That’s one expensive hangover

Also in today’s edition: Zee’s latest drama, China’s desert power, Swiggy’s social gambit

Good morning! Bhai is back. It’s not like he had gone anywhere but Salman Khan is now riding the NFT wave. The actor along with long-time collaborator Atul Agnihotri will be releasing digital tokens via something called Bollycoin. Hopefully, it will be something more entertaining than his last four films.

Btw, we’ve got a new podcast going. It drops every weekday at 5-ish PM. Give us a try. Subscribe, turn on notifications, and give us a shoutout on social media.

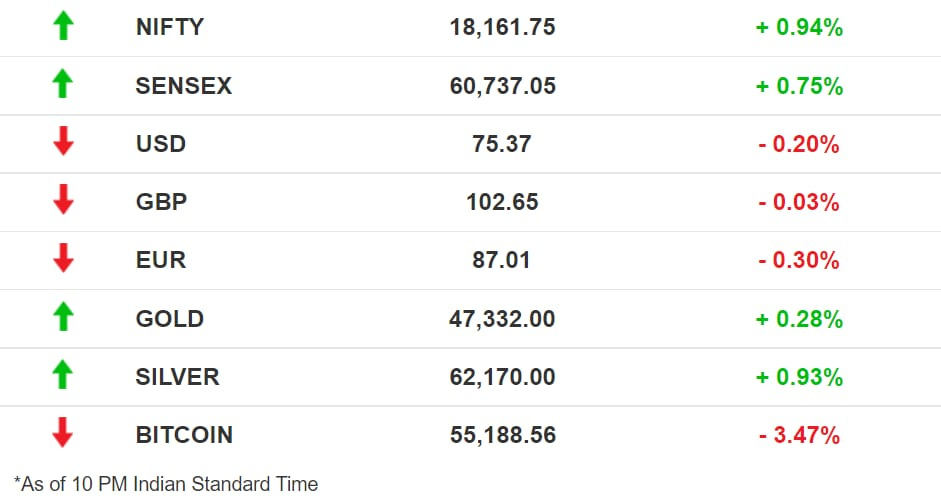

The Market Signal

Stocks: Indian benchmarks registered fresh record closes on the back of their fifth straight session in the green. All sectoral indices except for Realty closed in the green, with Tata Motors and M&M driving Auto (3.43%) to the spot of biggest gainer.

Swiggy’s Going Social

Swiggy is studying its investor Meituan extremely closely. According to Entrackr, the food and grocery delivery company is about to test social commerce. The project is named Swiggy Bazaar. The company is trying to encourage people to bulk buy groceries from it.

But Swiggy already has instamart: The biggest cost for any e-grocer is delivery. Every company, be it Grofers or BigBasket, breaks even when the order value passes a certain threshold. But Indians are slightly hesitant to pay high delivery charges. Swiggy, via Instamart, has been subsidising these charges in exchange for building habit. But like all habits, it is expensive.

Social commerce has the answer: It’s a win-win when customers combine their small lists into a bulk order which makes it worthwhile for the company to deliver at low or no extra charge. The likes of Flipkart, Meesho, and DealShare have all proven that there is a market for bulk delivery through social commerce in India. And Meituan has proven that the model can work at scale too.

Falling Sick May Cost You More

A surge in the cost of pharmaceutical ingredients is squeezing drug makers. Prices of 399 essential drugs in India are controlled but pressure is mounting on the government to mitigate high input costs. Even widely used fever-controlling tablets and syrup are becoming expensive to make as paracetamol prices have more than tripled.

China factor: Drug makers import raw materials from China where production losses due to an energy crisis have led to factory shutdowns and high prices. Prices of packaging materials have risen too. Aluminium is at a 13-year-high.

Another blow: Aluminium prices are affecting a range of industries from foils used in packaging medicines to beer cans. Beer maker Heineken said that the increasing metal prices will impact its profitability in the next year. That means neither can you have a beer nor afford a hangover.

Entertainment’s Battle Royale

In a new twist in the battle between promoters of Zee Entertainment and its single largest shareholder, Invesco Developing Markets Fund, a new protagonist has emerged, billionaire Mukesh Ambani’s Reliance Group.

Zee managing director Punit Goenka has said that Invesco was trying to oust him after he rejected a merger proposed by the firm. Invesco said it only facilitated merger talks between Reliance and Zee’s promoter family. Reliance later said it had abandoned the deal because the promoters wanted to increase their stake.

