Trump wants Truth🤡

Also in today’s edition: RBI rule trips auto pay, Funding the funded, PayPal picks Pinterest

Good morning! Manchester United is coming to India. Well, sort of. Its owners, the Glazer family, has been rumoured to be interested in purchasing an IPL franchise. The plan is to make it a global superpower like the football club in the UK. It’ll be curious to see if the #Glazersout protest follows them to the sub-continent. Just for the record, the family is competing with Gautam Adani and HT Media Group, among others, to buy a franchise. Interesting times.

Btw, our podcast has been going strong for over a month now. Tune in on your daily jog, drive to the office, or even as you WFH-ers have breakfast in bed. We promise it’ll be music to your ears.

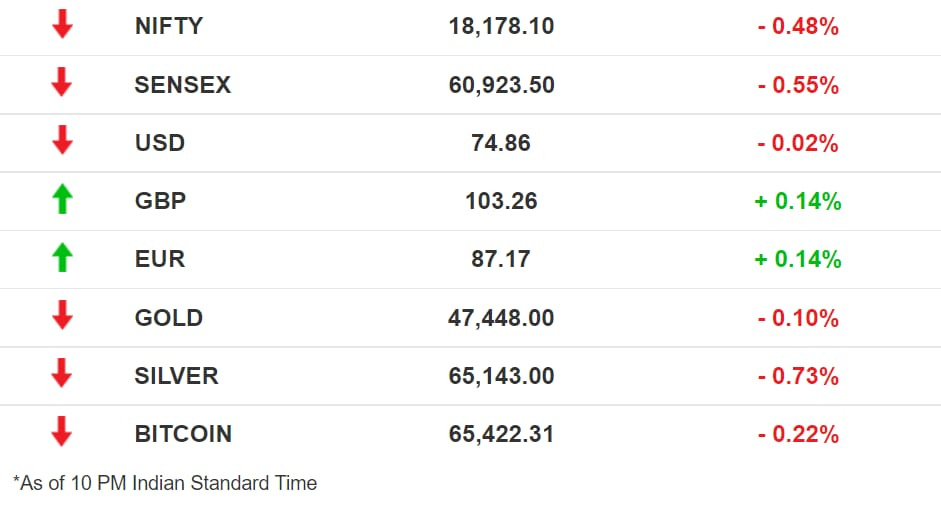

The Market Signal

Stocks: Indian benchmarks registered their third straight session in the red as profit booking from record highs continued in many stocks. Among the sectoral indices, IT (2.53%) and Metal (1.77%) were the biggest drags, while PSU Bank (2.73%), Private Bank (1.27%), and Financial Service (1.22%) outperformed. Kotak Mahindra Bank rallied nearly 7% to register a fresh 52-week high price of ₹2,155/share.

The Trumpian Non-Woke Social Media Odyssey

The former POTUS and failed casino owner, who had to permanently shut down a blog after a month because no one read it, is back!

Donald Trump, the man banned from Twitter, YouTube, and Facebook, now wants to take them on, with a social network of his own — TRUTH Social, and a subscription-based OTT platform called TMTG+ for “non-woke entertainment” (code for right-wing culture wars). And he’s doing it via the 2021 thing to do: a Spac. A press release quoted Trump as saying, “TMTG will stand up to the tyranny of the Big Tech”, a key grievance and rallying cry among Trump’s most ardent supporters.

| |||

This press release reporters are getting is legit - confirmed to me by sources close to former President Trump. He is launching a media company with a social media platform called “TRUTH Social”. | |||

| |||

Oct 21, 2021 | |||

| |||

236 Likes 142 Retweets 387 Replies |

Ideological social networks are echo chambers of misinformation, conspiracy theories, and other things (January 6th). They promise “free speech” as a feature but do not quite succeed because there’s no one to trigger or troll (can’t own the libs!). That’s why sketchy Trumpian platforms such as Gab , Parler, and Gettr haven’t quite hit the high notes they promised.

Magnesium Could Stall The Global Car Industry

After a semiconductor shortage, the automotive industry has a new problem now: a magnesium crunch. The metal is a key component in manufacturing aluminum alloys that are widely used in cars, from body panels to engine blocks.

Blame it on China: Once again, this hiccup boils down to the energy crisis in China. The Asian country produces nearly 85% of the world’s magnesium. Yulin, the hub of its production, shut down 35 out of 50 factories and scaled-down manufacturing at the rest.

Trouble, trouble: While the US produces a considerable amount of the metal, it may not be enough to meet global demand. Magnesium reserves across the world are already at critical lows, with Europe having backup only until the end of November.

It is a difficult chemical element to store, oxidizing in just three months. If China doesn’t regain control of the wheel, it could send the global automotive sector into a spin.

Nothing Automatic About It

Do you remember the motorcycle ad that went: Fill it, shut it, forget it? Auto debit had become something like that for subscriptions. Want Netflix? Key in your credit or debit card details and forget it. Every month the subscription would be automatically renewed and the card would be debited. No sweat. The same with the New Yorker subscription. And the utility payment. Auto debit had become so much a part of life that you did not think twice about it.

