WhatsApp doesn’t learn

Also in today’s edition: Reliance’s sports channel; India’s first EV recall; Twitter’s poison pill for Musk; Japan needs heirs by the dozen

Good morning! Kurt Cobain’s Fender Mustang guitar is going under the hammer next month. Cobain played the Lake Placid Blue guitar in the music video Smells like Teen Spirit, reports Forbes. The guitar, which belongs to the Cobain family, has been on display at the Museum of Pop Culture in Seattle for the past 12 years and could fetch up to $800,000. Sounds like Nirvana.

Our daily podcast, The Signal Daily, will resume regular programming tomorrow. In the meanwhile, do listen to our recent episodes on Lenskart, Indian retailers eyeing Russia, and BookMyShow’s rebound.

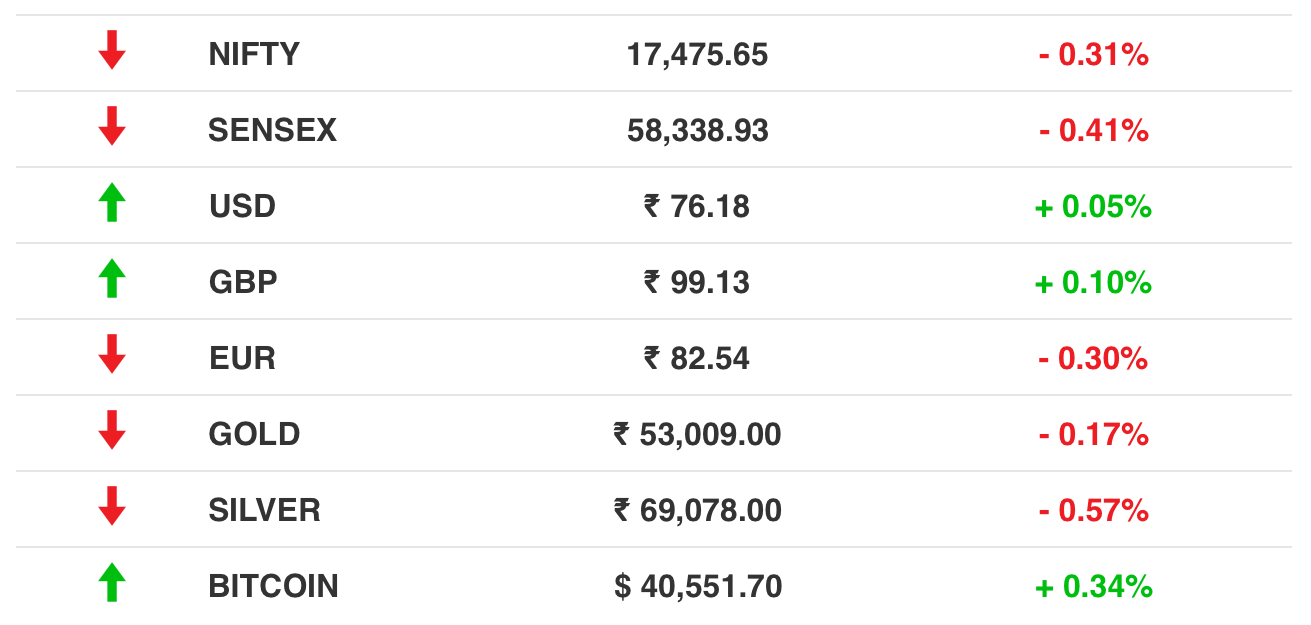

The Market Signal*

Stocks: Inflation continues to haunt markets as central banks the world over wrestle with it. Last week, seven of the top 10 Indian companies collectively lost ₹1.32 lakh crore in market value, PTI reported. The week will begin with China’s Q1 2022 GDP numbers followed by earnings reports in the US, including Netflix and Tesla announcements mid-week. Indian companies, including L&T, ICICI Bank, and HCL Tech, will publish Q4 FY2022 earnings.

CONGLOMERATES

Reliance Is Making Moves

A few weeks ago, we’d predicted that this would be the most competitive IPL we’ve seen yet. While that prediction appears to be coming true, the competition to broadcast the next IPL season just got a little more intense.

On air: Viacom18 officially announced the launch of Sports18, the network’s dedicated sports channel. The channel already has some interesting and marquee properties, notably the upcoming FIFA World Cup, NBA, La Liga, and top ATP and BWF events.

The big prize: All eyes will be on the next cycle of IPL rights though, with the BCCI having floated the media rights tender for the 2023-2027 seasons.

Not just sport: Reliance is also exploring a bid for Boots, the 173-year-old drugstore from its parent Walgreens Boots Alliance. Boots was put up for sale earlier this year, and could be valued at £7 billion ($9.1 billion) in a sale, Bloomberg reported.

GREEN BUSINESS

Up In Flames And Then A Recall

Electric two-wheeler maker Okinawa Autotech will recall over 3,000 of its Praise Pro scooters after three separate incidents of the vehicles catching fire.

Fire hazard: Vehicles from three other electric scooter makers, Pure EV, Ola Electric, and Jitendra EV have also combusted spontaneously, raising safety concerns.

