Headless Meta in limbo

Also in today’s edition: Google’s health-tech play; The eyewash that’s crypto accountability; China cops out in Europe; No greenbacks for plant protein companies

Good morning! One of the most popular games ever—someone is always playing it in a Mumbai local or Delhi metro compartment—just turned 10. To be specific, it’s a decade since Candy Crush switched from being a Facebook game to a mobile one. It’s been downloaded over three billion times since. Game Rant reports that developer King will update the game with “celebratory features”, including live orchestra tracks recorded at Abbey Road, best known as the studio that once recorded The Beatles. Talk about Crushing it.

🎧 There are now 8 billion people on Earth. For our deep dive, we look at how Elon Musk's Twitter mishaps aren't halting any time soon. The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

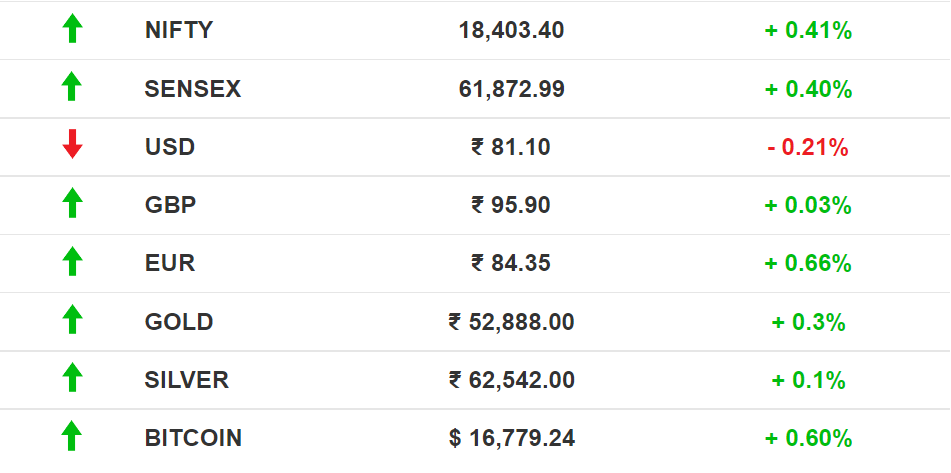

The Market Signal*

Stocks: Positive signals from China and the US after their presidents’ lengthy conversation at the G20 summit lifted market sentiments globally. Walmart posted better-than-expected Q3 sales and upbeat guidance for the year, indicating consumer resilience despite inflation.

Crypto exchange FTX’s meltdown, however, is worrying the Fed Reserve. The Wall Street Journal reports that Fed vice chair for supervision Michael Barr fears that crypto could pose a systemic risk should interlinkages develop between the crypto and traditional financial system.

Early Asia: The SGX Nifty shrunk (-0.33%) at 7.30 am India time. Hang Seng Index: (-0.72%) Nikkei 225: (-0.58%)

BIG TECH

Meta India Is Officially Leaderless

Barely two weeks after former Meta India chief Ajit Mohan quit to join Snap, his counterpart at WhatsApp, Abhijit Bose, is on his way out. That leaves two Meta products, Facebook and WhatsApp, without a leader in its largest market (by user base).

Revolving door: Meta’s director of public policy for India Rajiv Aggarwal has also left the building. He will likely join Samsung India in a similar capacity, several sources in the know told The Signal. Shivnath Thukral, previously responsible for WhatsApp’s public policy in India, has been elevated to Aggarwal’s role.

Bottomline: Manesh Mahatme, who headed WhatsApp’s payments business, exited in September. These departures, per sources who spoke to The Signal, had much to do with WhatsApp’s convoluted reporting structure for various functions.

Following these resignations and the mass layoffs last week, Meta may also restructure operations. This could impact India, where it now faces a leadership vacuum.

HEALTH TECH

Google, The Integrator

The Mountain View-headquartered company has vaulted into health and fitness aggregation with the public beta release of Health Connect. The Android app will be a one-stop destination to sync and manage data across 10 notable apps, including Peloton, FitBit, MyFitnessPal, and Flo.

There will be standardised data sharing between health, wellness, and fitness apps, although users will be presented with centralised privacy controls. Unsure how reassuring that is, considering Google has to pay 40 US states ~$392 million for tracking users' locations.

Ecosystem play?: Google parent Alphabet has serious healthcare ambitions. A quarter of its deals between 2019 and 2021 were in the healthcare and life sciences space. Unsurprising, considering its web spans wearables, health-related records and AI, and futuristic projects such as DeepMind.

Not far behind in their ecosystem ambitions, however, are Apple, Microsoft, and Amazon; the last just launched a health referral service on Tuesday.

CRYPTOCURRENCIES

Mountains Out Of Molehills

Crypto exchanges’ reputations are at stake after the collapse of FTX—whose bankruptcy proceedings may involve one million creditors. And so, they’ve pledged to publish “proof of reserves” (PoR). This means they’ll be transparent about their assets, a no-brainer for traditional financial institutions but seemingly revolutionary for an opaque, barely-regulated sector.

