Censor and sensibility

Also in today’s edition: Imports, deep fried; Billion dollar borrowers; Hamas’s Thanksgiving Turkey;

Good morning! Move over Pokemon, there’s a new Japanese export taking the world by storm. The Guardian reports that as living costs increase across the world, people are wolfing down packets of instant noodles. So much so that the World Instant Noodles Association estimates that consumers in over 50 countries ate as much as 121.2 billion servings of instant noodles in 2022. While noodle-eating countries like China predictably consumed it the most, India took the third spot. Suffice to say our love for two-minute noodles isn’t going anywhere. 🍜

Roshni Nair and Adarsh Singh also contributed to today’s edition.

We would like to know more about you. Participate in our annual survey by filling up this form. We’ll use your answers to tweak our products and make them more enjoyable for you. As always: you will remain anonymous.

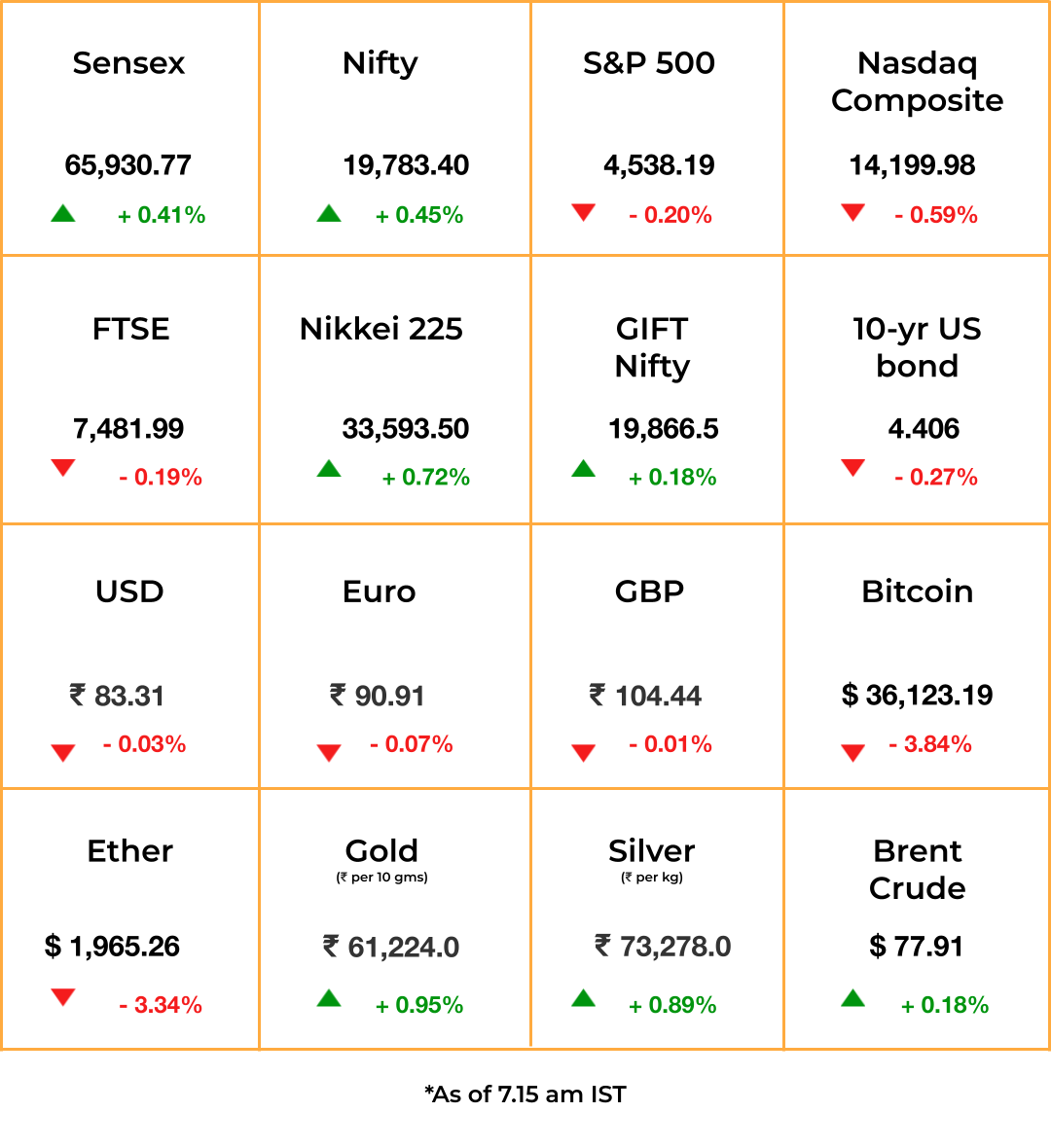

The Market Signal

Stocks & Economy: US equities continued to set the tone for Asia as well. Chipmaker Nvidia’s impressive quarterly performance failed to enthuse investors who seemed to have unrealistic expectations from the company.

