Will ‘Russia’s Google’ turn into ‘Russia’s Tencent’?

Yandex, the country’s biggest tech company, could look at India for growth

Good morning! A big hello to readers who signed up this week. Welcome to The Intersection, The Signal's weekend edition. This is not your usual story about business disruption but how the fortunes of Russia’s biggest tech company are changing because of the country’s isolation. Also in today’s edition: we have curated the best weekend reads for you.

Two months into the war with Ukraine, Russia has surpassed Iran as the world’s most sanctioned country. It’s currently staring at a 10-15% GDP contraction and a domino effect on its fast-growing IT sector. The exodus of tech giants such as Apple, Adobe, Microsoft, Cisco, and SAP—coupled with sanctions by the US, the EU and other countries—could lead to a 39% decline in Russia’s IT spending, down to $19.1 billion from $31.2 billion.

But the difference between Russia and other countries living under Western sanctions is the overarching power of its own Big Tech. Yandex, Sber (former Sberbank), VK (former Mail.ru Group) and online retailer Ozon operate across sectors ranging from e-commerce, mobility and food delivery to fintech and edtech, advertising and entertainment.

Not unlike how Chinese tech companies such as Baidu and Tencent became giants by keeping global rivals out, Russian firms are poised to grow in the face of near-absent competition. None more so than Yandex.

Founded in 1997 by Elena Kolmanovskaya, Ilya Segalovich, Mikhail Fadeev, and Arkady Volozh, Netherlands-headquartered Yandex—labelled the “Russian Google”—is the country’s oldest, most valuable tech giant. It draws roughly four billion visits a month and operates in Russia, CIS countries (former Soviet states), Europe, the Middle East, and Africa. Yandex went public in 2011 with a Nasdaq IPO that raised $1.3 billion– the sector’s biggest IPO of its time after Google. It had a market cap of nearly $31 billion in November 2021.

Yandex is a conglomerate, not unlike Tencent. It has 19,000 employees across 30 global offices and 50-plus services, from search engine (60% market share in Russia) to marketplace (Yandex Market), ride-hailing (Yandex Taxi), paid music streaming (Yandex Music), grocery delivery (Yandex Lavka) and its own Alexa and Siri-like AI assistant, Alice.

Source: Yandex investor presentation, February 2022.

On February 15, 2022, Yandex ended the year with $1.4 billion in cash after paying $1 billion to buy Uber’s stakes in their ride-hailing, food tech and delivery joint ventures. It was well-capitalised to fund its growth. The company's guidance for 2022 was $6.5 billion, driven in part by high turnover in e-commerce.

But nine days later, Russian president Vladimir Putin announced a “special military operation” against Ukraine. And Yandex’s outlook went with the wind.

Dominoes

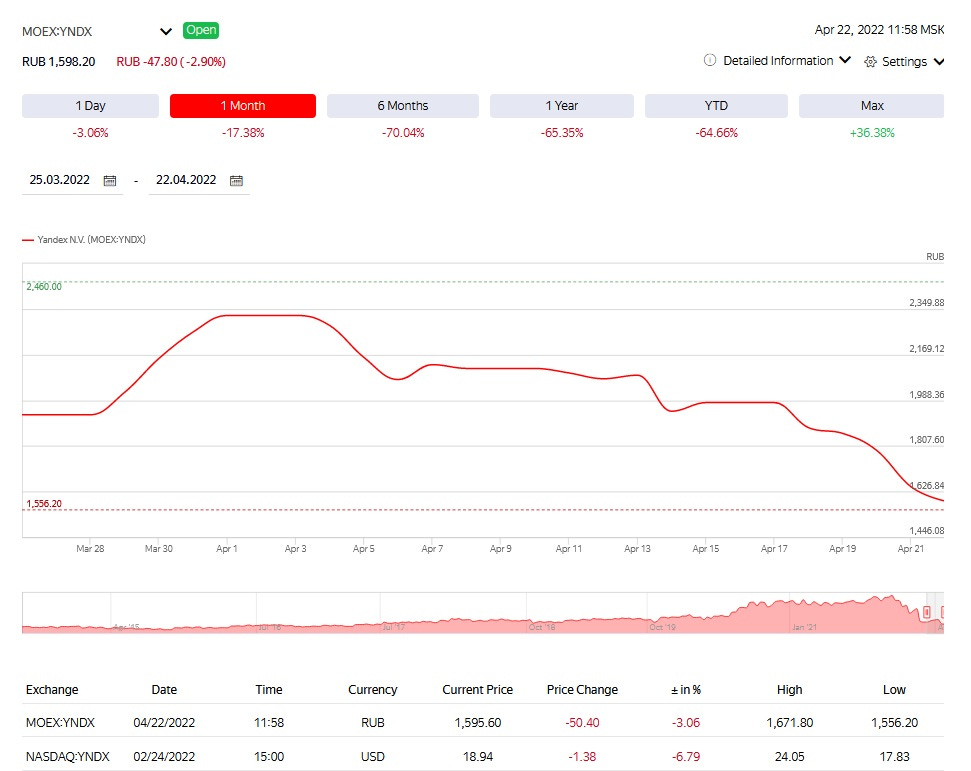

Its stock crashed almost 70% in the initial days of war. NYSE and Nasdaq suspended trading in stocks of certain Russian companies, including Yandex and Ozon. Trading at the Moscow Stock Exchange was suspended for one month.

