Tata recasting steel

Also in today’s edition: LinkedIn: Acquaintances better than friends; Not productive if manager can’t see staff; Temple treasure; Xi’s October

Good morning! Do you want to buy a Gucci bag and not have to sell a kidney for it? It might just be possible. Luxury fashion brands such as Gucci, Burberry, and Stella McCartney have entered the secondhand market. Why? Because pre-owned luxury is a booming $32 billion industry and gaining popularity, especially among young consumers, reports the Wall Street Journal.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

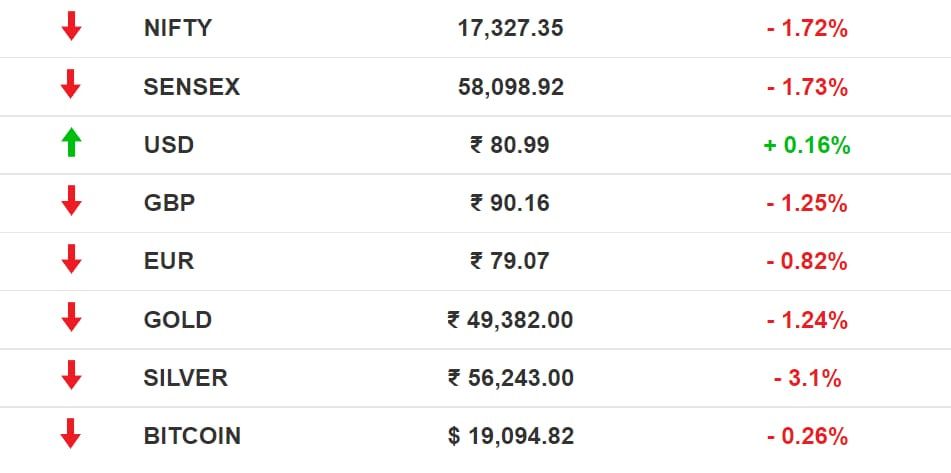

The Market Signal*

Stocks: The Fed rate hikes are leaving other markets poorer. Foreign portfolio flows into Indian equities fell sharply after topping $6 billion in August. September inflows so far are just over $1 billion. Star fund manager Cathie Wood of Ark Investment Management, which took a hit after the tech stocks rout, has given up two portfolios to colleagues, Financial Times reported.

Early Asia: The SGX Nifty (-0.90%) and Nikkei 225 (-2.21%) lagged at 7.30 am India time. The Hang Seng Index (0.083%) crawled upwards.

CORPORATE

Welding It Together

In a series of ads in the 1990s, Tata Steel presented itself as a philanthropic enterprise transforming lives. The ads ended with the punchline, “We also make steel”.

Over the years, an unwieldy group of companies grew around it, producing different kinds of metal products. Now the group is consolidating all of them—seven, including four listed—into Tata Steel. Soon after he became Tata Sons chairman, N Chandrasekaran began untangling the 100-company group’s corporate structure and holdings. The strategy is to create integrated companies in 7-8 industries to increase operational efficiency and balance sheet strength. The number of listed companies will come down to ~15 from 29.

Tata Steel’s bugbear, however, lies overseas. Efforts over the past 5-6 years to sell off European assets and South African operations have failed. Its European operations make money only when steel prices are sky-high.

BIG TECH

A costly experiment?

If you’re looking for a job on LinkedIn, tap your acquaintances rather than your close friends for an introduction. It’s your best bet, a new study co-authored by LinkedIn and published in the journal Science found.

What: The study included more than 20 million arbitrarily selected LinkedIn users. Over five years, researchers randomly varied the proportion of strong and weak contacts suggested by LinkedIn’s “People You May Know” algorithm.

But: While such large-scale algorithmic experiments are routine in Big Tech, LinkedIn has come under scrutiny because the study could have affected the likelihood of some people getting a new job. The company did not inform users that such tests were underway. Sounds like A/B testing at scale.

Deadly algos: In the US, more than 70 lawsuits have been filed this year claiming that the algorithms of companies like Meta, Google, TikTok, and Snap are causing real-world harm — including death by suicide.

WORK

Productivity Is In The Eye Of The Manager

Is the end nigh for remote work? The signals are mixed. The latest Microsoft Work Trend report says employees (87% of those surveyed) overwhelmingly believe they are productive. So do the metrics. Yet 85% of employers can’t “see” if employees are getting enough done.

Alphabet CEO Sundar Pichai says the macroeconomic conditions are not what it asked for but staff should not “equate fun with money”. Google has introduced austerity.

Elsewhere: After Apple, Peloton, and Comcast, General Motors is asking its remote workers to return to office three days a week. BTW, only 15% of job listings offered the option to work from home compared to 20% a few months ago.