The Federal Reserve will be cautious and will raise rates only if data shows inflation remains unaffected by its actions, minutes of its last meeting released on Tuesday showed. Although markets are quite convinced that the regulator is done with hikes and are even expecting it to begin cutting rates sometime in 2024, the minutes suggest officials are more circumspect than confident.

Stocks in Asia were showing mixed trends, with some swinging between gains and losses in the morning. Japanese shares were steady in green. The GIFT Nifty’s movement indicated a positive opening for Indian shares as well.

ENTERTAINMENT

Don’t You Dare

If you’ve noticed the lack of daring local content on streaming platforms in India in the last four years, it is by design. The Washington Post reports that Netflix, Prime Video, and Co ask to rework political scripts and remove any religious references that might offend the Hindu right wing.

Fearing retribution, projects dealing with political, religious, or caste divisions have been declined or dropped since 2019. For instance, Prime Video shelved Gormint, a political satire, while Netflix chose not to release Indi(r)a’s Emergency, a documentary that contains veiled commentary about the Narendra Modi government.

Meanwhile, as the industry consolidates and focuses on profitability, streaming platforms are also in a cost-cutting phase and largely going for safe bets, like well-established franchises and the rights to big-budget movies, reports Mint. This is bad news for small, independent creators who are struggling to find buyers.

🎧 Netflix and Prime Video are back-pedalling on bold, provocative films. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

