Phase out? Absolutely not

Also in today’s edition: Spotify Unwrapped; Millets go through the grinder; More drama at BYJU’S; Enterprise AI is overhyped

Good morning! What’s in a name? If you’re Japanese, quite a lot. The New York Times reports of growing discontent against kira-kira (shiny/glittery) names in Japan. In the Japanese script, each name is written using kanji characters. These characters are pronounced on the basis of the sound associated with them. But… each kanji can have multiple pronunciations, a loophole parents use to give their children unique names. Sadly, such children have grown up bullied and now the government wants to ban the unique names. What a world!

Adarsh Singh also contributed to today’s edition.

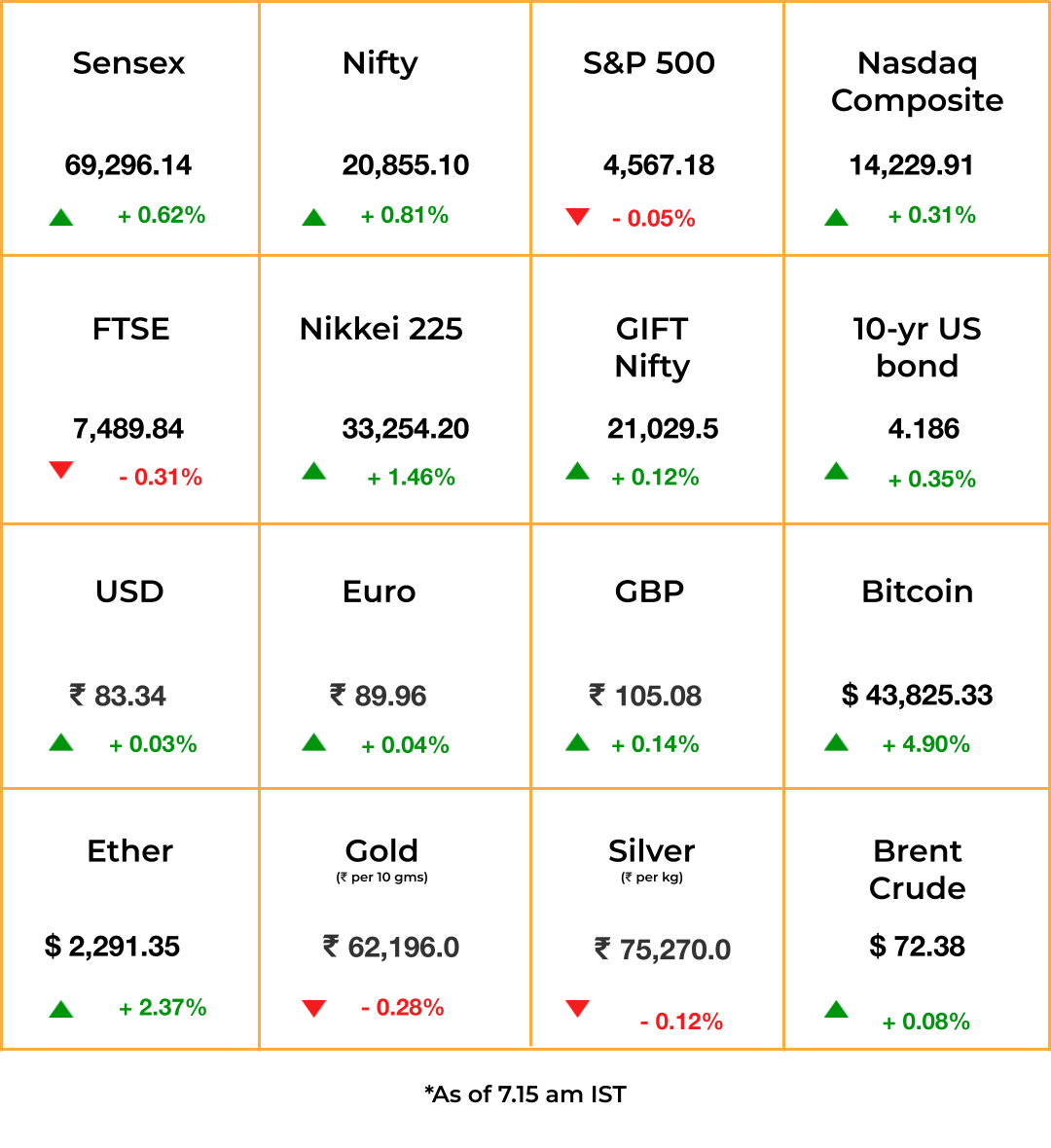

The Market Signal*

Stocks & Economy: US stocks ended the day mixed after key labour department data showed companies were going slow on hiring. New job openings fell to a two-and-a-half year low, reinforcing the belief that the Fed’s interest rate hikes were working, giving it more room to reverse course.

