Microsoft just wants to be loved

Also in today’s edition: RBI keeps rate unchanged; ShareChat consolidates short-video market; Watch out, Netflix; Wine isn’t cool anymore

Good morning! McDonald’s is in the throes of creating a McMetaverse. The fast food giant filed 10 trademark applications for virtual restaurants and virtual concerts. What’s more, virtual McDonald’s outlets will also offer home delivery of real and “virtual goods”. Sounds spiffy, but we aren’t lovin’ the idea of (a) a matrix burger, and (b) placing an order in the metaverse when you can do so faster on a food delivery app. Then again, these are incubatory days for Web3.

Millennials don't like to wine and dine anymore, at least in the United States. We also outline the recent ShareChat acquisition. The Indian social media platform is buying MX TakaTak. Is this a win-win situation? Tune in to the latest episode of The Signal Daily.

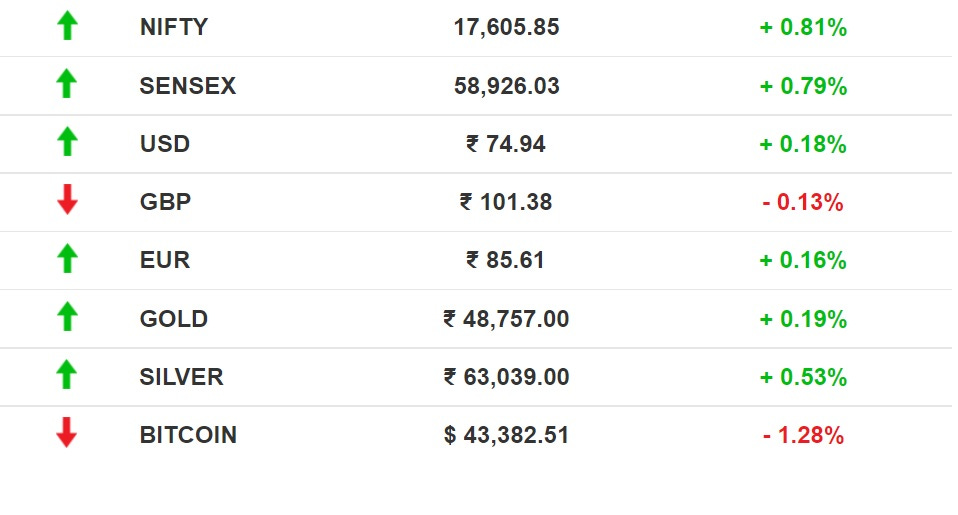

The Market Signal*

Stocks: Benchmark indices remained in the green after RBI kept rate unchanged; Realty, banking, power, and metal indices led the gains. Tata Steel was the top Sensex gainer.

Microsoft Tries To Be The Favourite Child

With the likes of Apple and Google increasingly coming under scrutiny over their app store rules, Microsoft is taking a fairer, “principled” approach to its own. The move is largely aimed at avoiding antitrust scrutiny, particularly in the wake of its $68 billion purchase of game developer Activision Blizzard.

But that could also mean…changing its business model.

On tap: For all you Call of Duty hardcores out there, we have some news for you. Keep playing on your Playstation devices.

Political debate free: LinkedIn wants to be loved, and by Gen Z too. Which is why it has begun testing a “no politics” setting for some users in the US. The professional social network is also trying hard to be creator-friendly, with offerings such as video profiles, live video and audio events.

RBI Really Wants Growth

The country’s slowing economic activity is what bothers Reserve Bank of India (RBI) governor Shaktikanta Das the most. Its monetary policy committee decided to keep rates unchanged for the 10th time in a row as growth surpassed inflation as the primary concern.

Under-control inflation? While consumer inflation rose, it is largely along expected lines. A repo rate hike would have adversely impacted demand, further impacting economic activity.

Following US’ footsteps: Perhaps, the RBI is holding on to see what the Fed will do and accordingly change its stance the next time. The experts in the US are expecting the Fed to raise rates amid a surge in inflation.

Warning: Reiterating his stance on cryptocurrencies, Das called it a threat to financial stability. This, even as the RBI is in the process of launching its digital currency.

ShareChat’s Long Play For Shortform Dominance

Mohalla Tech, the parent company of social media platform ShareChat, will acquire MX TakaTak for $700 million. Until now, MX TakaTak competed with ShareChat’s short video app, Moj.

The big short: India’s TikTok ban snowballed into an overnight spurt of homegrown short video apps such as Moj, Josh (by DailyHunt), MX TakaTak, Roposo, Chingari, and Mitron TV. Moj has the highest number of monthly active users, followed by MX TakaTak and Josh. The trio also has hefty backers. MX TakaTak is owned by Times Internet; Moj counts Tiger Global, Twitter and Snap Inc. as investors; and Josh has Google, Microsoft, and ByteDance.

