Milkshakes bring the boys to the yard

Also in this edition: China hits a hard reset, Flash goes out of sales, The decade of Tim Cook.

Good morning! It has been a crazy two days for nerds across the world. Day before, Sony dropped the Spiderman trailer, which at last count had clocked 13 million views. Now, Warner Brothers has dropped the Matrix trailer. Yes, the fourth film. It’ll be called The Matrix: Resurrections. But the trailer was screened to select groups and hasn’t leaked on to YouTube just yet. Both films are set to release around Christmas. Can’t wait.

If you like reading us, please share with your family, friends, classmates, colleagues, and networking groups. We promise to do you proud.

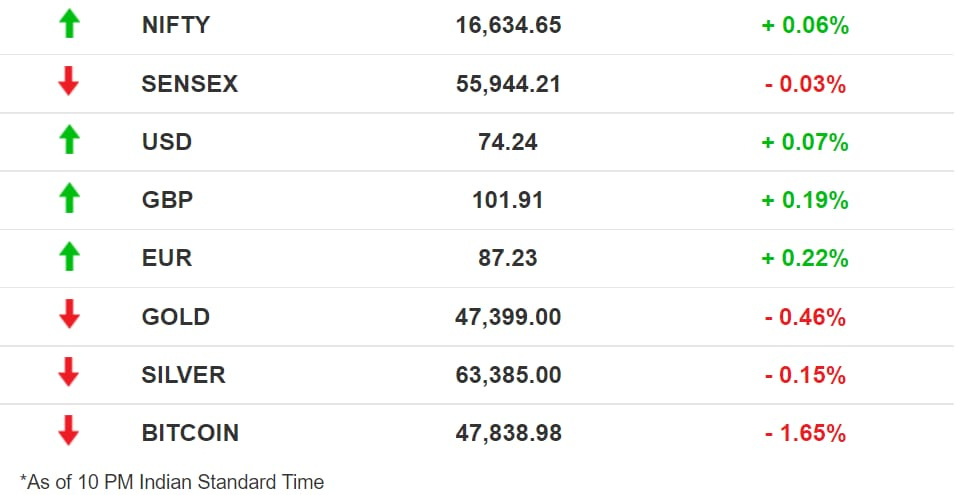

The Market Signal

Stocks: Benchmark indices touched new heights but closed below them on the back of profit-booking. Trading was largely bound to a narrow range, with all sectoral indices seeing a change of less than 1%. Broader markets displayed optimism by outperforming the benchmarks for the second day running as they await the outcome of the US Fed meeting.

McDonald’s Is Out Of Milkshakes

Nobody is ‘loving it’. McDonald’s has taken off milkshakes from its menu in England, Scotland and Wales citing supply chain issues. The fast-food chain joins a long list of restaurants that are facing supply shortages due to Brexit.

Brexit worries: Non-UK lorry drivers are forced to go through customs, which have caused delays and food spoilage. As a result, Nando’s had to shut 50 restaurants, while KFC had to tweak its menu. Staple meats like chicken and turkey are also facing production cuts. Supermarket shelves are also running empty. Warnings have been issued that turkey could be missing in the Christmas platter.

| |||

This was Nigel's #Brexit plan all along. McDonald’s runs out of milkshakes due to ‘supply chain issues’ theguardian.com/business/2021/… #McDonalds#BrexitFoodShortages | |||

| |||

Aug 24, 2021 | |||

| |||

214 Likes 55 Retweets 11 Replies |

Mad scramble: Since the UK has not yet taken a decision on relaxing entry rules, there are fewer low-wage workers in the UK. Restaurants are now leaning on prison labour to fill the gap.

Amazon And Flipkart Go Shush

There was something missing in the newspapers last week. Frontpage ads declaring freedom from steep prices. The Independence Day sales. There was barely any promotion to one of the sales that usually precede the grand Diwali sales. This time, nothing.

Why so serious: One reason was so that the Competition Commission of India (CCI) does not come knocking. Amazon and Flipkart are under scrutiny for alleged deep discounting and preferred treatment offered to select sellers. To make it worse, the government has proposed changes including a ban on flash sales.

We’re destined to do this forever: Even if you did shop during this sale, things were expensive. And they are likely to stay that way. Amazon has increased its fee for sellers who use the e-commerce company’s logistics services. Not just that, it has also increased the commission for sellers too. Guess who will bear the brunt of these increases in costs?

