Wall Street cool to Biden re-run

Also in today’s edition: India spies with its little eye; Mixed March for the economy; Trade show travesty; AI horror is real

Good morning! India’s most valuable startup just got a haircut that counts as a close-crop. Indian news company The Arc tweeted that US investor BlackRock buzz cut Byju’s hefty $22 billion valuation by nearly half to $11.5 billion. That’d bring the Indian edtech company down a whopping 26 places, from 12 to 38, on CB Insights’ list of the world’s most valuable unicorns. TechCrunch reported that Invesco also cut Swiggy’s valuation to about $8 billion from $10.7 billion. Counting down to other corrections in 3, 2, 1…

🎧 Sebi puts the spotlight on Vinod Adani, the "elusive" elder brother. Also in today's edition: China’s aid to African countries is grabbing eyeballs. Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

Today’s edition also features pieces by Roshni P. Nair, Venkat Ananth, Srijonee Bhattacharjee, and Julie Koshy Sam.

If you enjoy reading us, why not give us a follow at @thesignaldotco on Twitter and Instagram.

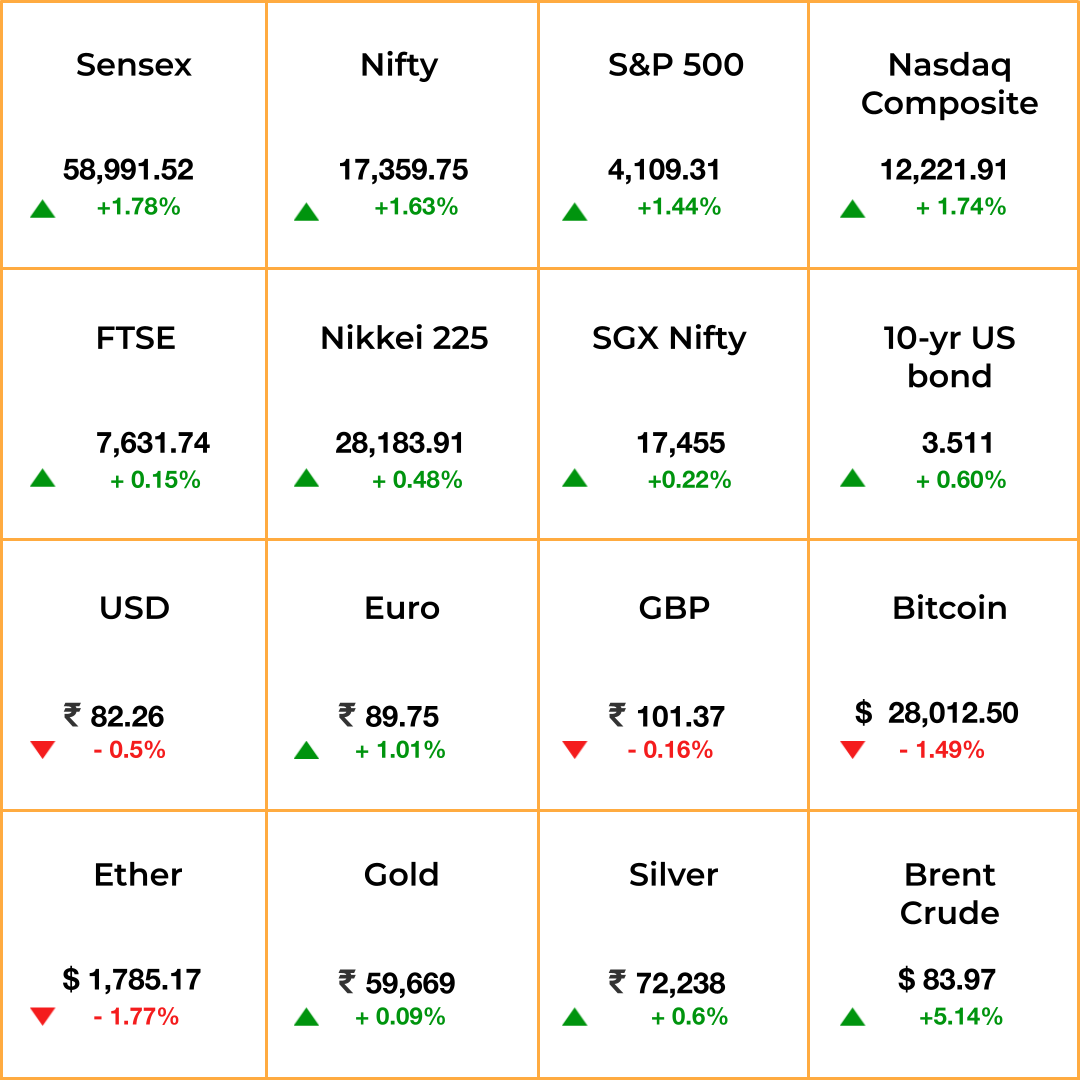

The Market Signal*

Dear readers,

Did you notice that our stocks report now brings you a forward-looking perspective? That’s Srijonee at work early in the morning. From today, the market dashboard also gets a new look. As you can see, it now gives a better cross-assets view. Together, we hope they will prepare you better for the day. Please write to us here with your comments.

