Meta calls time on token play

Also in today’s edition: Cred, Amazon eye video-commerce; FinMin has a task at hand; BNPL with iPhone?

Good morning! It was an idea that had come on the Twitter timeline (apologies to Victor Hugo). Mathew Tuttle rolled with it and bet against Cathie Wood, the reigning star of pandemic stock picking. Tuttle floated a fund that would oppose Wood’s ARRK ETF, meaning it would make money when Cathie’s fund lost. Tuttle’s anti-ARK fund, SARK, is up 61% so far while ARK has slid 43%. Investors are flocking in and the SARK is now $350 million, reports Bloomberg.

ICYMI, in the latest episode of The Signal Daily, we highlight the issues Netflix has been facing in India; slow subscriber growth and opposition to its woke content. We also talk about the latest music NFT - The Beatles memorabilia and more.

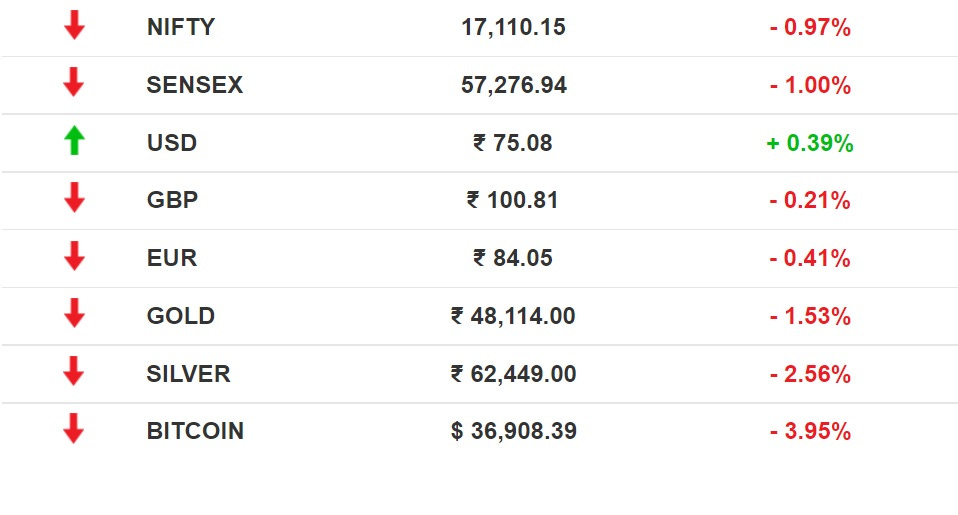

The Market Signal*

Stocks: For the first time this week, Indian indices broke away from the trend in US markets and slid down. Hawkish comments from Fed chairman Jerome Powell did not reflect negatively on the Nasdaq and NYSE indices, which rose in the last session, but they spooked Indian investors. Rising oil prices because of tensions on the Russia-Ukraine border have also been weighing on the markets.

Keep ‘Em Moving, Keep ‘Em Hooked

Twitter guru Kunal Shah-led credit card payments platform Cred is building a video commerce offering under Cred Store. Online retailer Amazon is reportedly venturing into the hot video commerce space in India with funding for influencer-led platform Trell.

Nascent space set for growth: Both companies are attempting to increase engagement and screen time in the hope that users will eventually shop from their stores. Video commerce, where influencers play a key role in shaping shopping preferences, is a focus area for many companies.

In November 2021, Myntra was one of the first Indian companies to follow Chinese pioneers Pinduoduo and Taobao to launch an influencer-driven online shopping platform. Some experts believe the space could balloon to a $40 billion opportunity by 2025.

TRACKING THE THIRD WAVE

Shrug And Move On?

India registered 2.86 lakh cases on Thursday. The BA.2 variant is surging.

Are you eligible for the booster dose? The Government is having a rethink about that. The WHO has a similar take.

Sidelined: Third dose or not, only 67.6% of Indians are partially vaccinated. For the second dose, gig workers are on their own. While companies actively took on the job to jab (and earned social media bragging rights) in the early days, they are lukewarm to drives now. And the vaccines will likely cost ₹275 per dose.

End-game? Denmark will lift Covid-19 restrictions. England has scrapped most of them too, even as Moderna starts trial for an Omicron-specific vaccine booster.

Anti-vaxxers have been raking it in publishing newsletters but some good doctors on TikTok have been combating their conspiracy theories.

Meta Winds Up Diem

Just when Google decided to go all-in on crypto and digital finance, Meta has decided to can its ambitions for tokens.