A MESSAGE FROM OUR PARTNER

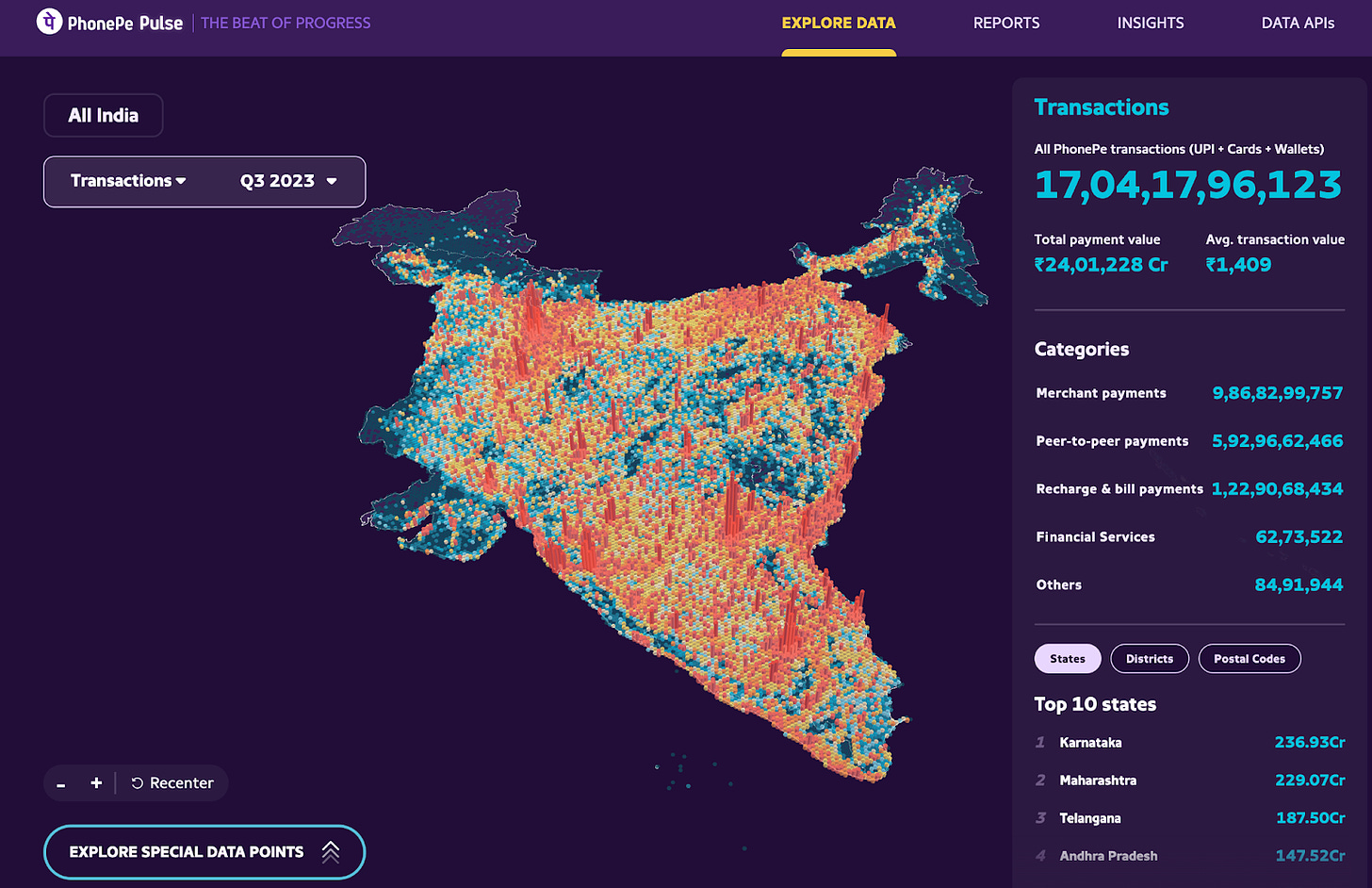

Who's Powering UPI In India?

Let’s face it, we all love UPI. Why else would 330 million Indians use it almost daily? In Q3 2023, Indians used UPI for over a whopping 31 billion transactions! PhonePe, India’s leading UPI app with 500 million registered users, processed over 17 billion transactions, totalling ₹24,01,228 crore. UPI on PhonePe is helping Indians transact, invest and grow their businesses securely with a tap on the screen.

Folks in Karnataka, Maharashtra, Rajasthan, Andhra Pradesh, and Uttar Pradesh are the biggest users of PhonePe. Bangalore Urban, Pune, Rangrareddy, Hyderabad, and Jaipur take the top spots for PhonePe transactions. Pretty sure that at least a quarter of transactions in Bangalore Urban stem from MTR, Rameshwaram Cafe and Vidyarthi Bhavan 🫢.

But this is not all. To see more of this granular data, check out Pulse, a fascinating destination that showcases how India transacts, with interesting fun facts, deep insights and in-depth analysis based on data put together by PhonePe.

COMMODITIES

Sp(oil)sport

India’s tryst with oil is a story for the ages. While our lack of crude oil hogs all the attention, we’re witnessing a shortage of another form of oil: the edible ones. As it stands, India is a net importer of edible oil. Between 2013-14 and 2022-23, India’s edible oil imports grew by roughly 42%, while domestic production for the same increased by only 32%.

King of oils: As per the government, palm oil accounts for 56% of the total imports of edible oil. It’s predominantly used by restaurants and the packaged food industry. A rise in dining out and the consumption of ultra-processed foods is fuelling palm oil demand, stoking public health concerns.

Challenges: Over-reliance on imports can cause supply and price volatility problems. Taking cognisance, the Centre launched the National Mission on Edible Oils.

Meanwhile: A similar story is unfolding in pulses as well.

FINANCE

Happy To Borrow, But Dollars Please

Indian conglomerates are making a beeline to take on foreign currency debt. AV Birla Group’s Birla Carbon Black is the latest to join the queue.

Going abroad: Bloomberg reports that the tyre additives maker is talking to a clutch of banks to raise $1.5 billion. Birla joins Bharti Airtel, which is looking to raise $1 billion through an offshore bonds issue. Reliance Industries is also exploring a $2.5 billion loan, for which it secured board approval in January 2023.

Done that: The Tata Group has already raised $660 million overseas this year, with Tata Sons picking up $167 million, Tata SIA Airlines $279 million, and Tata Capital Financial Services $215 million. Separately, Tata Technologies’ share sale—the first of the group since Tata Consultancy Services in 2004—valued at a little over ₹3,000 crore (~$360 million) opens today.

Indian companies have raised $20 billion in foreign debt so far in 2023.

The Signal

Although interest rates have risen abroad, these top-rated companies have no dearth of lenders or favourable terms. Most are borrowing to refinance existing loans, while some others such as Tata SIA (for aircraft) and Reliance (for retail, Jio 5G) need money for business expansion. Airtel has to make telecom spectrum payments. The conglomerates enjoy a natural hedge against currency fluctuations because of their substantial overseas operations. That also allows them to easily create pledges on foreign assets. Birla, for instance, is the world’s largest carbon black maker with 16 manufacturing units globally.