Asian shares were mixed, with the Shanghai and Hong Kong indices taking a beating after Moody’s lowered China’s credit outlook. Shares in Japan and the rest of Asia rallied in early trade.

Indian equities continued to celebrate the Bharatiya Janata Party’s state election wins on Tuesday and will likely get a boost from US data and the Chinese downgrade. Early GIFT Nifty movement was indicating a positive opening. The Reserve Bank of India’s rate-setting committee begins its three-day meeting today.

Bitcoin surged after BlackRock’s plans for a spot exchange traded fund got a $100,000 investment boost.

COP28

Face-off Over Phase Out

The message emerging from the United Nations’ climate summit in Dubai is unambiguous: petroleum producers will not accept a phase-out or phase-down of fossil fuels.

Carbon dioxide emissions from fossil fuel use are expected to hit a record 36.8 billion tonnes in 2023.

Saudi Arabia’s energy minister Prince Abdulaziz bin Salman said his country would “absolutely not” agree to any phase-down deal. Even COP28 president Sultan Al Jaber is not in favour of a phase-out. While they are agreeable to commit to other reduction measures such as cutting methane emissions, they do not want any curbs on production. ExxonMobil and Chevron have even opted out of a methane-cutting fund.

Meanwhile, 60 countries have reportedly signed a Global Cooling Pledge to phase out hydrofluorocarbons to cut emissions from cooling systems. India, whose annual greenhouse gas emissions are expected to rise 435% in 20 years, may not join the pledge.

A MESSAGE FROM OUR PARTNER

Enabling Merchant Acceptance

A good story must have three things: an engaging plot, a protagonist & their journey, and a damn good climax. Luckily for us, India’s digital payments story has all three.

The plot is deceptively simple: make Indians fall in love with digital payments. Who will stand up to the challenge? *Enter our protagonist* PhonePe!

To make digital payments accessible for merchants, PhonePe launched a suite of services like custom photo QR codes for customer convenience and merchant safety, followed by innovative smart-speakers featuring Amitabh Bachchan's voice for real-time transaction validation. Completing the lineup are POS devices, offering a seamless payment processing solution. But... like any good story, the main villain is still out there: financial inclusion!

*Cue climax* PhonePe partners with banks and NBFCs to provide easy credit for merchants. In doing so, it also forges a path for their expansion by making Stores and Pincode, two platforms where customers can easily find the best local mom-and-pop stores. The result? PhonePe's widespread presence across 3.7 crore (37 Million) merchants covering over 99% of the postal codes across India, validating over 100 crore transactions monthly - a triumphant victory for our protagonist!

To know more of PhonePe’s amazing story, check out PhonePe Pulse.

MEDIA

Playing It By Ear

Good things come to those who wait. In Spotify’s case though, the wait is neverending. The company is pulling the plug on its two highly acclaimed podcasts, Heavyweight and Stolen. The move is part of Spotify’s larger drive to “rightsize its costs”, which also included eliminating 17% of its workforce.

Broken dreams: Spotify’s big bet on podcasts did not go as planned. We’ve covered how its strategy of celebrity-led podcasts failed. Now that it’s curtains for in-house scripted podcasts, Spotify is only left with licensed podcasts. Even there, its prized possession, The Joe Rogan Experience, is due for renewal.

Broken model: Spotify’s business model is drawing increased scrutiny. Its low subscription fees do not cover the high costs of paying royalty and licensing fees. Neither artists nor studios are happy. Furthermore, it has to stave off competition from loaded rivals like Apple, Amazon, and Google while maintaining profitability.

🎧 What’s Spotify’s gameplan? Listen to The Signal Daily on Spotify, Apple Podcasts, Amazon Music, Google Podcasts, or wherever you get your podcasts.

AGRICULTURE

Pleb Goes Posh

Demand for “sri anna” was bound to increase given the International Year of Millets and India’s Millet Initiative, but few foresaw that top quality jowar and ragi would retail at prices 150% and 45% (respectively) higher than wheat. Because of the spotlight, the poor man’s food is now out of reach of the masses.

FMCG brands hopping on the ‘alt flour’ and millet snacks bandwagon have played a critical role and so has erratic weather. Millets are hardy but gauging from the fall in production in key regions such as Karnataka, Telangana, Andhra Pradesh, and Maharashtra, they’re not immune to drought. That’s spiking prices by 15-20% every month.

The Signal

Blame climate change-induced rainfall patterns. In the case of pearl millet or bajra alone, core production shifted to 18 districts across Haryana and Rajasthan from 1998 to 2017. Bajra farmers in Gujarat are gradually switching to cash crops such as cotton and castor because of increased precipitation.

Over in Tamil Nadu, acreage of sorghum, bajra, foxtail, ragi, etc. has decreased since 2021 despite programmes like the Tamil Nadu Millet Mission, which aims to enhance production. Local farmers cite the lack of subsidies, support prices, and awareness about seed varieties.

