Good morning! The Central Bureau of Investigation’s (CBI) conscience is tugging at it. Banks are getting letters from the agency asking them if they followed principles of natural justice when they classified several accounts, most of them loan defaulters, as “fraudulent”. Why did the CBI suddenly decide to do right by “fraudsters”? Apparently, it’s taking the cue from a Supreme Court ruling of March 2023, which said that a borrower must be given a hearing before labelling the account. The Economic Times reports citing unnamed sources that banks are not the least bit happy about it as they fear it’ll delay cases, and some so-called fraudsters may even get away. Now, who might those be?

Roshni Nair and Dinesh Narayanan also contributed to today’s edition.

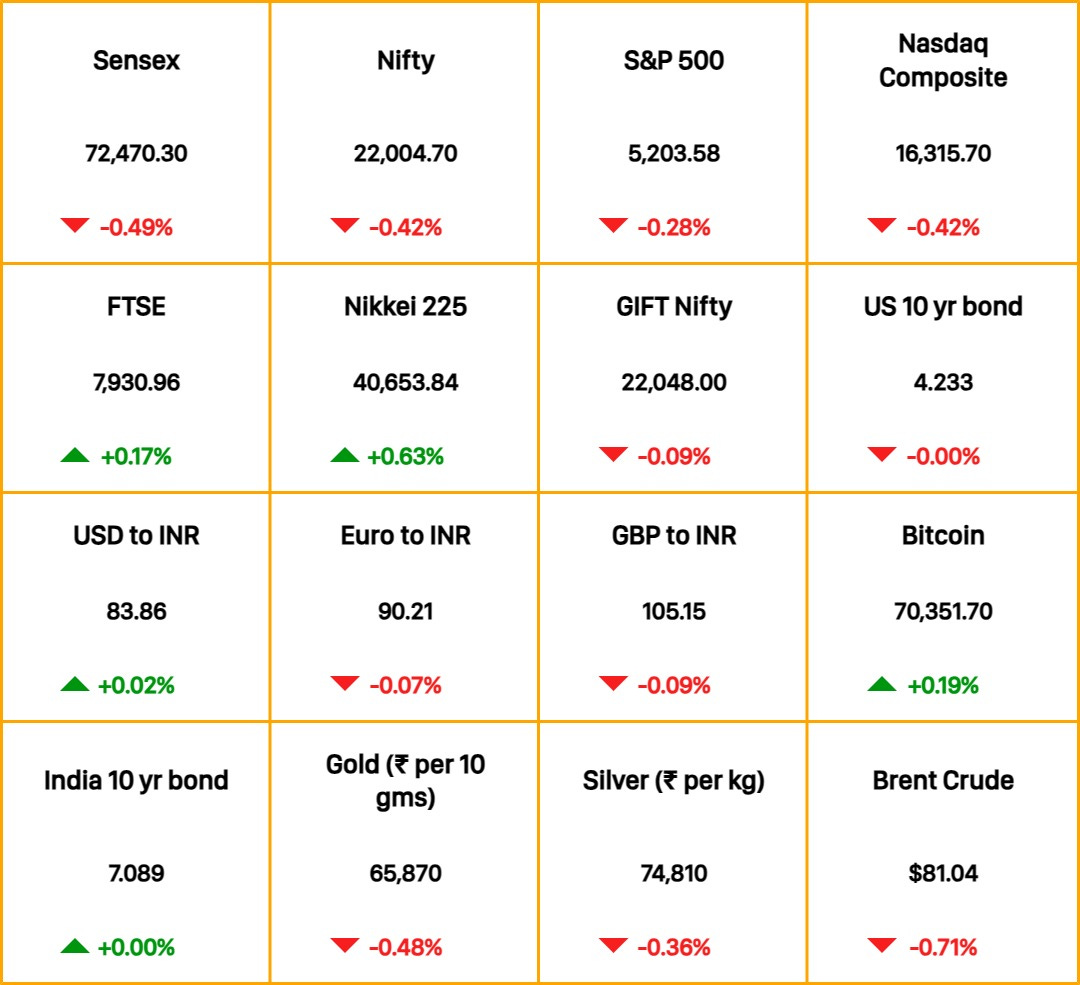

The Market Signal*

Stocks & Economy: Stocks & Economy: Gold has been shining of late but the commodity that currently appears to be more precious than the yellow metal is cocoa. Global prices have crossed a record $10,000 per tonne. The reason is production shrinkage in Africa, the biggest cocoa supplier, due to vagaries of the weather. Traders are watching a mid-crop harvest that usually is smaller but estimates suggest that will shrink further. That means you may have to let go of those chocolate urges or burn a hole in the pocket.

US equities slumped in the final hour of trading and Asian stocks were mixed on Wednesday morning. Shares advanced in Japan and Singapore.