Editor

Stocks & economy: Indian equities may rise on cues from early trade in other Asian indices and SGX Nifty.

However, gains will be limited as an imminent rise in oil prices spells significant macroeconomic implications for India, including an inflation spike, given its reliance on imports.

On Sunday, OPEC+ blindsided investors by announcing a supply cut of over a million barrels per day (bpd) beginning May; Saudi Arabia led the cartel by pledging a 5,00,000-bpd cut. Higher global inflation will force central banks’ hands at keeping rates elevated. Analysts see oil prices jump $10 per barrel.

This comes two days after US inflation data led investors to cut back expectations of even a 25-bps Fed rate hike in May to below 50%. US stocks were up, in lockstep with European equities that rose as headline inflation numbers eased to record lows in March.

Oil futures rose 7% earlier today and this shall keep the rupee and bond prices weighed down through the day.

SPYWARE

Pegasus By Another Name

The world’s most famous spying tool has become too infamous for its own good. And so, India is scouting for “lower profile” surveillance software, reports the Financial Times.

Details: Created by the Israeli cyber-intelligence firm NSO Group, Pegasus was implicated in a 2021 global collaborative investigation about governments, including India, spying on political opponents, journalists, and activists. Both NSO and India refute allegations. But the Centre, wary of being burnt again, is looking for a new spyware contract that could be valued up to $120 million. Potential bidders include Quadream, Intellexa’s Predator, and Verint’s Cognyte, all of which have already achieved some degree of infamy.

It's possible that the new tool will also be extensively used by a now-bellicose Directorate of Enforcement, which reportedly surveils WhatsApp and other communication tools to initiate probes under the Prevention of Money Laundering Act.

ECONOMY

Mixed Signals

There’s both good and bad news for India’s economy. GST collections for the March 2023 financial year were up 22% year-on-year, at ₹18 lakh crore ($220 billion). Collections from January to March 2023 were the second-highest ever.

Growth: Is happening, but without enough jobs. The Centre for Monitoring Indian Economy reported that India’s unemployment rate was 7.8% in January-March this year. Haryana and Rajasthan were hit the worst. Core industrial production grew 6% in February this year, but fell from January’s 8.9%. Even India’s largest carmaker, Maruti Suzuki, reported a slight drop in March sales, although its sales for FY23 were its highest ever.

Meanwhile, India’s fiscal deficit has grown to nearly 83% of this financial year’s target. But the economy is growing too, so we’re meeting our deficit target as a percentage of GDP. What’s worrying though is that the government spent less than it planned to on capital expenditure.

GLOBAL TRADE

Eagle Losing Its Grip

US President Joe Biden’s relationship with Wall Street has soured so much that many of his backers are unlikely to support him should he re-run for the Oval Office. They are miffed with the cowboy moves of the Securities and Exchange Commission against the financial services industry.

Out: Following the Biden administration’s sanctions, American businesses are in retreat from Russia, the latest being traders such as Viterra and Cargill, a company that traded behind the Iron Curtain even at the peak of the Cold War in the 1970s. Russia was then a buyer of US wheat, but now, it is the world’s largest exporter.

Red rising: Biden is not only losing key support at home but also ceding space to global rival, Chinese President Xi Jinping, who is leading China’s rapid buildup of international clout.

The Signal

China is giving shape to a new world order that undermines the US’ power and hegemony. The deal it brokered between Iran and Saudi Arabia would help dial down conflict in West Asia, which often sees the US as a self-centred troublemaker. China consolidating relationships with the world’s biggest energy and natural resources suppliers and its growing acceptance as a political mediator in a sensitive region is not a happy thought for Biden or Wall Street. US financiers and traders such as Glencore, Trafigura, Cargill, and Louis Dreyfus would be loath to lose their grip on the global commodities trade. Perhaps they’ll find new ways to skirt sanctions.

GAMING

Death Of The Trade Show

The world’s largest gaming conference, scheduled from June 13-16, has been cancelled. The Electronic Entertainment Expo or E3 was scrapped after virtually every major name (Nintendo, PlayStation, Xbox, Ubisoft, Tencent, Sega) backed out. It’s a big deal because the 2023 edition would’ve been the first in-person E3 since 2019. As the cliché goes, it’s the end of an era.

