Truth or dare?

Also in today’s edition: Vi’s pal Airtel; Twitter may go bust; Another startup fraud; USD’s oil trial

Good morning! Fancy a trip to Seoul? You can now visit the South Korean capital… in the metaverse. While the city’s virtual replica will only be completed in 2026, the initial stage already offers youth counselling, support for tax queries, and e-books (?!) to citizens. CoinDesk says future versions will include the ability to manage municipal infrastructure with augmented reality. Last month, Cointelegraph had reported that other Korean cities such as Seongnam and Changwon may have virtual replicas too. It also visited the Israeli diplomatic mission in the Seoul metaverse at the time and guess what? It was totally empty.

🎧 Will Netflix's bet on the ad-supported business model work out? The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

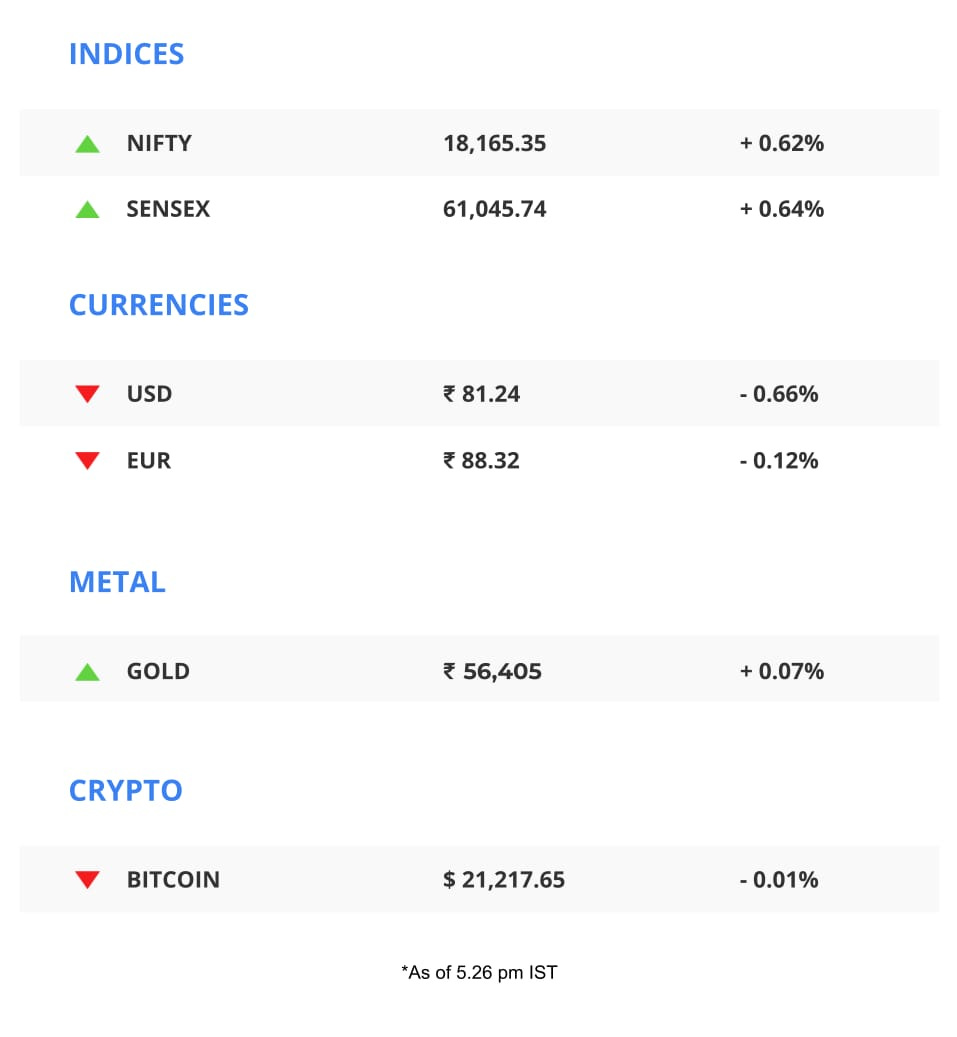

The Market Signal*

Stocks: Crude prices hit a six-week high, according to Marketwatch. The International Energy Agency says oil could touch record highs in 2023 as post-Covid China limbers up. Earlier lockdowns there, however, hit luxury brands Burberry and Cartier-owner Richemont, which reported a slump in quarterly sales. Its hopes are up as the country reopens, according to Financial Times.

