Paytm boss makes a vow

Also in today’s edition: It’s Musk vs SEC; Short video players load up on cash; WarnerMedia loses head; Akasa squeezes rival even before take off

Good morning! Advertising is as much entertainment as it is propaganda. And PepsiCo revelled at it. The soft drink giant is ending its 30-year advertising and media buying association with WPP Group because rival Coca Cola has hired them globally, the Economic Times reported. The partnership delivered some memorable ads, including the iconic Yehi Hai Right Choice Baby and Yeh Dil Maange More.

In today’s episode of The Signal Daily, we look at troubled companies. First, Boeing, whose woes aren’t going away anytime soon because its inability to deliver planes is affecting expansion plans for airlines such as SpiceJet. We also take a closer look at Paytm, whose founder Vijay Shekhar Sharma has made a curious promise to investors: that it will be profitable soon.

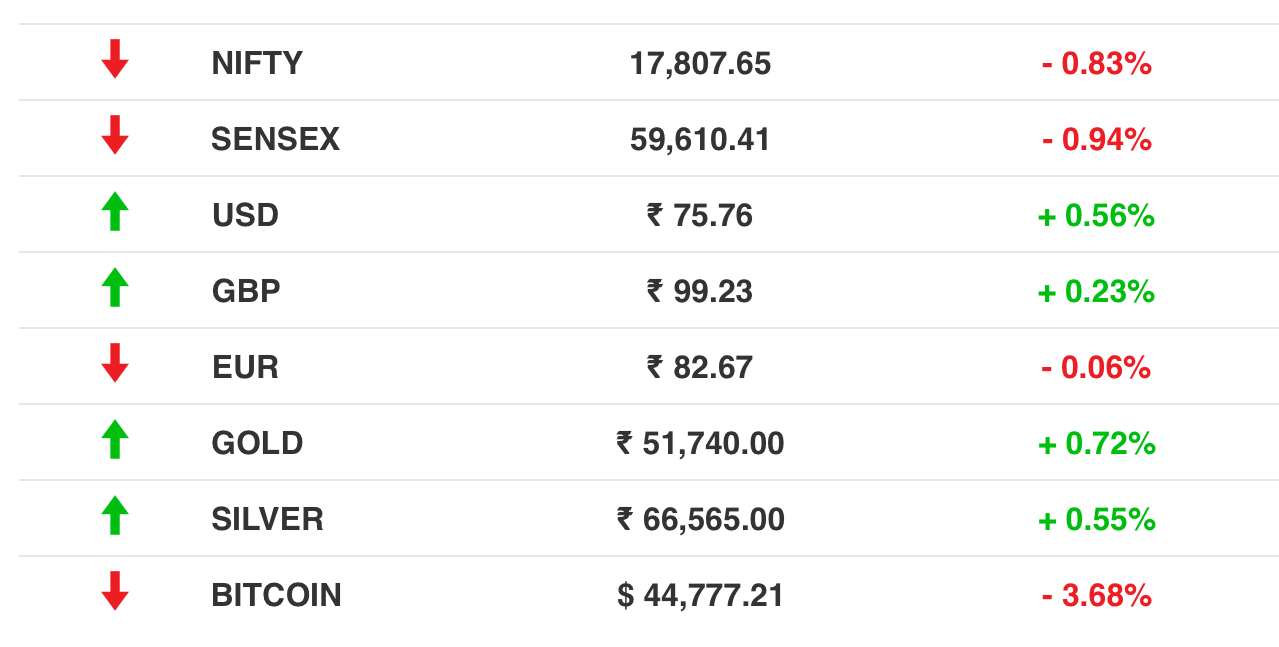

The Market Signal*

Stocks: Indian markets saw a sell-off in line with global peers which were spooked by the US Fed’s hints that it was planning steeper interest rate hikes. Talk of the US and the EU imposing more financial sanctions intensified even as Russia inched closer to a dollar-debt default. The RBI will unveil its monetary policy on Friday.

BIG TECH

Musk Is What Musk Does

Elon Musk has likely done what billionaires are wont to do. Break rules.

Musk might have accumulated Twitter stock without making disclosures on time. He probably saved a few hundred million dollars by delaying mandatory SEC filings.

No law: The world’s richest man’s dislike for regulation is well known. In fact, he even moved his base lock, stock and barrel from woke California to conservative Texas to escape tough laws. He is also not a practising apostle of free speech absolutism as he claims.

Cock a snook: Musk’s dalliance with Twitter to promote his business interests ran parallel with his run-in with the SEC. But for all that, his 9.2% stake in the company might turn out to be a good investment too.

SOCIAL MEDIA

How's The Josh? High, Sir

VerSe innovation, the parent company of news aggregator DailyHunt, short video app Josh and hyperlocal video app Public Vibe, has raised $805 million in a Series J round led by the Canada Pension Plan Investment Board.

More than a verse: The company will use the funds to enhance its artificial intelligence, machine learning and data science capabilities and also expand its offerings, monetisation models and Web3 chops.

There's money again: Josh is locked in a pitched battle with Moj for supremacy in the short video market. This fundraise makes it equal in value to Mohalla Tech, the parent company of Moj that is raising a round as well. It will be interesting to see how the flush-with-capital parent companies, with a suite of products, conquer the Indian market for social media, news and video.

Elsewhere: Instagram creators are reporting a dip in Instagram Reel payouts by as much as 70% per view. In other news, Meta is integrating Reels with third-party apps.

A MESSAGE FROM OUR PARTNER

What's Your View?