Wary officialdom: Meta’s (formerly Facebook) finance consortium Diem Association will sell its tech to a small bank that was part of the group. The project was beleaguered from the time it was launched in 2019. Known as Libra then, it had raised eyebrows in Washington which feared it could cause financial instability and promote fraud and money laundering.

For the same reasons, the IMF has told El Salvador to junk bitcoin as legal tender. The lender has not cleared a $1.3 billion loan because of its bitcoin law.

Frauds galore: The worries may not be misplaced as a new Chainalysis report shows that cyber criminals laundered cryptocurrencies worth $8.6 billion in 2021. Even the IRS says there are “mountains and mountains” of fraud in crypto and NFTs. It’s sometimes a wonderland.

That has not stopped a bunch of mayors in the US from evangelising currency tokens, accepting crypto-denominated salaries and trying to wheedle them into city budgets.

The Signal

The year 2022 could be the year of reckoning for cryptocurrencies. While the wildly swinging prices of bitcoin and alternative coins have not deterred several high-profile investors and institutions from becoming converts, lawmakers are busy preparing fences and leashes. The real competition to cryptocurrencies could be a digital dollar if the Federal Reserve decides to launch one.

Govt Has A Burden To Bear

Finance minister Nirmala Sitharaman must be losing quite a bit of sleep. High borrowings have cranked up the Centre’s interest burden and it is likely to rise more than 15% in the upcoming fiscal.

Why? Government borrowings doubled from pre-pandemic levels and revenues plummeted, pushing the fiscal deficit to 9.5% in FY21. Currently, interest payments add up to over ₹8 lakh crore. It is expected to rise to ₹9.3 lakh crore.

Global rates hike: This comes at a time when the Fed is poised to raise interest rates from March 2022 because inflation in the US is at a 40-year high. Experts warn that it will slow down economic recovery in emerging markets.

Apple’s Chip Off The Block

Apple is developing a tap-to-pay feature that will turn iPhones into a mobile point of sale (mPOS) terminal. In other words, iPhone users can soon accept payments by just tapping a credit card on their phones. The contactless technology will run on the Near-Field Technology chip, already in use for Apple Pay.

Closing in: The move could affect financial services company Block, whose Square hardware dominates the US payment processing market. The rollout comes over a year after Apple’s acquisition of startup Mobeewave, which developed the mPOS feature.

About time: Samsung, whose devices already enable contactless payments, was an investor in Mobeewave. Apple’s move, however, could integrate an ecosystem (Apple Pay, Apple Card, and Buy Now, Pay Later) across more than 1 billion active iPhones worldwide. It could also boost sales as a business utility in a burgeoning market.

Apple reported its single largest quarter in terms of revenue, beating analyst expectations of sales in every product category except the iPad.

FYI

Going NFT-way: Similar to Twitter, Reddit is now testing an NFT profile picture feature called CryptoSnoos. It's unclear how it'll actually look to end users.

Called out: B'wood talent Ranveer Singh and Jacqueline Fernandez among social media influencers breached product endorsement guidelines.

Oil is well? India may need to get on speed dial with Brazil and Argentina to procure sunflower oil because of Ukraine-Russia border tensions.

Time for a bubbly: Kota-headquartered Allen Career Institute is reportedly closing a deal with Lupa Systems, taking its valuation to close to $1 billion.

Bagged: Walmart-backed fintech company has signed on two startups—Even and One—to achieve its super app dream. Your move, Amazon.

Eyes on the prize: Samsung has registered a 64% rise in Q4 net profit despite supply chain issues triggered by the pandemic.

Jackpot: Tesla has made a cool $5.5 billion profit on revenue of $17.72 billion in a blockbuster year.

FWIW

On spotlight: Spotify chose Joe Rogan over Neil Young. Young had objected to his music playing on the same platform as Rogan, whom he accuses of spreading Covid-19 misinformation. Rogan has provoked more backlash after allowing a controversial clinical psychologist, Jordan Peterson, to go on a lengthy rant about the climate crisis. Twitter is trying hard to cancel Rogan.

All good in Thailand: Thailand and Saudi Arabia are friends again, ending a 30-year rift between the two countries over stolen jewels. A rift started after fake diamonds were sent back to the Saudi king, who was robbed by a Thai janitor. Psst! Thais can now also grow and smoke their own weed.

Japan’s miracle snack: Umaibo, a crunchy corn snack in Japan that means ‘delicious stick’ has fallen victim to global inflation as its price has gone up by a whopping 20% for the first time since its launch more than four decades ago. However, with ¥12 apiece from ¥10, it is still going to be the favorite snack for children.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.