UK inflation eased to 10.5% in December 2022, after reaching a 41-year high of 11.1% in October 2022.

Adani Enterprises is offering investors a discount of 10%-15% in India’s biggest follow-on public offer. It’s seeking to raise ₹20,000 crore ($2.5 billion) by selling shares in a price band of ₹3,112-₹3,276 per share, according to Bloomberg.

Early Asia: The SGX Nifty sunk (-0.44%) at 7.30 am India time. The Hang Seng Index (-1.25%) and Nikkei 225 (-1.00%) also lingered in the red.

REGULATION

Behold The Ministry Of Truth

The Indian government wants to enforce a censorship regime factcheck you. The Ministry of Electronics and Information Technology, which just extended the consultation period for draft amendments to the IT Rules, 2021, wants the Press Information Bureau (PIB) to be the arbiter of truth.

What?: The PIB is the Centre’s nodal media agency. Per the latest draft (pdf), any content it flags as fake or false will be taken down or disallowed.

But PIB, which doesn’t have a spotless fact-checking record, won’t be the only arbiter. Any “other agency authorised by the Central Government…” can play that role.

Who’s expected to follow this?: Intermediaries. Aka not just social media platforms, but also web hosting and internet service providers.

Sneaky: This update came on the last day of a consultation process that was supposed to be about online gaming regulations. Unsurprisingly, everyone is up in arms.

| |||

A "fact check" by the Press Information Bureau is not a legal order and hence is not actionable as per Shreya Singhal. MEITY continues to flout legality by seeking to expand the IT Rules. 1/n | |||

| |||

Jan 17, 2023 | |||

| |||

47 Likes 24 Retweets 1 Replies |

🎧 Soon, the Press Information Bureau may determine what's fake news. What could go wrong? Find out. The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts.

TELECOM

Airtel Offers Vodafone A Hand

Telco Bharti Airtel will not come in the way of the Vodafone Group if it finds an external buyer for its stake in cell phone tower operator Indus Towers.

Vodafone Idea (Vi), which accounts for 40% of Indus’ revenue, owes the company ₹7,500 crore ($922 million). Indus’ operations will be affected if Vi doesn’t pay up, a situation Bharti wants to avoid because it owns ~48% of the company. Vi paid off some of its dues to Indus last year after Bharti bought Vodafone’s 4.7% stake for ₹2,388 crore ($293 million).

No surprises here, it is also behind on payments to the government.

Problems galore: Vi’s promoter Vodafone UK is planning its biggest job cut in five years to rein in costs. It’s also selling its operations in Ghana to the Africa-focused Telecel Group. Although pressure is mounting from the Indian government, which had earlier bailed Vi out, the other promoter, AV Birla Group, is unlikely to pony up capital on its own.

CORPORATE

Twitter Could Go Bankrupt

Elon Musk’s muse is holding a garage sale. Considering the shrunken billionaire has pretty much gutted Twitter of its staff, income and values (whatever it had), office furniture and memorabilia are the only things left.

Coffee machines, chairs, boardroom tables and several bird statues are up for sale. We wonder if there are any magic legumes on offer.

Cash trickle: Magic is what the company needs after 500 of its top advertisers scooted the show. Its revenues have plummeted 40%.

Twitter had made $5 billion in 2021. Musk estimated it to turn in $3 billion this year and help meet an upcoming $1.5 billion interest payment. The interest is on the $13 billion debt Twitter took on behalf of Musk from a banking syndicate to fund the $44 billion acquisition.

The Signal

Twitter risks going into bankruptcy and Musk losing control over it if the company defaults on the interest payment. Musk could buy out the loans, but he himself may not be in the best shape financially despite his paper riches. Much of his Tesla stock, the chief source of his wealth, is pledged and he doesn’t have too much wiggle room to pawn more. He is also facing legal heat over a 2018 tweet on taking Tesla private, which played havoc with the company’s stock price and eventually led to the class action suit.