Will menstrual leave boost women’s participation in the workforce or hurt it? What do civil service changes bode for Chandigarh, the capital of Punjab and Haryana? Do online shoppers have rights?

Debates around these and other topics rage all the time. Which side are you on, or rather, which side should you be on?

Look no further than either/view to make an informed choice. either/view is a daily newsletter that dissects arguments on every side of the story to help you make unbiased opinions on the news that matters.

While we at The Signal cover business and tech, check out either/view if you're also into politics and current affairs. We already have. What’s more, it's free!

FINTECH

VSS Takes Stock of Paytm Profitability

Vijay Shekhar Sharma, CEO of One97 Communications—which owns fintech platform Paytm—has miles to go and promises to keep.

Profits incoming: In a letter to shareholders, Sharma said that Paytm would operationally break even in six months. The company disbursed 6.5 million loans during the fourth quarter of FY22 aggregating to ₹3,553 crore, registering a growth of 417 per cent compared to the same quarter the previous year.

The CEO also said that his stock grants were now tied to the company’s share price reclaiming the IPO tag of ₹2,150 and sustainably staying above that level.

The Signal

Paytm’s resolve to turn profitable and Sharma’s pledge to link his stock options to the company’s performance in the equity market are commendable. The Paytm stock, which has lost three-fourths of its IPO value, jumped 4% on the news. But it has to rise 360% from the current level for Sharma to redeem the vow.

Linking executive compensation to the company’s share price, however, often creates what academics call a moral hazard as it could incentivise risk-taking. Investors, who would stand to benefit, might also be tempted to look away when the value of their holdings rises. Indian markets saw this playing out many years ago at the now extinct Global Trust Bank, where its founder Ramesh Gelli allegedly allied with powerful brokers to rig the share price of the bank to fulfil promises he had made to some shareholders.

MEDIA AND ENTERTAINMENT

Headless WarnerMedia Trundles Toward Discovery

WarnerMedia—the AT&T-owned media giant that operates HBO, CNN, Warner Bros., and DC Entertainment—is witnessing a leadership exodus days before merging with Discovery. CEO Jason Kilar, WarnerMedia Studios & Networks chief Ann Sarnoff, and HBO Max honcho Andy Forssell all exited in a span of 24 hours.

Discovery CEO David Zaslav will head the merged entity, Warner Bros. Discovery.

Disruption: The trio collectively oversaw WarnerMedia’s TV, theatrical, and streaming slates. During the pandemic, Kilar announced ‘Project Popcorn’, under which films such as Tenet, Dune and Godzilla vs. Kong released simultaneously in cinemas and HBO Max. The mixed results angered Hollywood but revived the streaming platform, which netted 73.8 million subscribers by December 2021.

Oblivious: AT&T chief John Stankey reportedly kept Kilar in the dark about Discovery. Meanwhile, Kilar’s brainchild, the news streamer CNN+, has launched with a whimper.

AVIATION

India’s Civil Aviation Dogfight Takes Wing

The competitive airline market in India is gearing for another dogfight. Akasa will not only take up market share in the sector but is also building its fleet at SpiceJet’s expense.

What happened? Spicejet had plans to add 10 Boeing 737 MAX planes to its fleet. But Boeing—seemingly more interested in Akasa, which ordered 72 aircraft—is delivering only three to the low-cost carrier. Akasa is a great opportunity for the US aircraft maker to find a foothold in the Indian aviation market, which is dominated by Airbus.

Interestingly, Akasa chose Boeing over Airbus simply because the latter had a long waiting period.

Boeing’s continuing troubles: The rollout of new Air Force One presidential jets has been delayed due to production mishaps. It’s the latest setback for Boeing, which was banking on federal and defence contracts post the 737 MAX and 787 Dreamliner disasters.

FYI

Funding alert: Deep tech and enterprise-focused VC firm Speciale Invest closed its second fund for ₹286 crore ($37.7 million). It also led a $4.5 million round for visual robotics platform CynLr.

Swipe swap: Russian banks are issuing domestic Mir cards and partnering with China’s UnionPay to circumvent sanctions by Visa and MasterCard.

Virus spotted: The first case of Covid-19 variant XE, said to be more transmissible than Omicron, has been detected in Mumbai. The asymptomatic patient had tested positive last month.

Critically ill: Sri Lanka, which imports 85% of medicines, is facing a health emergency as supplies of life-saving meds are running out.

Distress fund: China’s central bank is helping raise a multi-billion yuan fund to help financial firms, indicating that the economy might be far more distressed than is visible.

Moving jobs: About 50,000 IT jobs could shift to India from Ukraine, a digital engineering powerhouse, as companies look to maintain the continuity of their services.

Whitewash: A Variety investigation reveals that women of colour are leaving the BBC since its culture does not support “anyone who is different”.

FWIW

Shroom magic: Fungi, it seems, can do a lot. They can help in space travel. Remember Paul Stamets, the astromycologist from Star Trek? The character is named after real-life mycologist Stamets and the mushroom-based space travel tech on his research. Now another mycologist says fungi talk, like humans…

Peely bot: Robots are surely acquiring fine motor skills. Researchers at the University of Tokyo have trained a robot to flawlessly peel bananas. It took the machine 13 hours of training to use two hands to peel a banana in about three minutes.

Dasvidaniya: Vladimir Putin’s war has turned his countrymen, especially the rich ones, into personae non-gratae in many parts of the world. But they are being missed sorely on the beaches of Thailand, Vietnam, Maldives and Cuba. The big spenders propped up local economies and were a pampered lot. They can only hope for the tide to turn.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.