By April 2022, the market cap of Russia’s Google had tanked from $31 billion to $6.8 billion.

Nasdaq's trading chokehold on Yandex triggered risks of default on $1.25 billion in convertible notes if bondholders decided to redeem them with accrued interest. Yandex warned investors that it didn’t have sufficient resources to redeem notes in full. Its cash balance had dwindled to $615 million, of which around $370 million was located outside Russia). Its efforts to restructure convertible bonds ran into hurdles too. Turnaround specialists JPMorgan Chase & Co. and Latham & Watkins LLP refused to advise the company; the job eventually went to Alvarez & Marsal Inc. and Morgan Lewis & Bockius LLP.

Yandex stock has tumbled over 70% in the last six months. Source: Yandex.

In March 2022, Stanford University professor Ilya Strebulaev and prominent Silicon Valley investor Esther Dyson resigned from the Yandex board of directors. Shortly after, honcho Tigran Khudaverdyan was designated under EU sanctions, forcing him to step down as executive director and deputy CEO of Yandex N.V. (the Netherlands arm) and its Dutch subsidiaries.

Uber, which still has a 29% stake in Yandex.Taxi, announced that it would accelerate its divestment from the Russian company. Yandex and Uber had struck a partnership in 2017, following the latter’s inability to capture the Russian market; this was similar to the ride-hailing giant’s challenges in China, where it sold its local business to Didi Chuxing. In 2021, Uber had divested itself of its holdings in Yandex’s delivery and autonomous vehicle units, sold part of its stake in Yandex.Taxi, and agreed to allow Yandex to buy its remaining Yandex.Taxi stake.

Lithuania, Latvia and Estonia banned Yandex’s ride-hailing operations. The company also shelved plans to expand its successful grocery delivery service Lavka to Paris and London, where it was recently rolled out under the brand name Yango Deli.

Yandex's ambitions to become a global leader in AI and automated vehicles (AVs) went bust too. It had an AV testing centre in Ann Arbour, Michigan, and a delivery pilot service with GrubHub using its six-wheeled sidewalk robots on the campuses of Ohio State University and the University of Arizona. These US businesses were paused, and American employees laid off. Yandex may also halt autonomous robotic delivery projects in Dubai and South Korea, a person with direct knowledge of the matter told The Intersection.

But not all analysts believe Yandex has a grim future.

Plan B

“Yandex is only closing its divisions in "unfriendly" countries. We expect that it will shift expansion to “friendly” countries due to slowing domestic business development, assuming some of its resources are freed up after sanctions,” Konstantin Asaturov tells The Intersection.

Asaturov, who’s an asset manager at Sistema Capital Management, believes the likely destinations could be India or Latin America, if not China. The most likely segments for international expansion could be food delivery or AVs, he adds.

Russia’s economic slowdown notwithstanding, others disagree with Asaturov and believe the departure of global giants could cement Yandex's position in its native market. Take Yandex.Taxi, which has no ride-hailing competitor.

“International expansion will take a backseat compared to entering new segments and retaining existing ones. Yandex will accelerate AI rollouts, including in the field of unmanned vehicles,” Finam analyst Leonid Delitsyn believes. He adds that its search competitor, Google, is not withdrawing from Russia yet. But if it leaves and takes away Android OS, the question of an alternative OS will become acute; if Yandex doesn’t snatch this opportunity, others (read: Chinese smartphone manufacturers) will.

E-commerce offers significant growth potential, considering the sector is projected to have double-digit growth in Russia. In 2021, e-commerce grew by 44% year-on-year. Russian e-commerce research agency Data Insight projected that by 2024, the top four online retail players would account for 54% of the entire segment in the country. Unlike its bigger online retail rivals Wildberries and Ozon, Yandex Market doesn’t have a great e-commerce footprint; the vertical was launched during its decade-long partnership with Sber, Russia’s state-owned bank-turned-tech giant. But with international retailers such as Amazon suspending shipments to Russia, there’s ample ground to be reclaimed by domestic players.

The electronics industry could witness some shapeshifting too. Ozon and Sber already announced plans to produce their own TV sets, and Yandex may not want to be left behind. Asaturov points out that smart electronics are a natural progression for the company, considering it already has Alice-enabled smart speakers. Ditto the food and grocery delivery business; opportunity awaits those who want to cash in on traditional retailers Magnet, X5, and Lenta suspending or stalling store expansions.

All easier said than done, however. While Yandex has decent cash flows in the domestic market and can raise funds in Russia, it’s unlikely to compete in segments where the size of the investor's wallet decides everything.

“Yandex was highly profitable until it decided to increase revenue at the expense of its low-margin ride-hailing business. This need to increase revenue for the sake of being more attractive to global investors will weaken in the near future,” Delitsyn explains.