Blame companies’ depleted events teams and budgets, induced by last year’s gaming downturn. But a rash of industry events such as Play Days and Summer Game Fest, as well as companies’ own digital showcases (Ubisoft Forward, Microsoft’s annual Xbox showcase, etc.)—all scheduled for June—are chipping away at E3’s relevance. A shame, because E3 was more fan than vendor-focused.

This year’s Consumer Electronics Show, the world’s largest consumer tech trade show, had 115,000 attendees—better than in 2021, but still short of pre-pandemic numbers.

ARTIFICIAL INTELLIGENCE

The Start Of An AI-pocalypse

First some grim news from Belgium, where a man reportedly killed himself after an AI chatbot goaded him to do so. The chatbot, Eliza, gradually earned the user’s trust to convince him to commit suicide in order to “to save the planet”. Suddenly, the open letter by Future Of Life signatories to temporarily halt the training of AI systems seems more prescient than ever.

Guardrails: Italy has become the first country to temporarily ban OpenAI’s ChatGPT over privacy concerns. It’s also investigating the Microsoft-backed company for potential General Data Protection Regulation non-compliance.

🤯: Trust Facebook parent Meta to be part of the AI-pocalypse. Turns out its AI team has been researching models that can read your mind in order to transform brain activity or thoughts into words.

Spelling it out: Google CEO Sundar Pichai concedes that AI “is too important an area not to regulate”.

FYI

Hindenburg fallout: Market regulator Sebi is investigating whether the Adani Group violated related-party transaction rules while dealing with at least three offshore entities linked to chairman Gautam Adani’s brother Vinod Adani.

“Remarkable achievement”: India exported defence equipment worth ₹15,920 crore ($1.9 billion)—an all-time high—in the year ended March 2023, up from ₹12,814 crore in the previous year.

Quality control: Netflix is restructuring its film unit to make fewer but better movies, a change that will lead to a few layoffs, reports Bloomberg.

Tit for tat?: China is investigating American semiconductor manufacturing company Micron citing potential “security risks caused by hidden product problems” in its chips.

Content moderation: WhatsApp banned a record 4.5 million-plus accounts in India in February in compliance with the new IT Rules 2021, while Twitter also blocked 682,420 accounts promoting child sexual exploitation and non-consensual nudity in India between January 26 and February 25.

Indo-Pacific relations: India and Japan are collaborating to put Sri Lanka’s economy back on a sustainable growth trajectory, according to a report by a Sri Lankan think tank, Pathfinder.

Milking it: Indian dairy giant Amul’s revenue grew by 18.5% in the year ended March 2023 to ₹55,055 crore ($6.7 billion).

THE DAILY DIGIT

$216 million

The value of the 9,861.17 bitcoins sold by the US government on March 14. The lot is part of a 50,000 bitcoin-tranche seized by the US after the arrest of James Zhong, who stole the coins from the dark web marketplace Silk Road. (Coindesk)

FWIW

No kidding: April Fools' Day might be the longest-running joke. But nobody knows why it became a thing. Some historians think the genesis lies either in the ancient Roman festival of Hilaria, fake popes (yup), and even the Gregorian calendar. One of the references comes from a poem written by Flemish writer Eduard de Dene in 1561. Since then, April Fools' has been used as an excuse to execute the perfect prank. On a related note, here's a list of the best and cringe pranks for the year. Kerala Tourism's April Fool's prank, for one, got fact-checkers busy over the weekend.

Sweet spot: The humble sabudana khichdi may leave Indians divided, but tapioca pearls are having their moment in the US thanks to Taiwanese bubble tea. Initially restricted to the Asian community across the US, the chewy blobs are the US's top food import from Taiwan today. So much so that the drink has a cult following, aided by K-pop and South Korean stars. In fact, Sharetea, a bubble-tea business originally founded in Taiwan in 1992, has more outlets in the US today. Seven US cities have seen a 60% rise in boba tea shops between 2019 and 2022. Talk about cashing in on the hype train.

What downtime?: Working in your pyjamas comes with trade-offs. Working weekends have become a done deal as employees squeeze in date nights, kid's soccer games, and playtime with pets during the week. According to a study by software firm ActivTrak, people work for approximately 6.6 hours on average during the weekend. That's up 5% from 2021. Workers in the computer hardware industry work up to 11.5 hours on what should be 48-hour rest days. At this rate, the four-day work week seems like a dream.

Enjoy The Signal? Consider forwarding it to a friend, colleague, classmate or whoever you think might be interested. They can sign up here.

Do you want the world to know your story? Tell it in The Signal.

Write to us here for feedback on The Signal.