Silicon Valley Is Going Under

Also in today's edition: Twitter wants you to shop, a new fund is here, booster shots

Good morning! News broke yesterday morning that Ixigo had raised over $50 million in primary and secondary capital in a fresh round of funding. It seems this is a pre-IPO round by the company, which plans to list sometime this year. The lead investor, Singapore’s sovereign wealth fund, GIC, seems to be very bullish that travel will take off soon.

On to the day’s stories:

Big Tech raked in the moolah last quarter.

Ola’s playing a different game.

The IMF is raising red flags. Things aren’t ok.

IMF Has Got The Jitters

The International Monetary Fund (IMF) has started to feel a little anxious. It has warned that emerging economies will take longer to limp back to normal if they don’t get enough vaccines to battle the pandemic. Frequent waves of the virus will cause shutdowns and the longer it takes, the worse it will become.

Where is India in all of this? The IMF expects emerging economies to grow at 3.9%. But expects the Indian economy to grow by 9.5%. This isn’t good news. It is three percentage points lower than its earlier estimate.

Another rule for the others: Gita Gopinath, the IMF’s chief economist, however, upgraded the growth projections for advanced economies.

Why: The IMF says rich countries have the financial muscle to keep their economies afloat in a crisis. There is going to be a growing gap between the rich and the poor and it should worry everyone.

Google’s Going To Feel A Little Wet

San Francisco Bay Area in the US is the tech hub of the world. It’s also one of the spots most vulnerable to flooding. Research suggests that global warming could force sea levels higher by ~2 feet in a few decades. This puts campuses such as Google and Facebook at risk of inundation.

Fencing: Local governments are looking to build embankments and restore marshes on the shoreline to prevent disasters, but it’s a costly affair. Here’s the twist though – many of the tech projects were built on vulnerable land despite clear evidence of the risks.

Time to pay up: Naturally, local residents want the techies to pay their fair share to prevent flooding. While Facebook has committed $7.8 million for protection efforts, that’s just 0.009% of its 2020 annual revenue. State allocation, on the other hand, is 13% of the annual budget.

Big Tech Is Only Getting Bigger

Big tech hit a monster home run this quarter. Cue the Shohei Ohtani references, please. Brushing aside concerns over antitrust, the calls for “breaking them up”, and thanks to increased economic activity, they broke records, even as caution takes over the next quarter. Big tech, on Tuesday, reinforced the belief that it isn't done yet. Far from it. And well, Facebook and Amazon are yet to come. Just saying.

