largest maker of lithography equipment by volume. If its NIL is robust, it may help Chinese customers regain access to cutting-edge lithography machines.

But the operative word is “if”. NIL as a technology has existed for two decades but hasn’t found as much favour. EUV is less prone to defects and other challenges that come with high volumes. Fwiw, Nikon also tried to disrupt ASML.

Even if Canon’s NIL overcomes such challenges, analysts reckon it won’t be long before it’s subject to export controls to China.

ARTIFICIAL INTELLIGENCE

Binny The Brave

What else do you call a man who’s planning an AI-as-a-service startup in a crowded market—one where India’s Big Four IT companies have already made their moves?

What are you talking about?: This Bloomberg story about Binny Bansal emulating the outsourcing model. The Flipkart co-founder and former CEO has hired 15 AI experts for a venture that may offer AI services to the e-commerce, data science and analytics, financial services, and legal industries. We don’t know what the last one entails, but ICYMI, we’d written about the problems with judicial automation back in May.

Bansal’s AI startup will reportedly launch products and services in 2024.

In other news: At its first-ever developer conference, OpenAI announced that it’s launching a store later this month for custom GPTs, much like apps developed for and platformed in an app store. The company will also offer a ‘copyright shield’ to enterprise customers and developers.

GEOPOLITICS

Australia 🤝 China

Staunch US ally and Five-Eyes cog Australia and China have put a lid on the animosity built up between the two countries during the Scott Morrison era. Australia Prime Minister Anthony Albanese just wrapped up a successful visit to Beijing, at the end of which Chinese President Xi Jinping indicated that their relationship was stabilising.

Albanese has worked hard to mend ties ever since he took over last year from Morrison, during whose term trade broke down and political relations hit rock bottom.

US next?: The thaw comes ahead of Xi’s US visit next week and a summit with President Joe Biden on the sidelines of a meeting of 21 Pacific Rim countries of the Asia Pacific Economic Cooperation forum. There is likely to be business talk, as well as ground rules of strategic and economic engagement wherever the two nations find themselves pitted against one another.

FYI

Deal watch: The Tata Group is considering selling its home appliance company Voltas due to challenges in scaling up the business in a competitive market, reports Bloomberg. Voltas denied the report.

Third wheel: The Information reports that Amazon is working on a large language model named Olympus to power features across verticals; the company may announce the conversational AI tool by December.

Costly acquisition: The UBS Group posted its first quarterly loss—of $785 million—in almost six years after taking over rival Credit Suisse earlier this year.

Lofty ambitions: Chinese fast fashion major Shein is targeting a valuation of $80 billion-$90 billion as it prepares for an initial public offering in the US, Bloomberg reports.

Ciao: James Gorman, who’s stepping down as Morgan Stanley CEO by the end of this year, has said he also plans to give up chairmanship by the end of 2024.

Pink slips: Big Four firm PwC plans to cut around 600 jobs in the UK due to lower-than-normal attrition rates and subdued growth in parts of the business.

Pause: Apple has halted development of next year’s software updates for all its devices until it irons out bugs in the code.

THE DAILY DIGIT

34.1%

The percentage of households in Bihar that live in poverty, earning a monthly income of ₹6,000 ($72) or less, according to the state’s caste survey. (The Indian Express)

FWIW

City of Stars: When Frank Sinatra crooned, "I want to be a part of it, New York, New York," he likely pined for a welcoming city. However, modern-day New York is anything but. The city's ultra-wealthy are transforming it into a gilded gated community, complete with exclusive clubs and private helicopter rides. Additional services catering to their lifestyle include a $250/day pet hiking service in upstate areas and an annual $3,500 on-demand 'concierge emergency care provider.' Boy, these New Yorkers are making Marie Antoinette look modest.

Now and then: That’s the name of the ‘last song’ of The Beatles and also a perfect descriptor of their enduring popularity. The band is gaining clout amongst Gen Z as they discover the song on TikTok. Some are third-generation fans indoctrinated by their grandparents, while others find their love for the band through music history classes and films like A Hard Day's Night. For most, though, it is social media communities that are helping them come together and enjoy Strawberry Fields Forever.

Time capsule: After 265 years, a collection of French love letters confiscated by the British is now in the public domain. These letters offer unprecedented insights into the lives of people from that era, capturing both the ordinary and the thrilling aspects of their experiences. Why? Surprisingly, for practical reasons rather than prudishness (as was our first guess). During the Seven Years' War (1756–1763), France possessed some of the world's finest ships but lacked experienced sailors. To exploit this, Britain imprisoned a significant number of French sailors in Britain. The confiscation of these letters was collateral damage of that turbulent period.