India is projecting itself as the global standards-setter for millets; that work will include setting quality parameters such as grain defects and limits for moisture content—which ironically will get harder to adhere to as climate change undoes the hardiest of grains.

EDTECH

Sinking BYJU’S Clutches At Straws

Edtech company BYJU’S has more questions to answer every day. The National Company Law Tribunal has sent a notice to the firm for alleged non-payment of ₹158 crore (~$19 million) it owes the Board of Control for Cricket in India (BCCI), dues pending from the time BYJU’S sponsored the Indian cricket team’s jerseys. The BCCI wants the company declared insolvent.

The cash-strapped company has so far been unsuccessful in raising the millions of dollars it needs to save its sinking education business. Reports said founder Byju Raveendran pledged his Bengaluru homes to pay salaries. It has also not been able to sell assets such as Epic, Aakash, and Great Learning.

BYJU’S board of directors is scheduled to meet on December 20, two days before the deadline to reply to the NCLT notice, to consider, among other things, accounts. The company will hold its 11th annual general meeting the same day.

ARTIFICIAL INTELLIGENCE

Enterprise Train To Nowhere?

Here it is, straight from the horse’s mouth: AI isn’t a magic bullet. In an interview with CNBC, OpenAI COO Brad Lightcap alluded to potential clients approaching his company in the hopes of getting tools that’d make revenue skyrocket or costs plummet, stat—despite the technology still being experimental.

Reality checks like these don’t matter in some companies’ larger scheme of things though. Big Four firm EY claims to have a breakthrough in AI detection of audit frauds, but auditors are divided over the indispensability of such tools. As one put it, “fraud by its nature is unpredictable… using known fraud cases to train machine learning models is challenging”.

Elsewhere: The Information reports that Morgan Stanley is increasingly using ‘AI @ Morgan Stanley Assistant’ for financial advisors despite mixed reception internally and the custom OpenAI chatbot being used more by admin staff than the advisors it’s meant for.

FYI

Downgraded: Moody’s has revised the Chinese government’s credit rating outlook from stable to negative on slowing growth, risky property sector, and rising debt.

Need taxpayer💰: European aeroplane maker Airbus will need government support to develop a replacement for its workhorse, the A320 family of aircraft, its chief Guillame Faury told the Financial Times.

Don’t ape EU: Apple has warned India that it will make fewer phones locally if the government insists on equipping them with universal USB-C ports as Europe does. It’s also scouting for critical parts suppliers in Asia outside China.

Poof!: In the last five financial years, Indian banks have written off ₹10.57 lakh crore, half of which was borrowed by large companies, the government informed Parliament today.

Third party: Liz Cheney, Donald Trump baiter and co-chair of the congressional committee that probed the January 6, 2021, Capitol attack, is considering running for President in 2024.

Closure: ZestMoney, the buy-now-pay-later startup which nearly got acquired by PhonePe last year, is shutting down, the management told its 150 employees.

Taking aim: A group of nuns who collectively own about 1,000 shares in gunmaker Smith & Wesson has sued the company, alleging it is putting shareholders at risk by the way it sells its AR-15 rifle, a common weapon of mass shooters.

THE DAILY DIGIT

24%

The rise in cybercrimes registered in India in 2022 as compared to 2021. Economic offences, as per number of registrations, went up 11% in the same period. (The Indian Express)

FWIW

Music to the ears: An incredibly popular Taiwanese rock band, Mayday, is being investigated by Chinese authorities. No, not because of any geopolitical reason, but because the band has been accused of lip-syncing (remember Milli Vanilli?) during its recent concerts in the mainland. In China, government regulations explicitly ban performers from “deceiving audiences with lip-syncing”. That means no pre-recorded songs are allowed in concerts. If found guilty, the band could be fined for around $14,000. Not sure about others, but that’s one China model that the world should imitate.

Love story: Believe it or not, Taylor Swift is still ruling online discourse. This time, it’s for her sartorial choices. The pop star is making it rain for smaller, relatively affordable brands like Free People and Reformation. How? Apparently, Taylor likes to pair her high-end dress with accessories from smaller brands. When Swifties figure out those small brands (and they always do), they throng to their stores and give a massive boost to the sales. Some also speculate that this could be a deliberate strategy of Swift to make herself more accessible to her adoring fans. This love is good. ❤️

Success story: New Zealand and kiwi birds are a match made in heaven. So when the kiwi faced an existential threat in the country, it was only natural for the country to launch a massive conservation programme. The government decided to eliminate most non-native avian predators from the country by 2050. Within just six years, that decision is already bringing about visible change. For the first time in living memory, Wellington witnessed the birth of two kiwi hatchlings in the wild. The programme is also having a positive knock-on effect on other local species like the takahē and kākāpō. Talk of a win-win strategy.