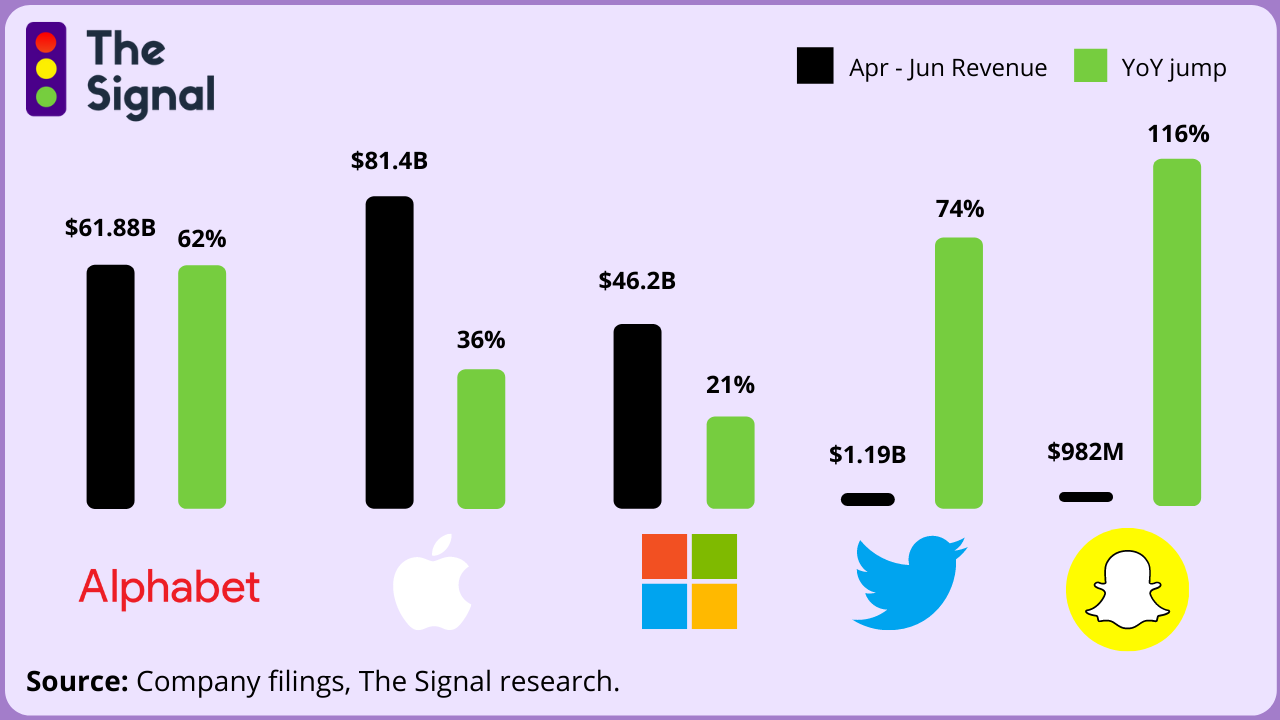

So, what’s going on? Let’s start with Apple, which grew across the board — from iPhones to Macs to iPads to services — posting a Q3 revenue of $81.4 billion, a 36% year-on-year increase. The iPhone was quite the star of the show, with $39.6 billion in sales (a 50% quarter-on-quarter increase). Mac and iPad sales broke quarterly records too, and services rose year on year from $13.2 billion to $17.4 billion.

The LinkedIn surprise: First, it crossed $10 billion ($3 billion in this quarter alone) in annual revenue, the first time since its 2016 acquisition, primarily due to advertising. Commercial cloud (36% YoY growth) delivered too, so did gaming (11% YoY). Overall, Microsoft reported $46.2 billion in revenue, a 21% increase on a YoY basis.

The Alphabet Juggernaut: With 15 billion views, YouTube’s Shorts is making quite the splash against TikTok, and helping the streaming platform earn serious ad revenue along the way. $7 billion to be precise. It headlined a quarter where Alphabet earned $61.88 billion in revenue, a 62% increase on a YoY basis. As the world opened to a considerable degree, so did Google.

The Signal

The phenomenal sales of iPhones aside, this is a quarter where exponential growth in digital advertising seems to be a common thread. The early indications of that boom came via Snap and Twitter’s results, with the companies posting 116% and 74% revenue growth in Q2 respectively. Cut to Alphabet, which has ridden the wave of increased online activity during the quarter, prompting advertisers to go big again, sometimes at the cost of traditional media. That also explains why LinkedIn Marketing Solutions managed to corner $3 billion, besides a 53% jump in Microsoft’s search business.

Ola Is Playing Checkers

Earlier this week, news broke that Ola is going to start selling used cars. The Entrackr story quotes an unnamed source, who said that the company planned to buy used cars from customers, service them, and then put them up for sale.

From hailing to selling: Ola has always been a tech company, which sold services. Its recent EV play, which mirrors its investor Didi Chuxing, is its first foray into being an OEM. Now, to get into selling used cars, Ola is trying to be a complete mobility player.

But why? India’s economy is still struggling and selling vehicles seems counterintuitive. But it may actually work out. For three reasons:

People want to buy cars because of the pandemic and may not be able to afford new cars.

The chip shortage is creating difficulties in production of new cars.

Cab travel is down, this gives an avenue for Ola to buy the used cars from its drivers.

What Else Made The Signal?

Billionaire take-off: India’s prominent investor Rakesh Jhunjhunwala is planning to buy 70 aircraft in the next four years. He has promised to invest $35 million for a 40% ownership in the airline.

One more shot: Those vaccinated with Pfizer and AstraZeneca jabs may need a booster shot since new research indicates that antibody levels start declining as soon as six weeks after complete vaccination.

No more intermediaries: Indian crypto platform WazirX is in the process of introducing a decentralised exchange that will eliminate an intermediary for transaction clearance.

End of the road? Ecuador has revoked Wikileaks founder Julian Assange’s citizenship. He is currently in a UK jail awaiting possible extradition to the US.

Govt wins: In what can be seen as a victory for the government, the Delhi High Court has decided that Twitter is in “total non-compliance” with India’s new IT rules.

Fresh moolah: Freshworks founder Girish Mathrubootham and Eka Software founder Manav Garg have launched an $85 million fund called Together. Meanwhile, Trifecta Capital has closed its late-stage fund with a capital raise of $130 million from domestic investors.

Tweet your order: Twitter is piloting a new feature in the US allowing businesses to add a shopping section to their profile, whereby users can complete purchases without leaving the platform.

Fun Signals

Golden haul: Japan is on top of the Olympic table. That’s having a domino effect on some of the stocks in that country. People are piling on to shares of companies with any association to the medal-winners, from real estate to car park operators, whose shares are now climbing up.

Bubbly without bubbles: Champagne is famous for its bubblies but the region is now making more flat wines. The reason? Climate change. Global warming has led to higher temperatures which allow grapes to ripen fully, and hence, allowing for fuller wines.

Is your cat happy? If you’ve ever wanted to know what your feline friend is feeling, there’s now an app that can tell you. Tapley, a Calgary-based app uses AI and facial recognition tools to tell pet parents if their cat is happy, healthy, or in pain.