The rise and rise of China’s chip industry

…and what it means for the global economic and security landscape

Good morning! Over the last eighteen months or so, China's growing ambitions in the semiconductor space have been the subject of constant tensions between the country and the US, so much so that there is a ‘Chip War’ already taking place. Today’s insightful essay delves into that, and how China’s once-laggard chip industry, has become the subject of many a fear in Washington, and what is at stake globally. Also, we have some of the best curated longreads for your weekend pleasure. Dive right in!

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter, Instagram.

Robyn Klingler-Vidra and Steven Lai

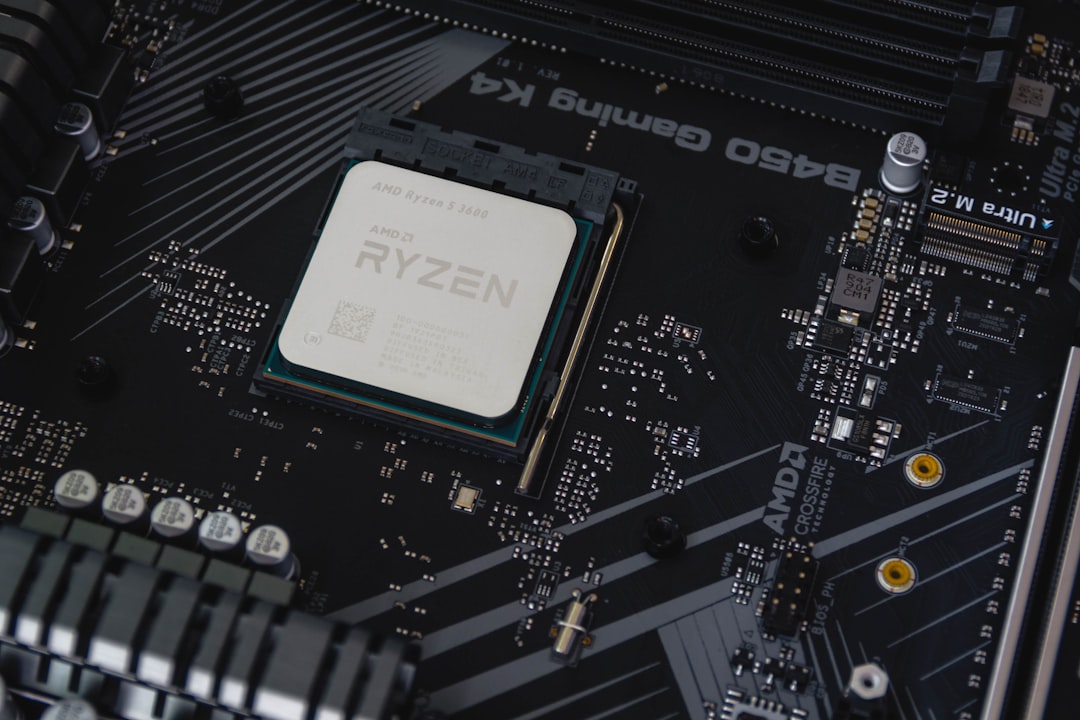

China’s national champions for computer chip – or semiconductor – design and manufacturing, HiSilicon and Semiconductor Manufacturing International Corporation (SMIC), are making waves in Washington.

SMIC was long considered a laggard. Despite being the recipient of billions of dollars from the Chinese government since its founding in 2000, it remained far from the technological frontier. But that perception — and the self-assurance it gave the US — is changing.

In August 2023, Huawei launched its high-end Huawei Mate 60 smartphone. According to the Center for Strategic and International Studies (an American think tank based in Washington DC), the launch “surprised the US” as the chip powering it showed that Chinese self-sufficiency in HiSilicon’s semiconductor design and SMIC’s manufacturing capabilities were catching up at an alarming pace.

More recent news that Huawei and SMIC are scheming to mass-produce so-called 5-nanometre processor chips in new Shanghai production facilities has only stoked further fears about leaps in their next-generation prowess. These chips remain a generation behind the current cutting-edge ones, but they show that China’s move to create more advanced chips is well on track, despite US export controls.

The US has long managed to maintain its clear position as the frontrunner in chip design, and has ensured it was close allies who were supplying the manufacturing of cutting-edge chips. But now it faces formidable competition from China, who’s technological advance carries profound economic, geopolitical and security implications.

Semiconductors are a big business

For decades, chipmakers have sought to make ever more compact products. Smaller transistors result in lower energy consumption and faster processing speeds, so massively improve the performance of a microchip.