The need for numbers cannot be overstated. While Chinese tech companies had a huge home market to grow in, Russia’s population is shrinking. That means Yandex will need a bigger market, and India is the only large English-speaking one that is currently friendly to Russia.

The Intersection contacted Yandex about its probable expansion plans. A company spokesperson did not elaborate on the subject, but stated:

“We are closely following the developments of this unprecedented situation. Our priority is to ensure continuous operations of all our services globally.”

People problems

Whatever routes Yandex takes will be impossible to navigate without a resilient workforce. And it’s here that the tech conglomerate has its work cut out.

For one, IT developers are fleeing Russia. Various estimates suggest that anywhere between 10,000 to 70,000 specialists left the country in the first three weeks of the war. Even in the best case scenario where developers return or are replaced by applicants hungry for a ‘dream job’ in the country’s largest tech company, Yandex faces an uphill task in keeping staff motivated even as it resumed recruitment in March 2022.

A key manager with one of Yandex’s innovation projects, speaking on condition of anonymity, told The Intersection that “there is a deep sense of depression” among employees. While its remote work policy enables peers to work from outside Russia while still retaining their jobs, not everyone has the luxury to do so. As one employee puts it: “Some have settled down in Armenia, Georgia, and Kazakhstan. Some went to Europe. But they’re the ones with visas and housing arrangements abroad. The company isn’t helping with relocation like other IT companies do.”

There’s a pervasive despair borne from the likelihood of future sanctions against Yandex. It is Russia’s largest search engine and news aggregator, after all, with the tools to control what Russian society reads, knows, and thinks. Yandex is being called out by internet users and former employees for misinforming Russians about what’s really happening in Ukraine. It doesn’t help that Putin’s regime has blocked major non-government media and social media and introduced laws criminalising “false information” about the army and government institutions. Violators face up to 15 years in prison. Lev Gershenzon, the former head of Yandex News, criticised his alma mater for not displaying news about residential bombings and civilian and armed forces casualties.

Elena Bunina—the former CEO of its Russian entity—stepped down from her role after criticising Russia’s actions in Ukraine, but still works in an unknown capacity for Yandex after relocating to Israel. Another publicised high-profile exit due to internal dissent was that of Tonya Samsonova, the founder of Q&A service startup The Question, which was sold to Yandex and rebranded as Yandex.Q. She resigned after calling the company’s concealment of information about Russian excesses in Ukraine a “crime”.

“I did my best to ensure that all information is conveyed to Russians. Despite my efforts, there was a difference in priorities — to continue doing business — at the cost of the horror that was unfolding,” Samsonova tells The Intersection. “I wanted no hand in it.”

And so, current Yandex personnel are stuck between the devil and the deep blue sea. As one employee noted in an emotional Facebook post, to detractors:

“What do you want from us? Shall we commit mass suicide for you? Or rush to London without visas with hundreds of thousands of grandmothers, cats, and children? So that we are left here without any income? Go to jail? What you are doing is called bullying.”

Epilogue

Yandex is looking to divest Yandex News and influencer blogging platform Yandex Zen. VK or Vkontakte—the Russian Facebook—may take over these “toxic” services. The tech conglomerate has a finger in every pie, from email and edtech to gaming and ride-hailing. The kicker? It’s majority-owned by Russia’s state gas giant Gazprom, making it an effective tool of public control in the hands of Putin’s government.

ICYMI

Censors swirling: Douban has been widely dubbed as China’s Reddit. The 17-year-old bulletin board platform had, over the years, emerged as the go-to for its millions of users for “gossipy discussions on everything from life advice...to wild eccentricities”. Now, Douban is battling for survival, with the Chinese government cracking down, both online and its offices in Beijing.

Pivot to populism: Marine Le Pen is running for the French presidency for the third time. This time, though, feels a little different. Le Pen’s 2017 campaign was largely around far-right rhetoric. Cut to 2022 and not only is she better prepared, but she's also channelling themes that have propelled populists to power — immigration, economic concerns, and protectionism. Tomorrow, as the results trickle in, we’ll likely know if her political makeover was worth it.

Coins, please: Where was the last time you used a vending machine? At the airport? At Tokyo, which the author calls its “spiritual home”? Do let us know. But while at it, do read this piece in The Guardian, a literal paean to the vending machine, its history, and its enduring appeal.

Online sleuthing: Daisy De La O was murdered in February last year. Her closest friend Rebecca Fuentes couldn't wait any longer. Three months after Daisy was stabbed to death, Fuentes lost faith in the police system, while still waiting for an arrest in the case. So, she took to TikTok and posted a video. That's all we'll say.

This was not written by AI: You've likely heard about OpenAI, the other company co-founded by Elon Musk. Its renowned GPT-3 program, this essay in The New York Times magazine says, has attained fluency that “resembled creations from science fiction like HAL 9000 from 2001.” While the development is fascinating, it is worrisome in equal measure too.

Want to advertise with us? We’d love to hear from you.

Write to us here for feedback on The Intersection.