India Khan’t get enough

Also in today’s edition: All's not well with ShareChat; Keeping up with Hindenburg vs. Adani; Is a US-China war imminent?; AI comes to Meta's rescue

Good morning! Days after India’s Enforcement Directorate froze 36 bank accounts tied to Vihaan Direct Selling—a franchisee of multi-level marketing (MLM) company scam QNet—details are emerging about the cult-like environment within the company. The BBC reports that chanting and dancing were routine during meetings, and that victims were expected to confide in fellow agents over their own families. They were also goaded into getting recruits via dating apps, and staging photoshoots with borrowed luxury goods to give social media users the impression of success. Lest this require emphasising: we implore people to not fall for Ponzi schemes.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

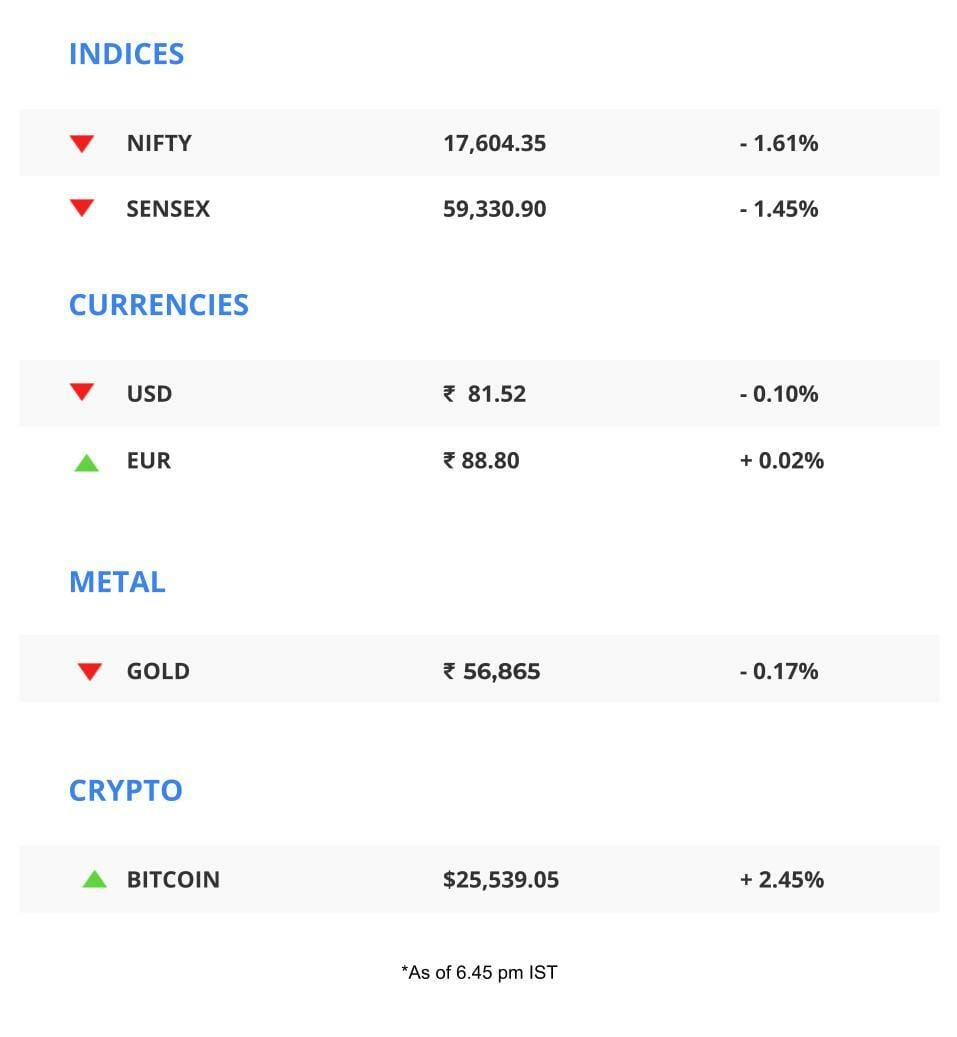

The Market Signal*

Stocks: The Hindenburg report on the Adani Group took Indian markets by storm. It not only hit Adani stocks but dampened sentiment enough to drag the entire market down. It has put pressure on shares of banks that have exposure to the group, reports The Economic Times. Life Insurance Corporation’s equity portfolio, which has large chunks of Adani stock, lost >₹18,000 crore ($2.2 billion) in last week’s crash.