Indian equities were lacklustre on Tuesday. This is a short week due to Holi on Monday and Good Friday and activity is likely to remain subdued unless there is a surprise trigger. The GIFT Nifty hints at a flat opening.

INVESTING

Promoters Play Hide N’ Seek With Vital Info

There is a pithy saying in the Indian markets: do as the promoters do. It means following company insiders—managers, directors, promoters—when they buy and sell stock.

Asset manager Unifi Capital estimates that if investors had followed promoters in buying stock and selling them after holding for three years, between 2005 and 2021, they would have clocked a CAGR of 23.7%.

But what if there is no information at all?

Info blackout: In three separate but recent instances, the promoters of the companies hid material information from other shareholders. BGR Energy Systems delayed telling exchanges that lenders had classified the company’s accounts as non-performing. It also did not disclose on time resignations of key executives even as the promoters sold their stake.

BPO Varanium Cloud as well as electric wires maker Ultracab hid promoter stake sales, causing huge losses to investors. Head to The Core for more.

PODCAST

Tune in every Monday to Friday as financial journalist and host Govindraj Ethiraj gives you the most important take on the latest in business and economy.

Today, he speaks to Anindya Banerjee, Head of Research, Forex & Interest Rates at Kotak Securities, about what may caused the record Indian Rupee low on Friday.

AVIATION

Deal Or No Deal

The long overdue shakeup at an American manufacturing icon-turned-meme is here. Dave Calhoun will exit as Boeing CEO by 2024-end. While he’ll probably get a golden parachute, Stanley Deal may not. Deal, who headed Boeing Commercial Airplanes (BCA)—which itself had a shakeup after Ed Clark, chief of the 737 Max programme, was ousted following the Alaska Airlines (AA) mishap—is departing pronto. Board chair Larry Kellner is leaving too.

The immediacy of Deal’s exit contrasts Boeing’s earlier decision to keep him after the AA incident. Its current woes largely stem from problems in BCA: regulatory scrutiny, criminal investigations, supply chain issues, irate airlines, and a union faceoff.

The executive changes once again raise the question of whether insiders can overhaul a decades-long culture of revenue before safety. Calhoun’s possible replacements are many. Until then and even after, airlines will struggle with unfulfilled orders, and passengers will grapple with expensive airfares.

🎧 Can a new leadership clean up the rot within Boeing? Also in today's episode: The Signal Daily interviews development economist Jayati Ghosh about India mulling a shift from minimum wage to living wage. Will this be enough to address the fundamental issue of wage disparity? Tune in on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

