Oh America

Also in today’s edition: Amazon’s kooky gadgets, The many shapes of Metaverse, Oyo IPO may get stuck.

Good morning! While the EV industry was busy lighting a fire under traditional automakers, it appears some of their (plentiful) players took their eyes off the ball. A video of an electric scooter on fire in Hyderabad going viral on social media has its maker, two-year-old Pure EV, sweating. After a second video surfaced, it may want to consider some sort of follow-up on the 25,000 vehicles it claims to have sold.

Btw, we’ve got a new podcast going. It drops every weekday at 5-ish PM. Give us a try. Subscribe, turn on notifications, and give us a shoutout on social media.

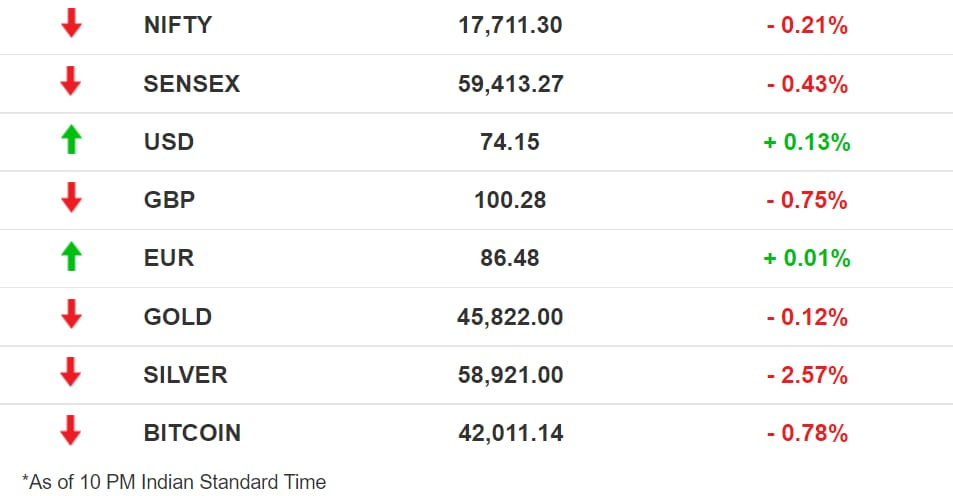

The Market Signal

Stocks: In a virtual repeat of the previous session’s trading, benchmark indices spent the first half deep in the red before a midday recovery saw them close much closer to where they began. Among sectoral indices, Metal continued its streak to settle among the day’s biggest gainers alongside PSU Bank, whose ‘Private’ counterpart was the day’s biggest drag.

Alpha bet? Facebook’s stock is now trading at its biggest ever discount to Alphabet, since the latter’s formation in 2015.

Welcome To The Jungle

The Amazon-ian one, where Alexa is always watching. It (she?) will now be supported by a rather incongruous bouquet of new hardware launches from Amazon.

Let’s start with Astro - the robot that strolls around your house, just...making sure everything’s alright. Sure, it looks kinda like Wall-E and that’s cute. But Amazon’s assurance that it’s built for "privacy at every turn" maybe not so much?

Next is the Echo Show 15, basically a wall-mounted smart-device control gadget. But with facial recognition and a screen you can watch TV on.Invoking Nietzsche: And as you watch Amazon, so does Amazon watch you. That perhaps explains the slew of camera-embedded products from a video-calling doorbell (Blink) to a video-chat device (Glow) for kids. Then there’s the security drone that will fly around the house at regular intervals...or when it “hears something”. Hmm.

There’s also an upgraded fitness tracker, an elder care subscription service, and more. Amazon has a sketchy history with experimental hardware, such as the Alexa-powered microwave. But clearly, it’s not happy just sticking to (Amazon)basics.

World’s Richest Nation On The Verge Of Default

Time is running out for the United States to manage its debt. The country will run out of funds by October 18 if a bill to hike the debt ceiling is not passed, according to Treasury Secretary Janet Yellen. If this happens, it will be the first-ever default by the US.

Debt woes: It doesn’t mean the government is bankrupt, but that the Treasury does not have the mandate to borrow via bond sales to pay for expenses. The Congressional Budget Office estimated that the debt limit has to be increased from $22 trillion to $28.5 trillion. If not, the US will default on its payment obligations. Suspending this debt ceiling and hiking the limit needed Senate approval but Republicans blocked the bill.

Repercussions: In case of a default, there will be a historic financial crisis that would lead to job losses and pay cuts. The White House admitted that this may lead to inadequate funding for infrastructure projects, and social security programmes would be halted too.

| |||

Make the call Janet. | |||

| |||

| |||

Sep 28, 2021 | |||

| |||

213 Likes 21 Retweets 9 Replies |

The Epic Metaverse Battle

You already knew about Facebook’s ambitious Metaverse plans. Now, it wants to spend $50 million to build it out “responsibly.” We'll let irony sit tight on that one, but something just dropped yesterday in the Wall Street Journal. Facebook, faced with stagnating growth in the US and Canada, wants to desperately capture ‘em young. How? Playdates as a growth hack. Sounds responsible?