Binance and several others will make their PoR public. CoinDCX went further, claiming it will reveal its reserves-to-liability (RTL) ratio. We’ll get to why this matters in a bit.

Rinse, repeat: The crypto ecosystem made similar pledges when the OG Bitcoin exchange Mt Gox capsized, and when Voyager Digital and Celsius went bankrupt earlier this year.

Dominoes: Crypto lender BlockFi is reportedly exploring a potential bankruptcy filing and planning layoffs in a trickle-down effect.

The Signal

Don’t take PoR pledges at face value. As Matt Levine details, balance sheets aren’t just about holdings and liquidity, but the nature of the assets themselves. Of the $19.6 billion in assets FTX had in its halcyon days, $14.4 billion was in now-worthless FTX-associated tokens. When Financial Times checked FTX’s books before it went belly up, the company (in)famously had $900 million in liquid assets versus $9 billion in liabilities.

Tl;dr: applauding companies for publishing just their PoR and not liabilities is akin to applauding men who wash the dishes—it’s not as big a deal as they’d like you to believe.

RTL ratios are, therefore, more reliable. But as Axios noted, even the most transparent exchanges do not divulge their total assets. As private companies, they aren’t beholden—least of all because liability calculations require handovers of internal customer databases to auditors.

CHINA

A Very Long Arm

Chinese county police are literally going to the ends of the world. At least three counties have opened outposts in places like Budapest and Buenos Aires.

What: The Financial Times describes them as “police service stations”. Fuzhou city police have established 30 and Qingtian county 15 in cities across the world. The service stations help the expat community with paperwork, gathering intelligence, and settling disputes.

The newspaper quoted a legal expert as saying that China has been enacting laws that have reach beyond its shores and is consistent with superpower behaviour. Parallels could be the Foreign Corrupt Practices Act or the Patriot Act in the US.

European governments are livid; some have ordered them shut. China says these centres merely provide administrative services. At least one Chinese political dissident in the Netherlands, however, reported getting calls from a local station set up by Fuzhou police.

FOOD

Plant Protein Cos Aren’t Bringing Home The Bacon

Oatly has lowered its outlook after its losses doubled year-on-year to $108 million in the quarter ended September 2022. It’s a significant setback for the oat milk brand that inspired copycats and blazed a trail, alongside Beyond Meat, Impossible Foods, etc., in an alt protein space that attracted big-ticket investors and partnerships.

Speaking of partnerships: McDonald’s has shelved plans to launch the McPlant burger—which used a Beyond Meat patty—across the US due to poor sales. Beyond Meat laid off 19% of its workforce last month and suffered an 80% crash in stock value from its peak.

Too many cooks: Insiders blame a crowded market and lack of innovation. But it’s also been a terrible time for agri commodities used as meat substitutes. In 2021, suppliers had sounded the alarm over a severe pea shortage; a chickpea crisis is looming over the horizon.

FYI

Are you watching, TikTok?: YouTube Shorts is expanding its e-commerce features in a bid to diversify revenue streams during a slowdown in digital advertising.

No nepotism: India’s richest banker Uday Kotak’s son, Jay Kotak, is reportedly not in the running to replace him as the CEO of Kotak Mahindra Bank.

Not working out: Indian mining company Vedanta Group is reportedly exiting the steel industry, four years after buying Electrosteel Steels Limited.

Family planning: As the world’s population touched 8 billion on Tuesday, the United Nations said India's population growth appears to be stabilising.

‘Free speech absolutist’?: Twitter’s new owner Elon Musk fired many techies who publicly criticised him on the social media platform. In related news, Musk’s SpaceX is looking to raise a fresh round of funds that will place the company's valuation at more than $150 billion.

Almost there: The Republican Party is inching towards victory in the United States’ House of Representatives.

Milestone: Indian fintech PhonePe crossed 10 billion transactions for the first time in the September quarter, parent Walmart said.

THE DAILY DIGIT

$130 billion

What India spends on weddings every year. The country will witness about 2.5 million shaadis in November and December 2022. (The Economist)

FWIW

When you can't beat them:...join them. That's exactly what British cheesemaker Simon Spurrell did to bypass prohibitive export costs post-Brexit. He sold his Cheshire Cheese Company to a larger rival, Joseph Heler Cheese, which has a strong presence across Europe. This was after he lost out on £600,000 ($715,000) in sales after Brexit.

Cheers to that: Champagne lovers are *popping* that bubbly. So much so that Moet Hennessy says there isn't enough champagne to go around, with New Year's Eve just around the corner. Now that's a lovely problem to have, and probably calls for a celebration.

Gatekeepers of brew: Speaking of alcohol, FIFA World Cup 2022 sponsor Budwiser isn't getting a lot for its money apart from bragging rights. According to reports, the Qatar royal family has asked the company to move its branded beer stalls to less prominent spots. Why? Security concerns, among other reasons.

Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here.

Do you want the world to know your story? Tell it in The Signal.

Write to us here for feedback on The Signal.

Absolutely loving your content Roshni, & Dinesh, would you be open to allowing us to share it with our 60k+ audience as well?