GEOPOLITICS

Hamas’s Turkish Delight

How is Hamas able to rake in more than $1 billion a year? According to The Economist, the widest money trail of the designated terrorist organisation leads to Istanbul.

Details: Hamas’ financiers shifted base from Amman, Jordan, in 1989 and now have a funding empire spanning crypto, construction, and indirect donations that make their way into coffers after skirting US sanctions. Over $20 million has been smuggled in via blacklisted Turkish currency exchange Redin. Local bank Kuveyt Turk and listed company Trend GYO also reportedly funnel $$$ to Hamas. The latter even won a government contract to build Istanbul Commerce University.

In a bid to be removed from the Financial Action Task Force ‘grey list’, Turkey recently introduced new rules for its otherwise lightly regulated crypto market. That may not deter Hamas, though. Much of its money also comes from real estate investments in countries such as Sudan and the UAE.

ARTIFICIAL INTELLIGENCE

Three Ring Circus

Yesterday, we told you how Satya Nadella would benefit from the OpenAI saga regardless of whether former CEO Sam Altman and former president Greg Brockman join Microsoft, or are reinstated in the company that booted them. OpenAI is still in “intense discussions to unify the company” and win over more than 700 employees who threatened to walk out. It’s also emerged that Altman and board member Helen Toner had serious differences.

Google and Amazon will be watching like hawks. They may benefit from OpenAI’s wary enterprise clients considering other, more stable vendors. Because both are investors in Anthropic, which has the same-same-but-different corporate structure as OpenAI, they may push for governance changes there to avoid a similar fracas.

Time, at least in the short term, is on their side when it comes to next-generation AI models. OpenAI’s goings-on have potentially disrupted the progress of its latest large language model, GPT-5.

FYI

Short truce: Israel has agreed to stop its assault on Gaza for four days in exchange for Hamas releasing 50 women and children held by the organisation as hostages.

That’s settled: Crypto exchange Binance will continue operations after it and its CEO Changpeng Zhao pleaded guilty to allowing money laundering. They agreed to pay $4.3 billion and $50 million in fines, respectively.

They’re safe: Indian authorities released a 30-second video showing some of the 41 workers trapped in a collapsed highway tunnel in Uttarakhand. They have access to light, oxygen, food, water, and medicines.

Watch this space: Tesla is close to signing an agreement with the Indian government to ship its electric cars to the country from 2024 and set up a factory within two years, reports Bloomberg.

More trouble?: The Enforcement Directorate has issued a show-cause notice to BYJU’S and its founder Byju Raveendran for alleged violations of the Foreign Exchange Management Act in transactions worth ₹9,362 crore ($1.12 billion).

Go ahead: Bharti Airtel-backed satellite operator Eutelsat OneWeb has received regulatory approvals from the Indian government to launch commercial broadband services.

AI ftw: Chinese internet giant Baidu’s revenue grew 6% quarter-on-quarter to 34.4 billion yuan ($4.8 billion) in the September quarter, beating analysts’ expectations.

Covid trauma: People who followed Covid lockdown rules strictly are the most likely to be suffering from stress, anxiety and depression, according to a survey by Bangor University in Wales.

THE DAILY DIGIT

1,250,307

The record number of fans who attended matches during the recently concluded men’s cricket World Cup, according to the International Cricket Council. (ICC)

FWIW

Frozen in Happiness: For the first time in forever, Disney has opened a theme park dedicated to the Frozen franchise. Part of Hong Kong Disneyland, it boasts of custom-made rides and accompanying sets straight out of the film. To give it that extra bit of Disney magic, the park has incorporated Norwegian design elements and Norwegian cuisine for its Golden Crocus Inn. Given Hong Kong’s tropical climate, makers of the park are banking on the extravaganza to make you forget that and ask your kids, “Do You Want to Build a Snowman?”.

IKEA on steroids: That’s what this 19th-century château in Bordeaux feels like. The building was completely disassembled three decades ago but its original walls (all four of them, mind you) remain. These walls are built with the same type of limestone used for the Unesco-listed historic centre of Bordeaux. All the pieces of the walls have been cleaned, catalogued, repacked and come with a detailed dossier on how to reassemble the facades over the course of roughly seven months. The total cost for the project is $10 million… only.

Sleepy head: If you’re one of those who like to obsess over your sleep—how well you slept, how much you slept, etc.—then it might be time to slow things down. Doctors and medical researchers have warned against a rise in stress related to sleep. Many individuals focus so much on going to sleep that they’re not able to sleep properly. Instead, they recommend following a schedule. Going to bed and waking up at consistent times matters more than how long you slept in the long run. No more snoozing those alarms, thems the rule.