Good morning! We, at The Signal and The Intersection, are taking a festival break from November 3 to November 7. This is a short version of our daily newsletter. We will resume full editorial operations from today.

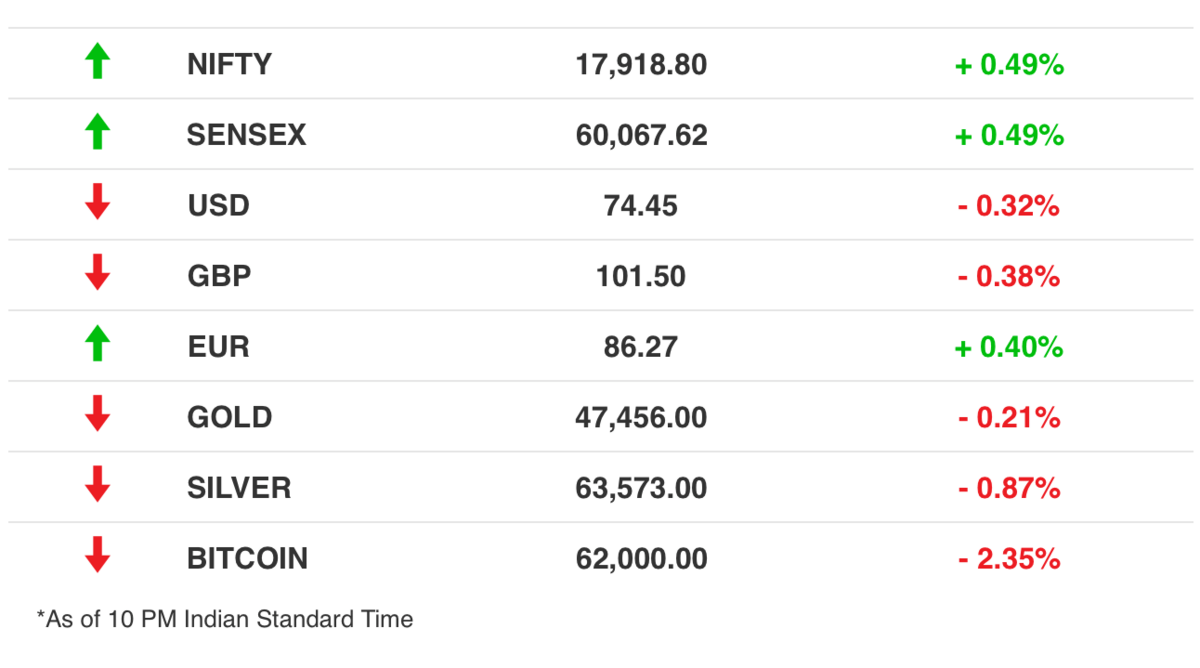

The Market Signal

Stocks: The markets in India were closed on Friday. Buoyant job growth data underpinned US stock prices, the SP 500 rising 2% to create a new record high. Concerns over inflation eased too as the Fed begins tapering bond buying.

Muskism or Extra-terrestrial Capitalism

Social media is so powerful that it can melt solid reputations, swing votes, and sway stock prices. But there are those such as Elon Musk to whose will it bends to please. Musk asked Twitter to decide whether he should sell 10% of his Tesla stock. Musk said he would abide by whatever the result was. Later, Twitter said yes.

| |||

Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock. Do you support this? | |||

Nov 6, 2021 | |||

| |||

144K Likes 23.3K Retweets 54.5K Replies |

“We are witnessing the Twitter masses deciding the outcome of a $25B coin flip,” venture capitalist Chamath Palihapitiya remarked about Musk’s tweet.

Tax debate: The flamboyant billionaire was ploughing into the debate on taxing billionaires for paper wealth. He says he doesn’t take a salary or bonus. So the only way for him to pay taxes is to sell stock.