As for the ones without bottomless funding: Mitron is struggling, Roposo has pivoted to live commerce, and Chingari is dabbling in social crypto with its GARI token.

The Signal

The MX TakaTak acquisition will consolidate user bases for ShareChat and offer some reprieve from the platform’s towering losses. ShareChat’s major expenses include marketing and licensing, and its prior acquisitions of Jeet11 (fantasy gaming) and Elanic (social commerce) are yet to reap monetisation opportunities–something MX TakaTak seems to do better, especially when it comes to creator funds and using The Times Group’s reach to snag exclusive short video rights for movies.

But breathing down ShareChat’s neck is Instagram Reels, which has a lot more of the four Cs: capital, creators, content, and copyright. And most of all, with growth slowing elsewhere for Meta, Reels has Mark Zuckerberg’s attention.

Disney+ Scores, Hotstar Grows

Much like Scrooge McDuck, Walt Disney Co. is making a pile of money: the company’s overall revenue rose to $21.82 billion in the quarter. As Covid-19 shut down parks and movie theatres, its streaming service Disney+ brought home the numbers (and money), adding 11.8 million subscribers in the last quarter alone.

Hotstar: Disney+ Hotstar, the company’s paid streaming service in India (predominantly), grew by 57% in 2021, ending the year with 45.9 million subscribers. It also showed a marginal increase in average monthly revenue per subscriber in 2021, increasing by 5% from $0.98 to $1.03. With the IPL rights up for grabs, Disney (via Star India and Hotstar) is likely to double down on sports, amid fierce competition.

Betting on: Disney+ is throwing everything at audiences to see what sticks. Earlier, this week, it live-streamed the 2022 Oscar nominations in the US. Reality television star, Kim Kardashian signed a deal with Disney’s Hulu in the US. That’s a lot of $$$. There’s also a metaverse plan in the works that the CEO is rather mum about.

US Millennials Are Ditching Wine

Wine is the least preferred drink among US millennials. That gives winemakers very little reason to raise a toast. If this trend continues, sales of American wine could tumble to 20% in the next decade (pdf).

Untimely intervention: The dip in wine drinking comes at a time when vodka and tequila are finding takers and competing with craft beers and even marijuana. Millennials are a health-conscious bunch. Maybe, that explains why even mocktails are finally having their moment.

The reality is that 61% of the US population, including millennials, live paycheck to paycheck. That gives it little room for wine to an everyday tipple when good quality wine is premium.

Reckoning: Winemakers realise they need to do something ASAP. So, aggressive campaigns are in the works. Fortunately, the Biden administration wants to break the consolidation in the US alcohol segment so consumers can save hundreds of dollars on their choice of tipple.

FYI

BNPL is the new black: Zomato is getting into the Buy Now Pay Later game for dine-in and food delivery services. The company also recorded narrowed losses and an increase in revenue for the quarter ending December 2021.

Mixed bag: Twitter clocked better revenues and user growth relative to the last quarter of 2020. This growth, however, has not met analyst expectations.

Fivefold: Mergers and acquisitions in the cryptocurrency space jumped a whopping 4,846% in 2021, per a PwC report.

Tailwinds: India has eased international travel norms for both outgoing and incoming passengers.

Sixer: Chinese researchers are set to propel their country towards 6G technology after transmitting 1 TB of data over 1 km in just a second.

Part and parcel: iPhone assembler Hon Hai Precision Industry Co. has forecast a welcome reprieve from supply shortages for electronic components.

New deal: Binance, the world’s largest cryptocurrency exchange, is investing $200 million in Forbes as the business magazine plans to go public.

FWIW

Doodle dash: A 60-year-old security guard was bored on his first day at work. And so, he drew eyes on the faceless subjects in the 20th-century Russian painting, Three Figures. The guard now faces prison time, and the gallery has installed protective screens for the remaining works in the exhibition.

Take that: With Omicron taking hold, New Zealand had temporarily cut off its borders for overseas citizens and visa holders last month. A politician questioned education minister Chris Hipkins if he’d met with the Covid-19 response minister to grant border exemptions for teachers. Turns out it was a silly question because Hipkins holds both offices. This is why he responded by linking to a popular meme showing two Spidermen pointing at each other.

Buzzword car: Cars depreciate in value. Maybe that’s why Italian automaker Alfa Romeo will offer NFT digital certificates to buyers of the Alfa Romeo Tonale SUV. That the car comes in a plug-in hybrid model, and that Alfa Romeo is pivoting to an all-electric line-up clearly isn’t enough. If an NFT can increase a car’s residual value, so be it.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.