Who owns WazirX?

Also in today’s edition: Amazon sucks up Roomba; Food delivery cos see green; RBI keeps up with rate hikes; Berkshire Hathaway’s earnings are a mixed bag

Good morning! The suit is dead, according to Bloomberg. And so, the tailors in Savile Row are redefining sartorial choices, with casual dressing becoming a mainstay. So far, traditional pinstriped suits have given way to linen and bespoke streetwear such as bomber jackets and tracksuits.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

🎧 SS Rajamouli's magnum opus RRR is a smash hit in the US.

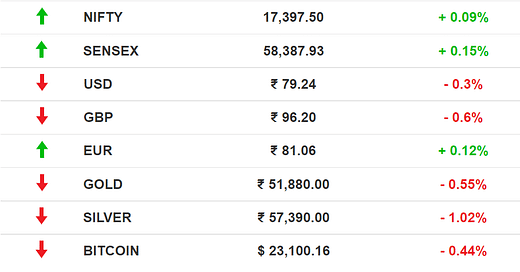

The Market Signal*

Stocks: Domestic equities ended the day on a positive note on Friday despite a rate hike by the RBI. About 28 companies have received a nod from SEBI to float IPOs between 2022-23. The earnings season continues for Disney, Bumble, and Coinbase, among other companies.

Early Asia: The SGX Nifty shrunk (-0.27%) at 7.30 am India time. The Hang Seng Index (0.78%) and Nikkei 225 (0.015%) lingered in the red.

EARNINGS

Food Delivery Uptick Continues With DoorDash

Estimates of a food delivery slowdown were proved wrong yet again after the Q2 2022 revenues of DoorDash climbed 30% year-on-year. Total orders on the app were also up 23%. Increased bookings on Uber Eats—the ride-hailing giant’s delivery arm—had contributed to Uber’s cash-positive growth in its latest earnings.

How?: Subscription programme DashPass seems to have covered DoorDash’s rising (and inflation-induced) costs. The company’s acquisition of Finnish delivery firm Wolt may have also accounted for the increase in orders, especially beyond the US.

Caveat: But DoorDash’s quarterly losses ($263 million) are making investors hold on to their cautious outlook. The company itself has a conservative forecast for the latter half of 2022 due to a “softer consumer spending environment” in the US.

A MESSAGE FROM OUR PARTNER

Geek Out On Asia-focused Financial News

We get it. It’s no mean feat to keep up with the endless stream of information flowing by the minute. Getting your news from various news streams can be a chore, and daunting.

DealStreetAsia is a financial news platform tracking the business of startups and private equity, venture capital, and corporate investments across Asia. We have a singular focus on capturing and analysing private equity and venture capital investments and other startup deals in Southeast Asia, India and China.

Sign up for The Daily Brief newsletter today to supplement your daily reading of DealStreetAsia.

Get your daily dose of news here

INVESTMENT

Berkshire Hathaway’s Roller Coaster Ride

Warren Buffett's Berkshire Hathaway reported a $43.8 billion loss but its operating businesses reported profits of $9.3 billion. Operating earnings were up at all the 90-plus businesses the investment conglomerate owns, except Geico.

Details: Berkshire Hathaway’s insurance units benefited from rising interest rates, while the rising fuel prices worked in its railroad unit’s favour. The company spent only $1 billion in buying its own shares compared to $3.2 billion in the first quarter. However, Berkshire bought $45.2 billion of stocks despite a net loss.

Etc: Berkshire Hathaway bought current VC (and Buffett’s likely successor) Greg Abel’s 1% stake in the company’s Energy unit, which spends heavily on transmission and renewable energy in the US.

ECONOMY

RBI Stays With The World

The RBI on Friday stayed in step with global central banks, raising its key interest rate by half a percentage point.

Calm: “In an ocean of high turbulence and uncertainty, the Indian economy is an island of macro-economic and financial stability and the economic growth is resilient,” RBI governor Shaktikanta Das said, calling the 50 basis points hike a new normal for central banks.