Investors Return To China For The Long Game

China is cool again! Indian mutual fund advisors and fund managers have begun pushing the emerging market as the place to be, now that valuations have crashed.

The long arc: This time last year, there was a wave of anti-China sentiment sweeping India. Apps were banned almost every day, goods were boycotted, and China was enemy number one in public perception. A year later, those sentiments are on the backburner. China is back to being our largest trading partner and Indian investors wouldn’t mind a slice of its growth even though the border dispute between the two countries remains the biggest investment risk.

The crash: Beijing’s unprecedented crackdown on its big technology companies such as Alibaba, Tencent, and Didi Chuxing had taken the wind out of their stocks. In one wild July week, investors lost more than a trillion dollars.

The rebound: They rebounded early this week as bulls returned to buy Chinese stocks. After all, there were a trillion dollars to recoup and the performance of companies such as JD, Alibaba, and Pinduoduo was not bad either. American investor Cathie Wood, who exited many stocks at the peak of Beijing’s clampdown, is again buying China. But that’s not the whole story.

It is not only the valuation discount that is attracting investors back to Chinese stocks but also the first principles of the crackdown. Much of it has the consumer in the dead centre. It is intended to increase competition and the quality of services these companies offer. The attempt to break monopolies would also pave the way for second-rung companies to grow, offering a wider field for investors to plant their money in. A fund manager at Edelweiss AMC, which operates a China-focused fund of funds, believes the short-term volatility has opened up long-term valuation opportunities. Cathie Wood believes in its “very entrepreneurial society”.

Shipping stinks. But not for long.

The dirtiest business on the planet is finally heading for a scrub. The world’s largest integrated shipping company, Maersk, is going to invest $1.4 billion in eight green vessels. These vessels will dock by 2024. This is a BFD! Why? These ships will run on green methanol in addition to bunker fuel.

Wow green ships? There’s one little chink in Maersk’s grand plan though – sourcing carbon-neutral methanol. Production of this green fuel is still low. The answer is to set up its own plants.

Fix what’s broken: Shipping contributes to ~3% of global carbon emissions. This shift will be 10-15% more expensive than using fossil fuels. But companies such as Amazon, Disney, and Microsoft, which use Maersk’s services, want to cut emissions in their supply chain and are cheering this move.

Late to the party: Euronav NV, Belgium’s leading crude oil tanker company with ~70 ships on water, is making vessels that can run on ammonia, while Cargill plans to add wing sails to its ships.