STARTUP

GoMechanic Breaks Down

Tiger Global and Sequoia-backed motor-garage aggregator GoMechanic is facing a forensic inquiry ordered by its investors after it admitted to cooking numbers.

Hot air: The irregularities came to light in a due diligence conducted by potential investor Softbank. EY India, which pored over its books, found ghost garages, preferred payments, and inflated metrics. Co-founder Amit Bhasin admitted in a LinkedIn post that the founders got “carried away” under pressure to perform. The company has fired 70% of its staff.

Common thread: GoMechanic, which has so far raised $62 million, is valued at $283 million. It is the fourth company after BharatPe, Zilingo, and Trell to be shown up for financial irregularities in external due diligence. What binds them is they are all funded by Sequoia, raising questions about the venture capitalist firm’s oversight of its portfolio firms at the very least.

CURRENCY

US Faces A Dollar Shake-Down

Saudi Arabia’s finance minister said the kingdom is prepared to move away from pricing oil exclusively in US dollars (USD) and trade in other currencies.

The pillar: The Saudi riyal’s peg to the USD, agreed upon in the 1970s, has underpinned the economic might of the United States for the past half-century. It helped make the USD the default currency for most nations to keep as reserves. That could change.

While Saudi Arabia’s relationship with the US has become rather frosty, it has warmed up to US rival and oil guzzler China.

More worry: Two other big oil producers—Russia and Iran—are also said to be exploring an alternative to the USD: a gold-backed stablecoin. Russia, incidentally, is among the world’s top three gold producers. Can gold make up for trust, though?

FYI

Fresh cuppa joe: Homegrown coffee brand Blue Tokai Coffee has raked in $30 million (₹243 crore) in a Series B funding round led by A91 Partners, among other investors.

Crammed: According to the UN, India was set to take the crown of the world's most populous country by April 14, 2023. However, India may have already surpassed the milestone, according to the World Population Review.

Cry-xit: Crypto exchange Coinbase is halting operations in Japan this month, citing volatile "market conditions". This comes after the US-based firm announced last week that it is letting go of 950 employees globally.

Pay my perks: Samsung's Indian outpost claims it is having a tough time collecting $110 million from the government as part of the production-linked incentives scheme. The government is willing to part with only $20.2 million for the fiscal year through March 2021.

Hold on: The Delhi HC has restrained ex-BharatPe managing director Ashneer Grover from selling or transferring the 3.09% stake in the company he got from former co-founder Bhavik Koladiya.

2.0: Hotel booking company OYO has revealed that it will file its updated IPO draft papers by February 2023.

See ya later: New Zealand’s Prime Minister Jacinda Ardern will resign from her position in February 2023.

THE DAILY DIGIT

$2.6 million

The amount spent by a Saudi Arabian businessman at an auction to watch a friendly between Lionel Messi and Cristiano Ronaldo. The winner has also won the chance to meet the two players. (Al Jazeera)

FWIW

Seal of approval: Disney can finally breathe easy FTM. Beijing has given the nod for Marvel films to play in Chinese theatres for the first time since July 2019. Almost four years after an unofficial ban, Black Panther 2 and Ant-Man 3 will release in the country next month. Cultural depictions—LGBTQ moments in movies, instances of US patriotism—and growing geopolitical tensions between US-China were a few assumed reasons behind the blanket ban. China remains Disney’s second-largest film market and, for now, the company will most likely want to make up for the lost time.

AI for the win: The eastern bristlebird was considered extinct after the 2019-2020 bushfires came for the Gondwana rainforest, Australia. That is until scientists tracked down the bird with the help of AI. Researchers from the Queensland University of Technology trained an AI programme to capture the bird's call. And, it worked. A bonus: the team learned that the area has a lot more species than they actually assumed. :')

Let them (not) eat cake: ...believes the UK’s top food watchdog. The Food Standards Agency’s chairwoman, Professor Susan Jebb, says bringing cake to work isn’t all that healthy since it could fuel the obesity crisis. She further compares it to passive smoking since it "inflicts harm". We'd like to know her view on water-cooler conversations. For now, we will stick to calling her a professional spoilsport.