Pay attention: The RBI, however, wanted you to do exactly that. From October 1 banks had to get customers’ permission before recurring payments fell due. Transactions would go through only after the customer’s approval. Customers had to go through a one-time registration process after which the additional authentication would not be required. For transactions above Rs 5,000, there was an additional requirement of an OTP every time.

The Signal

The central bank introduced stricter norms to prevent payment-related frauds, especially on third-party platforms, which had been rising sharply. The RBI had first fixed April 1 as the deadline and later extended it to October 1 for banks to put systems in place to avoid inconvenience to customers. Three weeks later, many banks are yet to do it.

It is not only subscriptions that are stalled, but many merchants and startups that rely on auto debit for repeat payments are stuck. Several SaaS, media, and telecom companies who depend on one-time mandates have been hit.

| |||

The most hated organisation in founder circles right now is RBI. Every founder who's biz ran on subscriptions is seething with rage and helplessness watching their retention cohorts get nuked by this random new regulation on credit card subscriptions. | |||

Oct 20, 2021 | |||

| |||

1.63K Likes 209 Retweets 56 Replies |

Even non-profits that count on recurring donations are struggling.

| |||

Help us! IFF had a 70% drop off for recurring donors from October 2021 as the RBI Mandate kicked in. Worse? Fresh sign-ups for recurring donations are unstable. This is a setback for sustainable, democratic, individual -- Indian -- funding. 1/4 internetfreedom.in/iff-needs-your… | |||

Oct 20, 2021 | |||

| |||

337 Likes 269 Retweets 15 Replies |

The Mighty Attract Bigger Bucks

Indian startups received record funding in 2021. But if you noticed carefully, the startups that received funding were already big names in their sectors. And it is only them getting bigger in this boom.

Deal makers: Venture Intelligence data showed that 50% of the $24.5 billion funds raised between January-September were follow-on rounds in established startups. Brands like Byju’s, Meesho, Swiggy and Pine Labs grabbed the maximum investments this year. Considering their business success, even large fund-raises are closing in record time.

FOMO: The marquee investors want to keep pumping in cash into unicorns and decacorns. This means that the same companies are able to raise multiple rounds. PharmEasy for instance raised five rounds this year alone. Good news for popular entrepreneurs but this means that investors will have limited room to infuse seed capital into new startups. Fund availability for ‘probable’ successes are far and few in between.

What’s Rousing PayPal’s Pinterest?

It might seem rather unusual for a payments company to acquire a social network, but PayPal isn’t messing around. It is likely shelling out $45 billion (yes, that much!) to acquire Pinterest. But why?

Super app ambitions: PayPal wants to be a…drum roll…super app, a la Paytm. Why? Take a look at its purchases. A Japanese buy-now-pay-later app Paidy for $2.7 billion, a shopping and rewards browser extension Honey for $4 billion in 2019. Pinterest wants to make everything shoppable, and PayPal, ideally would be best placed to close that loop by offering a checkout/transactions layer. Besides, PayPal gets access to user data, particularly on shopping and intent or about 450 million active users on Pinterest.

What’s in it for Pinterest? A great exit (and largest PayPal acquisition) notwithstanding, Pinterest is in a flux, so to speak. Its co-founder left the company last week, user growth has been stalling, particularly, post-pandemic, and it has a sketchy record on culture (an understatement). From its point of view, these talks couldn’t have come at a better time.

What Else Made The Signal?

Easy spend: Fintech company CRED has made its first acquisition - Chennai-based HipBar that will open up avenues for issuing cash vouchers and prepaid cards.

Going black: Chinese users have lost one of their last foreign news sources as the Yahoo Finance app has vanished from Apple’s App Store in the country. Meanwhile, independent business news site Caixin has been expelled from the country’s approved media list.

Google takes a cut: With regulatory pressure mounting, Google has reduced its Play Store commission fee for all subscription-based apps to 15%. It has also said “ebooks and on-demand music streaming services” will be eligible for a fee “as low as 10%”.

Hitting the mark: India has officially inoculated 1 billion of its citizens with Covid-19 vaccines. Over half of the population received at least one shot while 21% are fully vaccinated.

Deal denied: Amazon won an arbitration in Singapore, dealing a setback to Reliance and Future Group’s deal.

Tax break: World’s richest man Elon Musk’s Tesla, which reported record revenue and profit in the third quarter, is lobbying the Indian PMO for a cut in import duty on EVs.

Too low: Paytm may pull the plug on its ₹2,000 crore ($268 million) pre-IPO share sale, fearing investors may not give it its coveted $20 billion valuation.

FWIW

Four-letter ban: Here’s something to chew on - Swiss private equity firm Partners Group Holding has banned the word “deal” from its common parlance. It’s going so far as to fine partners $1,000 for every time they use the word. The idea is to dissolve transactional “dealings” and switch to a more ownership approach with each investment that they make.

We came first! Who was the first to discover North America? If you said Christopher Columbus, you’re now wrong. A scientific study has found that the Vikings set foot in Canada almost 500 years earlier than the Italian explorer.

Paint makers’ blues: The world’s favourite colour is running in short supply. In the Netherlands, Akzo Nobel is running out of raw materials to make some hues of blue. Another additive in paints, resins, is also running low. Looks like the world’s supply chain crisis is going to hit how our houses and cars look. Yikes.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.