Sequoia changes the game

Also in today’s edition: Who will pick up the climate change tab? China’s economy slows further, Cube craze

Good morning! This is a strange way to start your day, but you may have come across, and ignored, the chant, “Let’s Go Brandon”, on social media. It is being used by Republican lawmakers and their supporters as code asking Joe Biden to, ahem, f*** off. The meme started when a select group of people tried to make a political statement at a NASCAR rally and the chant was described by a presenter as the crowd cheering on Brandon Brown, a rally driver.

Btw, our podcast has been going strong for over a month now. Tune in on your daily jog, drive to the office, or even as you WFH-ers have breakfast in bed. We promise it’ll be music to your ears.

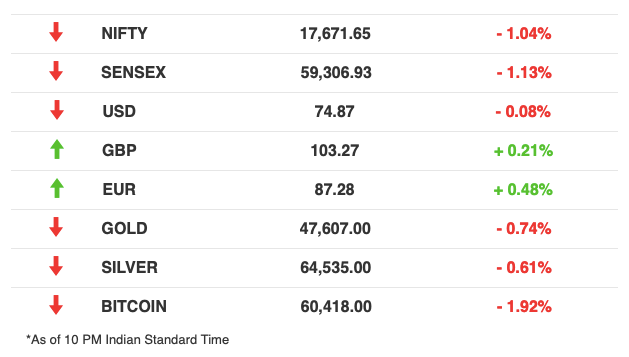

The Market Signal

Stocks: Indian markets closed the previous week in a precarious position. While both the Sensex and the Nifty have slid nearly 5%, technical analysts say that they have gotten into a position where they will find it hard to scale back to earlier peaks. At the same time, they also risk plummeting more if the selloff continues.

Mo Money, Mo Biz Models

Venture capital is evolving. Last week, Sequoia Capital announced that it will be changing its business model. So far, Limited Partners, a VC’s VC, would invest in firms, which would promise exponential returns over a 7-10 year period. But Sequoia has said that’s old news. It wants to create an open-ended liquid fund, which will invest in companies across their lifecycle. And it will give LPs an option to exit every year.

Why now? It’s another move in the battle for capital and LPs. The way to attract the big money is to promise return on investment in the largest companies in the world. Sequoia Capital changed the business model to guarantee that.

For context: Tiger Global raised an $8.8 billion fund just six months after it raised $6 billion. Not to be left behind, Lightspeed is raising a $5.5 billion fund, a year after its last one. The groundwork was probably laid by Softbank’s $100 billion vision fund in 2019.

More Pain For China’s Economy

China’s economy showed signs of further weakness in October as factory output shrunk more than expected, falling for the second straight month. A severe power crisis and high raw material prices have taken their toll on the manufacturing sector.

Harsh restrictions after the emergence of new Covid-19 cases have slowed down holiday spending too.

Shrinking numbers: The official manufacturing Purchasing Managers' Index (PMI) slipped to 49.2 in October. A PMI below 50 indicates low procurement expectations. It remaining below the crucial mark for two months in a row suggests contraction in production and that the economy is under pressure from both supply and demand sides.

India-China friction: Meanwhile, tensions are increasing on India’s eastern border as Chinese incursions are said to be at the highest level since 1962. India has deployed recently acquired US-made weapons along the border.

It’s All About Capital

In a last ditch attempt to prevent catastrophic climate change, leaders from 200 countries began talks in Glasgow, UK, on October 31 to thrash out workable solutions. The fortnight-long COP26 hopes to tie up the many ends left loose at the Paris Conference in 2015.

India under pressure: Although some countries such as China and Saudi Arabia have set a net zero target of 2060, an alliance led by the US and UK are committed to 2050. India is yet to commit to one despite international pressure, arguing that developed countries have a higher responsibility due to their historical emissions. Prime Minister Narendra Modi, who is attending the conference, is not expected to yield.

Key arguments: India has to overhaul its energy systems to reduce its carbon footprint, which requires money. Prime Minister Modi will likely push for more support from developed countries to make an energy switch.

The Signal

Political conferences such as COP26 can set targets and try binding governments to commitments that often go unmet. The real change will be forced by global finance and markets. Many companies are putting in place climate change mitigation measures on their own for fear of not being able to raise money. Often, powerful institutions put pressure on financiers to cut off funding to polluting industries. India’s lack of a vibrant corporate bond market means its companies are dependent on institutional finance.