The Signal

Companies are unable to find a balance between staff satisfaction, managerial capacity, and productivity improvements. Ever conscious of shareholder value, corporate leaders tend to err on the side of caution and costs. That’s why Pichai could not answer why he was scrimping on perks when the company was loaded with cash. During research conducted in the early days of the pandemic, managers had expressed reservations about remote working and employee productivity. Their scepticism remains strong and managers believe they can’t get the best of their teams from afar, the Microsoft study shows.

Last week, 95% of 41 UK firms that experimented with four-day work weeks reported improved or unchanged productivity. Bonus: Employees benefited from saving on commuting. But managers are likely to have the last word.

WEALTH

Hill Of Riches

If Tirumala Tirupati Devasthanam, the trust that runs the Tirupati Venkateswara hill shrine, was a company, it would be among the most valuable in the world.

What: The temple riches include 7,123 acres of land, 14 tonnes of gold and ₹14,000 crore in fixed deposits, and are valued at ₹85,000 crore. Their market value could be over ₹2 lakh crore, putting it ahead of TCS, Wipro, ITC and Infosys, and on a par with Vedanta in terms of assets.

More: The wealth, accumulated through donations from devotees, is expected to increase as it adds temples in India and abroad. The newest is coming up in Navi Mumbai, where the Maharashtra government has donated 10 acres of land.

Yet, like corporations, it faced a liquidity crunch when the pandemic hit, struggling to pay staff and letting contract workers go.

CHINA

Party Watch

Not just global leaders, even markets are looking for useful portents at the Chinese Communist Party’s 20th Congress that begins mid-October.

Consolidating power: The most awaited event, of course, is XI Jinping’s expected re-anointment as the general secretary for an unprecedented third time. But to markets and asset managers, the new team that will steer the economy is more important.

New team: Premier Li Keqiang and his deputy Liu He are expected to step down. Both were instrumental in soothing frayed nerves and business confidence over the past few months as Xi pressed on with his unpopular zero-Covid policy, disrupting economic activity and global supply chains.

Xi has quelled opposition ruthlessly. Even history is being watched closely, as the famous livestreamer “lipstick king” found out.

Rumour mill: Saturday Twitter was agog with rumours of a coup in China which turned out to be something like this:

| |||

Today in Beijing, I investigated the #chinacoup so you don’t have to. At considerable personal risk, I ventured out to some neuralgic key points in the city. Disturbing finds. Brace yourselves. /1 | |||

| |||

Sep 25, 2022 | |||

| |||

34.6K Likes 6.19K Retweets 1.41K Replies |

FYI

Trickle down: The upcoming on-campus placement season could be underwhelming. Startups and e-commerce companies may go slow because of macroeconomic headwinds.

Cleared: Byju’s has paid its dues owed to Blackstone-backed Aakash Educational Services $234 million as part of a $950 million deal to acquire the tuition chain.

Stay put: In a matter of days, Ola has reversed its planned decision to fire 200 engineers across verticals.

Dark clouds: The British antitrust regulator, Ofcom, will probe whether Amazon, Google, and Microsoft are dominating the cloud services market in the UK, as part of a wider investigation that also includes messaging and smart devices.

Add to cart: Reliance Retail is in talks to acquire Kerala-based electronics and grocery retail chain, Bismi.

In the dock: The Government is looking to revamp GST laws, which includes raising the threshold for criminal offences to ₹20 crore from ₹5 crore.

Bagged: Digital banking infrastructure provider Signzy has received ₹210 crore from a group of investors led by Gaja Capital in its latest funding round.

FWIW

Press pause: In the latest series of roadblocks for Ford is a shortage of the iconic blue oval badges for its F-Series pickup trucks. The company did tinker with a workaround such as a 3D printed insignia but eventually dropped the idea. About 40,000 to 45,000 vehicles are in line to be shipped to dealers. What's worse? The supply chain issues are expected to go on until 2024.

Only cash, please: The newly married in the US are now asking for cash rather than gifts to help them with home down payments or other housing costs. The trend is picking up in the US as housing costs keep surging. Can anyone blame them in this economy?

Look up: Sci-fi nerds, this one’s for you. This evening, around 11 million km from Earth, a NASA spacecraft will ram into an asteroid at over 25,000 kph. No, the aim is not to blow the asteroid into smithereens because it's hurtling towards Earth. The collision is only expected to nudge the asteroid slightly off course. Why? Because NASA is showing off its planetary defence capabilities. No, seriously.

🎧 An asteroid is hurtling towards Earth. But NASA is playing the superhero with a cape. American bankers stand united against the Chinese dragon. The Signal Daily is available on Spotify, Apple Podcasts, Amazon Music, and Google Podcasts, or wherever you listen to your podcasts.

Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here.

We recently got funded. For a full list of our investors, click here.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.