Multiple troubles: In an interview to The Hindu newspaper in September 2018, Zee group chairman Subhash Chandra said, “this gentleman (referring to Mukesh Ambani) has a different style of doing business. We will fight this out too. We will still stick to our ethical business practices”. He also said that the DNA of the Reliance group was monopolistic.

In December 2018, a proposed merger of the DTH arms of Zee and Videocon groups soured. In January 2019, Zee shares fell precipitously after reports of a probe into suspicious transactions in group companies. Chandra wrote a letter to lenders and shareholders saying “negative forces” were at work against his companies.

Twist: In a surprise move this September, Zee and Sony Pictures inked a deal to merge creating India’s second-largest entertainment network even as Invesco was fighting to oust Punit Goenka.

The Signal

It is tempting to speculate that a corporate rivalry was seeded in a media interview in which a media tycoon made remarks about the 10th richest man on earth. But the cold logic of business explains why Reliance may want to acquire Zee, one of the biggest players in entertainment content. A merger of Sony and Zee is even worse as the combined entity would be a formidable competitor, especially with Sony’s deep pockets.

Green Is The Colour

China is building a massive renewable energy project in the Gobi desert with a projected capacity of 100 gigawatts. That’s greater than all of the wind and solar-generated power in India and four times as much as generated at the Three Gorges Dam — China’s and the world’s largest power plant by installed capacity.

Step by step: Meanwhile, Reliance is building a stable of clean energy companies with some choice picks to its unit Reliance New Energy Solar Ltd. Its latest moves are a $29 million investment in a German solar wafer manufacturer, NexWafe GmbH, and an agreement with Danish Steisdal to bring the latter’s hydrogen electrolysers to India. Why? Mukesh Ambani has stated his ambition to make India the world’s largest green hydrogen-producer, and bring down its cost to $1/kg within a decade.

All this still might not be enough to save the world though, as the IEA has said carbon emissions ‘will drop just 40% by 2050 with countries’ current pledges’.

Sponsored by Uber Urban

Have you ever wanted premium, hotel-like bedlinen? They're hard to find! We've got a solution for you - Head over to Uber Urban for their best-in-class 100% Cotton 300 thread-count bedsheets. Their Super King sized bedsheet is ideal for the largest mattress available in the market - this royal experience will enhance the look of your bedroom.

Signal readers get an exclusive, 20% discount - simply use the code SIGNAL while checking out.

What Else Made The Signal?

Pick me: Amazon systematically studied products on its platform in India to make its own competing knockoffs and pushed them to its online storefront, a Reuters investigation revealed.

Need for equality: Less than 11% of women make up the judiciary of India. In the Supreme Court, just four out of 33 judges are women while only 66 out of 627 High Court judges are female.

Counter move: In the continuing Epic Vs Big Tech saga, Google has countersued the Fortnite maker for breaking contractually agreed rules whilst listing on the app store.

Screeching halt: Typhoon Kompasu brought Asian financial hub Hong Kong to a standstill on Wednesday, with even stock markets shutting down.

TaMo’s EV push: Tata Motors is upping the focus on its $9.1 billion electric vehicle business after a $1 billion funding by private equity firm TPG and Abu Dhabi’s ADQ.

Project red card: Hundreds of professional footballers are threatening legal action against major gaming, betting, and sports data companies over the allegedly unlawful use of personal information and performance statistics.

ICYMI

Toxic Blue Origin: Jeff Bezos’ aerospace firm Blue Origins, which took - the - William Shatner on a trip to space yesterday, may look like a dream employer from the outside. But in reality, the workplace is a toxic cocktail of sexism, harassment and inappropriate behaviour, according to this investigation by The Washington Post which is owned by Bezos himself.

It’s personal: Apart from the allegations made by whistleblower Frances Haugen, Facebook is also facing legal heat in countries such as Australia. The country’s deputy prime minister Barnaby Joyce is now forcing his government to impose accountability on US social media firms. Both Barnaby’s and Haugen’s resolve to tame the company hardened after witnessing social media toxicity first hand.

Shanghai Don: Rags to riches was the story of Shanghai underworld don Du Yuesheng. This piece chronicles Du’s journey from an opium dealer, criminal brotherhood of Green Gang to becoming the region’s most influential business tycoon. Unfortunately, today his contribution is overlooked.

Correction: Contrary to what was mentioned in our edition of October 13, Gaana HotShots is not functional. We apologize for the error.

The Signal and our podcast, The Signal Daily, are both taking a break. We’ll be back next Tuesday. See you then.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.