The central bank has stuck to its earlier economic growth forecast of 7.2% and expects inflation at 6.7% for the full fiscal year, well outside its upper comfort level of 6%.

The Signal

The hike was on expected lines, although some economists did speculate it to be smaller. That is because there are signs prices might soften. The RBI also believes that inflation has peaked but does not want to take chances.

EMIs on loans would go up which could have an impact on new home sales just when there were signs of a revival in key urban real estate markets. It will also hit consumer durable and auto companies which were booking better sales. Some vehicle models have waiting periods stretching for months.

Governor Das seems to be taking a punt on consumer demand sustaining despite the hike. He would be right if incomes rise and that will depend on the ability of companies to bear higher staff costs and the rains to provide a good harvest.

CRYPTOCURRENCIES

It’s Gloves Off Between WazirX and Binance

Days after India’s Enforcement Directorate (ED) froze ₹64.67 crore of WazirX bank balances, founder Nischal Shetty is slugging it out against Binance CEO Changpeng Zhao on Twitter. Reason: accountability.

Explain: India’s largest crypto exchange by volume first received an ED notice in 2021 to explain certain transactions. Months later, the agency concluded that WazirX had helped launder money for 16 Chinese-backed fintech firms involved in predatory lending.

Binance acquired WazirX in 2019. Following the asset freeze, however, Zhao denied owning equity in Zanmai Labs, the holding company of WazirX; the Binance website even updated the 2019 announcement with this claim. Shetty’s not only crying foul, but insinuating that Binance was opaque about its parent entity even with WazirX. Users are in a bind.

Throwback: A Reuters investigation in June revealed that Binance had helped launder at least $2.35 billion in dirty money.

TECH

Amazon Is Coming Home For More Data

Amazon announced a $1.7 billion deal to buy Roomba maker iRobot over the weekend. The tech giant is set to gain a lot more with this acquisition: access inside every house with Roomba.

Make vroom for data: Roomba will map out your floor plan to track data. It accesses information such as the size of a home and the number of rooms. That’s a goldmine of information for Amazon. iRobot has previously been under the scanner for sharing data with third parties. Privacy experts aren’t impressed.

Add to cart: Amazon’s first foray into consumer robotics is a piece in the smart home jigsaw puzzle. Amazon has been on a shopping spree in the last few years: think Ring, WiFi company Eero, Whole Foods and One Medical. Similar concerns about data privacy were raised previously.

FYI

Airborne: Domestic flyers have one more option, with billionaire investor Rakesh Jhunjhunwala-backed Akasa Air taking to the skies on Sunday.

Combo deal: Warner Bros. Discovery will merge HBO Max and Discovery+ into a single platform by 2023.

Big spenders: Crypto companies have pledged to spend $2.4 billion to back sports events and sportspersons. The promise will be tested in the coming months.

Oil slick: While oil producers and refiners were rolling in profits, marketers were getting hammered. IOC, HP and BP together reported Q1 2022 losses of ₹18,480 crore.

Mission failure: ISRO’s maiden Small Satellite Launch Vehicle voyage failed as it could not place its payload in the correct orbit, rendering the satellites useless.

Sold: Tata Motors will take over Ford Motor’s Gujarat plant for ₹750 crore. This, to boost its manufacturing capacity.

Ka-ching! Ed-tech unicorn upGrad has raised $210 million in fresh funding from marquee investors, putting its valuation at $2.25 billion.

🎧 ISRO's SSLV failed after it faced data loss at the terminal stage. Find out what happened.

FWIW

A fresh cuppa joe: Any coffee-making purist will tell you to discard coffee grounds. But Ground Control, run by a former Tesla CEO, is making do with reused grounds. The company believes that washing leftover dregs reduces bitterness and offers better flavour. Coffee stores in the US are giving it a bit of a nod.

NFTs… to the rescue?: Czech prince William Rudolf Lobkowicz is clinging onto NFTs to preserve his royal family’s history. Spanning over 700 years, the art collection includes 16th and 17th-century paintings from artists such as Bruegel, and hand-annotated manuscripts from Mozart, Beethoven, and Haydn.

Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.