Moore’s Law — the expectation that the number of transistors on a microchip doubles every two years — has remained valid in chips designed in the Netherlands and the US, and manufactured in Korea and Taiwan. Chinese technology has therefore remained years behind. While the world’s frontier has moved to 3-nanometre chips, Huawei’s homemade chip is at 7 nanometres.

Maintaining this distance has been important for economic and security reasons. Semiconductors are the backbone of the modern economy. They are critical to telecommunications, defence and artificial intelligence.

The US push for “made in the USA” semiconductors has to do with this systemic importance. Chip shortages wreak havoc on global production since they power so many of the products that define contemporary life.

Today’s military prowess even directly relies on chips. In fact, according to the Center for Strategic and International Studies, “all major US defence systems and platforms rely on semiconductors.”

The prospect of relying on Chinese-made chips — and the backdoors, Trojan horses and control over supply that would pose — are unacceptable to Washington and its allies.

Stifling China’s chip industry

Since the 1980s, the US has helped establish and maintain a distribution of chip manufacturing that is dominated by South Korea and Taiwan. But the US has recently sought to safeguard its technological supremacy and independence by bolstering its own manufacturing ability.

Through large-scale industrial policy, billions of dollars are being poured into US chip manufacturing facilities, including a multi-billion dollar plant in Arizona.

The second major tack is exclusion. The Committee on Foreign Investment in the United States has subjected numerous investment and acquisition deals to review, ultimately even blocking some in the name of US national security. This includes the high-profile case of Broadcom’s attempt to buy Qualcommin 2018 due to its China links.

In 2023, the US government issued an executive order inhibiting the export of advanced semiconductor manufacturing equipment and technologies to China. By imposing stringent export controls, the US aims to impede China’s access to critical components.

The hypothesis has been that HiSilicon and SMIC would continue to stumble as they attempt self-sufficiency at the frontier. The US government has called on its friends to adopt a unified stance around excluding chip exports to China. Notably, ASML, a leading Dutch designer, has halted shipments of its hi-tech chips to China on account of US policy.

Washington has also limited talent flows to the Chinese semiconductor industry. The regulations to limit the movements of talent are motivated by the observation that even “godfathers” of semiconductor manufacturing in Japan, Korea and Taiwan went on to work for Chinese chipmakers — taking their know-how and connections with them.

This, and the recurring headlines about the need for more semiconductor talent in the US, has fuelled the clampdown on the outflow of American talent.

Finally, the US government has explicitly targeted China’s national champion firms: Huawei and SMIC. It banned the sale and import of equipment from Huawei in 2019 and has imposed sanctions on SMIC since 2020.

What’s at stake?

The “chip war” is about economic and security dominance. Beijing’s ascent to the technological frontier would mean an economic boom for China and bust for the US. And it would have profound security implications.

Economically, China’s emergence as a major semiconductor player could disrupt existing supply chains, reshape the division of labour and distribution of human capital in the global electronics industry. From a security perspective, China’s rise poses a heightened risk of vulnerabilities in Chinese-made chips being exploited to compromise critical infrastructure or conduct cyber espionage.

Chinese self-sufficiency in semiconductor design and manufacturing would also undermine Taiwan’s “silicon shield”. Taiwan’s status as the leading manufacturer of semiconductors has so far deterred China from using force to attack the island.

China is advancing its semiconductor capabilities. The economic, geopolitical and security implications will be profound and far-reaching. Given the stakes that both superpowers face, what we can be sure about is that Washington will not easily acquiesce, nor will Beijing give up.

Robyn Kingler-Vidra is Associate Dean, Global engagement and Associate Professor in Entrepreneurship and Sustainability at King’s College, London. Steven Hai is Affiliate Fellow, King’s Institute for Artificial Intelligence at King’s College, London

This article is republished from https://theconversation.com under a Creative Commons licence. Read the original article at https://theconversation.com/chinas-chip-industry-is-gaining-momentum-it-could-alter-the-global-economic-and-security-landscape-222958

ICYMI

The Ozempic town: Kalundborg is probably the most important town in Denmark, more so than its capital city of Copenhagen, situated 100-odd kilometres away. It is in this town of 16,000+ where Europe’s most valuable company — Novo Nordisk is based. Novo Nordisk found initial fame in selling drugs used in the treatment of diabetes. Its new-found success, making it a household name, however, comes from weight-loss drugs Ozempic and Wegovy. That race to maximise profits have played a significant role in Kalundborg’s growth, with the company investing a lot into the town and paying a lot of taxes. This detailed story in The Economist’s 1843 Magazine, looks at the town’s unique history — from its pre-war shipbuilding roots to becoming home to Carmen, the hair curler company in the 1960s, to the Novo Nordisk era when Kalundborg is a city transformed.