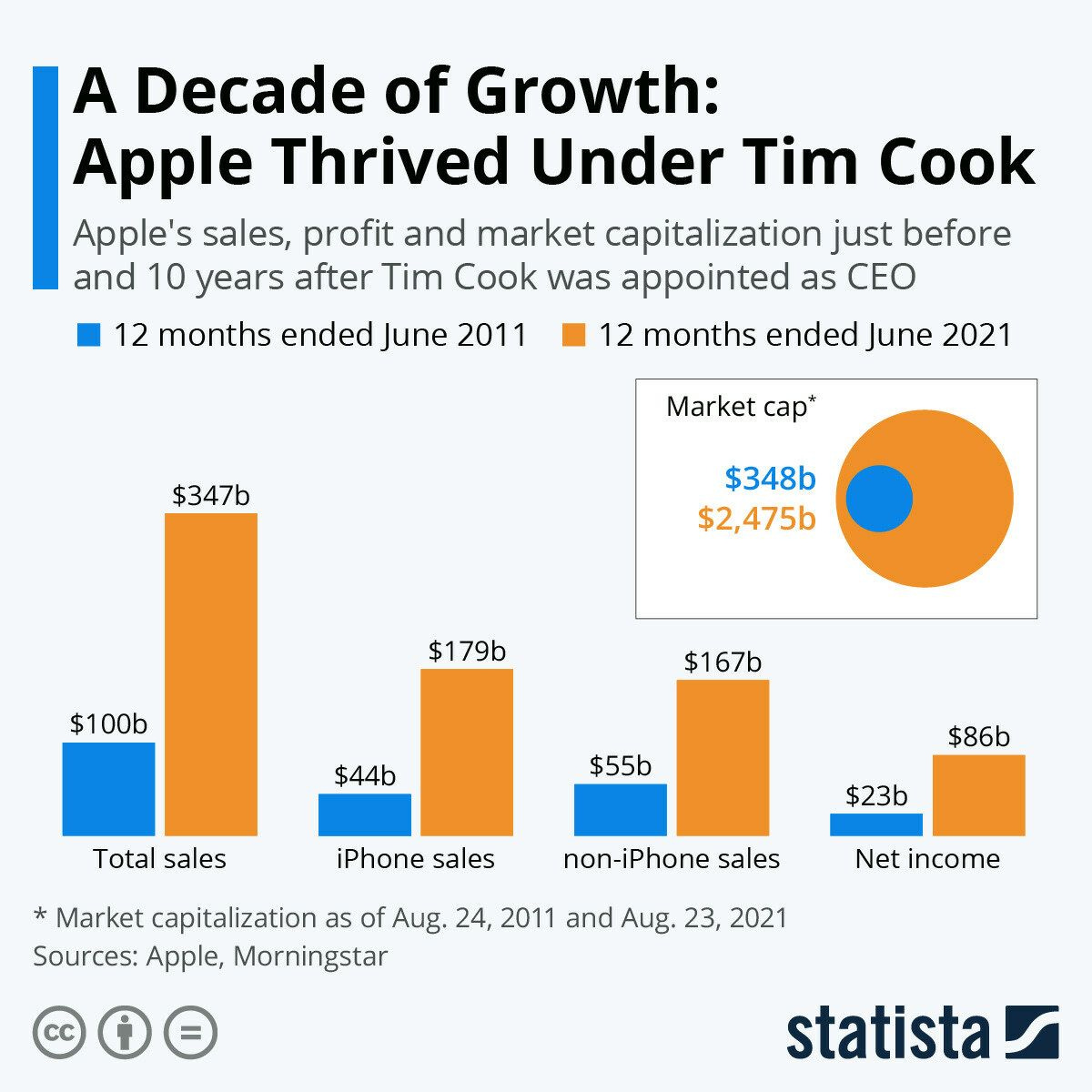

Tim Cook’s Decade

When Tim Cook succeeded Steve Jobs as CEO, even the most ardent Apple fans had their doubts. A decade later, there's no question that Cook has not only aced the legacy of his iconic predecessor, but also taken Apple to new heights.

Getting bigger: From $349 billion in market cap in 2011 to over $2.5 trillion in 2021 - Apple is now the most valuable company in the world. What’s better? Cook, the CEO, has added the most shareholder value ever.

Wait, there’s more: Under Cook's watch, Apple expanded its slate of wearables (Apple Watch and Airpods), doubled down on services (Apple Music, Apple TV+, iCloud), increased the iPhone size, and deepened the company’s relationship with China while also becoming a champion (of sorts) for privacy.

What lies ahead: The company has come under fire for its App Store policies and practices. It has to walk a tightrope between China and the West.

What Else Made The Signal?

OnlyPorn: A week after announcing its plans to ban sexually explicit content, OnlyFans has made a u-turn on its decision and acknowledged the extensive backlash from the creator community. Ouch!

Bye bye digi gold: The National Stock Exchange has barred all members from selling digital gold on their platforms starting September 10.

Prepping big: Delhivery has bought up Spoton Logistics ahead of its IPO plans for October that could raise as much as $1 billion.

Something’s brewing: Sequoia-funded Indian craft-beer maker Bira 91 plans to open its fifth brewery before filing for an IPO.

Child’s Play: While the UK regulator introduced a Child Code to prevent social media and gaming apps to keep kids hooked up, South Korea is lifting its controversial 10-year curfew that banned video games for children under 16 years of age.

Scrolling game on point: People are spending more time on short-video apps thanks to the lockdown. Entertainment platforms saw the highest monthly active users (MAUs) with a 90% hike in 2021.

New features: On Messenger’s 10-years anniversary, Facebook is not only giving you fun new features but also rolling out the option to make voice and video calls via the flagship app itself.

FWIW

Smells like teenage angst: Spencer Elden is over-bored and self-assured and he knows a dirty word. Who? Elden was once the face of the legendary cover of Nirvana’s biggest album Nevermind. He is taking the band to court over sexual exploitation.

The artist formerly known as Kanye West: That’s one way we’ll have to address him because he wants to change his name to just Ye. That’s it. Kanye has formally applied to the Los Angeles Superior Court to make this happen.

Bridge of death: Instagram trends are weird. They usually hurt people. Remember, tide pod challenge? Last year’s tide pod is this year’s #milkcratechallenge. Failed attempts to mount stacked-up milk crates could land you in the hospital.

Write to us here for feedback on The Signal.