Chinese companies have begun the year on a tear, topping US and European firms in equity fundraise so far, Bloomberg reports.

US investors are awaiting the December quarter performance review of Alphabet, Apple, and Amazon coming up this week.

Early Asia: The SGX Nifty was up 0.32% at 7:30 am India time. It has climbed steadily in the past five days and is now up 1.08% over January 25 despite the turbulence in the Indian markets last week. The Nikkei 225 was marginally up (0.15%) while the Hang Seng (0.49%) was in the red in morning trade.

ENTERTAINMENT

The Baadshah Is Back

And thanks to him, so is Bollywood.

Shah Rukh Khan’s return to the big screen in a lead role after a hiatus of over four years was worth the wait, if box-office earnings are anything to go by.

Production company Yash Raj Films revealed that Pathaan, which released on Wednesday, grossed ₹313 crore ($39 million) globally in its first three days—the biggest “opening weekend” for a Hindi title. Analysts expect it to breach the $65 million mark by Sunday, which would put it alongside regional blockbusters RRR, Baahubali 2, and KGF 2. That’s despite calls for a boycott by certain far-right groups.

Pathaan is on course to become “the highest-grossing Hindi film post-Covid”, providing much-needed respite to Bollywood. The Hindi film industry has endured a string of flops in the last few years, while regional-language movies such as RRR have become global, award-winning hits.

🎧 SRK's Pathaan helps Bollywood heave a sigh of relief. Also in today’s episode: Adani in damage control mode. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

STARTUPS

A Dumpster Fire By Another Name

Moneycontrol says ShareChat is in a crisis. The problems aren’t limited to the recent layoffs affecting 20% of its workforce, and co-founders Farid Ahsan and Bhanu Pratap Singh leaving their operational roles as COO and CTO, respectively.

Details: The social media platform, whose USP is its appeal with ‘vernacular India’—the non-English speaking population that lives in Tier-II and Tier-III cities and towns—hasn’t amassed a huge share of the Hindi-speaking audience due to competition from YouTube Shorts, Instagram Reels, etc. We’d told you why India’s TikTok clones, including ShareChat’s Moj, are losing to American counterparts in the battle for Bharat.

ShareChat’s losses mounted by 96% to ₹5,261 crore ($645 million) in the year ended March 2022. The company, which was offering sky-high salaries while suffering a monthly cash burn of $25-30 million, also saw eight executive exits before the departures of Ahsan and Singh.

CORPORATE

Adani Heads To The Trenches

The Adani Group came out guns blazing on Sunday with a 413-page rebuttal to Hindenburg Research’s over-100-page report that called the group the “world’s biggest corporate con”.

Despite a $50 billion stock rout last week, the group insists it will go through the $2.5 billion follow-on share sale of Adani Enterprises without any change in the price or schedule.

| |||

I don’t see how the bankers for the @AdaniOnline equity offering can allow it to close without doing due diligence on the issues identified in the @HindenburgRes report. There is just too much liability exposure for the banks. | |||

| |||

Jan 29, 2023 | |||

| |||

787 Likes 135 Retweets 168 Replies |

Adani is India: Adani called Hindenburg’s report a “securities fraud” by the “Madoffs of Manhattan”. It termed it a “calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India”.

Morgan Stanley Capital International which manages the MSCI indices, has sought feedback from market participants on Adani group stocks, eight of which are part of its indices.

The Signal

While it is true that Hindenburg's allegations, including that of unreal valuations, are mostly known and reported by Indian journalists before, fact remains that questions raised in the past have not yet been satisfactorily answered. That’s why domestic mutual funds largely stay away from Adani stocks.

Adani’s rebuttal implies that an attack on it is an attack on the country. As if on cue, Bloomberg reported that the episode puts at risk India as 2023’s hottest investment destination. It doesn’t help that group founder Gautam Adani is seen as a close friend of Prime Minister Narendra Modi. India is second only to China on MSCI’s emerging market equities index with a 14% weight.

GEOPOLITICS

World War Talk Gathers Steam

A US general has told his troops to begin target practice as he was expecting a war with China. Although the Pentagon did not share it, the general’s view is not too far-fetched given the rising tensions between the two superpowers.