HEALTHCARE

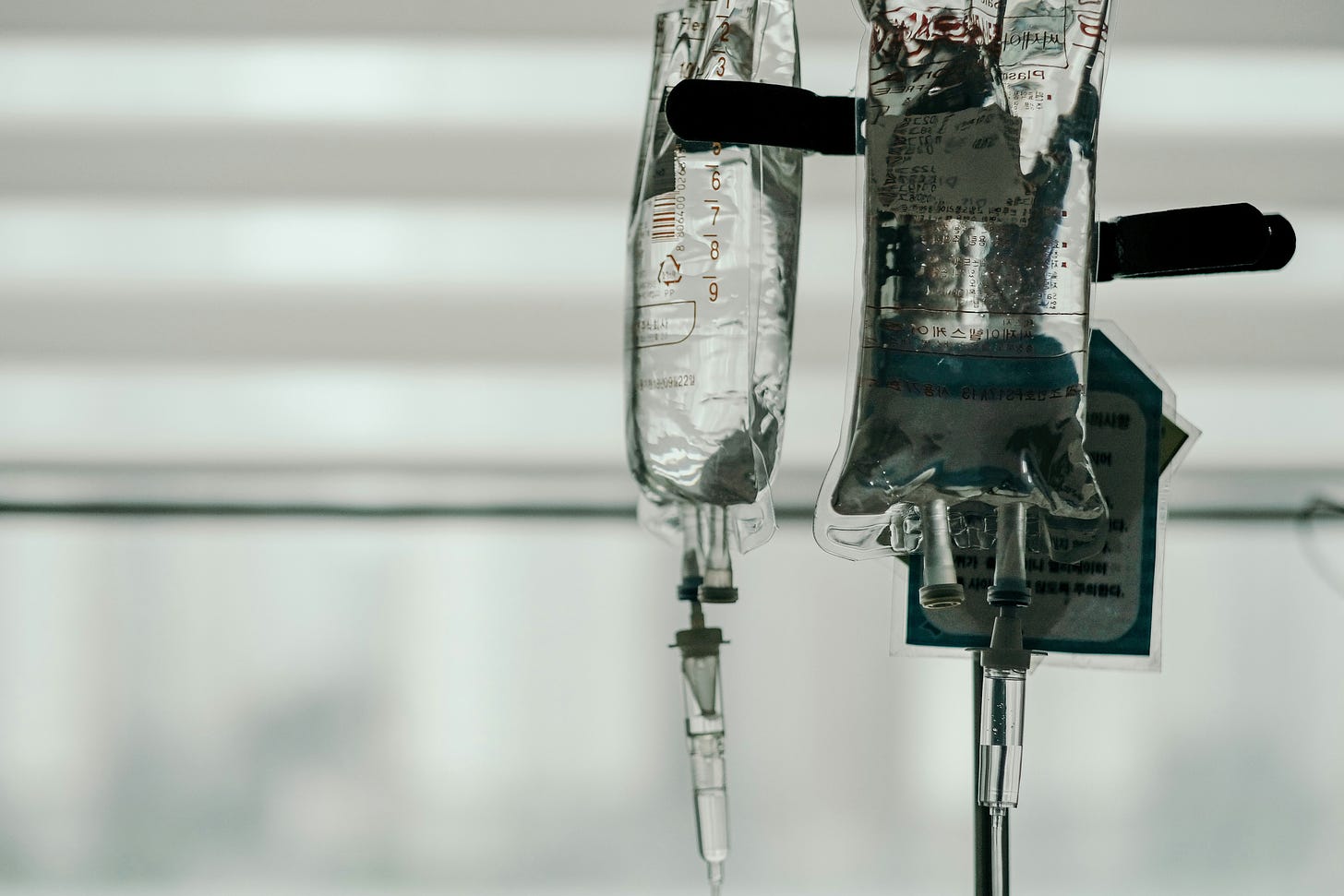

Don’t Overstay Your Welcome

That’s right. Corporate hospitals in India are not keen on patients indefinitely lounging on ICU beds. In fact, according to a Business Standard report, hospitals are discharging patients sooner than ever before.

A patient admitted to Fortis or Max, for example, won’t be staying in hospital for more than four days. For Manipal Hospitals, the average length of stay (or ALOS) is even shorter at a mere three days.

Why the rush?: Hospitals say that a shorter ALOS frees up ICU beds to accommodate more patients. Discharging patients as soon as possible has almost become a deciding factor in treatment plans. That’s why some doctors are mobilising patients on the very evening of surgery or opting for minimally invasive procedures.

While the desire to offer critical care to as many patients as possible is noble, there's more to it. 👇

The Signal

Corporate hospitals have lately come under fire. Last month, an annoyed Supreme Court threatened to enforce standardised rates at private hospitals. A group of health insurers had also blasted them for overcharging and committing insurance fraud. One oft-repeated allegation is that hospitals send inflated bills after keeping patients in in-patient care for longer than necessary.

A shorter ALOS thus kills two birds with one stone: hospitals can come clean while simultaneously cutting the cost per patient discharge. All this without hurting the bottom line, as a faster patient turnover means being able to admit more cases in the same timeframe. A win-win.

FYI

Temporary relief: Cash-strapped SpiceJet has reached a deal with Export Development Canada to clear liabilities worth Rs 755 crore; the agreement will help the private carrier save Rs 567 crore.

Break it up: The feud in Bharat Forge promoter, the Kalyani family, deepened after chairman Baba Kalyani’s niece and nephew, Sameer and Pallavi Hiremath, moved a Pune court seeking a division of family assets, potentially breaking up group ownership.

Sale sale sale: Private equity firm Olympus may sell nearly 10% of its stake in hospital chain Aster DM Healthcare, Moneycontrol reports; Aster, which is on a domestic expansion spree, is separating its India and West Asia businesses.

Tragedy: The US state of Maryland declared an emergency after the Francis Scott Key Bridge in Baltimore collapsed when a Singaporean cargo ship with an all-Indian crew collided into one of its columns. Six construction workers are presumed dead after falling into the Patapsco River.

Creepy gets creepier: Unsealed court documents in a class action suit filed by consumers against Meta reveal that the tech major intercepted and spied on users’ Snapchat/Snap traffic in an initiative called ‘Project Ghostbusters’.

THE DAILY DIGIT

92

The number of billionaires who call Mumbai home. That puts Mumbai behind New York City, which has 119 billionaires, and London with 97, but ahead of Beijing, which boasts of 91 ultra rich individuals. (Mint)

FWIW

Hophead: Food scientists the world over, including in India, are developing climate-resilient varieties of staple foods such as rice and pulses. While they’re at it, peers in the UK are working hard on, well, a hardy variety of one of the most essential ingredients in beer: hops. You see, production across Europe has plummeted due to hotter, drier weather, leading to a drop of ~20% in output in some regions. A team led by University of Kent’s Dr Helen Cockerton is currently isolating hop genes to produce more climate-resilient varieties that can also possibly yield new, intense flavours. Brewers can’t wait for the good news, and neither can we.