Another restricting factor in India’s climate change fight is the lack of a carbon credit market which is a great source of cash for companies.

Meta’s Ambitions Hinge On Facebook

Just like Apple and Google, Facebook is also back to the drawing board, preparing for a technological leap rather than incremental changes. The name change it announced earlier this week not only is its biggest pivot ever, but it is also an attempt to shake off the most incisive scrutiny it has faced since its founding.

Great leaps: It has promised to sink $10 billion building a metaverse, a sci-fi concept that Zuckerberg has described as the next chapter for the Internet and Facebook, now Meta. Facebook’s first big turn was when Zuckerberg spotted the potential of Instagram and bought it in 2012 in a $1 billion deal that he personally negotiated. He followed it up two years later with the purchase of WhatsApp for $19 billion. But it is another acquisition, Oculus, which it made in 2014 that is pivotal to its metaverse ambitions.

Tricky path: While Meta has the engineering chops and loads of money to write its next chapter, its success will depend on the ability to contain toxicity, something Facebook failed miserably in doing. Meta has to negotiate the global backlash and regulatory scrutiny. Zuckerberg has attempted to make sure that the media and political fire engulfing Facebook does not scorch Meta by separating its Reality Labs project.

It’s Not The Allspark, But Everyone Wants It

Nature rarely sculpts a cube. It leans more towards spheres—those orbs in space—because that is the perfect balance of gravity. A cube, however, has symmetry and holds a certain mystery for human beings, especially in pop mythology. Remember the Tesseract and the Allspark.

The cubists: Small tungsten cubes at $4000 apiece are the latest craze among online investors who went on such a buying spree that a major tungsten supplier found its stocks suddenly depleting. The run intensified after a Twitter joke about a shortage of the rare metal caused by crypto traders.

Heavy, heavy metal: A two-inch cube weighs five pounds. Most enthusiasts are also cryptocurrency and NFT aficionados who are using it as paperweights. They stare at it, contemplating the mysteries of the universe perhaps. It’s as if those inhabiting the digital world want to anchor themselves onto something. What’s better than one of the densest metals on earth?

What Else Made The Signal?

Knock knock: India has sought to reopen talks to enter the global nuclear cartel. Commerce Minister Piyush Goyal told the G20 that Nuclear Suppliers’ Group membership would be key to India being able to carry out its climate change responsibilities.

Koo wants more: India-born Twitter rival Koo is looking to expand into other Southeast Asian markets, including Indonesia, Malaysia, and the Philippines.

Time to take off: After over 18 months of a lull, domestic tourism is picking up again. Major attractions such as the Taj Mahal have thrown open their gates while domestic airlines are operating at 70-75% capacity.

Fly high: Adani has bought a 20% stake in Flipkart-owned travel app Cleartrip. As a part of the deal, Cleartrip will serve as the group’s online travel agency partner.

IPO soon: API Holdings, the owner of PharmEasy, is all set to file its draft red herring prospectus next week for a Rs 6,000-7,000 crore IPO.

Fall in line: The All India Institute of Medical Sciences’ director said that Covid booster shots are not a priority now. Instead, the goal should be to vaccinate the maximum number of people with their first shot and follow covid precautions.

Arrested: The Jaisalmer police has arrested former SBI chairman Pratip Choudhary in a loan scam case.

FWIW

Traffic-jam economist dies: The man who studied, and concluded, that traffic jams can never be wished away in big cities however wide the roads be, has died. Economist Anthony Downs, who studied the real estate market but was more famous for his books on traffic jams and voter behavior, was also well known for his public speeches peppered with jokes. He had a specific target of a joke every six minutes.

Roman Ibiza under water: Under the sea near Naples is a 2,000-year-old luxury resort that is believed to be a party spot for ancient Romans. Luxurious rooms, ornate mosaic floors, fountains, and ancient baths, part of the resort, have now been opened up to scuba-diving and snorkeling tourists, who can choose from seven diving spots.

Ghosts’ own country: Not many Indians may have heard of Varkala, but the little town in Kerala is a favourite spot for foreign tourists. So are areas such as Morjim in Goa and Fort Kochi in Kerala. Ever since the Covid-19 lockdown, these hotspots have turned into ghost towns with home-stays and stores shutting down. With international travel slowly opening up, the tourism folks are hoping for a quick revival of these ghost towns.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.