Be prepared: War or not, large Japanese companies such as Suntory and Mitsubishi Chemical are worried enough about the US-China rivalry to put aside more budgets for intelligence gathering. In December 2022, Japan had ditched its six-decade-old pacifist policy and become more hawkish towards China.

Kursk redux? The war in Ukraine, meanwhile, is set to intensify, with the US agreeing to ship 31 Abrams tanks to help Kyiv keep Moscow at bay. Germany will send Leopard tanks. These heavy weapons were built specifically to take on the Russian T series battle machines, says Columbia historian Adam Tooze in this insightful analysis.

ARTIFICIAL INTELLIGENCE

A Hope And A Prayer For Meta

Photo credit: Anthony Quintano / Wikimedia Commons

While Microsoft, Google, and Amazon are going hammer and tongs on AI to (mostly) bolster their cloud businesses, Mark Zuckerberg is banking on tech’s next big thing to boost ad revenue.

Details: The Wall Street Journal reports that $4 billion of the $5 billion Meta planned to spend on data centres in October 2022 was earmarked for AI. That investment has led to better recommendation algorithms on Meta’s shortform video offering, Reels. The result: better engagement, per Facebook head Tom Alison’s memo to employees.

Meta’s improved AI capabilities are also being used for ad targeting, critical in a scenario where the company gets accustomed to harvesting less third-party data. Apple’s privacy changes in 2021 had dealt a body blow to Meta’s digital ads business.

Aside: Google—creator of the very advanced-but-not-public LaMDA chatbot—has created an AI music generator called MusicLM. Its abilities surpass rivals Riffusion and OpenAI’s Jukebox.

FYI

Pay up: Starting next month, Amazon will charge US customers for grocery orders of less than $150. This includes Prime members.

Lenient: Twitter will take a light-touch approach to disciplining accounts that violate its rules. It won't suspend accounts unless they indulge in “severe or ongoing, repeat violations”.

Red signal: Bengaluru's RV University has banned the use of OpenAI's ChatGPT inside its campus, specifically for assignments.

Lifeline: Beleaguered budget carrier Go First expects to receive ₹210 crore ($26 million) under the Indian government's Emergency Credit Line Guarantee Scheme next month.

Shocker: Odisha health minister Naba Kisore Das was shot dead by a policeman. The motive is yet unclear.

Charging up: New Delhi-based Omega Seiki will invest ₹800 crore ($98 million) to build two plants in India to manufacture EV components like batteries and power trains.

🐐: Novak Djokovic beat Stefanos Tsitsipas 6-3, 7-6 (4), 7-6 (5) to win his 10th Australian Open, equaling Rafael Nadal’s record of 22 grand slam titles.

THE DAILY DIGIT

$159 billion

Value of mergers, acquisitions and corporate deals in India in 2022. With over 2,100 transactions and a 29% rise in value terms, India surpassed pre-Covid level dealmaking. (The Economic Times)

FWIW

Beyond Spotify Wrapped: Think your questionable music choices are private because you don’t share your Spotify year-in-review? Think again, coz Spotify snooping is apparently a thing. If you use the app on your desktop and have ‘Friend Activity’ on, anyone can look you up and check your listening history. People have taken advantage of the function to look up their exes and even check out what co-workers listen to. We bet some of you already headed to app preferences before you finished reading this sentence.

The grifter who keeps on giving: You’d think Anna Sorokin, aka ‘fake heiress’ Anna Delvey, would’ve had enough of the limelight. Not quite. The subject of a 2018 New York magazine profile who inspired a podcast and Netflix’s Inventing Anna will now have her own show, called Delvey’s Dinner Club. The unscripted series will feature Sorokin hosting “celebrities, moguls and glitterati” for dinner parties. Her dream guests include Elon Musk, Madonna, and, we kid you not, disgraced crypto czar Sam Bankman-Fried.

About that dapper dude: If you’re a Twitter user suffering the algorithmic ‘For You’ timeline, you’ll want to read this. It’s about @dieworkwear, the handle foisted on us by the new and unimproved Twitter. Even its owner Derek Guy—dubbed “Menswear Guy” since he tweets about men’s fashion—has no clue why the algorithm recommends his account everywhere. He’s racked up 30,000 followers over the last month thanks to it. We don’t mind him as much as other trash recommendations though, jussayin.