The battle: Facebook is not the only one with Metaverse ambitions. Fortnite creator Epic Games has been quietly acquiring assets to shape its own version of the Metaverse. Microsoft CEO Satya Nadella dropped a corporate version that he termed “enterprise Metaverse” in a July earnings call.

Contrary ideas: Mark Zuckerberg sees the Metaverse as the “next chapter for the company” with affordability, ads, and avatars driving its growth. He also has a head start on selling hardware such as VR sets necessary to experience the Metaverse. Epic Games meanwhile is building an ecosystem. It convinced rivals Nintendo, Xbox, and Sony to open their multiplayer bases to interoperate with other platforms while playing “Fortnite."

The Signal

While the Metaverse is still a nebulous idea, it is the approach that would make all the difference as it evolves as the next version of the Internet. Epic sees the Metaverse as a never-ending creation of the free-flowing imagination of thousands of creators and dozens of companies. Its CEO Tim Sweeney sees collaboration and interoperability as the key features which would also help avoid “pitfalls which turn consumer ecosystem companies into overlords that exert too much power”. Facebook, meanwhile, sees it as a real-world replica with the operating levers firmly fixed in Menlo Park. Remember Freebasics? Facebook’s attempt to create a gateway to the Internet with itself as the gatekeeper.

Oyo Needs Some Room Cleaning

A six-year-old unconsummated deal has muddied Oyo Rooms’ plan to go public at an expected valuation of between $12 billion and $15 billion.

Left hanging: Oyo Rooms’ parent Oravel Stays had signed a term sheet in 2015 to buy rival Zostel Hospitality which ran Zo Rooms. Zo was supposed to get a 7% stake in Oyo. Despite completion of due diligence of Zo, the acquisition never happened.

Now what? Zo has gone to court asking for a stay on Oyo’s share sale. It contends that the latter was bound by agreement and a tribunal award to boot to complete the deal. Oyo cannot alter its shareholding structure even in an IPO until it fulfils its obligations, it said.

So what? If the court agrees with Zo, it will not only take away Oyo’s IPO punchbowl but also leave investors such as Softbank, Lightspeed, Sequoia, and Airbnb who may want to cash out, high and dry. The last one to come in was Microsoft which invested $5 million at a valuation of $9.6 billion which means Zo’s 7% stake would be worth $672 million.

Ray Of Hope For Evergrande

Cash-strapped Evergrande is finally getting some help. The property giant is selling its stake in a commercial bank, Shengjing, for $1.5 billion to a state-owned asset management company.

With a debt of $305 billion, investor concern is growing after the company missed a bond interest payment last week. It has another interest payment upcoming, of $47.5 million on Wednesday. But the money it gets from the stake sale can only be used to pay back Shengjing Bank.

The fact that Evergrande is prioritising domestic creditors over overseas bondholders shows that domestic enterprises may play an important role in bailing the company out.

Everyone is curious to see if the government will step in and risk proving that some companies are indeed too big to fail or let 1.6 million homebuyers, apart from banks and creditors, lose money.

What Else Made The Signal?

New PM: Japan's former foreign minister, Fumio Kishida, has replaced Yoshihide Suga as the country’s prime minister. He didn’t take long to say he would work to curb China’s growing influence.

Ban for ban: YouTube will ban channels of prominent anti-vaccine activists and block all anti-vaccine content, targeting other vaccines apart from Covid-19 as well. Meanwhile, Russia threatened to block YouTube after RT’s German channels were deleted over ‘misinformation’.

Fresh unicorn: Edtech platform Vedantu has raised $100 million in a new funding round to become the latest Indian unicorn.

Dissent: Two foreign shareholders of Reliance Industries voted against the appointment of Saudi Aramco’s Yasir Al Rumayyan as an independent director on the conglomerate’s board.

Named it: The Tata Group has named its e-commerce super app, TataNeu. In the works for long, it was unveiled to the top leadership but is still some distance away for customers.

Big A: In the largest Series A funding ever in India, CredAvenue has raised $90 million, led by Sequoia Capital. It now has a valuation of $410 million.

Switching engines: Iconic British luxury carmaker Rolls Royce will make only electric cars from 2030.

FWIW

Let’s get gaming: Guess who has forayed into the gaming space? Netflix. It has acquired its first gaming company, the California-based Night School Studio, which created Oxenfree, known for its great storytelling.

Virtual party: Shopify is making virtual hangouts fun – by gamifying the experience. It has built Shopify Party, where people can hop in and out any time and simply hang out rather than play a game by the rules.

Helping hand: Virgil Griffith, a cryptocurrency expert who was previously a senior researcher with the Ethereum Foundation, has pleaded guilty to helping North Korea skirt sanctions.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.