Guided gamblers: “The average time an Indian trader holds an option is less than 30 minutes.” That is a startling figure. But there is more; 90% of retail traders lose money in derivatives and their collective losses added up to $5.4 billion in FY22. Skyrocketing stock indices, swelling company valuations and burgeoning individual wealth has been breathtakingly covered by the media and content creators on social media. It has drawn million of retail investors, a sizeable number of them for the first time, to the stock markets, and often to instruments that require knowledge and patience which they sorely lack. Bloomberg reports how social media influencers have interjected themselves into this milieu as guides along the roads to riches, offering courses and tips on private messaging groups and becoming millionaires themselves in the bargain. They also double up as a funnel for broking firms. It has surprised market regulator Sebi that enthusiasm for short-term trading has not died down despite losses. It is now punishing unscrupulous finfluencers and erecting safeguards. But it also does not want retail participation to dwindle. After all, there is no market without speculators.

The real deal: It isn’t surprising that the elites want to keep something exclusive to them. For a long time, that something was Davos. Of late though, Davos is anything but exclusive, leaving The Institut International d'Études Bancaires to take its place. The institute has been bringing together the who’s who of European finance and politics for 73 years now. The institute takes its exclusivity very seriously; members, meeting agenda and minutes are never made public. The three-day biannual extravaganza seeks to promote familiarity amongst the leaders of the industry, with that familiarity leading to eventual partnership. Like the 1997 merger of Swiss Bank Corporation and Union Bank of Switzerland for $29.3 billion. To know more about this world and its secrets, read this interesting article in the Financial Times.

Harbinger of change: That’s how VCs would describe themselves. Everything they touch has the potential to change the world because they’ve the midas touch. That 99% of VC bets fail is both, a fact well-known and easily forgotten. Yet, VCs are glorified and praised for their world changing zeal, if not anything else. Trail Mix Ventures or TMV is another such VC but it’s different because they’re actually putting their money where their mouth is. Established by Marina Hadjipateras and Soraya Darabi, TMV has invested in startups that fit the impossible trident of fixing the climate, fixing humanity, and making piles of money. Their latest bet is on the logistics sector, with investments in startups that are solving for per-voyage emissions, cargo demand, managing warehouses etcetera. It’s not an easy task, but this detailed profile of the women behind TMV in the Wired does a pretty decent job of explaining their adventures.

Depp and Salman play Jai and Veeru: Fighting off sexual assault charges in an ugly public battle can really leave a man lonely. Or worse, still, fighting off charges of brutally murdering and dismembering a famous journalist. Perhaps that is why actor Johnny Depp and Saudi Arabia’s de facto ruler Prince Mohammed bin Salman Al Saud are hanging out together so much. Or maybe it’s just the money. This story in Vanity Fair is an inside look into the budding bromance between Depp and MBS. It started with the Saudis offering to fund Depp’s flailing film Jeanne du Barry and has now ended in guitar strumming sessions and late-night chats on MBS’ luxury yacht on the Red Sea. Depp has joined a bevy of Hollywood (and Bollywood) celebrities supporting Saudi Arabia’s ambitions to become a global entertainment centre, attending the Red Sea film festival and shooting parts of their film in the kingdom. Can Depp help MBS make inroads into ‘progressive’ Hollywood the way Saudis have spent their way into Silicon Valley and international sport? If he succeeds, this friendship could be the image whitewashing redemption arc both men need.

When cultures collide: In times of great polarisation and ethnic violence, we forget that cultures are more complex than we realise. Take the example of the 8th century CE language Arwi. This story in the BBC traces the history and evolution of the language, written in a modified Arabic script, but with words and meanings borrowed from the Tamil language. Arwi was born from the interaction of Arab seafaring traders and local Tamil communities, mostly from the need to understand each other and conduct trade seamlessly. Slowly, it became the language that brought together intercultural couples: Arab traders often married Tamil muslim women and turned business ties into personal ones. But the language is dying out and old books written in the language are often rescued from various states of abandonment. Yet, hundreds of villages and communities in Tamil Nadu painstakingly preserve oral and written Arwi traditions; some younger folks have even built an Arwi language Android keyboard!