When the World Food Programme chief commented that a sliver of Musk’s fortune could save 42 million hungry people from starvation, he immediately offered to sell Tesla stock worth $6 billion if he could see a plan how the money would be spent.

| |||

| Replying to@DrEliDavid | |||

If WFP can describe on this Twitter thread exactly how $6B will solve world hunger, I will sell Tesla stock right now and do it. | |||

Oct 31, 2021 | |||

| |||

324K Likes 55.9K Retweets 12.8K Replies |

Musk deftly uses Twitter to control talk surrounding his burgeoning wealth and what he uses it for. In doing so, he also acts as a decoy for fellow billionaires to embark on fantastical quests without attracting censure.

Muskism: That’s what Harvard historian Jill Lepore calls it. She defines it as an “extreme, extra-terrestrial capitalism” where billionaires such as Elon Musk, who grew up on the science fiction of Iain Banks and Douglas Adams, build their own fantastical worlds in which the “rest of us are trapped”. Muskian capitalism is driven by science fiction rather than earnings, Lepore says.

That is why it is important for billionaires to groom the public to accept highly risky and costly endeavours as urgent to human progress. Alleviating hunger? Now that requires a publicly auditable plan before Musk will put money on the table, or Twitter.

ICYMI

The valuation game: This isn’t about startups. It is about businesses. Recently, English football club Newcastle United was bought by the Saudi royal family for about $410 million. In 2019, an MLS team was purchased for north of $300 million. How do teams in MLS, which is an inferior league and lower potential for revenue, cost more than those in the premier league? That’s an answer this video holds for you. It’s nothing to do with football.

For profit cops: It’s difficult to ascertain a business model around some parts of our social fabric, like policing. Once a business model takes shape, it stops becoming public service and more topline. This is something small towns in the US are facing where cops are forced to fine people because towns are running out of money. These fines sometimes spiral to arrests and even deaths.

Big Tech cartel: Businesses cartelising is as old as business. Companies have secret pacts to fend off competition all the time despite legal frameworks and regulatory set-ups in place to stop them. Google and Facebook entered into such an arrangement to prevent competition in the advertising business. They called it Jedi Blue, which helped both make billions of dollars. The tech giants not only knew that what they were doing was not proper, they were even prepared to face legal repercussions and deal with public flak.

Asset management: When T Rowe Price bought New York-based Oak Hill Advisors for $4.2 billion last week, it marked the 13th biggest deal of all time in the asset management industry. It is a sign of how private pools of capital are expanding and looking for new avenues for growth as traditional lenders and financiers (read banks) take a backseat. The private capital industry is now about $8 trillion and is likely to grow to $13tn by the end of 2025, according to Morgan Stanley.

Out of track: Formula1 star Lewis Hamilton is trying to find a new purpose in his career with a drive for social justice and campaigning for diversity. While pursuing his record-breaking career, Hamilton is now more aware and more concerned about the representation of people in his sport. He was the first Black driver and there are none following. Hamilton wants to change that.

What Else Made The Signal?

Mount cash: Warren Buffet’s Berkshire Hathaway now has about $150 billion cash, an all-time record. Its Q3 profit declined by two-thirds year-on-year, however.

Sold: Billionaire Jeff Bezos has sold his Amazon stock worth $3.3 billion in the last week. Paying for rocket fuel, perhaps.

Buoyant trade: Chinese exports grew 27% year on year to top $300 billion in October, beating economists’ expectation by more than five percentage points.

Super deals: Global hit K-Pop band BTS will have its own NFTs, comics, and novels.

Cleared: US legislators approved a $1 trillion budget that will allow the Biden administration to begin overhauling the country’s roads, rail, bridges, and power infrastructure.

Data breach: A cyber security consultancy has said that share depository CDSL’s KYC data was breached twice in 10 days. Nearly 44 million accounts were likely exposed.

Assassination attempt: Iraqi Prime Minister Mustafa al-Kadhimi survived an attempt on his life with an explosive-laden drone.

Shaping history: Chinese President Xi Jinping may make a move to continue in power indefinitely at a crucial meeting of the Communist Party of China begins.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.