Lithium-ion batteries are prone to what is known as thermal runaway or overheating, the main cause of fire. They are particularly vulnerable in the Indian summer when temperatures are sometimes near 50 degree celsius and routinely stay above 40 degree celsius.

Policy ahoy: A top government official and industry veterans have tried to allay fears, describing Okinawa’s move as a positive and proactive development. The government is considering a recall policy for EVs.

SOCIAL MEDIA

WhatsApp Throws Politicians A Legit Lifeline

Last week, WhatsApp announced that it was experimenting with a product feature called “Communities.” The feature essentially allows users to club separate groups “under one umbrella with a structure that works for them.” Sounds good? It cited groups of school parents or aid workers or resident complexes as an example.

What it didn't say? “IT Cells” or social media cells of political parties can now organise themselves formally in a centralised fashion in WhatsApp-ubiquitous countries such as India and Brazil.

Not happy: Speaking of Brazil, its populist president Jair Bolsonaro isn't too chuffed. Why? Because WhatsApp will be delaying the rollout of the Communities feature in his country until after the presidential elections are completed later this year. This is a giveaway that WhatsApp is probably aware of its potential misuse by political organisations.

The Signal

That WhatsApp has become integral to political communication in non-US countries is fairly established. This move by Meta, if anything, formalises the workarounds that parties and candidates have been deploying, not just to reach their potential base electorate, but also their workers, much like a walkie-talkie.

This included bulk-messaging services parties could buy off the shelves or over the cloud for similar functionalities. The Communities feature, to some extent, mitigates that, and is a potential strike against such software.

M&A

The Elon-Twitter Rabbit Hole

Twitter’s chaos-ridden Muskian odyssey is just about getting started. Last heard Twitter was preparing a poison pill defence. So, in case you missed it, we put together a theme-based rabbit hole, you could (safely) dive into.

Will he, won't he? Let's start with Bloomberg Opinion columnist Matt Levine, who has been keeping a hawk’s eye on the developing situation. His takes from Tuesday and Friday are well worth reading. The weeds on how Musk’s takeover could potentially happen. We’re talking about money.

Free speech: Musk likened Twitter to a town square, with free speech as its underlying principle. But what is this deal really about? Renee di Resta in The Atlantic thinks it’s attention. Also, read Mike Masnick of TechDirt on what Musk doesn't get about content moderation. Oh, and here's a 🧵by the former Reddit CEO Yishan Wong on the challenges of running a “cultural battlefield.” (hint: not fun)

Meanwhile: Twitter has another offer. Tesla investors might have something to say about “Funding secured.” And why Musk is serious, while Om Malik reckons that Parag Agrawal needs to go. And WSJ profiles Musk’s Twitter superfans.

And hey, have we considered President Elon yet?

ECONOMY

Wanted: Sons And Daughters To Run Family Businesses

Japan is facing a shortage of heirs. Once touted as the world’s manufacturing superpower and still the third-largest economy, the country has been struggling with an ageing population.

No one to take the wheel: With founders near the end of their road, thousands of family-run companies will shut down as there is no one to pull the cart. Government data shows that 40,000 small firms a year need someone to take over.

In Japan’s strictly hierarchical culture, knowhow, relationships, and even financial details are often preserved in the owner’s mind who sometimes doesn’t even share it with close family. Such loss would be immeasurable.

Matchmakers: While venture capitalists are swooping in, banks, financial advisors and even governments worried about local economies are trying to help. There is even a dating-style app, Tranbi, for ‘heir’ matchmaking.

FYI

Tax overhaul: With states pressed for revenue, the GST council may scrap the 5% slab. Some essentials in that bracket could be taxed 3% and the rest 8%.

All for IPO: In a bid to boost interest in the LIC share sale, the Government has changed rules to allow 20% foreign direct investment in the insurer.

Market push: B2B marketplace Moglix has invested $5 million in EV startup Euler Motors.

Virus spike: Covid-19 cases jumped 35% in India last week, the first time they are rising since January. Shanghai has reported first Covid-19 deaths after lockdowns started.

Censor rules: A Russian court has threatened Google and Wikipedia with fines for failing to follow Moscow’s content diktats on Ukraine.

Giant power bank: India is setting up a ₹2,000 crore green energy storage from which discoms can tap up to 500 MW for two hours.

FWIW

Money plants: Wealth does grow on plants. Or let’s just say, you are in the money if you own a Monstera Albo. You can do some “plant flexing” on Instagram too. If there is one trend that is as quirky and often as scammy as NFTs, it is house plants. Pandemic shutdowns gave the hobby fodder as people took to it with a zeal that is matched only by the prices some of the rare ones command.

Flat and hip: Comfort certainly made a fashionable comeback during the extended lockdowns. Some of that pandemic aesthetic is now on the runway. Ballet flats returned at a Miu Miu show and, some say, in no small measure also due to their prominent presence in the runaway hit Bridgerton that is set in an era when they had first become popular in post-Revolution France.

IPO song: A storied piano-maker is going for an IPO. Steinway Musical Instruments Holdings, a 169-year-old company that makes the iconic Steinway pianos is no stranger to the stock market. Its shares traded under the symbol LVB for Ludwig Van Beethoven until 2013 when billionaire John Paulson’s eponymous hedge fund took it private for $512 million. It will now trade under STWY.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Signal.